13 Best Prop Trading Firms in 2023 [TOP SELECTIVE]

Read this detailed review of top Prop Trading Firms with features, comparisons, etc to analyze the best proprietary trading firms:

Proprietary trading companies hire or train professional and experienced traders and then invest money in trading assets through these professionals. Depending on the company’s offers, you can get funded from between $500 to millions of dollars and apply your expertise and professional trading tools to trade profitably and earn commissions or profit splits.

We researched and ranked the top prop trading companies or firms you can join and trade for profits or commissions. Most of them will hire you to trade their capital. They allow trading on Forex, crypto, and commodities like metals, indices, bonds, stocks, and even futures.

We ranked them based on popularity but also on profit splits, maximum capital funding, speed of promoting accounts to funding level, and other important factors.

Prop Trading Firms – Review

Market Trends:

- Most proprietary traders in the United States are aged over 40 years.

- Most trade for between one and two years in length, and have a bachelor’s degree and above.

- Prop traders earn an average of $122,000 per year.

Earnings for proprietary traders:

[image source]

Expert Advice:

- The top prop trading firms are to be compared mainly based on profit splits, total or maximum funding possible, assets they trade in, the evaluation process, and their duration, how fast they promote accounts to a funding level, maximum funding, and maximum loss, and targets before promoting accounts.

- Some have trial accounts, instant funding, and bonuses, and some have up to a 90% profit split. These are the top prop trading firms.

What is a Prop Trading Firm

A prop trading company recruits professional traders and funds them with company capital for trading in stocks, bonds, forex, crypto, indices, futures, and commodity markets. These traders are groomed to earn profits, and they split profits with the company.

A prop trading company can provide extra support, training, retraining, professional coaching, and professional trading tools to the traders.

In most cases, prop trading companies will develop stringent trading rules to support traders and govern the exercise to encourage profit-making and discourage loss-making as much as possible.

Ideally, hiring a professional trader in top prop trading firms starts with a staged evaluation, mainly through evaluation test accounts on which the beginner trader must prove that they have the skills needed.

Some of the skills include risk management and trading to profiteer from live markets. Traders may be rewarded with commissions or profit splits even during evaluation. After this, they may qualify for increased funding when they meet targets.

If you are searching for extra information on what prop trading is, a prop trading company can either be remote or require prop traders to work at their physical offices. Most of those listed here are global.

Prop Trading FAQs

Q #1) Is prop trading good?

Answer: Prop trading gives much higher earning potential compared to investment banking or private equity jobs. It allows a trader to make money trading for firms regardless of how much money they make from their expertise. It is thus much more favorable for the expertise and experienced traders.

Q #2) Which are the best prop trading firms?

Answer: 3Red Partners, Akuna Capital, Belvedere Trading, Chicago Trading Company, FTMO, My Forex Funds, and Lux Trading Firm are some of the best proprietary trading firms to try. Other top proprietary trading firms for your consideration include The 5ers, Audacity Capital, Fidelcrest, Topstep, SurgeTrader, and City Traders Imperium.

The best proprietary trading firms may be ranked based on profit splits or sharing with traders, but other factors used to evaluate them include the amount of capital provided, targets, loss limits, leverage, support, training, and flexibility. The best proprietary trading firms for beginners offer the possibility to learn while trading and increase traders’ capital limits stepwise.

Q #3) How much do the best prop traders make?

Answer: A prop trader makes between $42,373 and $793,331, depending on their skills and experience. The median salary for prop traders is $203,679. Middle 57% earn between $203,679 and $400,084. The top 86% make $793,331. A beginner prop trader can do much less at the evaluation stages.

Q #4) How much do prop trading firms make?

Answer: Prop trading firms make between 20% and 50% of each trader’s profits. They also charge users to open accounts with them. A few split the profit at 90:10, meaning they make just 10% from every trader who makes a profit. Some may require traders to pay for training and expert coaching.

Q #5) Is proprietary trading legal?

Answer: Proprietary trading is legal for individuals, groups, brokerages, and companies. In some jurisdictions and cases, it may be illegal for banks and other financial institutions to deal in prop trading. However, in most cases, it is legal.

Our TOP Recommendations:

=>> Contact us to suggest a listing here.

List of Top Proprietary Trading Firms

Some well-known best prop trading firms list:

Comparison Table of Some Best Firms for Prop Trading

Detailed reviews:

Topstep like many other prop trading firms, hires stocks, futures, and indices traders and provides capital, support, risk management strategies, and coaching to help them trade successfully. Traders are then rewarded using a robust profit split.

