100% FREE Invoicing Software for Self-Employed

Invoicing software allows freelancers and small business owners to create and send invoices with much less effort, focusing on more lucrative activities than chasing client payments. What’s great is that almost all invoicing software is free.

But before we start, you should know that Paymo is a software in which you can create 100% free invoices for life. If you’re the hands-on type, you can click here, get a free account and create your first invoice immediately. Here’s a quick tutorial on how to invoice your clients and get paid in Paymo:

The best tools of this kind have evolved, offering various functionalities, from creating estimates and expenses to task management and tracking time to connecting to payment gateways.

What’s even better is implementing a completely free invoicing solution.

Different free invoicing software suit different consumer needs. This article will look at the top-rated invoicing software for small businesses and freelancers and analyze them in terms of their main features, pros and cons, and pricing plan—besides the entirely free invoicing module—such as add-ons, for example. We’ll also look at what criteria to consider when choosing the software that fits best. After all, your whole business depends on it.

Note the distinction between these three categories lest there is a hotchpotch of expectations regarding invoicing: invoice generators, invoicing software, and accounting software:

Invoice generators. Invoice generators are your go-to for a one-off project or a miscellaneous invoice you must send quickly. An invoice generator uses in-line editing to enter your info—and logo—into custom fields. This simple solution generates a customized invoice, which you can download as a PDF or send via email. To review invoice generators, read this article on the best invoicing generators.

Cloud invoicing software. Invoicing software is a more robust invoicing solution best suited for freelancers, small businesses, consultants, and lawyers. Invoicing software or tools typically integrate time-tracking and project management features and generate invoices based on outstanding tasks or time. This option is preferred for creative and web agencies or small businesses that deal with services rather than products.

Business accounting software. Business accounting software is a full-fledged financial solution that includes invoicing, bookkeeping, and other types of financial tracking, like payroll or expense tracking. Most accounting software requires know-how to get your money’s worth and is a better fit for large companies and enterprises.

If you’re new to invoicing, I highly recommend reading through this invoicing guide to help you understand the basics, like how to generate invoices, bill your client, and avoid invoicing mishaps.

Now, without further ado, here is our invoicing hall of fame:

Mục lục bài viết

1. Paymo – The best free invoicing software for self-employed

If you want to marry invoicing software with time tracking and project management, look no further than Paymo – the best invoicing software with native time tracking and advanced project management features.

Whether a small business or a freelancer, you can exclusively use Paymo to generate unlimited invoices, estimates, and expenses. Paymo has always strived to be the best invoice software for small businesses.

Paymo‘s debut in 2008 as a time tracker for scheduling and billing was aimed at freelancers and small businesses (employers and staff). It slowly morphed into a full-featured project management app over the years. Besides projects and tasks, you can track time and pull time entries directly into an invoice. Then further customize it (in different languages), add a tax or discount, and get paid in 95 currencies.

Moreover, you can set three late payment reminders when the invoice is overdue. This year, Paymo introduced its online payment gateway, PM Payments, allowing your clients to pay you directly and securely via credit card and ACH. This feature is available for US clients. You can be paid online through other payment gateways, so take your pick.

But that’s not all. Paymo covers other billing & invoicing aspects, such as creating estimates—from scratch or based on a project’s tasks—and expenses. There’s even the possibility of registering a deposit as a down payment to obtain the necessary resources to kickstart a project. This way, you’re better positioned to sell your services by the hour while managing projects in parallel.

All these—especially paid invoices—help freelancers or business owners assess their project profitability, namely how profitable their projects are, by contrasting internal costs to the billed AR.

Paymo is the best free invoicing software for service- and project-based small businesses and medium teams.

Pros:

- Users can create estimates, track time automatically, log billable hours, and register expenses, then convert all these into an invoice.

- Recurring invoices automate the sending of invoices based on your settings.

- Project management features, like Gantt charts and a resource scheduler.

- Invoices and estimates can help you forecast and keep track of your project profitability

Cons:

- No accounting functionalities

Pricing:

Free for freelancers who want to generate unlimited invoices, expenses, and estimates. The Starter plan ($4.95/user/month) also has a limit of 1 user but offers more clients and tasks.

The Small Office plan ($9.95/user/month) removes the user limit and includes extra features like recurring tasks, active timers, live reports, file proofing, and versioning.

The Business plan ($20.79/user/month) covers the exact billing and invoicing needs but comes with different project planning features, like Gantt charts and resource management, such as a Team Scheduler and Leave Planner.

2. Invoice Ninja – Best for customization

Invoice Ninja is perhaps the most customizable invoicing software out there.

Invoice Ninja does so much more than an invoicing system – lately, it focused more on PM features like Kanban boards, time tracking, etc. Its UI used to be quite rudimentary, but it was slightly updated since my first review—it’s now on version 5. Still, it’s pretty intimidating and complex.

