Best Cryptocurrency Wallets in 2023 (Mobile, Desktop, Paper)

Right off the bat – this is a long guide and we made a quick rundown for those of who are in a hurry.

Here are best bitcoin & cryptocurrency wallets you can use to safely store your coins:

A “wallet” is basically the Bitcoin equivalent of a bank account and it allows you to receive bitcoins, store them, and then send them to others. You need a Bitcoin wallet to manage your Bitcoins or altcoins, just like you need an email program like Outlook or Gmail to manage your emails.

In general, wallets grant you access to your public Bitcoin address and allow you to sign off on transactions. However, they differ based on how you choose to access them.

Wallets also interface with the Bitcoin blockchain and they monitor Bitcoin addresses on the blockchain and update their own balance with each transaction.

Now, I want to tell you something about private keys. They are necessary for accessing a Bitcoin address and they are stored on a “bitcoin wallet.” „What defines a wallet is where its private key is stored“ is definitely one of the most important things to remember about a wallet.

What Is a Cryptocurrency Wallet and Why Do You Need One?

One of Bitcoin’s greatest achievements is giving owners the ability to be their own bank and take control of their finances directly. However, this ability comes at a cost.

It is not recommended to keep your coins on an exchange because you’re giving away control of your BTC to a third party and exchanges are known to be “hackable”. Also, they are prime targets for cyber criminals given that they hold large amounts of funds. Also, it can be challenging to keep your funds safe.

There are hardware crypto wallets that can be used to increase your security. However, they may not be affordable for everyone. Other cold storage solutions also require a second device, but a regular piece of paper can come a long way in ensuring that you are in control of your funds and that your private key cannot be reached.

A cryptocurrency wallet is very simple and it is one of the most popular options for keeping your bitcoins safe. It is a digital wallet that you can use to store, send and receive various cryptocurrencies. The cryptocurrency wallet consists of two ‘keys’. The one is the public key. This is your wallet address and is how other people send bitcoins to you. The other part of your bitcoin wallet is the private key, which enables you to send bitcoins to other people. The wallet doesn’t exactly “store” your money as a real world wallet does, but instead, it saves your public and private keys which in turn help you send and receive money.

What Are Private and Public Keys?

You can think of a private key like the secret coordinates for locating your Bitcoins, which means that whoever knows your private key has control over your Bitcoins. In general, it is a very long string of numbers and letters that acts as the password to your Bitcoin wallet and it’s from this number that your wallet gets its power to send your Bitcoins to other people.

The private key is also used to generate your Bitcoin address and it’s something you give out to people who want to send you Bitcoins. However, there’s no way figure out what the private key is just by examining a Bitcoin address, even though the Bitcoin address is generated through the private key.

To sum it up, the wallet’s core function is the creation, storage and use of the private key, which means that the wallet automates Bitcoin’s complex cryptography for you.

HD wallets, or hierarchical deterministic wallets, were created as Bitcoin wallets evolved. HD wallets generate an initial phrase known as a seed or mnemonic phrase and this seed is a string of common words which you can memorize instead of the long confusing private key.

Later on, you can enter these words if your wallet gets destroyed or stolen in order to reconstruct the private key. Additionally, all of the transactions sent to addresses created by the same seed will be part of the same wallet because an HD wallet can memorize many Bitcoin addresses from the same seed.

These private keys and seeds must be kept secret and safe because they have complete power over your Bitcoins. The bitcoins that your wallet’s private key or seed controls could be irretrievably lost if you fail to protect it.

A standard Bitcoin wallet will create a wallet.dat file. This file contains its private key and it should be backup by copying it to a safe location like an external flash drive, an encrypted drive on your computer, or even copying to a piece of paper and hiding it away.

An HD wallet on the other hand will supply you with a seed phrase. This phrase contains up to 24 words that you should write down in a safe place.

Crypto security has never been more important with Bitcoin, Ethereum, and a host of other cryptocurrencies once again making headlines following an incredibly bullish year. This guide will show you how to protect your cryptocurrency with a paper wallet and cold storage.

If you’re reading this guide it’s likely that you’ve recently decided to purchase into this rapidly expanding market, potentially to trade but, most probably, with the intention of holding an amount of a particular currency long term. This guide will help you learn how to safely store their cryptocurrencies themselves.

„You and you alone are responsible for your cryptocurrencies and their security is only your concern. “ is the first and most important lesson in this guide.

Before we understand what public and private keys are let’s think of a real world situation. Anyone can put their money inside the machine, right? But, because they don’t have the key, they can’t take out the money. Only the owner of the machine has the key and he is the only person who can take out the money.