When undertaking the programs, traders will learn trading habits that work while avoiding those that do not. You must first prove that you can trade and manage risk to earn a funded account, after which you earn more funding incrementally based on your trading success.

A trader chooses an account size from three available, based on monthly pricing, buying power, profit target per step, number of contracts, loss limits, and trailing maximum drawdown. The minimum buying power or funding is $50,000 and the maximum is $150,000. The company deals with futures trading.

Profit split: 100% up to $5,000, then 80% afterwards.

Features:

- Free 14-days trial.

- Group performance coaching sessions.

- Private trading coach with professional coaches and AI coaching. Also, leverage professional trading tools and resources to earn more.

- Scaling plan based on trading success.

- Keep the first $5,000 in profit and 80% afterward.

- Support team.

- Pay fees through PayPal, Mastercard, Visa, American Express, and Discover.

- Supported trading platforms include NinjaTrader, TradingView, and TSTrader. Others are Bookmap, Investor/RT, Trade Navigator, Sierra Chart, Jigsaw Daytradr, MultiCharts, RITrader Pro, VOIFix, etc.

Pros:

- According to the company’s website, it funded 8,389 accounts in 2021 for customers spread across 143 countries.

- Leverage of up to 1:100.

- Referral program.

Cons:

- No bonuses from broker Equiti Capital.

- The support service is just on weekends.

Founded: 2010

Headquarters: Chicago, Illinois

Revenue: $14 million

Employees: 51 – 200

Fees/charges: $165/month, $325/month, and $375/month for $50,000, $100,000, and $150,000 buying power respectively.

Visit Topstep Site >>

SurgeTrader allows trading of forex, metals, indices, oil, crypto, and stocks. A standard prop trading account at SurgeTrader costs $25,000 for a profit split of 75:25, a profit target of 10%, daily loss of 4%, and a maximum trailing drawdown of 5%. This package costs $250.

An intermediate account costs $400 for a maximum funding of $50,000, a seasoned trader account $700 for $100,000 funding, and an advanced trader account $1,800 for $250,000 funding.

The expert account costs $3,500 for a $500,000 funding while a master account costs $6,500 for a $1 million funding. As such, SurgeTrader is one of the prop trading companies with the widest account options out there.

However, traders are required to keep up to 75% of their profits with the capital. Furthermore, like many prop trading companies, the account limits get adjusted based on how well a trader is performing.

You must adhere to rules such as limiting risks, closing positions before the weekend, and keeping the maximum number of open lots equal to 1/10,000 the size of the account. For instance, you must not incur a loss of more than 5% up to a starting balance of +5%.

Profit split: Up to 75%.

Features:

- No monthly recurring fees.

- There are no minimum trading days for account levels, ensuring you qualify for higher funding limits quickly.

- Trade in any strategy that works for you.

Pros:

- Up to 75% profit split.

- Up to $1 million trading limit.

- Non-recurring payments to qualify for a live-funded account.

- 1-step audition process.

- 10% profit targets without a period to achieve it.

- Fast withdrawal processing.

Cons:

- Short operating period for the company (started in 2021).

- No positions are to be held during the weekend.

- 5% maximum drawdown, 1/10000 maximum open lots.

- Low leverage – 10:1 forex, metals, indices, oil; 5:1 for stocks, and 2:1 for crypto.

Founded: 2008

Headquarters: South, Naples, Florida

Revenue: Not available

Employees: 1 – 10

Fees/charges: $250 on the cheapest package and $6,500 on the most expensive package.

Visit SurgeTrader Site >>

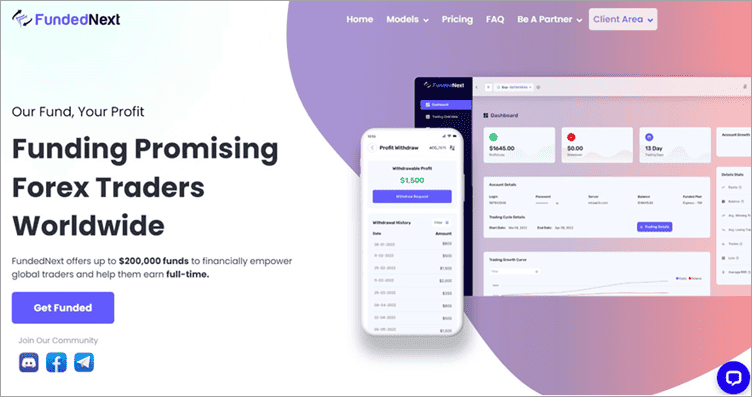

FundedNext happens to be a relatively new prop trading platforms out there that caters to Forex traders across the globe. They quickly distinguish themselves from their contemporaries by offering a 15% profit split at the evaluation stage itself. The firm rewards you handsomely if you manage to keep your accounts consistently lucrative.

