Bitcoin vs. Bitcoin Cash: The Full Comparison | BCH vs BTC

On August 1st, 2017, there was a hard fork, or split, in the Bitcoin blockchain. As a result of the fork, a tale of two competing cryptocurrencies emerged; Bitcoin vs. Bitcoin Cash – the split from the original Bitcoin.

While Bitcoin Cash wasn’t the first such split from Bitcoin, it was one of the most prominent, as it quickly rose to become one of the top crypto assets by market capitalization (number of the asset in circulation multiplied by the asset’s price).

However, with the names being similar, it can be hard to understand the difference between Bitcoin and Bitcoin Cash from a quick glance.

Bitcoin Cash price predictions aside, here’s a full, detailed comparison for Bitcoin vs. Bitcoin Cash:

Mục lục bài viết

Bitcoin vs. Bitcoin Cash: Blocksize

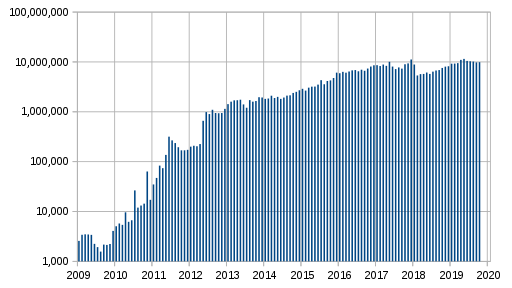

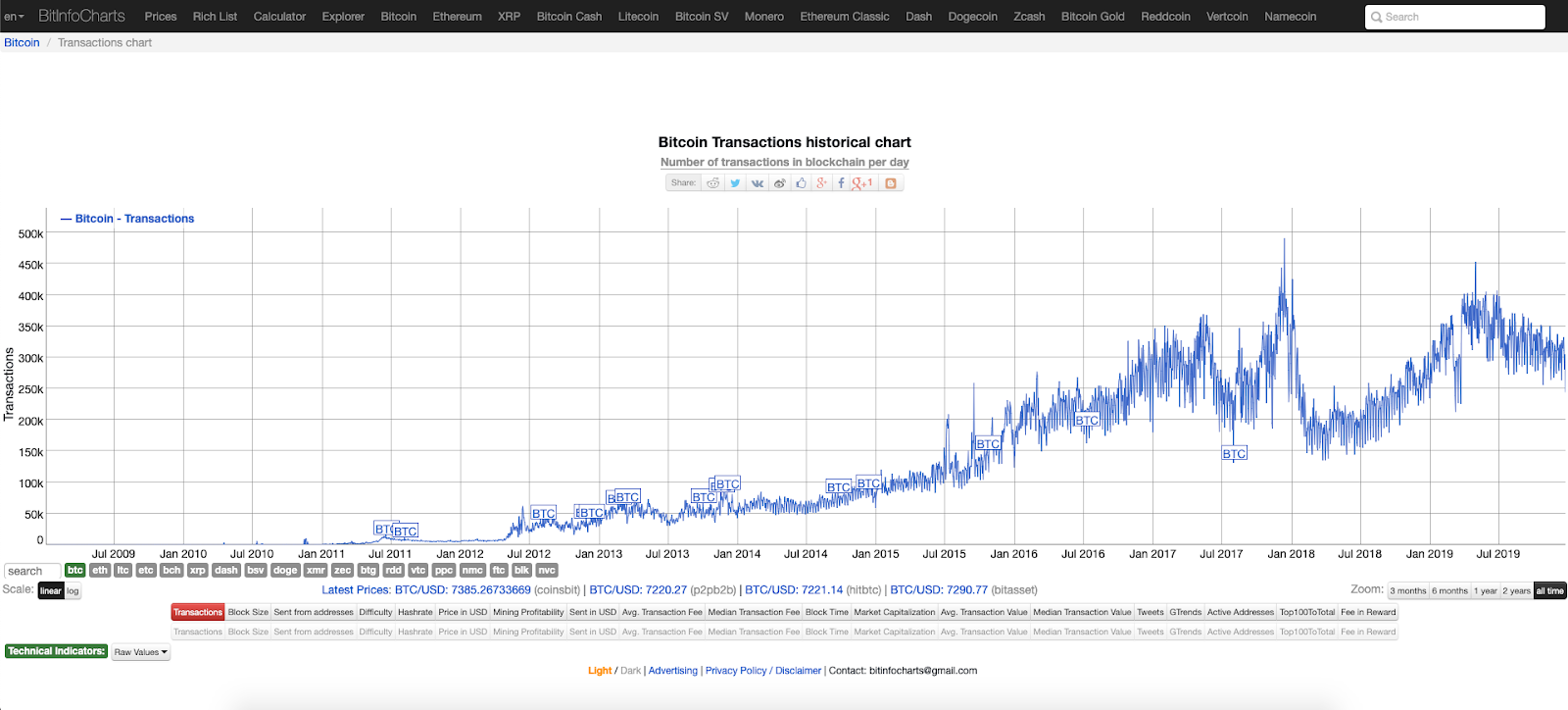

Before Bitcoin became as popular as it is today, it had no problem handling transactions, because there weren’t that many to begin with. Nowadays, with hundreds of thousands of transactions happening daily, transaction speeds can be slower and transaction fees higher. As a result, the network struggles to handle large amounts of traffic while maintaining low fees.