The vending machine is the public address in this example and anyone uses this address to send money to you. In this example, you are the vending machine owner, and the key that he is carrying is your private key. You can access your money and do what you please with it only by using this private key.

The public key is the address that anyone can use to send you the money. On the other hand, the private key is what you will use to send money to anyone else. ONLY you should know what your private key is, remember that, and under no circumstances should you ever lose your private key. Otherwise anyone can use your cryptocurrency wallet to send your money to any other addresses.

Let’s put this in super simple, understandable terms that everyone can understand. You are SCREWED if you lose your private key (yes, uppercase has been used to emphasize the gravity of the situation). To save and store your private keys you should use at least two different techniques. These various techniques will be discussed a little later in the article.

As of right now, let’s discuss the hot storage and cold storage. These are the two methods of storage that you can use to store your cryptos.

Hot Wallets vs Cold Wallets

Using a real world example I will explain the basic distinction between these two types of crypto storages.

Hot storage is like the cryptocurrency wallets that you carry around in your pocket, while the Cold storage is somewhat akin to your savings bank account. As we move forward, keep this distinction in mind.

You must use hot storage if you want to use your currency frequently. On the other hand, you must use cold storage if you want to store your money for a long time.

Hot Storage

In simple terms, hot storage is when you keep your cryptocurrency in a device that is directly connected to the internet and this connection is what makes a device “hot”.

You should think of exchange wallets, mobile wallets, and desktop clients as a hot wallet. It’s simple to access funds on a hot wallet, and there’s nothing wrong with using one for day-to-day spending if you live somewhere that accepts cryptos for micropayments. You should think of it like fiat (government issued) currency. You might walk around with a portion of your wealth in a wallet for convenience.

However, you should keep the majority of your wealth secured away. Your hot wallet should behave in the same way as a real-world wallet, which means that you should use it to carry a small amount of cash for ease of access.

Transacting with hot cryptocurrency wallets is very simple. However, they are easily hackable and that is a huge drawback when it comes to them. The whole crypto-space has been gaining a lot of value recently. As is well known, where there’s value, crime is never far behind. Previous compromises of large exchanges and recent ransomware attacks should be sufficient beacons to beginners.

You’ll not be storing a great deal of value on your hot wallet. However, to avoid losing funds through human error it’s vital that you follow the backup steps within the restoration section of your wallet. You should be able to restore any cryptocurrency wallet painlessly enough with your private key, and seed phrase intact.

Hot Storage Pros and Cons

Pros ✔️

- Sending and receiving is simple thanks to the User-friendly Uis.

- There are a wide number of options, and support for different devices.

- You can access your funds quickly.

Cons ❌

- It is exposed to cybercrime. There is a constant threat from sophisticated hackers, ransomware, and other malicious actors.

- The restoration details could still be lost/damaged/stolen.

- You could destroy the wallet by damaging the device. You could permanently lose your cryptocurrency investment without carefully backing up private keys, and seed words.

Let’s find out about the different kinds of hot storage wallets that can be used.

Multi-Signature Wallets

By thinking of a safe which needs multiple keys to operate is the simplest way of understanding how a multi-signature cryptocurrency wallet works like. A multi-signature wallet (multi-sig) is good for 2 purposes:

- To create a more democratic wallet that one or more people can use.

- To create more security for your wallet and save it from human mistakes.

How will multi-sig wallet save you from human mistakes? Let’s take the example of BitGo. This is one of the premier multi-sig wallet service providers in the world and they issue 3 private keys. One is held by the user and one by the company itself.

The third key is a backup that the user can keep for themselves or give to someone trustworthy for safe keeping. You will need at least 2/3 keys to operate to do any sort of transaction in a BitGo wallet. It will super difficult for hackers to get their hands on 2 private keys, even if you have them behind you. And even if you lose your private key, you still have that third key that you had given to someone trustworthy for safe keeping.

How will a multi-sig wallet create a more democratic environment? Imagine that you are working in a company with 10 people and to make a transaction you need 8 approvals. You can simply create a custom multi-signature wallet with 10 keys using software like Electrum and in this way you can make seamless democratic transactions in your company.

However, a multi-signature wallet is still a hot wallet, even with all its amazing features. This means that it must be used economically. The Bitfinex hack happened despite the fact that it had multi-signature security. Plus, the company whose cryptocurrency wallet you are using still has one of the private keys and it completely depends on their ethics as to what they can do or not do to your funds.

