7 Best Places To Earn Interest on Crypto For 2023: Latest Reviews

The information provided on this page is for educational purposes only and is not intended as investment advice. We may receive compensation from our partners if you visit their website. Read our disclaimer to learn how we make money.

As we witness global interest rates get closer to zero (and even negative in some countries), more people are paying attention to cryptocurrencies as an alternate means to generate additional income. A popular way to earn passive Bitcoin is via interest accounts and lending platforms using decentralized finance services or commonly known as DeFi.

These services allow you to earn interest on Bitcoin and crypto without having to trade the markets using an exchange. They enable borrowers and lenders to exchange money with each other to receive either a crypto-backed loan (paid in fiat currency) or earn interest payments on Bitcoin, Ether and others without a bank.

Based on our reviews, these are the best places to earn interest on crypto:

- Binance (best overall crypto interest platform)

- Nexo (Best interest platform for reputation)

- Crypto.com (best crypto savings account app)

- Coinrabbit (top interest platform for zero fees)

- Gemini (safest platform to earn crypto interest)

- Hodlnaut (best to earn interest on Bitcoin)

- CoinLoan (good for long-term interest)

Mục lục bài viết

Crypto Interest Accounts Compared

HedgewithCrypto has conducted an assessment of the top savings accounts to earn interest in this comparison table. The comparison takes into account important factors such as ease of use, reputation, supported currencies, crypto interest rates, pay-out frequency, fees, security and customer support.

Best Sites To Earn Interest With Crypto: Reviews 2022

1. Binance – Best Overall Place To Earn Crypto Interest

Binance is one of the best crypto trading exchanges in the world that offers something for both crypto-investors, HODL’ers and traders. It is often regarded as the world’s leading cryptocurrency exchange that provides an online platform that bridges the gap between traditional fiat money and crypto through innovative feature-rich service. New customers on the exchange can also get up to $100 for free when using a unique Binance referral code.

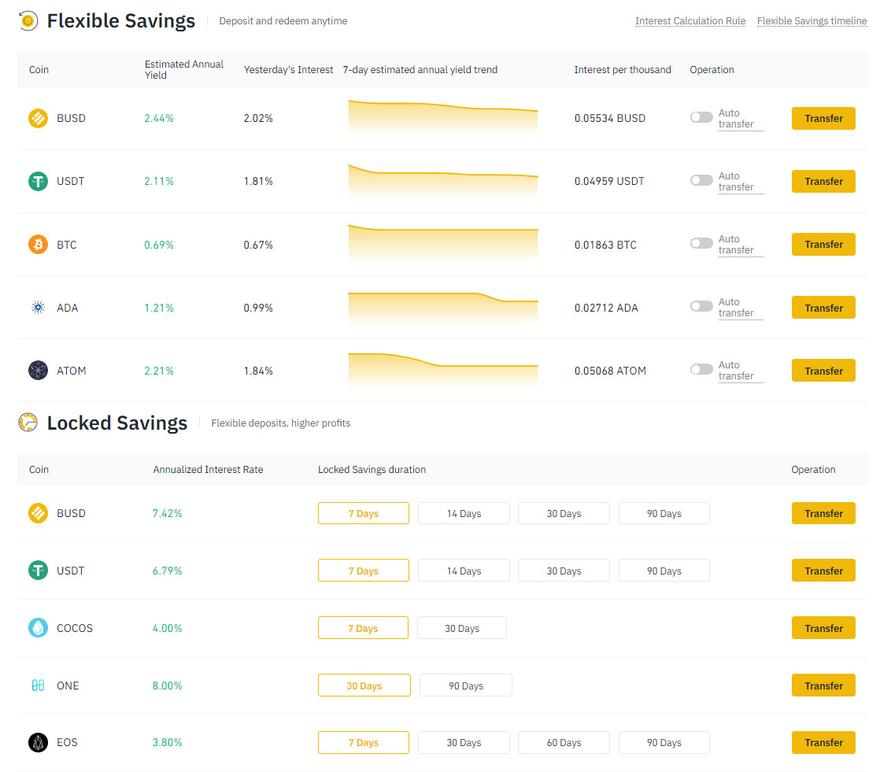

While the platform is well-known for offering its innovative trading products, altcoin trading and new features, the team has recently launched a way to get interest on Binance with the introduction of ‘Binance Savings’.