Number of Bitcoin Transactions per month. Source: Ladislav Mecir [CC BY-SA 4.0], via Wikipedia

Number of Bitcoin Transactions per month. Source: Ladislav Mecir [CC BY-SA 4.0], via Wikipedia

This issue of figuring out how to make blockchain technology suitable for mass usage is often referred to as “scalability”.

One of the main ways in which scalability could be achieved is by changing Bitcoin’s blocksize. A new block in a blockchain network contains new transactions that get added to the blockchain periodically.

In the case of BTC and BCH, this is done through the process of “mining”, where miners use their computing power to solve complex mathematical equations.

Miners compete to be the first to solve the equations and win the right to add a new block to the blockchain. In return, they receive a block reward in the form of BTC or BCH for helping to validate new transactions and secure the network.

With BTC’s blocksize at approximately 1 megabyte, there are only so many transactions that can be added to every new block. Periods of high transaction volume can create a long “line” (known as the mempool) of users waiting to get their transaction into a new block.

The only way to deal with this as a user is to wait for your transaction to go through or pay a high transaction fee so that miners prioritize your transaction and include it in a block before others.

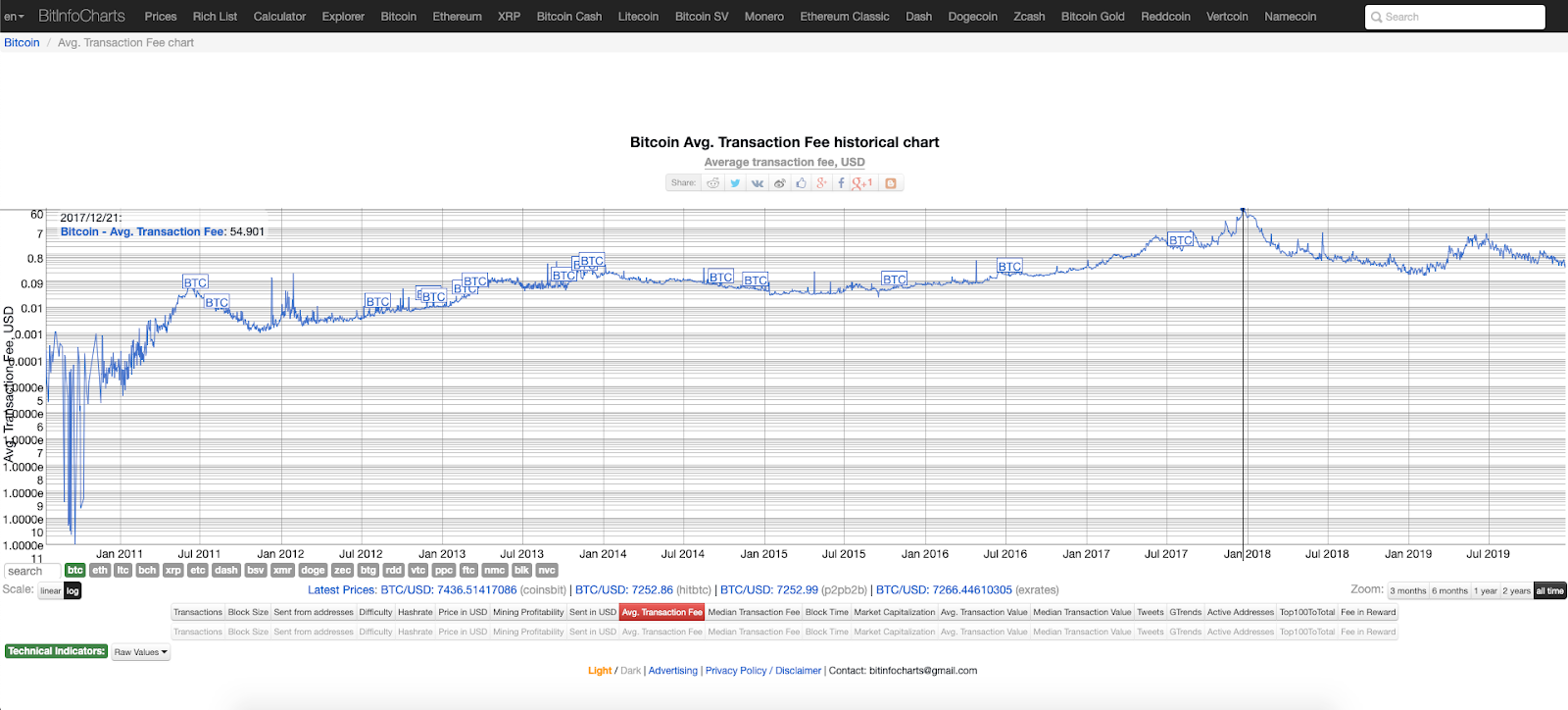

BTC’s average transaction fees shot up to $55 per transaction towards the end of 2017, when many people were using the network. While $55 per transaction is comparable to payment methods like wire transfers, which can also have hefty fees, a $55 transaction fee definitely doesn’t work for something originally envisioned as “peer-to-peer electronic cash” in the Bitcoin whitepaper. Source: Bitinfocharts

BTC’s average transaction fees shot up to $55 per transaction towards the end of 2017, when many people were using the network. While $55 per transaction is comparable to payment methods like wire transfers, which can also have hefty fees, a $55 transaction fee definitely doesn’t work for something originally envisioned as “peer-to-peer electronic cash” in the Bitcoin whitepaper. Source: Bitinfocharts

Discussions about the Bitcoin scalability problem had already been going on for years, and eventually, some members of the Bitcoin community got fed up with the situation. These members of the community became the Bitcoin Cash (BCH) community.

On August 1st, 2017, the BCH team implemented a hard-fork which increased the blocksize from 1 megabyte to 8 megabytes. This resulted in a split Bitcoin blockchain and the birth of the cryptocurrency Bitcoin Cash.

Though this change allows for each block to accommodate more transactions, there is a tradeoff.

Larger blocks also means that less individuals are able to become “nodes”, or computers or servers that store the blockchain and serve it up to other users. This is due to larger blocks taking up more hard drive space, which costs more money for node operators.

This of course can lead to more centralization of nodes, which can undermine the security of the network if a small handful of malicious but powerful actors choose to compromise Bitcoin with their power.

The BTC camp (“small blockers”), therefore, wants to keep blocks small and figure out scalability with “layer 2” or off-blockchain solutions like Lightning Network.

In sum, Bitcoin (BTC) wants small blocks. Bitcoin (BCH) wants big blocks. BTC wants to scale off-chain using layer 2 technologies, while BCH wants to scale on-chain by increasing each block’s size.

Still in development, Lightning Network is one of the main ways in which the BTC community plans to scale the Bitcoin network. This solution would try to maintain the decentralization of Bitcoin nodes by keeping blocks small and using an off-chain solution like LN to scale Bitcoin. Image credit: Blockstream

Still in development, Lightning Network is one of the main ways in which the BTC community plans to scale the Bitcoin network. This solution would try to maintain the decentralization of Bitcoin nodes by keeping blocks small and using an off-chain solution like LN to scale Bitcoin. Image credit: Blockstream

