Best Free Accounting Software Programs for 2023

Danielle is a writer for the Finance division of Fit Small Business. She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years.

Tim is a Certified QuickBooks Time (formerly TSheets) Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content.

Wave and Zoho Books Free are our top two free accounting software. Wave allows unlimited users and is always free, while Zoho Books has paid plans with many more features that your company will need as you outgrow the free option.

Here are our seven recommendations for the best free accounting software for small businesses:

- Wave: Best overall free accounting software for unlimited users

- Zoho Books: Best for free accounting software that can easily be scaled

- Baselane: Best free rental-specific accounting software for independent landlords

- ZipBooks: Best for assisted bookkeeping with free accounting software

- GnuCash: Best open-source accounting software

- NCH Express Accounts: Best free desktop accounting software for businesses with five or fewer employees

- Zoho Invoice: Best free software for managing invoices

Mục lục bài viết

At-a-Glance Comparison of the Best Free Accounting Software

Software

Free Plan Limitations

Scalable, Such as Availability of Premium Plans

Accessibility

Standout Free Features

No limitations; includes unlimited users

✕

Cloud

- Unlimited users

- Accounts payable (A/P)

- Accounts receivable (A/R)

Visit Wave

Only for businesses with less than $50,000 in revenue; only one user

✓

Cloud

- Fantastic mobile app

- A/R

- A/P

Visit Zoho Books![]()

![]()

Only one user

✕

Cloud

- Checking Account

- Track expenses by property

- Tenant rent collection tools

Visit Baselane

Only one user

✓

Cloud

- Invoicing

- Assisted bookkeeping

Visit ZipBooks

Only one user

✕

Desktop only (Windows, Linux, and Mac)

- Open-source; customizable

- Cash and amortization tracking

Visit GnuCash

Limited to companies with five employees

✓

Desktop only (Windows and Mac)

- Bank reconciliation

- Intuitive workflow diagram

Visit NCH Express Accounts

No limitations

✕

Cloud

- Totally free

- Intuitive workflow diagram

- Deep integration with Zoho Books

Visit Zoho Invoice

Retailers need accounting software that tracks their cost of goods sold (COGS), which the free software on our list won’t do. We highly recommend any business with significant inventory to subscribe to QuickBooks Online Plus or Advanced for high-quality inventory accounting in easy-to-use software. QuickBooks Online tops our list of the best retail accounting software.

Wave: Best Overall Free Accounting Software With Unlimited Users

Overall Score:

3.40

/ 5

Pros

- Free accounting and invoicing

- Easy to set up

- Vendor bills and customer invoices can be created and tracked easily

- Offers bookkeeping assistance for a fee

Cons

- Bank reconciliations don’t work if there are checks written that have not cleared the bank

- Very limited mobile app functionality

- Cannot track project profitability

Read our Wave review

General Features

- Bookkeeping support through Wave Advisor at $149 per month

- Assisted payroll services through Wave Payroll for $35 per month for tax service states and $20 per month for self-service states

- Recurring invoices

- Autofill items into invoices and bills

- Sales tax tracking

Read our Wave review

Visit Wave

Wave is our top choice because it offers many accounting features and unlimited seats for free. Since it doesn’t have higher plans, some of its features are already considered premium in paid software, like sending recurring invoices and adding sales tax. Moreover, Wave has bookkeeping support for businesses wanting to outsource their bookkeeping to a Wave Advisor.

The free features that we like the most are the following:

- Unlimited user access: Wave lets you add as many users and companies as needed for free. Most free bookkeeping software include only one user, and you’ll have to upgrade to a paid plan to add multiple users.

- Managing unpaid bills: A/P is Wave’s strongest feature. It makes it easy for users to track bills, purchases, and vendors. You can also enter bills and expenses without paying.

- Invoicing: Despite being free, Wave is good at invoicing. You can customize invoices in different ways, such as choosing from various templates, including your logo, and adding a personalized message.

