Bitcoin (BTC), Stablecoins (SBC) And Gold: The Who’s Who Of Money

D-Keine/iStock via Getty Images

Mục lục bài viết

Summary

Bitcoin (BTC-USD) and its core principles are divisive topics amongst investors. While most agree that blockchain technology is great, many still think that Bitcoin has no place in the financial and monetary markets of tomorrow. This is not an argument over Bitcoin’s technology and capabilities though, but rather an argument about what money is. Detractors of Bitcoin are quick to mention that stablecoins offer all the inherent advantages of crypto and blockchain, and are better alternatives to Bitcoin. However, I believe that Bitcoin does not compete with these stablecoins, although they make for a more complete and robust ecosystem.

Ultimately, Bitcoin’s value comes from the fact that it is decentralized, which stablecoins are not, and this is why I believe Bitcoin’s role will be similar to that of gold in the 19th century, an ultimate store and measure of value.

What is money?

Bitcoin was developed to act as a form of digital money. What does this entail exactly? The principles that govern currency have been the same for millennia, and Bitcoin was designed to, in many ways, mimic what has been considered the next form of money/currency over the world for centuries; gold.

Money has to fulfill three basic functions:

-

It must enable trade (be easily divisible and countable)

-

It has to maintain its value over time (it can’t decay)

-

It has to be stable in value in the short term (to allow for stable trading and economic calculations)

Gold emerged as the world’s preferred form of money because it fulfilled these conditions in the best way possible (nothing is perfect of course). Gold is a very malleable metal and could be made into coins. I will add though, that gold had its limitations, which is why silver was often used with gold to allow for smaller transactions. Also, gold does not perish, it can be stored over time. Lastly, the value/price of gold is stable. For simplicity’s sake, we will equate these two words.

But why is the price of gold stable? Well, let’s look at the forces that determine price; supply and demand. In terms of supply, gold has both a limited and abundant supply, which could be seen as a paradox. Since gold is never consumed or used up, there is plenty of gold that has been mined over the ages. However, most of the gold available, around 80% has already been mined, meaning supply can’t quickly increase or decrease. Supply for gold could be said to be perfectly inelastic since it won’t react to price.

On the other hand, demand for gold is very elastic; it does react to price. Since gold has no real “utility” beyond being nice to look at, people can happily forgo buying/owning gold at a certain price. Alternatively, below the market price, demand for gold would be “infinite”.

The result would be something like this:

Source: Author’s work

We would have Demand intersecting with Supply at a single point where Price meets Quantity. This means that no “shift” in demand or supply would alter the price. Supply by definition is “fixed”, and demand will either move to “infinite” or “0” if the price changes.

This is a very technical interpretation, and in reality, nothing is “Perfect”, which applies to elasticity too. However, it makes sense when we simply think about what gold is; a relatively abundant yet for the most part useless metal. This makes it a very reliable form of money. Having a stable currency is incredibly important because prices act as signals in economies. They serve to adjust supply, demand and determine what something is “worth”. Changing prices impede the proper assessment of value and hamper the rational decision-making that is required when handling scarce resources.

What’s the point of Bitcoin?

I guess I just made a pretty convincing point for gold as currency, which might leave you wondering where Bitcoin fits into the mix. I will argue in this section that Bitcoin is superior to gold as money for two key reasons.

Firstly, while gold has for a long time been the best form of money available, and can serve this purpose well, I find that Bitcoin excels over gold in some of the key areas that make for good money.

In terms of practicality, Bitcoin is divisible ad infinitum, so any amount of wealth can be represented and transacted. Some people wrongly argue that it would be ridiculous to pay 0.00000001 BTC for a loaf of bread, but this is ultimately a nominal challenge. In fact, 0.00000001 BTC is also referred to as 1 satoshi. This is still a unit of Bitcoin, only a much smaller one. In El Salvador, where Bitcoin is legal tender, it is common to refer to the price of some things in satoshis, rather than bitcoins.