Online Wallets aka Cloud Wallet

Online wallet is literally a web-based wallet and it is the easiest to use among all. Online wallets store your private keys on a computer connected to the Internet and controlled by someone else.

The creation is very simple. It’s basically creating your own account on any of the exchange services.

One advantage of online cryptocurrency wallets is that they can be accessed from any server or any device in the world as long as it is connected to the net. Having said that, they also have one major disadvantage. They can put the organisation running the website in charge of your private keys unless implemented correctly.

This essentially takes your bitcoins out of your control and it is basically like serving up your key to hackers on a silver platter. That’s a scary thought, so Do NOT use online wallets to store huge amounts of your money. You should only store the bare minimum that you need for exchange purposes.

Desktop wallets

Desktop cryptocurrency wallets are the most common type of wallet. Desktop wallets represent a much better option in terms of security and they are downloaded and installed on a single PC or laptop.

It is important to note that they are only accessible from that one device where it was downloaded. It is a much safer alternative than an online wallet. However, it can still be very inconvenient since you will not get access to your money unless you are on the device from which the cryptocurrency wallet was downloaded.

Atomic Wallet, Exodus, Jaxx, Edge and many others are some great desktop wallets.

Mobile Wallets

Desktop-based wallets are all very well. However, if you are out on the street, trying to pay for something in a physical store they are not very useful. This is where mobile wallets come in handy. Mobile wallets are pretty convenient to use. All you need to do is to download an app into your phone. The wallet can store the private keys for your bitcoin addresses running as an app on your Smartphone. It can also enable you to pay for things directly with your phone.

A bitcoin wallet will even take advantage of a Smartphone’s near-field communication (NFC) feature in some cases. This enables you to tap the phone against a reader and pay with bitcoins without having to enter any information at all.

It is important to note that mobile cryptocurrency wallets are not full bitcoin clients. A full bitcoin client has to download the entire bitcoin blockchain. This is always growing and is multiple gigabytes in size, which could get you into a trouble with your mobile service provider. The provider will be only too happy to send you a huge bill for downloading it over a cellular link. And the problem is that many phones wouldn’t be able to hold the blockchain in their memory.

Instead, these mobile clients are often designed with simplified payment verification (SPV) in mind and they download a very small subset of the blockchain. They also rely on other, trusted nodes in the bitcoin network to ensure that they have the right information.

Examples of mobile wallets include the Android-based Bitcoin wallet, Xapo, Mycelium, and Blockchain.

The real problem with desktop wallets and mobile wallets are the dangers associated with virus attacks, because a hacker can easily put Trojans in your system to phish for your details. Also, if your desktop or mobile is damaged you can easily lose your cryptos.

Bitcoin Wallet for Android and Blackberry

Risks of Hot Storage

Different hot wallets carry different security risks and those hosted on Exchange sites are definitely the least secure. Leaving your currency where you purchased it might seem like a good idea because „I can change it back to dollars quickly if it starts to crash. “ But in reality, if you leave cryptos on an exchange you trust an unlicensed entity with your money. They hold your private keys, and they ward off daily attacks and they’ve even succumbed to such threats in the past. Exchanges store a lot of value and they are a huge target for criminals. This risk is part of the deal if you are day trading. On the other hand, you want to avoid it all together if you’re holding long-term.

A great example of the dangers of hot storage is the Bitfinex hack. The people at Bitfinex noticed in early August 2016 that several of their security measures were being compromised and before long, a hacker had stolen over $72 million worth of BTC. It was so bad that, within a day, the value of BTC fell 20%.

So how can you keep your cryptocurrency safe from malicious attacks like this? You use cold storage, so let’s find out what that is all about.

Cold Storage

Cold storage is keeping your currency in a device that is completely offline. Cold wallets are the way to go for those seeking the most secure form of storage and long-term holders, who don’t require access to their coins for months, or years at a time.

They aren’t without their own set of risks. However, these are greatly minimized if you follow the instructions correctly, and take every precaution possible.

Unfortunately, it has piqued the interest of attackers because of the amount of attention that cryptocurrency has been receiving over the last couple of years. In the light of that, using cold storage as means of storing your money is a far more secure option. CoinBase, San Francisco-based bitcoin wallet and exchange service, holds up 97% of its coin reserves in paper and hardware wallets. So, what are paper and hardware wallets? We’ll get there. Let’s check out the pros and cons of cold storage for now:

Cold Storage Pros and Cons

Pros ✔️

- It is completely offline, which means that it provides a safety net against hackers and people with malicious intent.