Bitcoin vs. Bitcoin Cash: Transaction Fees

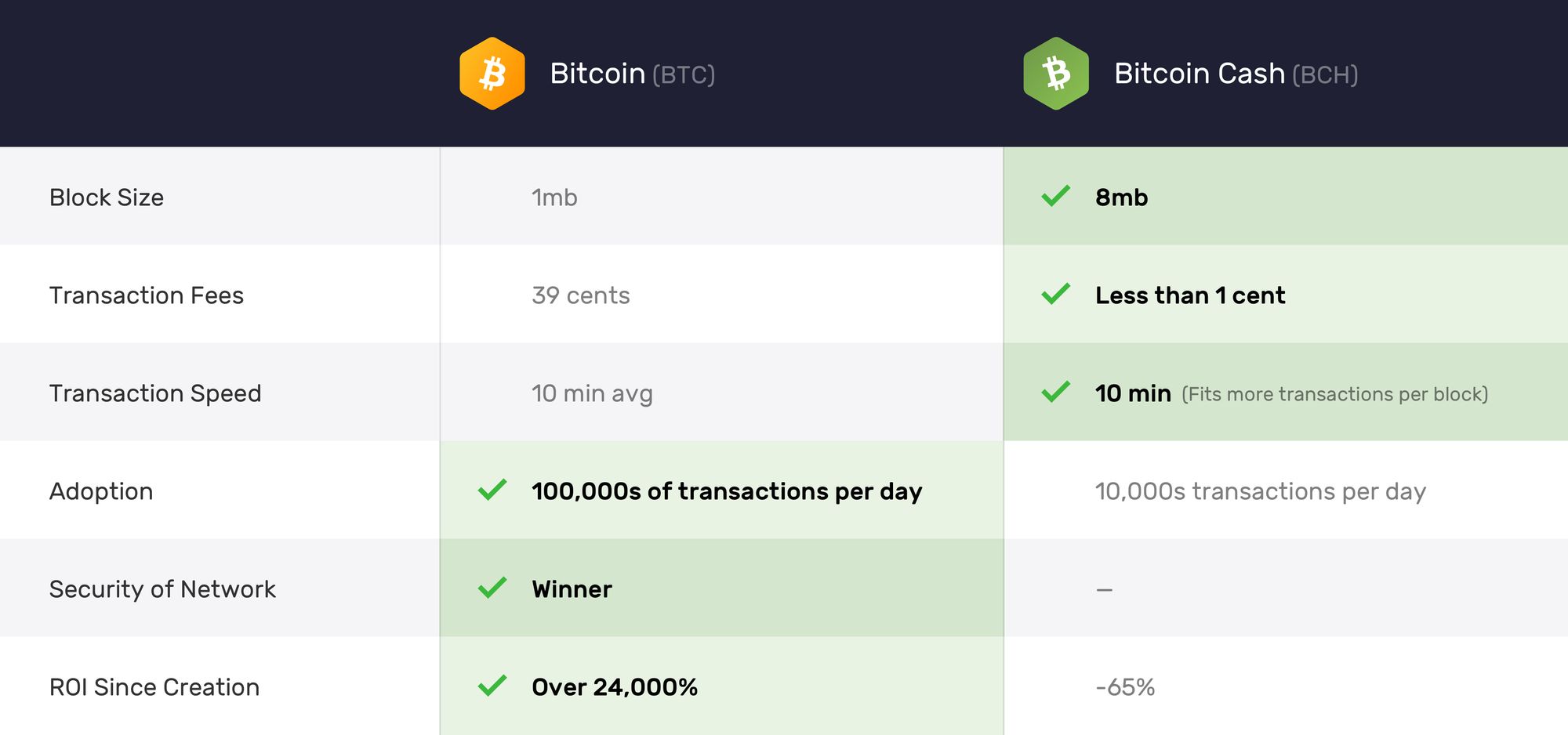

As mentioned, one of the main criticisms of BTC as it struggles to meet increasing demand, is high transaction fees. As of now, BCH has lower average transaction fees than BTC ($.0019 for BCH vs. $0.39 for BTC).