The Binance Savings account allows you to grow your wealth by accruing interest on your crypto that is stored in a cold storage wallet by the platform. Essentially, you’re lending your assets to margin traders on the platform, and they pay interest to you in return for borrowing your funds. The Binance Savings/Interest account supports a wide variety of lending options including major digital currency coins such as Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), and earning interest on USDT.

Users can either choose from a Fixed Deposit or Flexible Deposit which provides slightly different crypto interest rates as shown below. A flexible deposit allows you to withdraw your funds at any time at a variable rate. This type of interest account will appeal to traders that want to earn interest on their crypto portfolio while waiting for a trade setup.

2. Nexo – Best Crypto Interest Platform For Reputation

Nexo is an online cryptocurrency loan service that offers financial benefits for storing crypto assets such as Bitcoin and Ethereum. In return, Nexo offers a high-interest account where users can earn up to 10% p.a. on Bitcoin, crypto, stablecoins and fiat currency. The lending service is licensed, regulated and insured up to $100 Million against theft with BitGo and is available in 40+ fiat currencies and across 200 jurisdictions worldwide.

Since its launch in 2017, Nexo has processed more than 1.5 Billion dollars from over 800,000 users in more than 200 jurisdictions across the globe and supports over 40 fiat currencies. It has gained widespread popularity as an alternative crypto investment method and storage option for individuals and companies to leverage additional financial benefits for borrowers and lenders.

Crypto interest savings services such as Nexo are attractive for customers as the interest earned is significantly higher than the rates offered by traditional financial institutions such as banks. Interest in a Nexo savings account is paid out daily which allows the savings account to compound and grow rapidly. For example, those looking to earn interest on Ethereum can get up to 8% APY with the interest paid daily. This makes the Nexo interest account superior to other platforms like BlockFi which have monthly interest payments and a reduced compounding effect.

AssetInterest RateUSD10% APYEUR10% APYGBP10% APYUSDT10% APYTUSD10% APYUSDC10% APYBTC6% APYETH6% APYADA6% APYSOL6% APY

Nexo has recently doubled its crypto interest rates across its supported digital assets and brought the interest rate up to 6% APY, which previously ranged between 4% and 5% on cryptocurrency assets. Users can also earn an additional 2% when paid out in NEXO tokens. For example, an interest account with USD can earn 12% APY when paid out in the platform’s native token.

Users that provide liquidity to the Nexo.io platform by depositing and storing their fiat and crypto assets with Nexo are eligible to register for a savings account. Funds from the wallet funds can be accessed at any time allowing users to withdraw funds to a top cryptocurrency wallet of choice.

In short, the crypto interest rates on Nexo are above-average in the market and represent an excellent choice for investors that want to earn interest on 32 supported digital assets with daily interest payouts. For these reasons, Nexo is our top pick for the best crypto interest accounts.

3. Crypto.com – Best Crypto Savings Account App

Crypto.com is a digital asset platform that offers several digital currency products and services including a crypto interest account. The network’s sole purpose according to its founder is to increase the adoption of crypto on a global scale by making it easy for individuals to access.

With over 10 million users on its platform, Crypto.com offers a powerful alternative to traditional financial services, making it easier for everyone to obtain cryptocurrencies. The digital currency platform is known for having one of the best crypto apps to buy, sell, trade, spend, store, earn, loan cash and even pay bills with crypto!