You can send unlimited invoices and quotes to up to 50 clients, create an inventory list of products, manage projects and tasks, and benefit from other general features related to billing. Likewise, you can get paid via 45 different payment gateways, including Apple Pay and Alipay, to scale your business globally.

Coming back to the invoicing part, Invoice Ninja alerts you when a client has viewed or paid an invoice. It also offers a password-protected client portal where clients can view their invoices and payment history. This way, you can nurture a better relationship with them without chasing payments or breaking the bank to add them as regular users.

Pros:

- Most generous free offering in terms of the number of clients covered.

- Forty-five payment gateways, including Apple Pay and Alipay.

- Password-protected client portal.

Cons:

- Limited integrations.

- Not-so-excellent user experience

About the company: it was launched in early 2014 by a small team of three founders, Hillel, Dave, and Shalom—who claim to handle support personally—aiming to build a suite of apps for freelancers and small businesses. Invoice Ninja is based in Pardes Hanna, Hefa, Israel.

Pricing:

Invoice Ninja’s free plan is good enough to cover a freelancer’s needs, even though it allows you to invoice only 20 clients and use four invoice templates. The Ninja Pro ($10/user) plan removes the client limit and Invoice Ninja watermark.

If you need to manage the financials with more people, the Enterprise plan depends on the number of users: $14 (1-2 users), $26 (3-5 users), $36 (6-10 users), and $44 (11-20 users).

3. Zoho Invoice – A best-automated billing software

Zoho Invoice is the best billing software for small businesses that want to automate their invoicing process and scale simultaneously.

Zoho Invoice has been one of Zoho’s first products, supporting the parent company’s growth, and is well known for its plethora of SaaS tools. It has a generous offer, covering several invoice types (recurring, retainer, credit notes), estimates, and payments in different currencies that can be accepted through 10 payment gateways. Customers can sign up to the client portal when viewing/paying invoices via the link.

Due to the myriad of similarly branded products Zoho Corporation offers, finding tutorials and help articles is a bit confusing. Their websites and help pages are virtually impossible to distinguish. For example, I looked for info on editing invoice templates in Zoho Invoice but got redirected to an article and Youtube video for Zoho Sign instead.

It offers sales inventory items, projects, and timesheets, although a bit more rudimentary when compared to Paymo. The invoice templates look better, but you can only edit them with placeholders, which can be difficult for beginners—plus, there’s no custom HTML/CSS.

What makes Zoho Invoice stand out, though, is the automation functionality. Of course, invoice and estimate templates and the ability to customize payment reminders and in-app notifications are a given. But the real value stems from the fact that you can trigger automations to activate specific discounts or late payment fees depending on how early your clients pay you. You’ll need to be literate in the Deluge language since you need to write these scripts independently.

Another common dissatisfaction among Zoho Invoice users is the inability to group multiple invoices and submit them once if you need to invoice clients in batches.

Pros:

- Credit notes as a way to balance/cancel already existing invoices.

- Configurable automations for discounts and late payments.

- Extensive expenses category.

Cons:

- Email templates don’t look so professional. Hence they might come off as spammy.

About the company: first known as AdventNet, Inc. (1996-2005), was founded by Sridhar Vembu and Tony Thomas to provide network management software. Zoho CRM was released in 2005, followed by Zoho Invoicing in 2008. In 2009, the company was renamed Zoho Corporation after its online office suite.

In 2017, Zoho launched Zoho One, a comprehensive suite of over forty applications. As of October 2021, Zoho One has been expanded to 50 applications. Its headquarters are located in Chennai, Tamil Nadu, India.

Pricing:

Zoho Invoice has recently rid itself of all its paid plans, being completely free—yes, you read that correctly—and posing at the same time a severe threat to Invoice Ninja.

Zoho Invoice is the best match for small businesses with complex invoicing workflows.

4. Hiveage – A powerful software for individuals

Hiveage, formerly called CurdBee, is a simple invoicing software for freelancers.

The setup is relatively straightforward. The team behind it stripped it down only to the essentials, leaving an easy-to-navigate interface that doesn’t overwhelm you. All you need to do is fill in your company details and clients (under a light CRM), then adding an invoice is a breeze.

The neat dashboard delivers the most relevant information about your cash flow for the current fiscal year: a profit & loss statement, plus a comparison between accounts receivable and accounts payable. Quite handy if you throw in the Track tab for tracking time, estimates, and mileage in a single place, making sense from a design perspective.

Yet one of Hiveage’s unique features, albeit entirely hidden, is the multi-profile. Simply put, you can add different companies under the same account. Pair this with the many commercial payment gateways and 30 languages available, and you’ve got a cheap billing and invoicing tool for running multiple hustles.

Given the app’s focus on simplicity and ease of use, I didn’t find many drawbacks. If we look at the freemium plan, sending unlimited invoices to 5 clients is more than enough, making Hiveage the best invoicing software for freelancers. If you’re looking for more robust accounting features, though, Hiveage is not the right choice.