You are eligible for a 40% increase in your account balance every 4 months, provided you are consistent with your profitability. Getting started with FundedNext is also very simple. You sign up by selecting your preferred funding model (Express or Evaluation), start trading consistently, and eventually become a certified funded trader.

FundedNext further makes your life easier by assigning a dedicated account manager. These account managers are capable of addressing your queries and concerns anytime you need them.

Profit Split: Up To 90%

- Profit split of 15% at the evaluation stage

- Dedicated account manager assigned

- $4M Scale-Up Plan

- 2 Different Funding Model Options to Choose from

- Android and iOS mobile apps are available

Pros:

- Compatible with all trading styles

- Low commissions

- Get account access within seconds

- Trader-friendly leverage

- Unlimited evaluation

Cons:

- No weekend holding option for the Express model.

Founded: 2022

Headquarters: Ajman, AE

Revenue: —

Employee Size: 51-100

Fees: One-time fee starting at $99 for Evaluation model of funding and One-time fee starting at $119 for the Express model of funding.

Visit FundedNext Site >>

FTMO lets people learn and discover their forex trading talents using the FTMO Challenge and Verification course, after which they are invited to join the proprietary trading firm and manage a trading account with the company. Besides, the company hires performance coaches and does account analyses, as well as other things, to help customers once they start trading.

As a trader, you get 90% of your profits earned from trading with the firm and its tools. Customers are also trained on how to manage trading risks. Thus, it is ranked as one of the best proprietary trading firms.

Profit split: Up to 90%.

Features:

- Maximum capital $400,000.

- Swing accounts that have no restrictions on holding positions over the weekend or during microeconomic releases.

- An increase to the account balance limit by 25% every four months. The scaling plan ensures a long-term business relationship.

- 80:20 payout ratio. It adjusts to 90:10 when the FTMO account balance limit is increased.

- Custom apps developed for traders. Some help them discipline, others are for journaling, while others are useful in analyzing the market.

- Leverage trading at 1:100 makes it one of the best Forex Prop trading firms.

- Low spreads.

- A one-time fee makes it one of the best proprietary trading firms for beginners.

- Payouts are once a month.

Pros:

- Customers who include retail traders get access to MT4, MT5, and CTrader trading tools.

- Customers are furnished with data coming from liquidity providers to simulate real market conditions for traders who aspire to make more money when trading.

- The platform supports trading crypto as well as forex, indices, commodities, stocks, and bonds.

- About seven payment methods are available, including Bank transfer, and Skrill.

Cons:

- Higher cost compared to other options.

- You can’t hold trades over the market weekend close unless you use the swing trader challenge.

Founded: 2014

Headquarters: Praha, Hlavni Mesto Praha, Czech Republic

Revenue: $14 million

Employees: 51 – 200

Fees/cost: From free to 155 sterling pounds.

Visit FTMO Site >>

My Forex Funds provides instant funding for traders who join to trade with it. Customers can then earn not just profit splits but also bonuses. The funding programs are customized and choosable based on one’s trading experience. Traders can join the platform for a low entry cost and even earn money while gaining more trading experience.

The company specializes in trading forex, contracts for differences or CFDs, indices, and commodities such as metals.

Profit split: Up to 85%.

Features:

- The high-profit split makes it suitable for pro-prop traders.

- Prove your trading experience by passing an evaluation.

- An accelerated arrangement is more suitable for full-time traders.

- Trade with MetaTrader 4 and 5.

- Tools to support trading include discord chats, blogs, insights, and 24/7 trader support.

- Pay using crypto – BTC, ETH, BTC, and LTC.

- A demo account is based on real market conditions.

- The first payout is 30 days after the first trade placement. Afterward, 4% of the profit target is paid in phase 2, 112% refunded as a purchase fee refund, and 75% profit split in the first month.