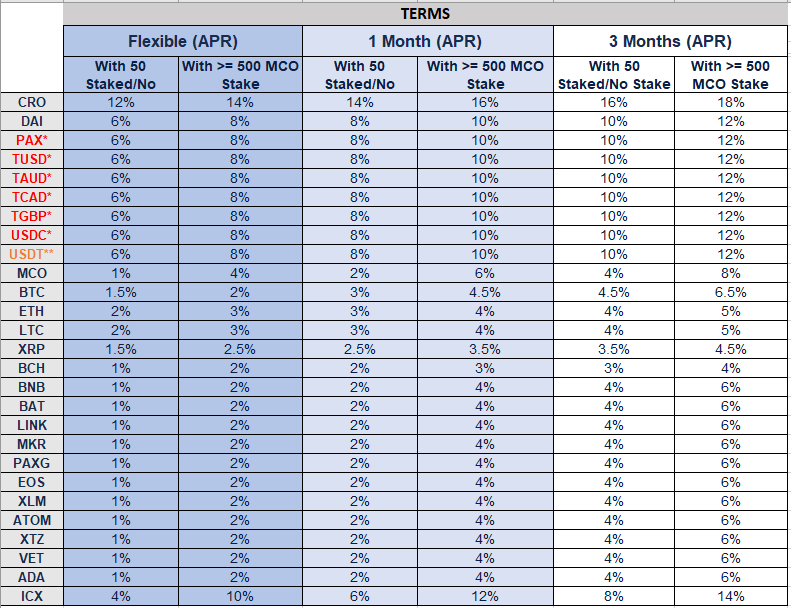

The Crypto.com app crypto interest account offerings allow its users to earn up to 8% on cryptocurrency and 12% on stablecoins. This essentially substitutes traditional savings accounts at a bank. Customers can deposit their preferred digital assets to the app to begin accruing interest on a daily basis.

Interest earnings accrued are credited to your wallet every 7 days and paid out in the same currency as the deposit. For example, if you deposit BTC, you will bring in interest that will be paid out in BTC. You can have multiple deposits to accrue interest for different cryptocurrencies in your wallet.

Crypto.com app users can that stake the platform’s MCO token to earn higher interest rates as listed below. As these rates can change often, we suggest checking the rates on the app before creating an interest account.

4. Coinrabbit – Top Interest Account For Zero Fees

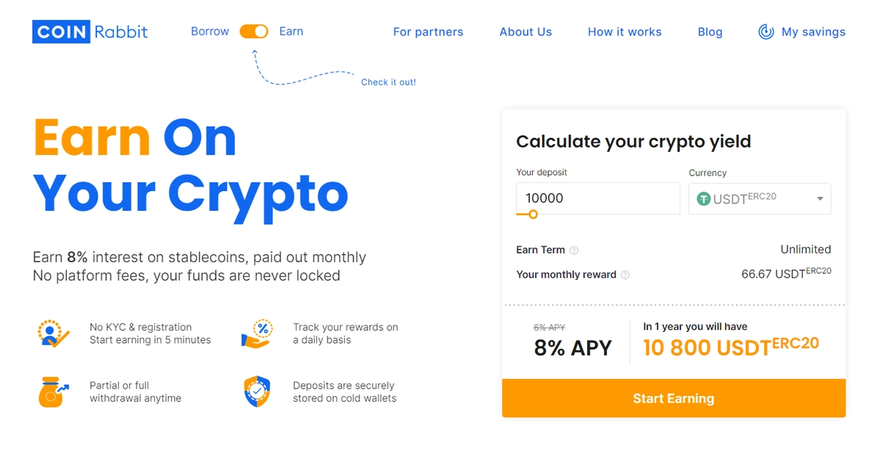

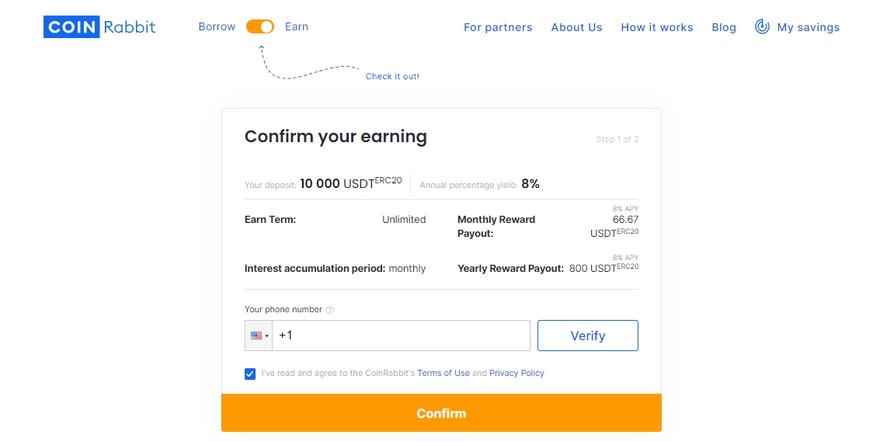

Coinrabbit is a popular platform for individuals to obtain instant crypto loans or earn interest on crypto deposits. A major benefit is the beginner-friendly and easy-to-use design that will suit new investors. The workflow to creating an account and depositing funds to earn interest or get a loan in under 10 minutes. There is no KYC or document upload process which streamlines the account creation process. Customers will only be required to complete an ID verification stage if Coinrabbit’s risk-control system terminates the transaction due to suspicious activity.