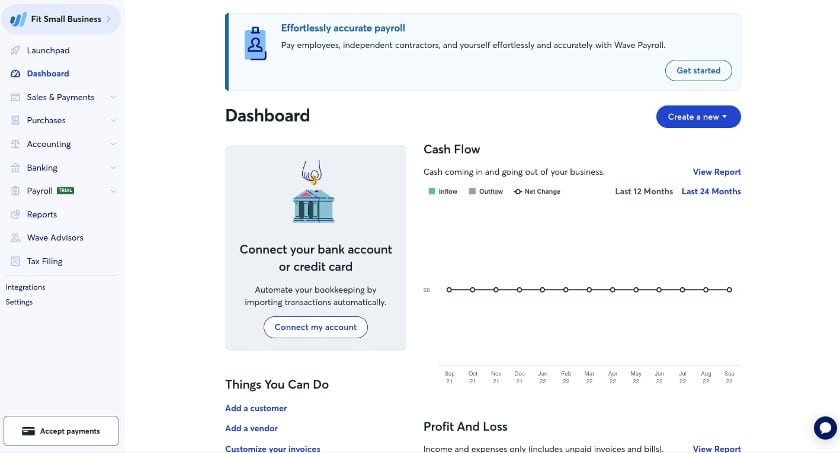

Wave has a very minimalistic dashboard, which includes different tabs, such as launchpad, sales and payments, purchases, accounting, and banking. As you scroll down, you’ll see charts displaying a summary of your income and expenses, invoices and bills payable, an expense breakdown, and other important information about your business.

Wave is totally free software with no higher premium plans. Therefore, it is not a scalable solution for growing businesses. If you envision your business to grow in the near future, we recommend choosing paid accounting software like QuickBooks Online. For only $30 per month for one user, you get the most basic bookkeeping functions you’ll ever need as a startup.

Zoho Books: Best for Scalability

Overall Score:

3.00

/ 5

Pros

- Free plan for businesses with less than $50,000 in annual revenue

- Competitive features at an affordable price

- Can reconcile bank accounts even when checks are outstanding

- Fantastic mobile app

Cons

- Free plan is only for a single user

- Billing, inventory, and project accounting is available only in the Professional and Premium plans

- Custom reports and budgeting is available only in the Professional Plan

Read our Zoho Books review

General Features

- Manage up to 1,000 invoices per year

- Online and offline payments

- Recurring invoices

- Mileage and expense tracking

- Bank and credit card statement imports

- Payment gateways through PayPal and Stripe

Read our Zoho Books review

Visit Zoho Books

Because of Zoho Books’ six plans, you can upgrade to any tier, depending on the kind of features you need. Hence, it is an outstanding software for businesses needing room for growth. We also recommend it because of its excellent customer support and outstanding mobile app functionality.

Here are the free features that you’ll get from Zoho Books’ free plan:

- Invoice customization: Zoho Books’ invoice customization feature is commendable. Users can manipulate the look and feel of the invoices—you can add a logo, change the template, colors, and font styles, and add a personalized message after the invoice.

- Mobile app: Zoho Books’ mobile app is the best among all the programs we’ve reviewed. It is helpful for doing regular tasks like sending invoices, entering bills, and receiving payments. Users can also view reports, track time, and categorize bank feed expenses on the mobile app.

- Zoho integrations: The free version can be integrated with other Zoho apps, including Zoho CRM, Zoho People, Zoho Expense, and Zoho Inventory.

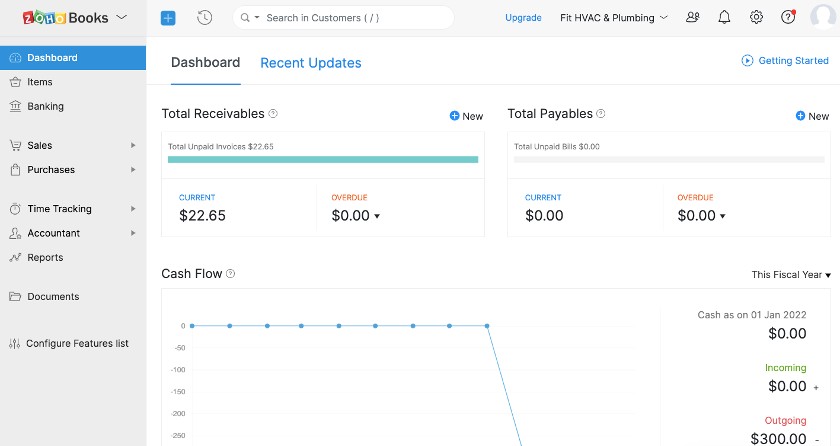

Zoho Books’ dashboard includes a list of your bank and credit card accounts and a summary of your financial transactions, including your total payables and receivables, cash flow, income and expenses, and projects.