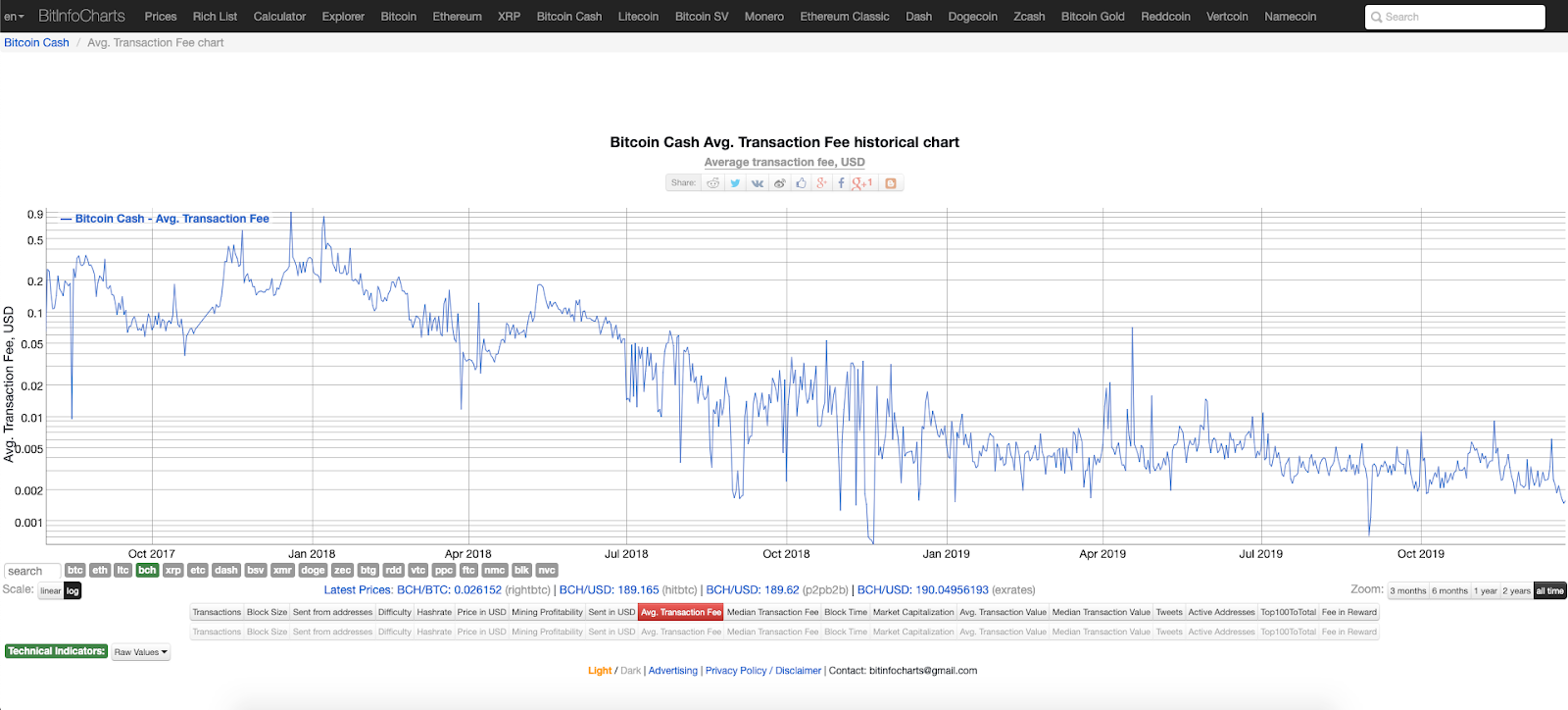

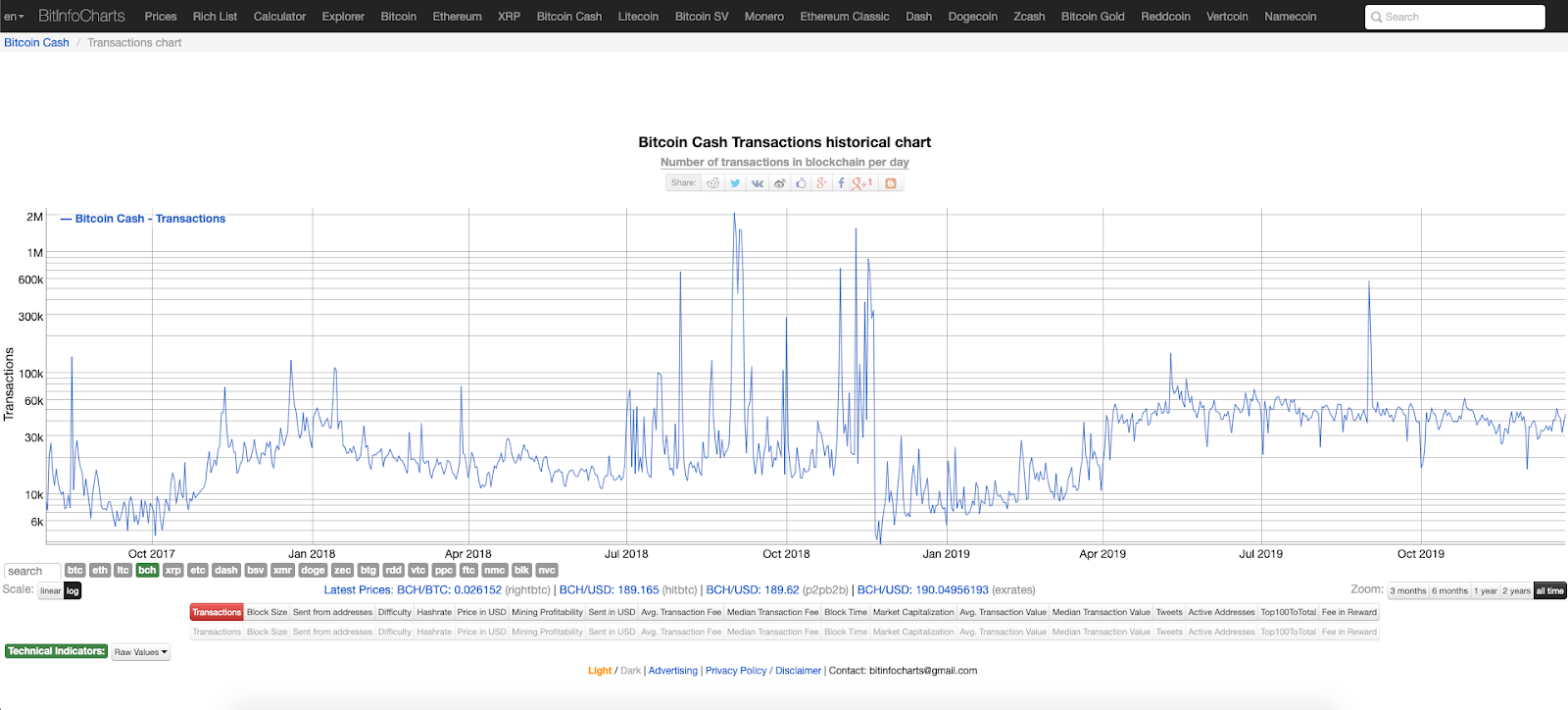

However, while the BCH camp might use this point to criticize BTC, it isn’t necessarily a fair comparison (yet), as BCH isn’t used nearly as much as BTC and doesn’t have a large network load.