Coinrabbit offers an interest account similar to the other lenders in this article. To start earning interest on stablecoins, users can deposit the desired amount of funds which will activate the savings account in a few minutes. Deactivating savings accounts and withdrawals works similarly. The interest payments are paid out monthly with no recurring fees and can be withdrawn in full or partially at any time.

This means investors can deposit funds to earn interest without limitations or lock-up periods. At the time of writing, the supported coins that are eligible for 10% APY are earning interest on stablecoins such as USDT and USDC.

In short, Coinrabbit is a great choice for investors that are holding stablecoins to earn interest during a bear market or decline. The funds can then be moved to a trading platform to purchase crypto at the right time. The option to deposit crypto back to Coinrabbit to obtain a loan is a good investment vehicle to never sell crypto.

5. Gemini – Safest Place To Earn Interest On Crypto

Gemini is a private New York trust company that was founded in 2014 by Cameron and Tyler Winklevoss, commonly known as the “Winklevoss twins”. The company provides a legitimate cryptocurrency exchange and has recently launched Gemini Earn to allow its customers to earn passive income on stored assets on the platform.

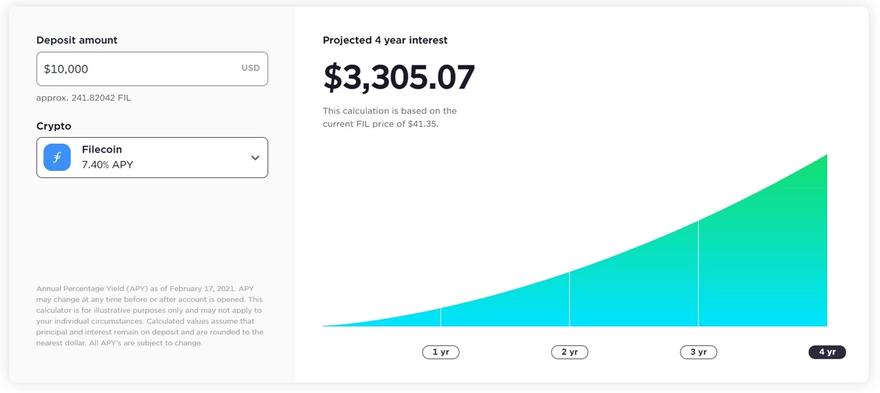

Gemini is highly regarded as a safe trading platform and provides the option to let its user’s crypto work for them with compounding interest rates up to 7.4% APY. The Gemini Earn program is available to US customers only and available in all states. Gemini provides the flexibility to move the crypto assets to the trading platform (with interest) and vice versa.

Unlike the other platforms listed in this article, Gemini Earn has simplified the user interface with a simple interest calculator. The drop-down menu shows all the supported coins, and the estimated interest rate and calculates the project interest earnings over a 1-4 year period.

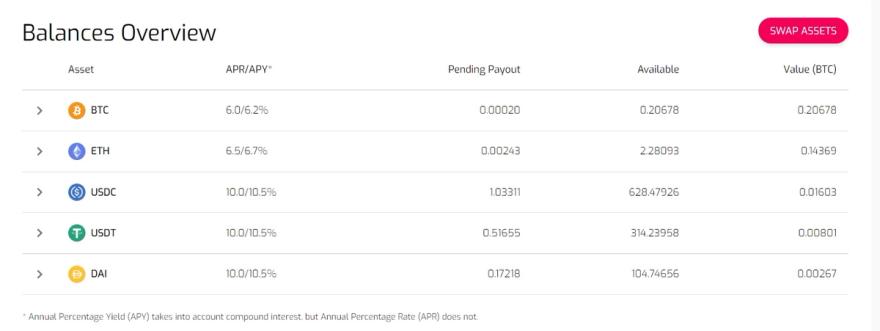

6. Hodlnaut

Hodlnaut is a financial platform based in Singapore that offers financial services to individual investors who want to grow their crypto investments. With over 5,000 investors and $250 Million in custody, Hodlnaut set itself apart from its competition by offering some of the best crypto interest rates available for cryptocurrencies. The platform is able to offer higher rates by lending the assets to established and vetted financial institutions that pay an interest rate to hold those assets.

Important. Hodlnaut has suspended withdrawals since August 8, 2022.

Hodlnaut offers one of the highest interest rates for Bitcoin at 6.2% APY (as of 11 June 2021) compared to the 4.9% offered by Blockfi and 6% on Nexo. No fees are charged when making a deposit however a small fee applies for withdrawals.