Zoho Books’ free version has a $50,000 annual revenue limit. If your small business is not yet on that level, you may stay in the free plan. However, Zoho Books is scalable and very flexible. We highly recommend it if you want to start free and stay in one accounting software provider.

The monthly pricing per organization of Zoho Books’s paid tiers are as follows:

- Standard: $20 per month for up to three users; can send up to 5,000 invoices per year

- Professional: $50 per month for up to five users; unlimited invoices

- Premium: $70 per month for up to 10 users; unlimited invoices

- Elite: $150 per month for up to 10 users; unlimited invoices

- Ultimate: $275 per month for up to 15 users; unlimited invoices

Add-ons:

- Additional users: $3 per user, per month

- Receipts scanning: $10 for 50 scans per month

- Snail mail credits for sending invoices: $2 per credit

Baselane: Best Rental-specific Accounting Software for Independent Landlords

Pros

- Responsive customer service via phone, email, and live chat

- Software is free for both landlords and tenants

- Easy to use with intuitive dashboard

Cons

- No tenant screening features

- No mobile app

- No access for accountants

Read our Baselane Bookkeeping review

General Features

- Free rental property calculator and rental property ROI calculator

- Tenant rent payment collection

Free landlord-specific bookkeeping software

- Rental performance dashboards

- Access to lending and insurance

Read our Baselane Bookkeeping review

Visit Baselane

Baselane is a cost-effective option for independent landlords and real estate investors who want an easy-to-use solution for receiving rent payments and managing finances. It has excellent bookkeeping tools so that landlords can track income and expenses to simplify tax preparation, and its online bank account even pays interest and allows landlords to earn cash back on purchases.

*Baselane isn’t rated because it isn’t intended to be used as general accounting software.

Here are a few of Baselane’s notable standout features:

- Bookkeeping software to streamline finances: Baselane automates your bookkeeping and reporting, so you can keep track of all of your finances in one place and track both real-time cash flow and performance.

- Income and expense tracking: With Baselane’s bookkeeping software, you can automatically tag transactions and categorize them by property and Schedule E category.

- Tax package: Baselane’s tax package is a report that can be shared with an accountant or anyone who needs access to your financials. Included reports are Net Operating Cash Flow and a transaction ledger.

- Free checking account: Baselane’s free checking account has features built for landlords, such as the ability to track multiple properties. It also allows you to earn up to 5% cash back debit rewards. To learn more, read our Baselane Business Checking review.

Baselane is completely free to use and gives tech-savvy landlords an easy-to-use platform that will save time and money. While it doesn’t offer any paid plans with premium features, it can accommodate independent landlords with multiple properties. It also frequently releases new features that will assist with financial analysis and has plans to expand its platform to property management features.

ZipBooks: Best for Assisted Bookkeeping That Comes With a Free Plan

Overall Score:

2.80

/ 5

Pros

- Bookkeeping service comes with ZipBooks plan for free

- Easy to use, even for nonaccountants

- Able to attach receipts to transactions

- Unlimited customers and vendors

Cons

- No mobile app

- Can only connect one bank or credit card account

- Cannot import transactions from comma-separated values (CSV) or spreadsheet files

- No inventory tracking features

Read our ZipBooks review

General Features

- Unlimited invoicing to unlimited customers

- Payment gateways from PayPal or Stripe

- Account for value-added tax (VAT), taxes, and invoice discounts

- Multicurrency invoicing

- Track vendor and customer details

Read our ZipBooks review

Visit ZipBooks

If you think you might need bookkeeping assistance, ZipBooks is a great option. In addition to its free plan, it offers an assisted bookkeeping option that gives you access to a personal bookkeeper and tax filing assistance. And if you sign up for this plan, you’ll receive the ZipBooks software for free.

On a tangent, we recommend ZipBooks as an alternative to Zoho Books Free because ZipBooks Free doesn’t have a revenue cap per year. ZipBooks is also a good pick if you don’t sell inventory because the software doesn’t have inventory tracking features.

The best features of ZipBooks Free are:

- Invoicing: ZipBooks’ invoicing screen is very user-friendly, even for non-accountants. It has readily available templates that you can customize in a few seconds.

- Assisted bookkeeping option: If you want a personal bookkeeper to handle bookkeeping and assist in preparing tax filings, ZipBooks offers a bookkeeping plan that includes the ZipBooks software for free.