Bitcoin Cash transaction fees are a fraction of a penny on average. Source: Bitinfocharts

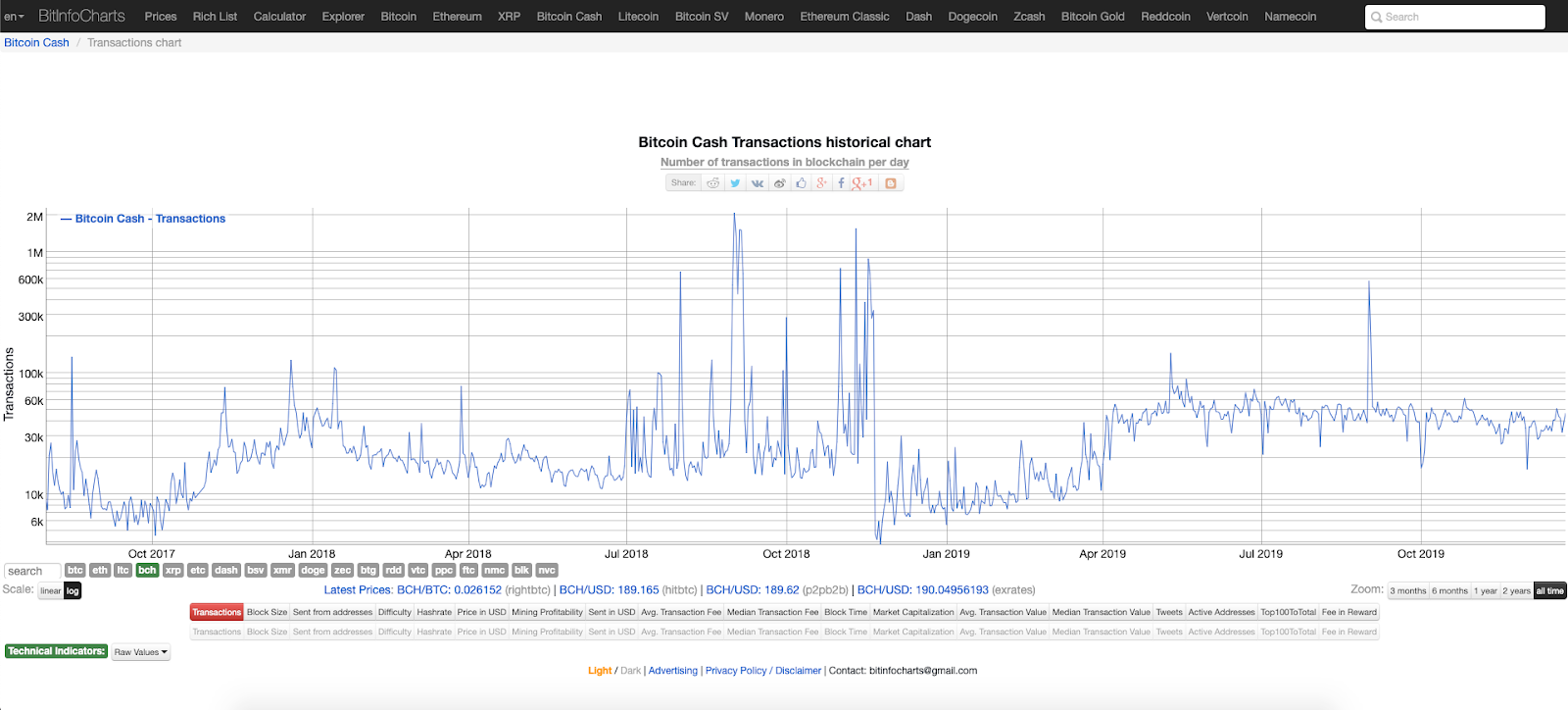

Bitcoin Cash transaction fees are a fraction of a penny on average. Source: Bitinfocharts Bitcoin Cash’s daily transactions are a fraction of those of Bitcoin’s. Source: Bitinfocharts

Bitcoin Cash’s daily transactions are a fraction of those of Bitcoin’s. Source: Bitinfocharts

Bitcoin vs. Bitcoin Cash: Transaction Speed

BCH blocks can accommodate more transactions at once, which means transactions are more likely to fit into a block without needing to wait for the next one.

However, it should be noted that BCH is not used nearly as much as BTC and therefore, it has not been tested to the same degree in terms of network traffic.

In any case, BCH is further ahead in its block height when compared to BTC – a clear indicator that BCH is mining blocks and confirming transactions faster.

Bitcoin block height: https://coin.dance/blocks

Bitcoin Cash block height: https://cash.coin.dance/blocks

Bitcoin vs. Bitcoin Cash: Adoption

On the topic of user and merchant adoption, BTC is the clear winner. Though this could change in the future, more wallets, centralized exchanges, merchants, and people in general use BTC.