Users on the platform can diversify their portfolio and earn interest on other cryptocurrencies such as Dai (DAI), Ethereum (ETH), US Dollar Coin (USDC) and Tether (USDT). The selection of supported assets is limited, however, for Bitcoin-only investors, it is a better platform for the higher rates.

Hodlnaut has a token swapping service that allows investors to trade their digital assets for others within the platform. There are no fees or limits for swapping crypto to crypto. This means that users can take control of their cryptocurrency portfolio by managing asset balances without having to transfer coins out to another exchange.

7. CoinLoan – Best For Long-Term Crypto Interest

CoinLoan is another lending and borrowing provider that offers crypto-backed loans and a savings account to earn interest. The platform also allows individuals to buy, sell and swap cryptocurrencies. Founded in 2017, CoinLoan is headquartered in Tallinn, Estonia.

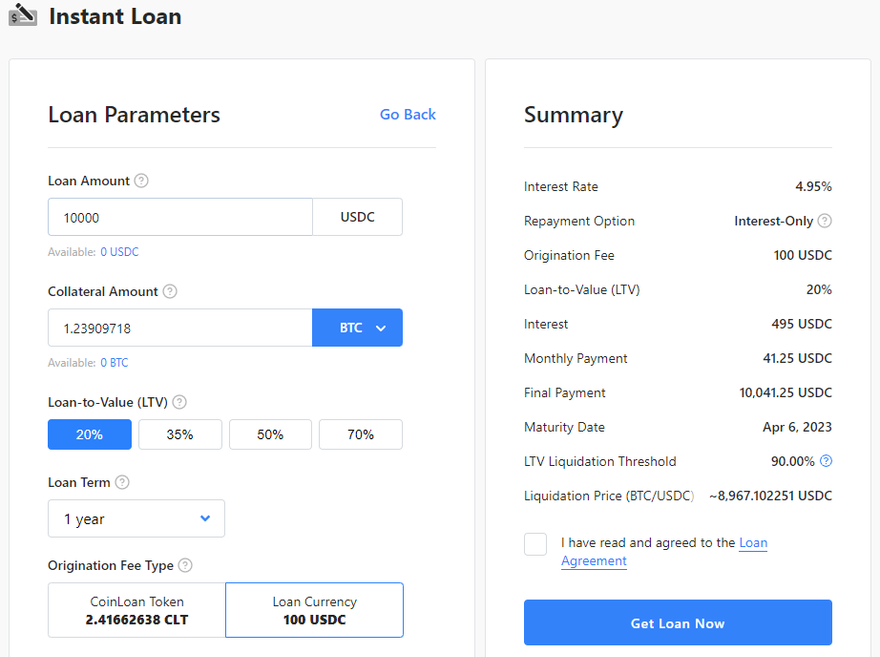

The crypto-backed loans support 25 cryptocurrencies which can be transferred as collateral to obtain a loan in EUR, GBP and other digital currencies. with a loan-to-value ratio of 20%, 35%, 50% or 70%. The interest rates vary by crypto selected and loan terms are 6 months up to five years.

Screenshot of the crypto-backed loan process on CoinLoan.

Like the other platforms herein, the loan must be paid back in the currency that was borrowed (such as USDC). However, users can obtain a 50% discount on the loan origination fee if the loan repayments are settled using CoinLoan tokens (CLT). The default origination fee is 1%, which is cheaper than BlockFi (2%) but more expensive than Nexo and Hodlnaut, which do not charge an origination fee.