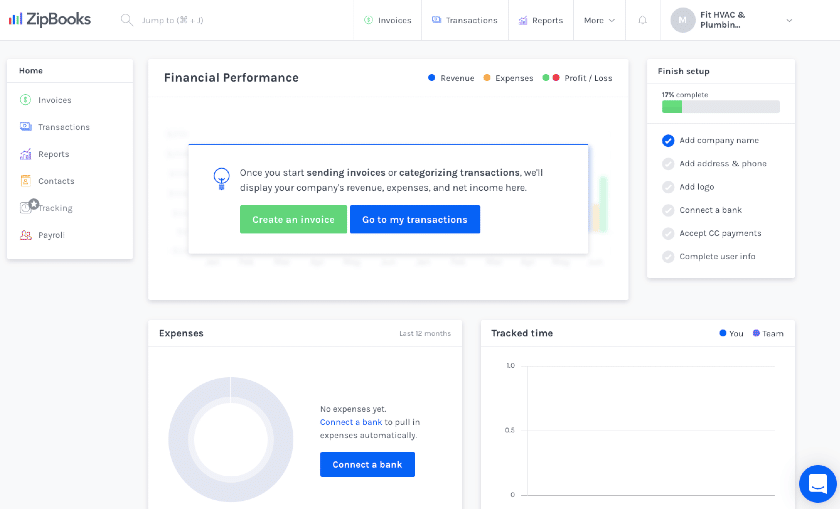

ZipBooks’ dashboard is the first thing you’ll see when you log into your account. It gives you quick access to its most commonly used features, such as invoicing, transactions, contacts, and payroll.

ZipBooks is also a scalable option on this list—but it’s not as scalable as Zoho Books. Upgrading to ZipBooks Sophisticated can give you advanced accounting features, though not as advanced as Zoho Books Ultimate. However, you’ll receive a ZipBooks plan for free if you get the Simple Bookkeeping subscription for $125 per month or Multi-classifications Bookkeeping plan for $145 per month.

The paid options of ZipBooks are as follows:

- Smarter: $15 for five users

- Sophisticated: $35 for unlimited users

Users can try ZipBooks Smarter and Sophisticated for 30 days.

Choosing between ZipBooks and Wave? Read our comparison of ZipBooks vs Wave to learn which free accounting software is more suitable for your needs.

GnuCash: Best Open-source Accounting Software

Overall Score:

2.50

/ 5

Pros

- Outstanding cash management and amortization features

- Free and customizable

- No internet connection required

Cons

- Requires programming expertise to modify or enhance the source code

- No option to remotely share data with another user

- Very hard to use

- Customer support is software manual only

Read our GnuCash review

General Features

- Checkbook-style register for recording cash, check, and credit card transactions

- Transaction scheduling

- Customizable reports for profit and loss (P&L) statements, balance sheets, portfolio valuations, and cash flow

- Multicurrency accounting

- Stocks and mutual fund accounting

Read our GnuCash review

Visit GnuCash

GnuCash is a niche software for those who prefer open-source software. It is free to download and can be installed on multiple operating systems like Linux and FreeBSD. As open-source software, it can be reprogrammed to have additional capabilities beyond the vanilla version.

The best free features we like from GnuCash are as follows:

- Open source: Because it’s open-source software, programmers can modify or enhance the source code to strengthen the security or improve functionality. Since the source code is readily available, GnuCash can be redesigned to be a powerful accounting system that’s customized to your needs.

- Cash and amortization tracking: You can track your cash flow easily, reconcile your accounts, and even connect your bank account. GnuCash’s amortization features help you segregate your long-term loan payments into interest and principal, so you can see how much is deducted from the principal and how much interest you have paid.

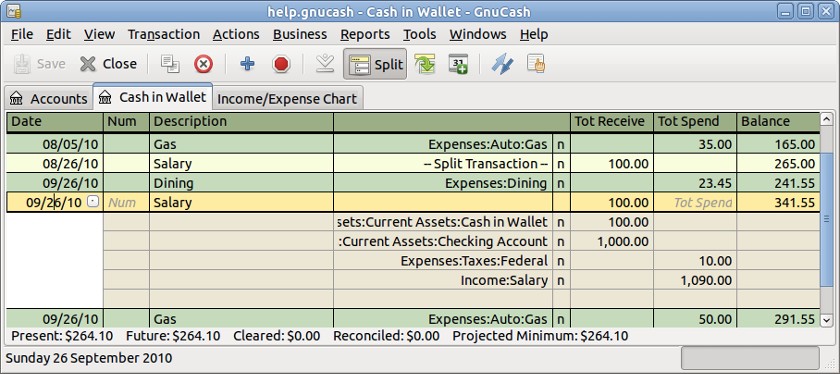

GnuCash has a spreadsheet-like dashboard, which shows a list of your accounts and income and expenses. The dashboard looks a bit outdated, and it may be difficult to navigate, especially if you’re used to cloud-based software.