Moving on, Bitcoin is easier to transact than gold. The theory is that, eventually, Bitcoin will be able to fly around the world seamlessly. Gold can’t do this, and when it comes to trade, proxies have to be used. The dollar was originally nothing more than an IOU for gold. This system can work perfectly, but it is also subject to flaws.

In terms of storage, both gold and Bitcoin have their draw. Theoretically, though, Bitcoin kept in cold storage could be thought of as more secure than gold, less expensive to store, and less perishable. However, I can see the appeal of storing physical gold too.

Lastly, in terms of value, gold and Bitcoin operate in the same way, precisely because Bitcoin was made to mimic the supply of gold. And again, in terms of demand, Bitcoin like gold has no real use beyond being money. Some are bothered by the fact that Bitcoin has no “intrinsic value”, but the whole concept of value is based on subjectivity. Of course, we could all turn around tomorrow and stop “valuing” gold, just like we could all wake up tomorrow and stop “valuing” tea. Gold has had value for millennia, which is why I am inclined to think it will continue to. Bitcoin, granted, has a shorter record, but there’s no reason, (beyond coercion), why people should turn around and stop using Bitcoin. The value of Bitcoin resides in its ability to act as money, which is powered by blockchain technology.

With that said, I’ll move on to the other major reason that Bitcoin is “better” than gold and better than anything else, for that matter, in terms of money. Bitcoin allows for a greater degree of decentralization, specifically when it comes to finance.

Money, finance, debt… you can’t have one without the other, and the story of gold and Bitcoin has to be understood in these terms as well. While above I made a good case for using gold as money, you may very well be wondering, then why isn’t gold money today?

My first instinctive answer would be to tell you that gold was purposefully hijacked by the powers that be. In the words of President James A. Garfield, “He who controls the money supply of a nation controls the nation.” There are clear incentives for governments/banks to replace gold with another form of money, the supply of which they can control. In “modern economic literature,” aka Keynesianism, you might see this justified as “Giving governments/central banks the ability to fight economic downturns”.

In any case, I will argue that this process (a shift from a decentralized gold-based monetary system to a centralized fiat-based system) did not happen overnight, and indeed, it was only because gold lent itself to centralization that this was possible.

For all its merits, gold doesn’t solve the problem of centralization in finance. In many ways, centralization was inevitable, and necessary, to grow our economies.

Let’s take coinage, for example. For gold to be practical in trade, standardized coins, with the same gold content, had to be minted. Of course, we could all say “let’s agree to make coins containing 25g of gold”, but who can guarantee this? And also, not everyone has the means to mint coins. The most logical solution was to have a single place where all the coins could be minted in a standardized fashion. As useful as this is, it lends itself to nefarious actors taking control of this facility, and using it to their advantage. Centralization always does.

The same can be said of finance. Did you know that, originally, central banks were conceived as clearinghouses for other banks? Central banks were used to settle transactions between other banks, and also disputes. It made sense to have a place where all these transactions were settled. A necessary, at the time, centralization.

Lastly, I would also like to address the above-mentioned problem of gold itself not being used to transact. As finance advanced, it became more common for IOUs, redeemable in gold, to be traded. In England, these were IOUs from the King. At some points, in America, each bank would issue its own dollars, gold-denominated IOUs. There’s no reason why this can’t work, but again, we know that it led to misconduct, or at the very least mistakes. Ultimately, these IOUs were not gold but promises to pay gold, and promises can always be broken.

Bitcoin, however, does not lend itself to any form of centralization, because it works so well in a decentralized way, which is why it is much harder for it to be hijacked. There is no need to have a centralized mint or clearinghouse. And, most importantly, when you trade a Bitcoin, you are trading a Bitcoin.

Thanks to Bitcoin, finance and money do not need to be centralized. The degree of decentralization Bitcoin allows for is unprecedented, and is the determining factor behind its incalculable utility.