Since my last review, its bookkeeping features have slightly improved, now offering detailed reports with accounts aging, revenue by the client, invoice details, tax summary, and output vs. input tax summary. Other than that, not much changed. Its features and UI are the same—a straightforward, simple tool for freelancers.

Pros:

- Simple, straightforward design.

- Multi-company profiles under the same account.

- Supports 30 languages and various payment gateways.

Cons:

- Lacks robust accounting features such as bookkeeping and bank reconciliation.

About the company: founded by current CEO Lankitha Wimalarathna in 2006 as an internal invoicing tool, it eventually evolved into CurdBee in 2008, then Hiveage in 2014.

Pricing:

The Free plan is perfect for starting entrepreneurs, featuring unlimited invoices for five clients. The Basic plan ($19/month) is a better fit for freelancers with an established business with up to 50 clients.

The Pro plan ($29/month) brings in teams and financial reports for small businesses. The Plus plan ($49/month) adds support for importing data, which is a bit pricy if you ask me for software that only does simple billing and invoicing.

5. Harvest – Best invoicing tool with straightforward features

Harvest is a time-tracking tool with reliable invoicing functionalities that works great for freelancers and business owners looking for a non-complicated user interface.

Harvest has an easy learning curve, as it provides onboarding and quick feature tour guides.

As for the ‘Invoices’ module, there’s an Overview that lists all invoices issued in the current year, tracking the total balance of all invoices. It’s a cool feature, but after I had marked a few invoices as paid, it hit a snag – the balance did not show in the Overview, and the timeline was unchanged.

A nice-to-have ‘Report’ tab filters invoices by timeframe, clients, or status if you need a breakdown of your invoices in a CSV or Excel.

Adding an invoice is not complicated if you know how to create one. After you send an invoice, you may set up reminder emails, write it off, or create a recurring invoice.

Admins can create recurring invoices to be sent automatically for flat fee projects. Recurring invoices allow minimum customization, such as issue date, frequency, duration, and billable hours. For Time & Materials, a draft invoice is created for the project manager to send manually.

A ‘Retainer’ tab allows users to track funds paid in advance via retainer invoices.

As for customization, in the ‘Configure’ tab, you may add a logo under 5MB but cannot make changes design-wise. Even so, the invoices are intuitive and easy to read. No templates exist, but you may configure your invoice and even translate invoice labels.

Those translated labels will appear on the printed and PDF versions of all invoices if you send invoices internationally, although you’d have to change them every time if you have more than one foreign language.

Harvest is best suited for freelance work or project managers but not so much for employees who would like to see how their work adds up. Most users complain that it’s difficult for a non-admin to see summaries of time worked without manually adding up the time entries.

Considering how freelancers or small business owners usually send invoices—and if that’s you—it shouldn’t concern you unless you need a tool that fuses time-tracking and invoicing well. I know we do.

Pros:

- recurring invoices, attaching expenses to invoices

- retainers to help users track funds paid in advance

- accepts online payments and syncs with QuickBooks and Xero, and other 50+ apps

Cons:

- accessibility: the layers of visibility for admins, project managers, and users can be confusing

- limited invoice customization

About the company: Harvest is a web-based time-tracking tool launched in 2006 by Iridesco, LLC—a small web design agency. In 2010, Harvest launched online payment integrations, and by 2015 expanded integrations across devices to cater to popular collaboration tools.

Pricing:

A Free plan is available for a solo user with a maximum of 2 projects. The Pro plan offers unlimited seats and projects at $12 per seat/month—if your team is larger than 50 seats, you get a discount. Harvest offers a 15% discount for nonprofits, schools, and universities.

6. Zervant – best invoicing tool for inventory

Zervant is an invoicing tool catering to European small business owners and freelancers interested in providing products and services to their clients and customers.

There’s quick onboarding as soon as you sign up – a checklist of tutorials and an app tour guide. Setting up your account is done by personalizing your documents: company details, payment methods, and design.

Zervant feels like an invoice generator—a product they also offer. Thanks to the dominant in-line editing, Zervant has that feel and look. When you add a new invoice, you must manually enter the products you logged in the ‘Products’ tab.

In Zervant, invoicing is built around products rather than services—a workaround is to have your web development services packaged as products. You can still invoice based on units of time (i.e., hour), so it’s not an issue.

You can’t set a due date but must stick to specific NET payment terms. What you can do is add a discount (value or percentage). You may add customer/client information from the ‘Customer’ tab or quickly add a new customer. Again, you are limited to 5 in the Free plan.

By hitting ‘Customize design,’ you may choose one of the 18 default colors (or a custom hex color code), pick which elements you want to be colored and what font to use from 23 options—Comic Sans is not available. You may also add a logo.

To create recurring invoices, add down payments, or a payment schedule in your invoice; you need a Pro or Growth plan and automatic payment reminders sent by email: 1 day before, on the due date, and seven days after the due date. Invoices can also be sent by post/snail mail—yes, really.