- The accelerated program provides funding for traders – get from $2,000 to $5,000 and grow your capital to a maximum of $2 million. The rapid program is for testers, and the evaluation program is also funded with between $10,000 and $200,000, although customers can grow their accounts up to $600,000.

- Assured funding varies based on the target.

- Leverage of up to 100 times depending on the plan chosen.

- Get paid 50% of your account profits weekly for accounts older than 5 days. Get paid through PayPal, Bank, TransferWise, or via crypto.

Pros:

- The account offers cover for beginner, intermediate, and pro traders.

- Affordable evaluation costs – 25% cheaper than FTMO for the same capital level.

- High-profit splits, instant funding, low-profit targets–8% on the first stage and 5% to proceed to a funded account.

- 40,000 trades in 120 countries.

Cons:

- Slow customer service.

- Drawdown is based on equity, not account balance.

Founded: 2020

Headquarters: Toronto, Ontario, Canada.

Revenue: Not available

Employees: Not available

Fees/cost: $499 to $2,450 one-time registration fees for between $2,000 and $50,000 trading account targets.

Visit My Forex Funds Site >>

When it comes to industry-leading prop firms, The Funded Trader Program is a different beast altogether. The FTP is known for not regulating your trading style. They also afford traders the privilege of holding trades overnight, trading during news, and trading during the weekends. The prop firm offers two funding program options to its traders.

First, there is the Standard Challenge Accounts which aims to identify skilled traders. These traders are then rewarded based on their consistency amidst the two-phase evaluation period. The evaluation program account allows traders to trade with 1:200 leverage.

Then there is the Rapid Challenge Accounts, which aims to also identify serious traders and reward them for their consistency in the two-phase evaluation period. The only difference is that traders here are allowed to trade with 1:100 leverage. This, along with relaxed trading rules, makes The Funded Trading Program the best prop trading firm out there.

Profit Split: Up to 90%

Features:

- Maximum Capital with standard: $600,000

- Up to 200:1 leverage

- News Trading Allowed

- Weekend Trading and Overnight Trading allowed

- Maximum Capital: $1,500,000 with scaling plan.

Pros:

- Very relaxed trading rules.

- Tempting benefits with their scaling plan, which allows traders to hold a maximum balance of up to $1,500,000 and a 90% profit split.

- Supports a plethora of trading instruments like forex pairs, indices, cryptocurrencies, etc.

Cons:

- Customer support needs work.

Founded: May 2021

Headquarters: Fort Lauderdale, Florida, USA

Revenue: NA

Employee Size: 1-10

Fees: $315 for $50K account size.

Visit The Funded Trader Program Site >>

Lux Trading Firm hires career trading experts (forex, crypto, and other financial assets) and funds their accounts for up to $2.5 million. The account is upgraded step-wise from the time a trader hits a 10% target until it reaches the $2.5 million limit. The highest stage 8 is for fund managers. Traders can prove their worth by using Evaluation accounts that start from $5,000 (lowest).

Lux offers traders MetaTrader 4, Trader Evolution, and TradingView trading platforms with detailed trading tools. Traders can view their trading progress from the dashboard, including the amount dealt, total trades, total value or balance, and other things.

Profit split: Up to 65%.

Features:

- Elite traders’ club helps to boost one’s success rate.

- Personal mentors and fees are advantageous for those who join the elite traders’ club.

- Live trading rooms.

- Automated investment analytics and analyst research services.

- Risk management desk for elite traders. Get trading styles and advice on how to use 4% maximum relative drawdown, stop losses, leverage, lot sizes, and realistic profit expectations.

- KPMG audits results for all professional live accounts.

- Trade forex, crypto, and other financial assets or instruments.

Pros:

- Free trial.

- High capital funding up to $2.5 million.

- No time limit on targets.

- Weekend holding allowed.

- Evaluation is just one phase.

Cons:

- Low leverage.

- 4% maximum relative drawdown and maximum loss limit.

Founded: 2021

Headquarters: Upper George Street, Luton, Bedfordshire, United Kingdom.

Revenue: Not available

Employees: 300+

Fees/Cost: Varies from 299 to 499 sterling pounds depending on the amount you want to start with (from $5,000 to $15,000) refunded after stage 1.