- If you need to hold large amounts of coin for a long period of time this is a great place.

Cons ❌

- It is not ideal if you need fast and everyday transactions.

- It is still vulnerable to theft, external damage and general human carelessness.

- It can be a little intimidating for beginners to set it up.

Now let’s take a look some cold storage wallets that you can use to store your coins.

Hardware Wallets

Currently, hardware wallets are very limited in number. These are dedicated devices where you can store your cryptocurrency. They come in a few forms. However, the USB stick style typified by the Nano Ledger series is the most common. Hardware wallets are still prone to compromise, although many swear by them. It’s very important that you make sure that the company who made your wallet hasn’t logged all the private keys with a plan to raid wallets in the future. This applies to those purchased from the company themselves. However, this is particularly the case if a hardware wallet has been pre-owned and under no circumstances should anyone ever use a second hand wallet.

It is important to note that hardware wallets can be restored. However, loss or damage can spell disaster for the unprepared. Therefore, it’s just as important to back up your hardware wallet, as it is your online hot wallets and the restoration details should be kept in a safe place that only you, and anyone you plan to leave the money to know about. You should think very carefully about who (if anyone) you share your restoration details with, because they open the wallet. Remember, there is a chance that something unfortunate happen between you and anyone else who knows your private key so it’s also vitally important that you transfer all coins to a new wallet.

Here are some hardware wallets that can be used:

How to Keep Your Cryptocurrency Safe Using Bitcoin Hardware Wallets: 3 Must Have Hardware Wallets

It is only a matter of time before your crypto holdings surge in value with the current merciless run of the bull market. When it does crypto will unavoidably receive much-unsolicited interest from hackers. You have to take extra care that your money doesn’t end up in the wrong hands because hackers are always on the lookout for some easy money. We are living in the era of cryptocurrency right now. With this increased attention comes increased risks and that’s why it is absolutely critical to keep your cryptocurrency safe and secure.

You must put all your money in a cryptowallet to do this and the question of why you should buy a wallet becomes the more pertinent question of which wallet should a cryptocurrency investor use. Cryptowallets basically store your public and private address. They use which you can send, receive and store cryptocurrency. Security comes at the cost of money and convenience, as do all forms of insurance and the question is how we should balance it in a way that suits our risk profile.

There are two kinds of wallets that can be used:

- Hot Wallets

- Cold Wallets

Hot wallets are simple to use transaction wise. However, they are extremely insecure and it is not recommended to store a large number of your cryptocurrency in hot wallets. On the other hand cold wallets are extremely secure and you should definitely use a cold wallet if you are looking to store and save large amounts of money. But it is important to note that there is a major issue with cold wallets.

The Issue with Cold Wallets

The main issue with cold wallets is that the money can’t be spend directly from them and the only way that you can spend is by re-importing your private key into a hot wallet. However, by doing this you’re negating all the precautions that you had taken by making a cold wallet in the first place. What is the point of choosing a cold wallet if you have to import your private keys into a hot wallet anyway?

The Solution

What we are looking for is a wallet which will not only protect your cryptocurrency from hackers and malware but will also make sending and receiving money super easy. A wallet which will give you the security of a cold wallet but at the same time make transactions extremely easy. A hardware wallet is a solution to all this.

What is a Bitcoin Hardware Wallet?

A Hardware wallet is a physical device that can be carried around like a normal wallet and use it as and when you please. These wallets hold your private key and they have a USB cable which you can use to plug into your laptop/desktop to do all your transactions.

In the case of theft or scams hardware wallets promise enhanced security against software wallets. Moreover, your coins are safe even if someone steals your Hardware wallet or your computer is hacked because you can always restore all your coins on a new wallet if you lose your hardware wallet.

Important point: No one can transfer Bitcoins or other coins from your hardware wallet without knowing your secret pin code. Also, hardware wallets do not use your laptop or anything that is equipped with a dedicated LCD screen, which means that no spy screen recorder or Trojan can record what’s happening on your Hardware wallet.

The private keys and digital signatures needed to spend bitcoins are generated via hardware wallets and you need to write down the seed word (recovery phrase) in a piece of paper and store it at a safe place. I recommend making 2-3 copies and distribute it. And there is no possibility of getting hacked because your keys are offline.

There has been no reported theft or loss of bitcoins from a hardware wallet at the time of this writing. Some hardware wallets have a little digital screen with a user interface to verify transactions, and some have security grid cards. You can restore your bitcoins easily with the recovery phrase, even in the case of damage to your hardware wallet.