Zervant has five supported languages for invoices: English, German, French, Finnish, and Swedish.

Pros:

- dashboard of sales, top customers, and top products

- allows multi-entity/multiple trade names

- accepts online payments via Stripe

Cons:

- glitchy interface

- expensive compared to competitive invoicing software

About the company: Zervant is a cloud-based invoicing software launched in 2010 by Mattias Hansson & Tuukka Koskinen, serving primarily European markets: Finland, Sweden, France, Germany, and the UK. As of late 2021, Zervant is part of Ageras Group, a provider of seven banking, accounting, and admin software in Europe.

Pricing:

Zervant is by no means cheap, charging subscriptions in euros. The Starter plan (€11/month) is limited to 30 customers and three premium deliveries (e-invoices or postal invoices) and has limited invoicing functionalities. The Free plan allows unlimited invoices to a maximum of five customers.

The Pro plan (€20/month) includes time-tracking and recurring invoices, typically core functions of the invoicing or project management tool.

The Growth plan (€46/month) is similar to Pro but maximizes e-invoices and postal invoices to 30 monthly. For extra premium deliveries, you’ll need to ask for a quote.

Zervant offers a referral program in which you get 50% of your referee’s subscription fee for one year, paid in quarterly installments.

7. ZipBooks – best accounting software

ZipBooks is a cloud-service bookkeeping service that allows users to create invoices, monitor transactions, and track time and projects to some extent.

ZipBooks is true to its advertisement: it is indeed simple and beautiful. A neat user interface and design—you get an intuitive feel for the app after a few minutes. ZipBooks is powered by dashboards, menus, and a quick search. Not everything is on sight, though – you must click “More” to access all capabilities.

Let’s cover some of the core features.

Invoices. Generating an invoice is simple, similar to a sleek invoice generator. There are highlighted fields you must edit before sending to your client. An “Invoice Quality Score” evaluates your invoice—part of the data-driven intelligence technology that gives you actionable insights. I haven’t used it enough to figure out how to improve my 48/100 invoice score.

Transactions. Sending the invoice and recording payment is easy, but to change the invoice status, you must turn to ‘Transactions.’ That’s where you stumble on ZipBooks’ premium features, such as Reconciliation, Tags, and Banks. ZipBooks syncs to bank accounts available only in the US, Canada, South Africa, Australia, and New Zealand.

Reports. Users can generate quick reports, although these cannot be exported to PDF or other formats—pity. You find your financial statements, accounting & tax, sales, expenses, and team reports here.

Contacts comprise customers and vendors, and Payroll integrates with Gusto, starting at another $40/month.

Tracking. ZipBooks includes a native time-tracker but has little flexibility. Users may also create ‘projects’ that are services to be billed.

Pros:

- cute user experience and ease of use

- ideal for businesses with no inventory

- accounting insights, quality scores, and reports

Cons:

- lacks many features and integrations that competitors offer

- does not allow multi-entity/multiple trade names

About the company: ZipBooks was launched in 2015 in Utah by Tim Chaves, backed by VC firm Peak Ventures. The company secured an extra $2M in funding in 2016 and was awarded a $100k economic grant by the Governor’s Office of Economic Development, State of Utah, in 2017.

Pricing:

A free Starter plan includes unlimited invoicing, vendors & customers. The Smarter plan ($15/month) adds 5 team members, automates reminders, connects multiple bank accounts, and tracks time. The Sophisticated plan ($35/month) doubles down on accounting features, such as reconciliation, locking of completed books, and secure document sharing, among other features. Thus, ZipBooks can be considered expensive if you only need invoicing.