GnuCash is open-source accounting software that can be modified by altering its source code. This software is scalable up to a certain extent, but we believe that small businesses will find it difficult. Since altering its source codes requires an information technology (IT) expert, the cost of modifying or upgrading GnuCash’s codes weighs more than the benefits it has to offer. Hence, we recommend choosing scalable free accounting software in this guide, such as ZipBooks and Zoho Books.

NCH Express Accounts: Best Free Desktop Accounting Software for Businesses With 5 or Fewer Users

Overall Score:

2.70

/ 5

Pros

- Reconcile bank and credit card accounts even when timing differences exist

- Free for companies with fewer than five users

- Easy to use considering it’s a traditional accounting software program

Cons

- Cannot establish a live connection with your bank or credit card account

- Remote access to your program requires configuration of your firewall and router

- No mobile app

- Steep learning curve for non-accountants

Read our NCH Express Accounts review

General Features

- Sales and A/R management and reporting

- Basic financial statements and other specific financial reports like sales by customer report, sales by salesperson report, and many more

- Purchases and A/P management and reporting

- Check creation and printing

- Purchase order creation

Read our NCH Express Accounts review

Visit NCH Express Accounts

If you find GnuCash complicated to use, NCH Express Accounts is an easier alternative. It’s also a desktop software that’s free if you have five or fewer users, and it’s packed with features found in paid solutions. However, we recommend it only if you or your bookkeeper have experience in using accounting programs as it is not beginner-friendly.

The best free features of NCH Express are as follows:

- Bank reconciliation: NCH Express Accounts, one of our best bank reconciliation software, lets you add or edit transactions easily without leaving the reconciliation screen.

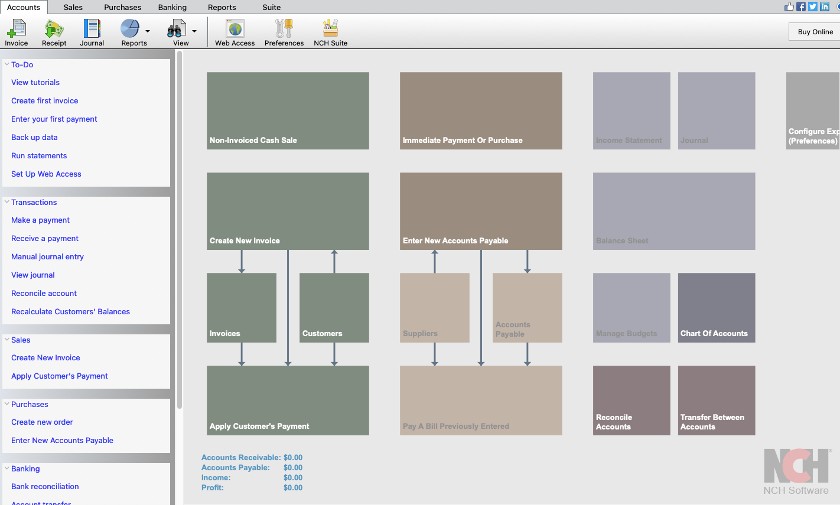

- Intuitive workflow diagram: NCH Express Accounts provides a workflow diagram within each accounting function that helps users understand the accounting cycle within the area and shows them where they should enter transactions.

When you log into your account, you’ll see a traditional dashboard with a workflow diagram. We are unimpressed with it, as the small fonts can be hard to read.

NCH Express Accounts is, by default, a paid software. However, it has free software for businesses with five or fewer users. If you expect the number of employees to grow in the coming months, we recommend buying the paid versions for ease of use.

The paid plans of NCH Express Accounts are as follows:

- Express Accounts Plus: $129 one-time payment

- Express Accounts Basic: $99 one-time payment

Add-ons:

- Express Invoice Plus: $139 one-time payment

- Inventoria Corporate Edition: $195 one-time payment

- Reflect CRM Plus: $35 one-time payment

Microsoft Excel is a helpful tool to supplement your free accounting software by providing some of the missing accounting functions. Read our guide on how to use Excel for accounting to learn how to track invoices, bills, COGS, and inventory costs. Plus, you get a free downloadable template.