Important Note: Bitcoin hardware wallets were invented after Bitcoin was born, but other cryptocurrencies can be stored in these wallets as well (ETH, LTC, DASH, etc.).

You should definitely order a hardware wallet if you want to store Bitcoin and other Cryptocurrency secure for long term. I recommend ordering hardware wallet as soon as possible because most of these hardware wallet have waiting period of a month or two because of huge demand.

Desired Traits of Bitcoin Hardware Wallet

What are the desired traits of a crypto wallet? How hard can choose a wallet to be? Unfortunately, these seemingly simple questions do not have a satisfying answer. Convenience may come at the cost of security. Also, additional features may come at the cost of a steeper learning curve. But the big question is: What are the traits that, ultimately, you value over the others? See the list below:

- User-friendliness – Can a range of altcoins be stored? Is the hardware wallet UI intuitively designed?

- Cost – Is the wallet free and what are the drawbacks of using this wallet?

- Style -Do you have a weakness for tech gadgets?

- Security – It is very important to see if the company have a track record of security excellence.

- Convenience – When the time calls for it will you be able to make a fast buy?

- Mobility – Is the wallet accessible anytime, anywhere and is it easy to keep and difficult to lose?

Remember, all wallets have their edges and shortcomings and you may want a wallet that offers the best combination of the above-mentioned traits.

Pros of Bitcoin Hardware Wallets ✔️

- These wallets can be carried around easily because they are designed to be sleek.

- Your private key will be safe and secure since it’s a cold wallet. The keys are stored in the protected area of a microcontroller. This means that they cannot be transferred out of the device.

- They are resistant to malware, virus and hacker attacks and there have been no instances of hardware wallets ever been hacked.

- Transactions are super simple. All that you have to do to make your transactions is to plug in the wallet and follow the instructions. The UI interface of the wallets are extremely user friendly and all the transactions that you will make will be safe and secure.

- Hardware wallets can store multiple addresses for you to send funds over.

- The wallets are pin code protected. This is very important in case your wallet falls into the wrong hands. Your wallet will automatically shut down on entering the wrong pin code 3 times.

- The software is open-source most of the time. This means that you can simply take a look in the code itself if you want to know how the hardware wallet works and keeps your private keys secure.

- You can recover your money by using the restoration details that comes with each wallet if your wallet shuts down for whatever reason.

Cons of Bitcoin Hardware Wallets ❌

- It may not be possible to store all kinds of cryptocurrencies in the wallet. The Ledger Nano supports bitcoin, Ethereum, ERC20 Tokensand other altcoins. On the other hand, the Trezor only supports bitcoin and dash (when connected to Electrum).

- Hardware wallet is a physical object. This means that there are chances that it might get bruised or damaged via external stimuli. (Seed Phrase overcomes this problem).

- You have to blindly trust the company developing your hardware wallet when you are purchasing a hardware wallet because you stand to lose all your cryptocurrency if the company gets compromised for whatever reason.

- There is a chance that you might get a used, second-hand wallet instead of a new one, which means that you will also have to blindly trust the company delivering your wallet. I highly recommend that you don’t use a second-hand hardware wallet.

- Hardware wallets are still susceptible to design flaws, like all products, and there is a possibility that hardware wallets have a fundamental design flaw which can get exploited in the future.

Paper Wallets

Using a paper wallet is, without a doubt, the safest way to store any cryptocurrency. You can set one up entirely for free by following a few pointers below. This truly makes you the master of your investment and there’s no possibility of your private keys being known by anyone else if precautions are followed. Of course, this means that it is even more important to keep a record of them, because you’ll forfeit the entire contents of your paper wallet if you lose your private keys.

What Are Paper Wallets?