Free invoicing software with limited invoices

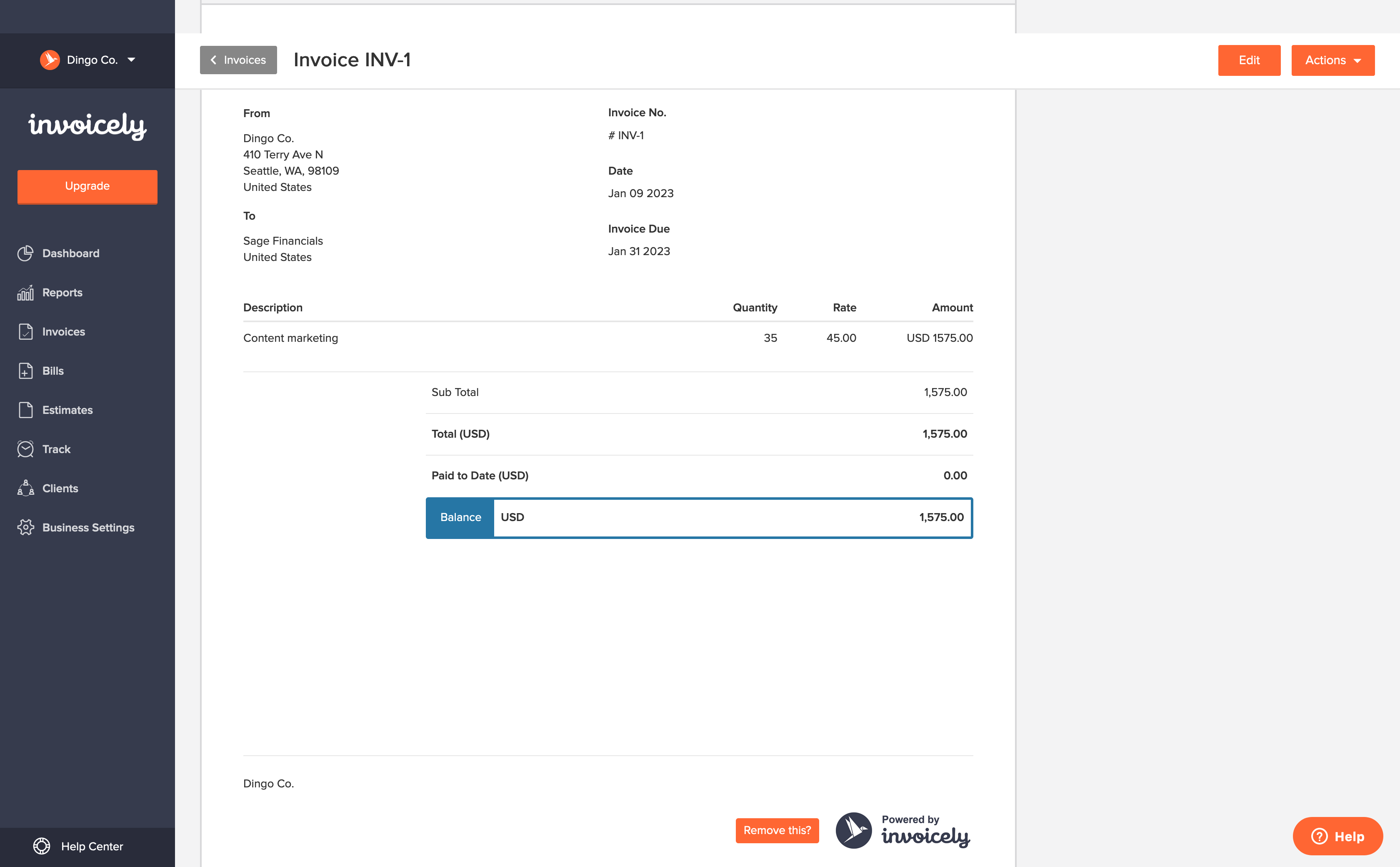

Invoicely – a simplistic invoicing tool

Invoicely looks like an elevated invoice generator, helping small businesses and freelancers with fewer accounts manage their invoices, bills, and estimates.

The Dashboard displays an invoice summary, a breakdown of your AR and AP, the number of invoices and expenses sent, and a ‘Recent Activity’ log. In Invoicely, users may generate reports, manage client information, track time and expenses, and generate invoices, bills, and estimates.

The Free plan allows professionals to send five monthly invoices, but if you need more features, such as tracking time, expenses, mileage, creating estimates (quotes), and business branding, you’d need to upgrade to a paid plan. If you compare it to other free invoicing software offering unlimited invoices, I’d say Invoicely could be dropping that invoice limitation.

Pros

- Recurring profiles

- Payment integration: PayPal

Cons

- Limited functionalities for an invoicing tool

- watermarked in the Free plan

- expensive compared to competitive invoicing software

About the company: First launched as Invoiceable in 2012, Invoicely is based in London, UK.

Pricing:

Only the Enterprise plan ($29.99/mo) allows unlimited invoices. The Basic plan ($9.99) and Professional plan ($19.99) allow 100 invoices per month, and 250 invoices, respectively. This model could work for you if you don’t invoice as much. Should you scale your business, you’d have to upgrade to the Enterprise, which is costly compared to competitors.

Invoicera – an old-school invoicing tool

Invoicera is an invoicing solution for enterprise verticals, ranging from hospitality, tour & travels, to telecommunication, transport & logistics.

Invoicera has the aesthetics of an invoicing generator launched in the early 2000s that remained the same. There is no onboarding—tour guides, tutorials, or checklists—and the interface needs a redesign. While it provides necessary features like client profiles, recurring invoices, time-tracking, and reports, it is unappealing to the point of deprecation.

Pros

- integrates with 25 payment gateways

- multi-business invoicing

Cons

- glitchy when generating invoices

- unintuitive user experience

- web 1.0 interface that needs major revamp

About the company: Invoicera was launched in 2006, in Gurugram, India, under Vinove Software & Services LTD.

Pricing:

The Starter plan is free of charge and includes three active clients and 50 free invoices, expenses, and estimates. Paid plans start at $15/month, allowing unlimited invoices and other features.