Visit Lux Trading Firm Site >>

Based in Liechtenstein, The Trading Pit is a globally-recognized prop trading firm that follows a partnership model. They provide traders with a cutting-edge platform that allows them to trade in Forex, Cryptos, Stocks, ETFs, Shares, commodities, indices, etc. To register with them, you’ll need to pay a small administration fee.

After registering, you’ll need to complete a trading challenge presented by them. Depending on how well you do, you’ll be presented with numerous options. You can partner up with them, produce trading signals for them, and much more. In collaboration with their network partners, The Trading Pit can also offer you a chance to initiate your own Fund or Certificate.

Profit Split: Up to 80%

Features:

- Fixed 10%

- Simple and Fast Withdrawals

- Global Reach

- Multi-Lingual Support

- Real-Time Statistics

- A Wide range of payment options

Pros:

- State-of-the-art trading systems

- Free and paid educational tools available

- High conversion rate

- Dedicated account managers

Cons:

- It’s a new firm with more than a year’s worth of experience.

Founded: 2022

Headquarters: Liechtenstein

Revenue: $1-5 Million (Approx)

Employees: 11-50

Fees/charges: Starts at 99 euros

Visit The Trading Pit Site >>

The 5ers is one of the oldest and most reliable prop firms in the industry.

The 5%ers let you trade forex, metals, and indices with a live account from day 1 without any need for trial accounts. You can trade at your own style, EA, or copy trade. The company also provides instant funding for those who like it.

The company has three packages.

- The5ers created the first instant funding program that everyone is copying today with growth up to $4M(you can have 3 instant programs at the same time.

- The Bootcamp – the first low-entry cost challenge, where you can prove your trading skills and pay the rest only once you’ve passed. Overall you pay300 euros and receive a $100000 funded account

- The Freestyle – Forget everything you know about funding programs.

the5ers introduces a revolutionary funding model, where you show your trading skills over a series of trades instead of over time or balance targets.

The 5er’s best interest is for the traders to succeed. That’s why they invest in free resources for their traders. Here is part of the list:

- Daily Live Trading Room 4 times a week

- TRADING PERFORMANCE STATISTICS

- FREE WEBINARS

- Real-Time Trading Notifications

- RISK MANAGEMENT AND TRADING PLAN

- Free 1 On 1 Performance Coaching

- A high-quality blog

- A special collaboration with Dr.Gary Dayton, the author of the best-seller book” trade mindfully.”

- Prop firm course

- Trading ideas page

- Forex scalping workshop

- Forex supply and demand workshop

- The 5ers classes and trading strategies

Features:

- No payout minimums.

- Traders use MetaTrader 5.

- Trading community.

- Double the account on every milestone up to $4 million.

- High-quality resources

- Get paid any time you

Pros:

- Funding up to $4 million. There is no risk in funding. Funding doubles after each milestone.

- The Freestyle Program provides funding of $25,000 or $50,000, and traders can leverage the capital up to 30 times and withdraw profits after 50 positions.

- It’s one step with no time limit, no drawdown, and 100% profits are yours.

- The $100,000 Bootcamp The first low entry cost challenge Model has a starting balance of between $25,000 to $75,000 and a leverage of up to 10 times.

Founded: 2016

Headquarters: Haroshet Street, Raanana, Israel.

Revenue: $5 million

Employees: 25

Fees/cost: Instant Funding accounts – 235 Euros, Freestyle – 285 Euros, $100k Bootcamp accounts – 85 Euros.

Visit 5%ers Site >>

Audacity Capital funds professional forex traders in addition to providing them with extra tools for trading. Traders apply for positions, get access to their trading experience and strategies, then are invited for a face-to-face interview in London. After the approval, it is time to earn money from trading.

You can choose either the Hidden Talents program or the Funded Trader Program, each of which has different features. Accounts get upgraded step-wise whenever a trader achieves a 10% profit target. The company uses institutional liquidity providers and not retail brokers.

Profit split: Up to 50%

Features:

- A 50-50 profit split. This is shared every time a 10% target is hit.

- Trade only forex. No commodities or indices are supported.

- Double your account size (funding limit) every time you achieve a 10% profit target.

- 10% drawdown and traders are not liable for losses.

- Learn and interact with other prop traders.

- Get better trading support.

- Android, Desktop, and iOS apps.

Pros:

- The company has over 5,000 prop traders from 40 countries around the globe.

- No evaluation process.

- After approval, a trader gets from $15,000 up to $500,000 trading capital for trading in live markets.

Cons:

- Limited funding compared to other prop trading firms.