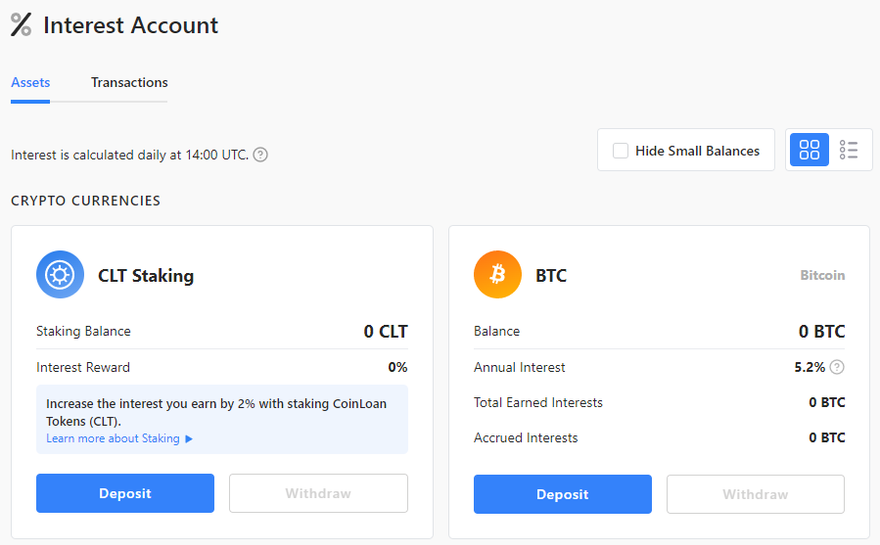

As for the interest accounts on CoinLoan, customers can earn up to 12.3% APY on crypto and fiat deposits such as EUR or GBP. However, the pay-outs are weekly instead of weekly which is not as good for compounding the initial investment. Similar to Nexo, there is the option to boost the interest rate on a crypto interest account by staking CLT tokens for a 2% increase in the interest rate.

Screenshot of the CoinLoan interest account.

Overall, CoinLoan is an easy-to-use crypto lending platform with loans as low as 4.95% APY and interest accounts up to 12.3% which is competitive in the market. Compared to other options, the number of supported cryptocurrencies for loans and earning interest is limited.

How To Earn Interest On Crypto

To earn interest on crypto, Bitcoin and stablecoins, follow these steps:

- Register with a crypto savings platform such as Binance

- Complete the signup registration process and verify the email

- Go to the top menu and click on ‘Deposit’

- Select Bitcoin, crypto or stablecoin to deposit

- Transfer crypto to the wallet address

- Earn compound interest on Bitcoin & crypto deposit

Frequently Asked Questions

Cryptocurrency owners can get interest paid out on Bitcoin, Ethereum, Tether and other digital assets by depositing funds into a website that offers lending and interest savings accounts. Sites such as Binance Earn incentivize the owners to give up ownership of their assets by storing them on the platform. In return, the owners are rewarded with interest which can be withdrawn with the initial outlay.

Cryptocurrency interest and savings account platforms such as BlockFi and Nexo use bank-like security protocols and safety measures to ensure customer funds are kept safe and protected from threats such as online theft and hackers that have been a regular occurrence on DeFi platforms over the years. For more information, read this article on the biggest hacks in DeFi history.

Crypto interest platforms are a popular way to earn additional income. Lending platforms can offer attractive interest rates as high as 12% APY on crypto, which is significantly higher than a traditional bank. The decision to earn interest on your Bitcoin comes down to risk tolerance. With any investment, it’s generally a good idea to have a well balanced crypto portfolio and don’t put all your eggs in one basket to reduce exposure to events outside an investors control.

The golden rule with investing is to never invest more than you can afford to lose. The same rule applies to Bitcoin and crypto interest savings accounts. Also, when a user transfers their crypto to an exchange platform, they give up their ownership of the Bitcoin private keys in return for earning interest. So it is recommended to weight up the benefits and risks before deciding to deposit funds to a Bitcoin interest account.

Lending and crypto savings platforms such as Nexo and BlockFi pay daily interest on cryptocurrency assets stored on their platform such as Bitcoin and stablecoins. The interest amount accrued compounds daily, increasing the yield and return for the investors.

Investors and traders that own Bitcoin and other cryptocurrency assets within their portfolio can leverage the services of Nexo to earn a higher return on their investment by accruing interest over time. It is often perceived as the equivalent of earning dividends on a stock to earn passive income whether the underlining asset appreciates in price or not.

Conclusion

Cryptocurrency investors can now grow their wealth by taking advantage of crypto lending platforms to make money and profits on crypto holdings. Long-term crypto enthusiasts that have been holding onto their digital assets now have the flexibility to generate additional profits without selling or liquidating their portfolios.

We hope that you found this article on the best sites to earn interest in your crypto useful. If you’re comfortable with transferring crypto from your wallet to an online lending service, then you will not be disappointed with the compound interest that you can accrue using these platforms. It is one of the easiest ways to grow crypto holdings.

Kevin Groves

Kevin started in the cryptocurrency space in 2016 and began investing in Bitcoin before exclusively trading digital currencies on various brokers, exchanges and trading platforms. He started HedgewithCrypto to publish informative guides about Bitcoin and share his experiences with using a variety of crypto exchanges around the world.

Share this post

Or copy link