What’s the point of Stablecoins?

With that said, what do we make of stablecoins? First off, let’s define what stablecoins are. Examples of stablecoins include USCoin (USDC-USD) and Tether (USDT-USD). These coins are designed to be equal in value to a unit of the US Dollar. Their value, therefore, is stable, relative to this currency. In other words, these stablecoins are pegged to the USD, in a similar way that, for example, the Hong Kong Dollar is pegged to the USD.

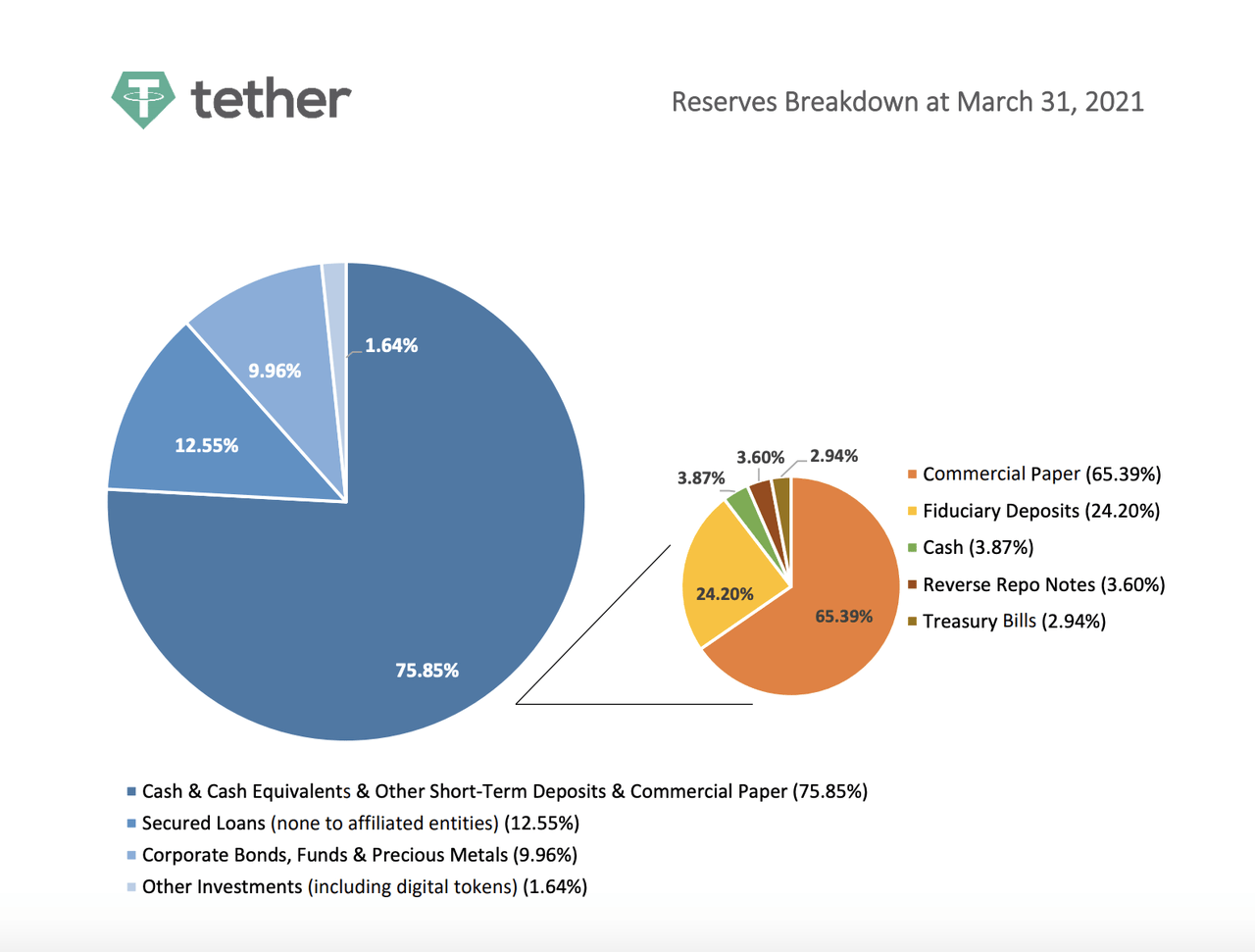

A lot has been made of the fact that Tether does not back all of its reserves in US dollars. There is no literal vault or checking account where all the dollars used to buy Tether are held. No, instead, much like a bank, Tether keeps a mix of dollar-denominated assets that yield interest:

Source: Tether.to

Above we can see Tether’s reserve breakdown as of March 31, 2021. The company owns corporate bonds, loans, precious metals, and 75.85% in “Cash & Cash Equivalents”. These are made up mostly of “Commercial Paper”, which are short-term loans to companies, Treasury Bills and other notes. Indeed, only 3.87% is kept in cash. Does this mean Tether is running some form of a scam? Far from it, in my opinion. Tether is operating in the same way that a bank would, and in fact, it is operating in the same way that Central Banks like the Federal Reserve and The Bank of England did back in the 1900s, when they were maintaining a peg to gold.

If we were to look at a breakdown of the Federal Reserve’s assets from 1917 to 1930, we would see that, even though dollars were redeemable for gold on demand, there was never a “100% reserve gold ratio”. Instead, the Fed held treasuries and even engaged in regular bank lending (Bills Discounted and Bills Bought). This didn’t prevent the gold standard from functioning well. Generally, no one is going to redeem dollars for gold, unless there is a perception that the Fed can’t honour this promise. The Fed could always do this, for the most part, since its assets equal its liabilities, though it couldn’t convert everything into gold on the spot. Why would it though? This is an unrealistic scenario. Instead, the Fed used its funds to buy interest-bearing assets, much like Tether is doing now. This is a matter of managing liquidity.