This of course is probably helped by the fact that BTC is the first cryptocurrency and has been around for more than 10 years, while Bitcoin Cash has only been around since 2017.

Bitcoin daily transactions. Source: Bitinfocharts

Bitcoin daily transactions. Source: Bitinfocharts

Bitcoin’s wider adoption is clearly visible in its large number of daily transactions relative to Bitcoin Cash (number of daily transactions below).

Bitcoin Cash daily transactions. Source: Bitinfocharts

Bitcoin Cash daily transactions. Source: Bitinfocharts

Bitcoin vs. Bitcoin Cash: Hashrate

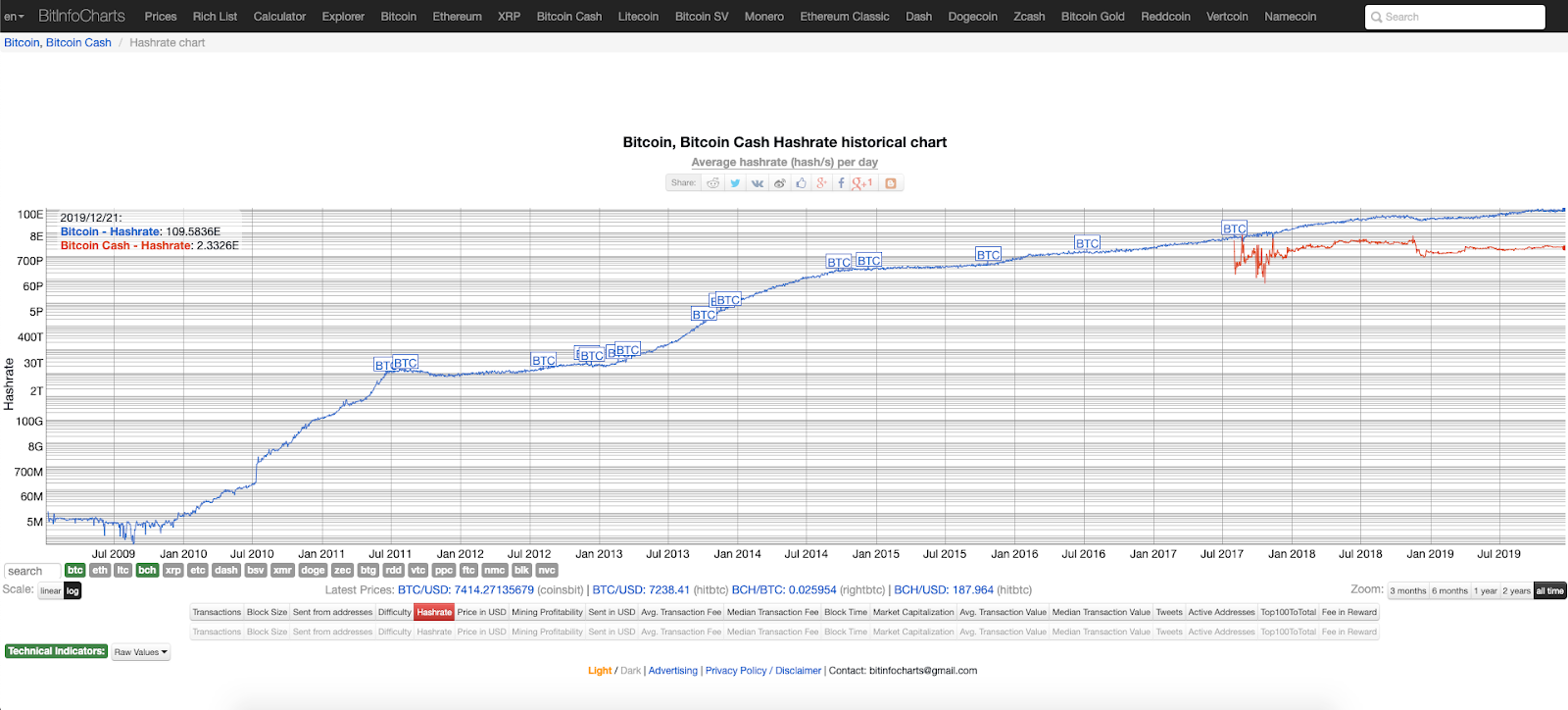

When it comes to hashrate, or “mining power” of the Bitcoin and Bitcoin Cash networks, BTC is the clear winner.

Bitcoin Cash’s total hashrate, which represents how much computing power miners are using to validate transactions and secure the network, is a fraction of Bitcoin’s. As of writing, BTC’s total hashrate is around 100 exahashes while BCH’s is around 2 exahashes, or a 50x difference.