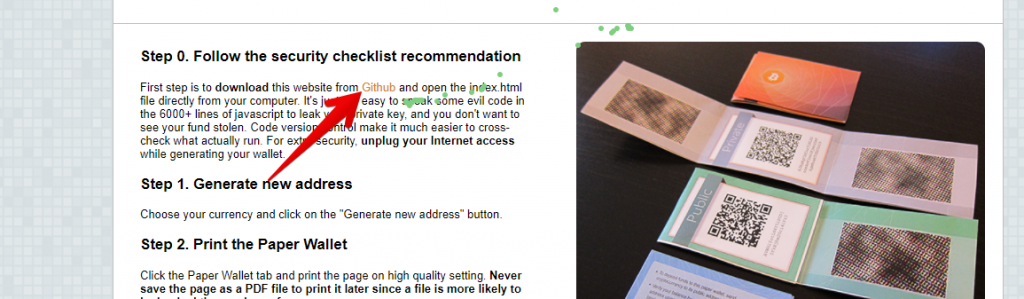

Paper wallets are an offline cold storage method of saving cryptocurrency they are one of the most popular and cheapest options for keeping your bitcoins safe. It includes printing out your public and private keys on a piece of paper and the keys are printed in the form of QR codes which you can scan in the future for all your transactions. After that, you store the paper and save it in a secure place. the reason why it is so safe is that it gives complete control to you, the user and the only thing that you have to do is to take care of a piece of paper. You do not need to worry about hackers or any piece of malware, nor do you have to worry about the well-being of a piece of hardware.

Do You Need a Paper Wallet?

The answer will largely depend on your circumstances. You probably don’t need it if you plan to spend the summer day trading a couple of coins. On the other hand, a paper wallet is the most secure option available to you if you’re in for the long haul, and don’t intend to touch any portion of your stash.

Creating a Paper Wallet

You form paper wallets by using a program to randomly generate a public and private key. What’s more, we’ll be generating our keys offline, which eradicates the exposure to online threats. Also, deleting the simple program after use will destroy any trace of them. The keys will be unique, and the program that generates them is open source and those who have advanced knowledge of coding can check the backend of the program themselves for randomness in results.

Don’t worry if this sounds confusing, because it’s not. You’ll need no specific knowledge of encryption or coding for this. A computer, an internet connection and something to record your keys on is all you need.

Anyway, follow these steps to create your paper wallet:

- First you need to ensure your computer is entirely free from any form of malicious software. A brand-new computer would be perfect. However, that is often not feasible.

- Go to this page http://walletgenerator.net/

- Click here to download the zip file:

- Once downloaded open the “index.html” file. But, make sure that your internet is off before that. This whole process is done to make sure that your wallet is hacker free.

- Generate your wallet. Keep hovering over the highlighted text and it will generate more characters, or you can manually type in random characters if you want. You need to keep doing it until the counter goes to zero.

- Your wallet will be generated the moment the count goes to “0”.

- Print the page or make multiple copies of the numbers from it, but make sure that your printer is not connected to Wi-Fi at this point.

- Delete saved web page and now you can safely reconnect to the internet.

- Store the private keys in their long term, secure home.

Creating a Paper Wallet for Ethereum

If you see the list of cryptocurrencies supported by walletgenerator, you will notice that Ethereum is not on that list. So, how to set up a paper wallet for Ethereum? It is really simple. You just need to follow these steps:

- Visit the page http://myetherwallet.com/

- Click on the help tab.

- Click on option 5:

- Open the highlighted link:

- Download this zip file after that.

- Open the zip file and click on the index.html file. Remember to switch off your internet so that you are offline before doing that.

- Create a new password and generate your wallet. Be sure that you are putting in a strong password:

- Now you will have to download your keystore file. This is basically your wallet file. It’s very important that you keep a backup of this file. Click on “I understand. Continue.” after you are done with that.

- There you go, your wallet has been generated and what you see here is your private key. Remember, you mustn’t share this with anyone.

- Click on the “Print” button to print your wallet, and this is what will you get. You can see both your public and private keys here:

And this is how you set up an Ethereum paper wallet.

👉 Paper Wallet Risks

Paper wallets substantially reduce the threat of compromise from the virtual world. However, they aren’t without their own set of risks.

👉 Fragility

At the end of the day, paper wallet is still paper and paper can be easily damaged or it can get worn out over time. For that reason it is strongly recommended to make multiple backups.

👉 Coercion

You shouldn’t go bragging about your crypto investments and make yourself a target because there are always going to be people willing to break the law to get at something valuable. It doesn’t matter if it’s in person or online, it’s never a good idea.

👉 It’s not immune to disasters

It is not immune to natural disasters since it is just a piece of paper, and if you have not taken any backups it can be destroyed easily.

👉 Stealing

It is written on a piece of paper. This means that anyone who can read it or take a photo of it can steal your money.

👉 Human mistakes

Humans are prone to errors and you can accidentally tear it or simply forget the location of your paper.

👉 Spyware monitoring

You should use a clean operating system to rule out the risk of any sort of spyware monitoring your activity. Creating a USB flash drive or DVD with a ‘LiveCD’ Linux distribution, such as Ubuntu (http://www.ubuntu.com/) is a good way to achieve this.

👉 Type of printer used

The quality of printer used can also have a detrimental effect, for example non-laser printers may cause the ink to run if the paper gets wet. Also, you should print the paper wallet from a printer that is not connected to a network for ultra-tight security.