Paid invoicing software worth considering

By paid invoicing software, I mean that you’ll hit their mandatory paywall. All the tools reviewed till now offer unlimited invoices in their free plans—of course, every invoicing software has paid plans.

But these contenders offer paid plans exclusively. Let’s see why they are, nevertheless, worth considering:

1. Invoice2Go – an invoicing software with client reviews

Invoice2Go by Bill.com is an invoice generator-turned-software that helps freelancers and small business owners manage their expenses and invoices thanks to multiple payment options. It has basic project tracking and reporting and integrates with Gusto for payroll. One peculiar feature is that Invoice2Go has built-in customer/client reviews, so you get client feedback straight from your invoice.

Pricing starts at $5.99/month for two invoices/month and card payment fees of 3.5%. The Premium plan ($9.99/month) allows five invoices/month and card payment fees of 3%. You’ll have to opt for the Professional plan at $39.99/month for unlimited invoicing.

2. SimplyBill – an invoicing tool with a retro look

SimplyBill is a simple invoicing tool with limited invoicing functionalities. The app features a Dashboard, Invoices, Quotes, and Clients. Its only differentiator is that users can automatically track payments and sales tax directly on the invoice. The user interface is instead 1.0.—2000s vibe, if you wish—and a bit clunky. It probably hasn’t been revamped in at least a decade. Despite its retro look, SimplyBill offers SSL data encryption and business branding.

Pricing starts at $5/month, wherein the Basic plan allows 25 watermarked invoices and unlimited clients; the Enhanced plan ($15/month) allows 100 invoices with business branding—for unlimited invoicing, opt for the Premium plan ($25/month).

3. BigTime – an essential invoicing tool

BigTime is a time-tracking tool with invoicing capabilities. The interface is essential for generating an invoice—instead, it looks like an invoice generator. There’s a Dashboard displaying work in progress, and thus potential revenue, AR, and a monthly invoicing summary. BigTime integrates with accounting software, such as QuickBooks and Sage Intacct (discussed under ‘Accounting software’).

The cheapest plan, Express ($10/month), does not include invoicing or expense tracking. Users must get the Pro ($30/month) or Premier plan ($40/month) to invoice clients, receive online payments, keep track of their expenses, or have other project accounting capabilities.

4. Scoro – a complex pm tool with invoicing capabilities

Scoro is a project management tool with invoicing capabilities to serve large teams or enterprises. Users can send prepayment invoices and quotes and keep track of purchases, expenses, and receipts. Invoices can be compiled into financial and sales reports. Scoro has native integration with Stripe and PayPal with dozens of marketing, sales, and productivity apps.

Scoro has quite the price tag: the Essential plan starts at $28/user/month for a 5-member team minimum—$140/month—to send quotes, invoices, and receipts. For more detailed financial reports, expense tracking, and multiple currencies, there’s the Standard plan at $42/user/month for the same 5-member team ($210/month). The Pro plan ($71/user/month, ergo $355/month) offers project budgets, margins, labor costs, and late invoice reminders. This is by no means affordable.

5. WORK[etc.] – a CRM tool with billing capabilities

WORK[etc.] is a CRM solution with pm and billing capabilities for small and medium-sized teams. Besides basic invoicing, users can manage subscription billing through recurring billing and automatic invoice creation. The interface is old-looking and clunky, but ok if you want to reminisce about the early 2010s. WORK[etc.] is available in 8 languages: Mandarin Chinese, French, German, Italian, Japanese, Dutch, Spanish, and Russian.

There’s no free plan, but users may test the app for 14 days before committing to a paid plan, namely the Starter plan ($78/month for a maximum of 2 users). For teams, the two plans, Team ($195/3 users/month + $49/extra user/month) and Foundations ($395/3 users/month + $59/extra user/month), also offer accounting integrations—which, in my opinion, are too pricey when scaled.

6. HoneyBook – a CRM software with invoicing for US freelancers

HoneyBook is a CRM software with invoicing capabilities for small businesses and freelancers. Users can book clients, sign contracts online, and generate invoices for their clients. HoneyBook allows online payments, and clients can auto-pay future payments. One peculiar feature is that HoneyBook has templates for users to streamline their client flow, thanks to its no-code builder.

There’s no free plan, but HoneyBook offers a 7-day free trial. Only one subscription plan at $39/month lets users access all features with unlimited invoices, team members, and concierge support. HoneyBook is currently available in the US and Canada.

7. ChargeBee – an invoicing software for subscriptions

ChargeBee is a subscription management tool with invoicing capabilities. ChargeBee focuses on subscription and billing automation fit for startups or companies providing services or products every month. It’s better suited for Revenue Operations, Finance, and Sales, and it integrates with 36 apps about marketing, resource planning, eCommerce, and customer support, among others.

There’s a Free plan for early-stage startups until they reach their first $100,000 in revenue. Then it automatically updates to $99/month + overage fees. Starting from $249/month, other plans include accounting and CRM integration, advanced analytics, and sales tax automation.