- Low-profit split.

Founded: 2012

Headquarters: Wood Street, London, U.K.

Revenue: $ 600,000

Employees: 201 – 500

Fees/cost: 199 pounds one-off joining fee and a 99 pounds monthly fee.

Visit Audacity Capital Site >>

#11) Fidelcrest

Fidelcrest prop trading firm finds, trains, and evaluates Forex, CFD, and other prop traders who can then earn profits and commissions by applying for the company’s capital. Traders are discovered through the Fidelcrest Trading Challenge evaluation course.

The challenge involves a trader choosing an account size and then trading for 60 days to meet a given profit target.

After a successful initial discovery, a trader is promoted to the funded verification stage where they have to prove their strategy works and can earn a 50% profit split. After this, the trader is promoted to the Fidelcrest Trader and gets funded with from $150,000 up to 1 million USD and can earn up to 90% profit split.

Fidelcrest Trader is of two types – normal and aggressive. They both have a minimum trading period of 30 days, and profit targets of between 10% and 20%. These have no profit targets but maximum loss limits.

Profit split: Up to 90%.

Features:

- Up to 90% profit split.

- Receive signup commissions based on performance during verification. With this, traders can start earning real money after at least 2 trading days.

- Can’t use robots.

- Swing trading is accepted.

Pros:

- The funding limit is $1 million.

- High-profit split of up to 90%.

- Get a bonus of up to 50% of profits earned in level 2 verification.

- Other bonuses are available.

- Trade multiple assets – CFDs, stocks, forex, and crypto. Withdraw via bank, PayPal, and other methods.

Cons:

- Step 2 is harder to overcome because the maximum loss is half that of step 1 yet the profit target is the same.

- Evaluation is a two-phase and can take up to 90 days.

- Long-term strategy trading is not favored by the trading limit of 30 days.

- Fewer education materials.

Founded: 2018

Headquarters: Wood Street, London, U.K.

Revenue: $ 600,000

Employees: 201 – 500

Fees: 649 Euros for the lowest level ProTrader Normal account, 999 Euros for an account with $250,000 capital funding, 1,599 Euros for a $500,000 funded account, and $2,699 for a $1 million funded account.,

Website: Fidelcrest

#12) City Traders Imperium

With City Traders, customers can get funded with up to $4 million and trade for up to 70% profit share. They are funded to trade a variety of instruments, including forex, shares, gold, and indices.

The company provides four funding plans namely Evaluation, Portfolio Manager, and Direct Funding Plans. An account is upgraded for higher funding limits each time a trader hits a 10% profit target.

At the Evaluation level, you get evaluated for up to 1 year and can qualify for a 400% reward of the evaluation initial capital to trade as a Portfolio Manager. For all accounts, you start at the lowest level and qualify for more funding incrementally.

The Direct Funding account has no qualifications needed. The Portfolio Manager account has no trading rules and gets a 60% profit share. You can even keep two Portfolio Manager accounts.

Profit split: Up to 70%.

Features:

- Besides funding, the company offers mentorship and training programs to help traders succeed.

- They are also given the necessary tools needed.

- They follow the Symmetry Triangle Theory, Corrective Strategy, and trading psychology.

Pros:

- Option to get a higher drawdown as the account grows.

- CTI team is very supportive.

- Good evaluation for swing traders.

Cons:

- Not so good for scalpers/day traders.

Founded: 2018

Headquarters: City Road, London, U.K.

Revenue: Not available

Employees: 1–10

Fees/charges: An Evaluation account costs 109 pounds, 199 pounds, 379 pounds, 449 pounds, and 649 pounds one-time fees for $10,000, $20,000, $40,000, $50,000, and $70,000 funding amounts, respectively.

Direct Funding accounts cost from 999 pounds, 1,799 pounds, 2,199 pounds, and 3,099 pounds for $20,000, $,40,000, $50,000, and $70,000 funding amounts, respectively. Forex Funded accounts costs between 109 pounds for a $10,000 funding to 649 pounds for a $70,000 funding amount.

Website: City Traders Imperium

#13) 3Red Partners

3Red Partners is based out of Chicago and deals on high-frequency proprietary trading platforms for trading crypto, options, futures, shares, securities, derivatives, and other financial instruments. As a top forex prop firm, it develops and deploys trading strategies based on math, IT, economics, research, and experience.