Tether is not doing anything new here, and there is evidence that, indeed, it can maintain a peg to the dollar without holding 100% dollar reserves. With that said, I would like to see more transparency from Tether, and it should perhaps be subject to regulation. But let’s not throw the baby out with the bathwater.

Tether and USDT work well, and they do indeed offer some of the advantages of cryptocurrency, such as DeFi and cheap transactions. USDT is exactly what a Federal Reserve issued CBDC would look like. However, that doesn’t mean that we can do away with Bitcoin and other cryptocurrencies, for this misses the bigger picture.

Bitcoin does NOT compete with Stablecoins

Even if Stablecoins offer some of the advantages of cryptocurrency, they are missing the most pivotal point that Bitcoin has going for it: decentralization. At the end of the day, Stablecoins are pegged to the fiat currencies they track, and in turn, these fiat currencies are controlled by Central Banks. If, for example, the Federal Reserve chooses to devalue the dollar by 50%, so too would Tether see its value halved. Tether would be forced to increase its supply of Tether to follow the dollar peg.

The other issue is that Tether’s balance sheet is, for the most part, made up of dollar-denominated assets. Unlike Bitcoin, Tether does not offer any protection from systemic risk. Tether’s fate is determined by the fate of the dollar and its ecosystem. If the Treasury market or the corporate debt market were to suffer in the future, Tether’s balance sheet would suffer too, and then indeed we could see a run on Tether where the company is not able to fulfil its obligations, at least not in a timely fashion.

In conclusion, though Tether and other stablecoins are an improved version of fiat currencies, they lack the most important advantages that Bitcoin has. They do not offer an independent form of value and they are still centrally controlled, both by the people who run Tether and by the Federal Reserve which dictates USD monetary policy.

The demand for Bitcoin will not be replaced by demand for stablecoins, as they do not fulfill the same role.