Zoho Invoice: Best for Managing Invoices

Pros

- Totally free with no limitations or in-app purchases

- Perfect for Zoho users

- Easy to use for freelancers

Cons

- Cannot manage incoming invoices from suppliers

- Not a full accounting system

- No mobile app

Read our Zoho Invoice review

General Features

- Seamless integration between Zoho apps like Zoho Books

- Customize and personalize invoices

- Manage customer invoices using invoice statuses

- Send invoices in multiple currencies

- Create recurring invoices

Read our Zoho Invoice review

Visit Zoho Invoice

Most freelancers and gig workers only need a solution for tracking and managing invoices for their income. Hence, we recommend choosing Zoho Invoice since it’s more convenient to use than full accounting software.

*It doesn’t have a score because we don’t consider it accounting software. However, we still included it because it has no limitations and is good for unlimited users.

- Recurring invoices: This feature is often included in the paid or premium version of most accounting software. But with Zoho Invoice, you can get it for free. With this feature, you can skip making weekly, bi-monthly, or monthly invoices for repeat customers.

- Built-in time tracker: Zoho Invoice has a timesheet that can help in tracking time for billable projects. This feature is a big plus for freelancers who need to bill by the hour.

Zoho Invoice is a standalone invoicing software and not a scalable one. This software is good for unlimited users and there are no higher plans available.

How We Evaluated Free Accounting Software

We evaluated the best free accounting software in terms of general features and whether they have the basic functions of paid solutions, such as bank feeds and bank reconciliations. Finally, we assessed the platforms based on pricing, ease of use, and our own expert evaluation.

40%

General Features

5%

Inventory

5%

Project Accounting

25%

Ease of Use

5%

Mobile App

20%

User Reviews

40% of Overall Score

We considered the software’s general accounting features, banking, A/P, A/R, tax, and reporting features. Since we were evaluating free applications, we gave higher points to products that offered premium accounting features. Moreover, we looked into whether they contained at least the basic features needed in small business accounting.

5% of Overall Score

Inventory accounting appears to be an elusive feature in most free accounting software. If you need inventory accounting, we recommend going with a paid accounting program. Hence, we gave inventory a light weight. We evaluated the software’s ability to track inventory costs and stock levels. More importantly, we took into consideration whether the software could track the COGS automatically and compute the cost of ending inventory.

5% of Overall Score

Just like inventory accounting, project accounting is an elusive feature. Project accounting is essential for service-based businesses looking for a free accounting software product. That’s why we evaluated the software’s ability to do more than just bill clients and create estimates.

25% of Overall Score

Most users looking for a free accounting software service intend to self-manage the books. For ease of use, we gave higher scores to products that are easy for non-accountants to use. We also considered accessible customer service and support networks.

5% of Overall Score

A mobile app should help on-the-go users keep their books organized. It should let users send invoices, send payments, receive payments, and enter bills. We also like to see advanced features, like viewing reports and recording time worked.

20% of Overall Score

We considered user ratings in the evaluation of free accounting software. User reviews have a large percentage because we want to take into account the feedback of actual software users. Since these platforms are free, there is an abundance of reviews from users who have tried the software.

*Percentages of overall score

Frequently Asked Questions (FAQs)

If you are a budget-conscious small business or freelancer and only need simple accounting, like income and expense tracking and invoicing, then you should consider free accounting software. Don’t use free tools if you buy and sell goods as you’ll need to calculate your COGS by hand.

When looking for the best free accounting software, determine the features you need and find out which programs offer those. Do you require an invoicing solution? Do you have multiple users? Do you want the ability to manage projects? Other factors you should consider include ease of use, customer support, and user reviews.

Small businesses should look for essential features, such as income and expense tracking, invoicing, and reporting. Also, check for a free mobile accounting app—which is important in today’s digital age. We recommend Zoho Books’ mobile app because it allows you to perform many basic functions, such as sending invoices, recording bills, accepting payments, and recording time worked.

Bottom Line

Wave is the overall best free accounting software for small businesses because it has no limitations, unlike other free options. Both ZipBooks and Zoho Books have great free plans but are limited to a single user—we recommend choosing either one if you don’t have plans to scale in the near future.

If you’re looking for accounting software with all the features you’ll ever need, we recommend checking out QuickBooks Online’s Plus.