It creates algorithmic trading software that extracts information from tons of data sources to derive valuable trading insights. The software then automates trading actions using automation technologies and rules.

Profit split: Not available

Features:

- Solid international base.

- Research-driven methods and trading strategies.

- Collaboration.

Pros:

- With the company’s software, you can use advanced trading strategies and leverage to trade crypto, options, futures, shares, securities, derivatives, and other financial instruments, all with risk management.

Cons:

- Not as transparent about the profit split or other details.

Founded: 2011

Headquarters: Chicago

Revenues: $10 -$50 million

Employees: 10 – 100

Fees/charges: Not available

Website: 3Red Partners

#14) Akuna Capital

Akuna Capital is a professional liquidity provider and a derivatives trading platform for stock, crypto, and other assets. It is a prop trading firm that uses market-making strategies, including both competitive buy and sells quotes. The company provides this service through low-latency technologies, trading strategies, and mathematical models.

Active in the US, Hong Kong, and crypto markets, the company also assists in institutional trading. The company hires employees as shareholders and has no external investors or clients.

It has four departments. This is a development that deals in writing code that solve advanced trading challenges; and Qauant, designs and develops trading algorithms by adding new signals and patterns to make the algorithms more robust and error-free.

The trading department makes trading and risk management decisions based on a vast set of conditions and inputs; while the IT team optimizes the systems.

Profit split: Not available

Features:

- For interns, junior traders, and experienced traders. Interns need no certification.

- Educational courses for traders. Training programs tailored to all the traders.

- Career progression in addition to profit splits.

Founded: 2011

Headquarters: South Wabash Avenue, Chicago, Illinois.

Revenue: $100 – $500 million

Employees: 201 – 500

Fees/charges: Not available

Website: Akuna Capital

#15) Belvedere Trading

Belvedere is a trading and trader training firm that has trading teams that provide two-sided quotes in market making. The market-making trades are executed through a combined set of strategies, including trade execution, multiple electronic exchanges, etc.

The company trades U.S. and foreign indices, interest rates, energies, grains, softs, and metals. However, it specializes in equity index and commodity derivatives. They keep adding new instruments to the list.

Additionally, it also uses competitive entrepreneurial individuals to develop world-class education programs and developer advantages.

The company adopts a team-based approach to trading, applies diversified trading methods, and utilizes talented members. They also provide mentorship to new members of the team. They also take time to develop and/or improve proprietary high-frequency trading technologies that help them win trades.

As such, Team Belvedere comprises software engineers, quality assurance and business analysts, product managers, quantitative analysts, and hardware engineers.

Profit split: Not available

Features:

- One of the best forex prop trading firms, it provides internships, on-campus training, campus events, and financial backing to experienced traders and trading groups where needed.

- Provides expertise in proprietary trading software and models.

Founded: 2002

Headquarters: South Riverside Plaza, Chicago, Illinois

Revenue: $16.58 million

Employees: 100-500

Fees/charges: Not available

Website: Belvedere Trading

#16) Chicago Trading Company

The privately held prop trading firm comprises a team of traders, quants, technologists, and operation workers. CTC deals in market-making trading in US derivatives exchanges for interest rates, commodities, and equity markets.

Profit split: Not available.

Features:

- Some of the exchanges it trades on include CBoE, the American Stock Exchange, NYMEX, Eurex, and the CME Group. In fact, it is a market maker on these exchanges.

- Like many top Forex prop firms, it employs risk management strategies, proprietary technologies, financial expertise, and market experience to succeed.

Founded: 1995

Headquarters: Chicago, Illinois, U.S.

Revenue: $50–$100 million

Employees: 201-500

Fees/charges: Not available

Website: Chicago Trading Company

Conclusion

The best prop trading firms offer 90% and above profit split. With some of the best offers from FTMO and My Forex Funds, you get 90% and 85% profit splits. You also ought to evaluate prop trading firms based on how much capital they can provide maximum.

Lux Trading Firms provides up to $3.5 million in funding while City Traders Imperium provides up to $4 million.

For those looking to diversify their trading, most prop firms on the list offer trading assets beyond stocks, futures, and forex. Thus you can get crypto prop trading with firms like FTMO, My Forex Funds, Lux Trading Firm, 3Red Partners, and Akuna Capital.

Research Process:

- Time Taken to do this Review: 20 hours

- Total Firms Listed for Review: 25

- Firms Actually Reviewed: 14

=>> Contact us to suggest a listing here.