Paid accounting software for your small business

1. FreshBooks – Best all-in-one invoicing and accounting software

Whether you’re all about the nitty-gritty of keeping accounting records, FreshBooks has covered you as the best all-in-one invoicing software with accounting features.

Yes, I’m talking about double-entry accounting reports and the ability to invite your accountant for free to register journal entries – features that paint a clear picture of the money that enters and leaves your company. If you don’t need them, don’t worry. The Lite plan allows you to send and create unlimited invoices for up to 5 billable clients, so FreshBooks suits teams with a low client headcount.

Invoicing-wise, FreshBooks nails the client-facing part. Aside from regular and recurring invoices, users can generate retainers with concrete terms and payment frequency for dealing with clients on a monthly budget. Those, in return, can pay for their services via credit card or direct debit (via ACH), making it a win-win deal for both sides.

Freshbooks also offers other features to help you run a healthy business, such as basic time tracking, project management, vendor tracking (still in beta), and proposals for when you need to showcase your work in front of new clients. However, it doesn’t have too many customization options for invoices, and some users have experienced some glitches when connecting their bank accounts with expenses to pull in charges automatically.

Some benefits include retainer invoices with term agreements and payment frequency, accounting and bank reconciliation features, and integration with over 100 apps, including eCommerce (Shopify) and payroll (Gusto).

The downsides of using FreshBooks are its limited customization options for invoices and its cost. When compared to other electronic invoicing software, FreshBooks is quite pricy. You only get one user/account, with every extra user costing $10/user/month.

Likewise, the Lite plan ($15/month) and the Plus plan ($25/month) cap the billable clients at 5, respectively 50. Companies with many clients must look for cheaper FreshBooks alternatives unless they opt for the Premium ($50/month) plan for unlimited clients.

Each plan offers extra paid add-ons. A 70% discount for the first three months is available for all plans.

2. QuickBooks – Best invoicing software for reporting

Speaking of cheaper Freshbooks alternatives, QuickBooks might fit the bill for those who still want to rely on accounting and bookkeeping features—though not that affordable.

The company was first introduced in 1983 by Scott Cook and Tom Proulx in Mountain View, California, USA. After the success of its Quicken product for personal financial management, the company developed similar services for small business owners. As of May 2014, QuickBooks Online had the most subscribers for an online accounting platform, with 624,000 subscribers.

Sold under the umbrella of Intuit, QuickBooks is a popular online invoicing software best known for its robust reporting. QuickBooks offers a detailed overview of your income and overall financial metrics thanks to ready-available reports such as profit & loss statements and balance sheets. These are just the most common ones, so feel free to dive deeper and search after your desired ones by category (sales & customers, expenses & suppliers, etc.).

Otherwise, QuickBooks automatically categorizes invoice items under a specific accounting entry to keep your books clean for the tax season, allowing you to accept or reject them. I also like that you can choose how much of your estimate to invoice, giving freelancers and agency owners a better way to get paid faster for a project/service as it gets completed.

Since my last review, QuickBooks’ focus has been on its desktop version, including new eCommerce features, plus pay and schedule bills within QuickBooks using a bank transfer, credit card, or debit card, instant deposits, and payment links.

With such a rich offering, where is QuickBooks missing the mark? Primarily in its pricing, which, even though it’s cheaper than FreshBooks’, it’s still offsetting for those who want to hop on it. Pricing plans also tend to jumble once a customer has paid for one. So if you stick to invoicing and have the other business aspects under control, there are other more affordable invoicing software above.

This is a good solution for bookkeepers or companies that can afford in-house accountants.

Some pros of using Quickbooks include its robust accounting & financial reports, automatic categorization of sales/invoice items, and the ability to split an estimate into several invoices.

On the other hand, here are some cons – high pricing compared to other quoting and invoicing software, bulky and intimidating from a UI/UX perspective. Plus, it requires a good understanding of accounting.

Unlike most invoicing software, QuickBooks doesn’t have a free plan, which might pose a barrier to early adopters. The platform still offers a Self-employed plan ($15/month) for solopreneurs, in addition to the Simple Star ($25), Essentials ($50, 3 users), Plus ($80, 5 users), and Advanced ($180/month, 25 users).

Remember that the pricing varies depending on the region where you browse their main website.

Note: Learn how to integrate Paymo with QuickBooks if your accountant needs it.

3. OneUp – a simple accounting software

OneUp is an online accounting software with invoicing for freelancers, small businesses, and accountants. OneUp offers invoicing capabilities—creating invoices from quotes, entering sales orders for customer POs, and invoice tracking—along with inventory and CRM. Pricing starts at $9/month if you’re a sole proprietor who does their accounting; for two or more users, plans start at $19/month. OneUp was founded in 2010 in San Francisco, California.