Tips for Keeping Your Paper Wallet Safe

- Store your paper wallet in a safe to protect from fire and theft.

- You can laminate your paper wallet for durability and proof against water.

- To protect your paper wallet against water or damp you can store it in a sealed plastic bag.

- You may store a wallet in several locations for added redundancy. Some bitcoiners use deposit boxes, others use trusted family members.

- The paper wallet could be entrusted with a solicitor, e.g. the person who holds your last will and testament.

Importance of Private Keys and Restoration Methods

In the same way that we’ve mentioned restoration details previously, the private key to your paper wallet is its single most important detail and you must guard it with your life. You lose your money if you lose your private key and it’s as simple as that. However, this doesn’t mean that you should get it tattooed on your chest. As well providing you access to your funds when you need them, anyone with the key can also get at them and it must be kept totally secret.

It’s highly recommended to store your paper wallet in multiple secure locations, which will help alleviate against certain “acts of God”, such as tornado, sudden evacuation, or similar. However, the higher the risk of compromise, the more locations you use to store your keys.

Under Lock and Key

Some people prefer to store their private keys in a physical location and a safe is usually favored for this. Only those people who are allowed access to the funds must know the combination of your safe. Of course, small home safe deposit boxes are often much less durable than they’re made out to be. This means that they will usually be a target for home invaders. You should use a high-quality safe if you have sole access to it, otherwise risking a lower end model may be your best option. Either way, the combination to the lock should only be given to those who have ownership of the coins stored on the paper wallet.

Cloud-Based Storage

Self-encrypting, decentralized “cloud” based storage will likely be an option in the (very near) future. Its reliability remains to be tested. However, it could reduce warranted concerns over storing private keys digitally. Wxisting cloud-based storage services are hackable, like exchanges, and they can fall victim to malicious attacks. Generally, it is not recommended to store your most sensitive documents. However, it’s possible to encrypt the data yourself and store it online and you limit the number of people who can view a document in its raw state by encrypting it. Also, uploading an encrypted version of a private key to the web is a suitable option for some people.

Memory

It is possible and incredibly secure. However, it should go without saying that this isn’t perfect because the practical barrier of remembering 64 unique characters will discourage the majority. It is certainly not recommended, although I am sure there are some who favor this method.

When considering storing private keys these are the things to remember:

- Most ways of practically recording private keys are potentially lost, e.g. fire, theft, water damage. It would be perfect if you could engrave metals yourself and can store it in a high-quality safe.

- The access to the private keys should be given to only those people who have access to the funds stored.

- All storage has risks and you should minimize them.

- Multiple safe locations are better than one, but additional locations must not compromise security.

Restoring a Cold Storage Wallet

You need to import the private key into a suitable online wallet when you want to bring your cryptocurrency back out of cold storage. Any wallet that supports importing private keys will work. For most wallets the process is simple and intuitive and the steps we have given below correspond to using the Bitcoin Unlimited wallet.

- Open the client

- Click on “Help”

- Select the Debug Window

- Click on the Console tab

- Type “importprivkey<private key>” replace <private key> in the fieldwith your private key

- Remove quotation marks

- Press enter

All the data from your paper wallet will be imported to your online desktop client. Remember, it’s not recommended that you keep an amount of crypto in such storage for any more than the minimum time possible because you are now exposed to all the security risks that exist with hot wallets. Also, if you’re trading to another crypto or fiat you should do some immediately and after that store appropriately. It is recommended that you set up an entirely new paper wallet if you were using a portion of your balance to make a payment, and want the rest to return to cold storage.

Types of Bitcoin wallets

When choosing the best cryptocurrency wallet for you factors to consider include security, anonymity and control. There are two main types of wallets:

- A software wallet. This wallet can be installed on your own computer or mobile device and you are in complete control over the security of your coins. However, my experience is that they can sometimes be tricky to install and maintain.

- A web wallet or hosted wallet. This wallet is one that is hosted by a third party and it is often much easier to use. However, you have to trust the provider to maintain high levels of security to protect your coins.

Tips to Choose the Best Bitcoin Wallet

So let’s see how to choose the best cryptocurrency wallet for your needs now you know all there is to know about Bitcoin wallets.

I use different Bitcoin wallets for different purposes. For example, I will use a different wallet if I need to store a large amount of Bitcoin safely than if I just want to have some small Bitcoin change to pay for a sandwich.