This means that Bitcoin Cash is more easily susceptible to a “51% attack”, where a malicious actor or group gains 51% or more of the network’s hashrate, which allows them to do things like reverse transactions or other actions that harm the network.

Bitcoin’s tremendous hashrate has contributed to its flawless security track record, as it has never experienced a 51% attack like other networks. Source: Bitinfocharts

Bitcoin’s tremendous hashrate has contributed to its flawless security track record, as it has never experienced a 51% attack like other networks. Source: Bitinfocharts

Bitcoin vs. Bitcoin Cash: Price

Another key comparison point to make between Bitcoin and Bitcoin Cash is price. At the end of the day, no one wants to use a crypto asset if it doesn’t have any value. For that reason, many people are making BCH price predictions today.

But when it comes to price, it’s hard to beat Bitcoin. For perspective, right before the 2010s, when the world economy went through a major economic recession, traditional financial markets collapsed.

From the market meltdown in March 2009 to December 2019 however, the S&P 500 and the Dow Jones Industrial Average, both major indexes that represent the broader US stock market, have gained 369 and 326 percent respectively. Those types of gains are nothing to laugh at.

Nevertheless, Bitcoin was in its own category and helped the broader crypto asset class become the best-performing asset class of the 2010s.

From March 2010, when 1 BTC was around $0.05, to December 2019, Bitcoin’s price rose more than 12 million percent. That wasn’t a typo! Such gains are unheard of in the world of investing.

Unfortunately, BCH’s performance hasn’t been as strong, since it’s lost about 65 percent of its value since its creation in August 2017.

Bitcoin vs. Bitcoin Cash Debate

Bitcoin vs. Bitcoin Cash discussions can get very heated, and there are regular debates on the topic, sometimes featuring prominent speakers.

One such debate was a debate between Roger Ver and Tone Vays. Roger Ver is a prominent figure in the cryptocurrency space, as he was one of the first big investors in and evangelists of Bitcoin.

His company, Memory Dealers, was the first established company to accept BTC as payment. He also funded many early Bitcoin startups like Blockchain, Kraken, Bitpay, and Purse.

However, after disagreeing with where the community was going, especially in terms of scalability, Ver turned his focus to BCH.

Vays, on the other hand, is a self-proclaimed “Bitcoin Maximalist” (someone who thinks Bitcoin is superior to other alternatives). Vays has a background in finance, as he worked on Wall Street for Bear Stearns and JP Morgan. Nowadays, he spends time promoting BTC as a means of economic freedom.

Their debate touches on things like transaction speeds, transaction fees, network usage, global adoption, scalability, and decentralization:

Bitcoin vs. Bitcoin Cash: Chart

Looking for a chart comparing BTC and BCH? Check out our crypto charts page for accurate and easy to use charts!

Conclusion: Which is better?

So at the end of the day, which asset is better: Bitcoin or Bitcoin Cash?

For now, BCH has BTC beat on block size, transaction fees and speed. However, BTC undeniably has wider adoption. Also, the Bitcoin network is much more secure due to its high hashrate. Not to mention Bitcoin wins on price as the best-performing asset (across all asset classes, not just crypto) of the decade.

Nevertheless, most of the talking points used to compare the two cryptocurrencies have a lot to do with how long a network has been around.

It’s possible that if BCH becomes more popular, that it will run into the same scalability issues as BTC and suffer from high transaction fees.

It might also be the case that BCH achieves similar or even greater adoption than BTC. Such an increase in popularity could also entice miners to switch over to BCH, if the price of BCH rises in accordance with its increasing popularity.

Thus, for now, a definitive conclusion which is better isn’t set in stone. Yet, for the foreseeable future it’s possible that both Bitcoin and Bitcoin Cash could play important roles, with Bitcoin being more like “digital gold”, or a store of value, and Bitcoin Cash acting as “digital cash”, or a convenient payment method.

Hence, it might not be Bitcoin vs. Bitcoin Cash but Bitcoin and Bitcoin Cash.

If you’re looking to buy Bitcoin and/or Bitcoin Cash, you can use Exodus crypto wallet to exchange other cryptos for BTC and BCH (mobile tutorial).

(If you don’t have crypto, buy Bitcoin using services like Cash App or Coinbase before exchanging in Exodus).

In addition, Exodus allows you to store both BTC and BCH in the same wallet. Exodus also includes the following features that we think you’ll like:

- Supports 100+ crypto assets

- Focuses on premium design and ease of use

- Is the only wallet to support desktop, mobile, and hardware wallet (Trezor) integration

- Allows you to exchange cryptos right from your wallet – without creating an account!

- Gives you the ability to sync your wallet between desktop and mobile

- Has 24/7, fast human support if you ever need help!

From left to right: Exodus on Trezor, mobile, and desktop. Download Exodus here

From left to right: Exodus on Trezor, mobile, and desktop. Download Exodus here