4. KashFlow – a UK-minded accounting tool

KashFlow is an accounting software with invoicing capabilities, allowing UK-based freelancers and small business owners to send invoices off of invoice templates, get paid online via PayPal and WorldPay, and chase late payments. The interface, however, needs an upgrade. As a bookkeeping platform, it focuses on MTD (Making Tax Digital) compliance, a program launched in 2018 to aid UK-based business owners in going digital and streamlining tax filing. Pricing starts at £9+VAT/month for a single user, allowing unlimited quotes but only ten invoices. KashFlow was launched in 2005 in the UK and was later acquired by IRIS Software Group in 2013.

5. TimeTracker by eBillity – a time-tracking tool with accounting

TimeTracker by eBillity is a time-tracking tool with billing capabilities for consultants and lawyers. TimeTracker is a simple time management tool that tracks time, attendance, and scheduling that converts time entries into invoices. The TimeTracker subscription plan ($9/user/month + $15 base fee) doesn’t offer invoicing, so you’d have to opt for TimeTracker Premium ($15/user/month + $25 base fee) for client billing, expense tracking, and online payments. The LawBillity plan ($30/user/month) is designed specifically for lawyers, and it includes legal invoicing formats, trust accounts, and a conflict checker. The app was launched in 2008 in Brooklyn, New York.

6. Bill.com – an easy-to-use accounting software

Bill.com is an accounting software serving small and medium-sized companies and accounting firms. They focus on credit and expense management, bill automation, and simplifying accounts payable. It integrates with QuickBooks, Xero, and Sage Intacct. Bill.com was founded in San Jose, California, in 2006. Pricing starts at $79/user/month for businesses and $49 for accountants.

7. Sage Business Cloud Accounting – a multi-purpose accounting software

Sage Accounting is a cloud accounting tool part of Sage Cloud Business—with 10+ other financial products—suited for accountants, bookkeepers, small firms, and medium-sized businesses. They focus on HMRC (HM Revenue & Customs, the UK’s tax, payments, and customs authority) and MTD (Making Tax Digital) compliance. Pricing starts at £12/month for a single user. Sage was founded in 1981—40 years ago—in Newcastle-upon-Tyne, UK. Sage Cloud Business as a SaaS was launched in 2011.

8. BillQuick Online (BQE) – an accounting tool for lawyers and consultants

BillQuick Online (BQE Core) is an accounting software with invoicing capabilities for lawyers, architects, engineers, consultants, government contractors, and bookkeepers needing a business management platform. It focuses on automatic billing and trust management account management, such as IOLTA (Interest on Lawyer Trust Accounts). BillQuick was launched in 1996 in Torrance, California. In 2019, it introduced BQE ePayments.

9. Xero – a bookkeeping suite for freelancers and accountants

Xero is a cloud-based accounting tool suite that serves businesses and bookkeepers with different products. Freelancers and business owners can track projects, quote, send invoices, and manage their AR and AP through its accounting dashboard. Should they hire an accountant, their fixed assets, taxes, and payroll (via Gusto) can be managed in-app. For freelancers and sole traders, pricing starts at $13/month, allowing 20 quotes and invoices. Xero also accommodates bookkeepers through its various products—Xero HQ, Cashbook, Ledger, Practice Manager, and Workpapers. Xero was founded in 2006 in Wellington, New Zealand.

10. Bench – an accounting platform for US customers

Bench is a bookkeeping platform that provides accounting services and consultancy to small businesses in the United States. Much to my surprise, Bench has no invoicing capability. Their in-house accounting team offers direct and unlimited communication with business owners. Their pricing starts at $299/month (Essential) or $499/month (Premium) for tax filing and unlimited income tax support. Bench Accounting was launched in 2012 in Vancouver, Canada.

Criteria for choosing invoicing software

Whether you’re a freelancer or a small business, at a bare minimum, business invoicing software should allow you to create and send invoices to customers, either once or repeatedly. Yet, you still need to take into account the following criteria, depending on the needs that you want to cover for your business:

- Estimates and expenses: Can I enlist the items to be further sold (inventory or billable hours) under an estimate and register expenses to be additionally deducted at the end of the fiscal year?

- Accounting and bookkeeping: Do I need to keep double-entry accounting records to prepare the books in advance for my accountant?

- Online payment gateways: Can I accept online payments? If yes, which of those are preferred by my clients? Also, be aware that each payment processor charges fees, so factor that in on the final invoice.

- Time tracking: Can I track the time for the services provided and transform timesheets into an invoice? You should ask yourself this question only if you sell billable hours.

- Scalability: How scalable is the billing and invoicing software I’m testing? How many clients does it accommodate when my business grows now and in the future?

- Accessibility: Can I create and send invoices with invoicing software for Mac or Windows? How about mobile invoicing?

We’re proud to say Paymo is a great invoicing software for billing your clients. But if you don’t want to use fully-fledged invoicing software, or if you want to generate an invoice occasionally, there’s always the alternative of an invoice generator. You can check our review and see which online invoice generator is the best.