Wallets usually vary on a scale of security vs. convenience. This means that you need to decide where you want to be on that scale and these are some of the questions you should ask yourself:

- Are you tech savvy?

- How often will you use the bitcoin wallet?

- How many Bitcoins will you be storing?

- Can you afford to pay for a hardware wallet?

- How much do you value your privacy?

- Do you need to carry the bitcoin wallet around with you?

- Do you need to share the wallet with someone else?

- Do you trust yourself to safeguard your wallet or do you want to give some 3rd party the task of doing so?

It should be easier for you to choose a wallet depending on the answers to these questions. The choice of bitcoin wallet will come down to an individual user’s preferences and whatever you decide, it will be a crucial aspect of your experience with the digital currency.

I would also highly recommend using more than one wallet, because this way even if your mobile phone breaks or gets stolen you’re not risking a lot of money.

Best wallets for individual coins

Best Ethereum Wallets

Best XRP Wallets

Best Litecoin Wallets

Best Ethereum Classic Wallets

Best Monero Wallets

Best Cardano Wallets

Best Tron TRX Wallets

Best Binance Coin BNB Wallets

Best Zcash Wallets

Best Stellar Lumens Wallets

Best IOTA Wallets

Best Waves Wallets

Best NEM Wallets

Best Bitcoin Cash Wallets

Best EOS Wallets

Best Bitcoin Gold Wallets

Best VeChain VET Wallets

Best NEO Wallets

Best PIVX Wallets

Best Multisignature Wallets

Best Chainlink Wallets

Conclusion

Creating a cold wallet is a straightforward way to help reduce third party risks associated with most other cryptocurrency storage methods. No method is entirely free from threat. However, storing coins offline drastically decreases the chances of losing your investment through digital means – ransomware attacks, exchange insolvency, exchange compromise, and other cybercriminal operations. It is still as important as ever to remain vigilant of real-world threats, such as damage, theft, or loss of private keys and you should always protect your private keys. Also, if there is any indication that their privacy may have become compromised you should ensure to replace them (setup new cold storage) immediately.

Diversification is the best solution. Always diversify (as the old saying goes, “Do not keep all your eggs in one basket.”) You should keep a portion of your currency (a major portion), in paper wallets. Also, it is very important to have lots of backups to ensure that you are not going to get screwed. Keep some in hardware wallets. Also, if you really have to, keep a few in a hot wallet that you can do fast transactions. Having said that, it is strongly recommended to keep most of your money in cold storage.

Remember, it is your responsibility to ensure your crypto investments are kept safe and not someone else’s. Plenty of people have already been frivolous enough to lose access to their cryptocurrencies through their own fault and others, which means that you shouldn’t take short cuts and underestimate the importance of security. You will drastically decrease your chances of joining this number by minimizing the risks effectively.

Also, remember that with any wallet, you will lose your money if you lose your private key. That is true for hardware wallets, paper wallets, or any other wallet type. There is no way to reclaim your cryptocurrency without your keys and the reason you lose them doesn’t matter.

You need to have a hardware wallet if you are a seasoned user of cryptocurrency. Hardware wallets keep your funds safe and secure, and they also make transactions very simple. An all-in-one package wallet does not exist so it is important that you manage to find the wallet that addresses your greatest concern, ease of transfer, security from theft, monetary cost, convenience and even style. A bitcoin hardware wallet may turn out to be your greatest investment decision.

It’s time to learn how to get some bitcoins now that you have a wallet set up.

How are regular people making returns of as much as 70% in a year with no risk? By properly setting up a FREE Pionex grid bot – click the button to learn more.

How are regular people making returns of as much as 70% in a year with no risk? By properly setting up a FREE Pionex grid bot – click the button to learn more.

Crypto arbitration still works like a charm, if you do it right! Check out Bitsgap, leading crypto arbitrage bot to learn the best way of doing it.

Crypto arbitration still works like a charm, if you do it right! Check out Bitsgap, leading crypto arbitrage bot to learn the best way of doing it.

Ads by Cointraffic

CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

![]()

Mục lục bài viết

Felix Küster

Felix Kuester works as an analyst and content manager for Captainaltcoin and specializes in chart analysis and blockchain technology. He is also actively involved in the crypto community – both online as a central contact in the Facebook and Telegram channel of Captainaltcoin and offline as an interviewer he always maintains an ongoing interaction with startups, developers and visionaries. The physicist has couple of years of professional experience as project manager and technological consultant. Felix has for many years been enthusiastic not only about the technological dimension of crypto currencies, but also about the socio-economic vision behind them.