Bitcoin Halving 2020: All you need to know | Plus500

During its entire thirteen-year history we have seen three previous Bitcoin Halvings (or Halvenings) take place and in all these times, the price of Bitcoin was impacted. A Bitcoin Halving is where the rate at which new Bitcoins are created is halved and this occurs approximately every 4 years. We are currently living in a very different economic landscape than that of the last Halving events: what might this mean for Bitcoin’s price after the next Halving?

Mục lục bài viết

How does Bitcoin Halving Affect Bitcoin Trading?

At face value, a Halving might sound like a negative event for Bitcoin miners; however, for traders and investors, it can come with many positives. The purpose of this article is to explore the potential impact of the next Halving event, (expected for May 2024). We will also look at how you might trade it and even ways to manage and mitigate your risk effectively. Let’s first understand what a Halving is and what can we expect in terms of the event’s impact on the price of Bitcoin in 2022 as market volatility caused by inflation, the war in Ukraine and economic turmoil continue to affect the market as a whole.

What is the ‘Bitcoin Halving’?

Only 21 million Bitcoin blocks can be generated by the network. Bitcoins are mined, and people that mine them are rewarded, with Bitcoin as their prize. When a Halving event occurs, miners receive 50% fewer Bitcoin, for the same amount of effort. The purpose of a Halving event is supply and demand: With less supply, there is greater demand and thus the value of each Bitcoin is generally expected to increase.

Bitcoin Halving Events

As mentioned above, since 2009, there have been 3 separate Bitcoin Halving events. The first time a Bitcoin Halving occurred was on November 28th, 2012. By that year, about 10,500,000 Bitcoin had been mined, and each valued at approximately $11 a coin. Within the next year, this value would rise a hundredfold. The next Bitcoin Halving took place on July 9th, 2016, whereas the most recent Halving occurred on May 11, 2020. As for when the next Bitcoin Halving event might take place, many posit that it is expected to occur on May 4th, 2024.

How will the Bitcoin Halving impact its price?

In the aftermath of past Halvings, the price of Bitcoin against the US dollar has appreciated. For instance, after the Halving event of 2012, the price of BTC/USD skyrocketed from around $11 to over $1000 in a single year – an increase of 80 times. After the Halving of 2016, the price of Bitcoin increased again; BTC remained in the $580-700 price range for a couple of months before slowly gaining towards the end of the year to the $900 level.

However, it is important to note that the demand for Bitcoin can drastically fluctuate and that the circumstances around each Halving are very different. This means that it is not at all easy to attribute a bullish or bearish price movement to a specific Halving event.

How often does the Bitcoin Split occur?

Bitcoin Halvings are scheduled to happen every time 210,000 blocks are mined, which occurs approximately once every four years.

The pros and cons of the Bitcoin Halving

As the price of Bitcoin tends to increase after each Halving, Bitcoin owners generally feel the positive effects; the value of their holdings generally increases.

Halving events tend to be a good thing for the demand for Bitcoin, as supply drops – this can be considered a catalyst for positive price action for the future of Bitcoin and the other altcoins.

However, traders must keep in mind that there may be some negative after-effects of the Bitcoin Halving. Some analysts have predicted that other altcoins may suffer as a result of the Halving; after Bitcoin’s bull run in 2019 a lot of the smaller altcoins suffered when their investors turned to Bitcoin.

There is also the risk that Bitcoin could suffer a big crash if the miners sell off their rewards because of the sudden doubled cost they’ll incur to mine.

Volatility also tends to occur as a result of a Halving, which can be a pro or a con – generally volatility increases before and after the event. Traders can use volatility to their advantage of course; however, wild price fluctuations also can make it difficult to ascertain a pattern in pricing, which therefore makes it harder to implement a successful trading strategy.

How can I trade the Bitcoin Halving?

Previous Halving events led to an upswing in the price of Bitcoin. The first Halving saw BTC’s price jump from $11 to $1,100, the second Halving led to the value of Bitcoin to increase from $600 to $20,000 in 18 months, while the third led to Bitcoin rising from $9,000 to around $30,000. However, the circumstances surrounding each Halving may be different and demand for Bitcoin can fluctuate wildly, particularly in light of the coronavirus pandemic, the war in Ukraine, as well as inflation, all of which have proven to be an economic test for even the most “stable” of assets.

The next Bitcoin halving event is expected to take place on May 4th, 2024 and investors would have to wait and see how this event would affect its price.

How can I take advantage of BTC Halving?

Bitcoin is expensive to buy. If you BUY Bitcoin and the price crashes, you will be stuck with an expensive loss. An alternative to buying Bitcoin would be trading CFDs on Bitcoin, which means you can speculate on the price movement, rather than buying the asset outright. You can also wait for the Halving event to occur and then open either BUY or SELL positions in BTC/USD, depending on which way you believe the pair is moving. Additionally with CFDs, you can trade in both rising or falling markets. If you believe the price of Bitcoin will drop then you can open a SELL position. Alternatively, if you believe the price will be moving up, then you can BUY low and SELL high.

How do I manage the risks of trading Bitcoin?

There are various measures you can employ to manage your risk while trading Bitcoin, including limiting the capital you put into each trade. That can be 10%, 5% or less depending on your trading strategy.

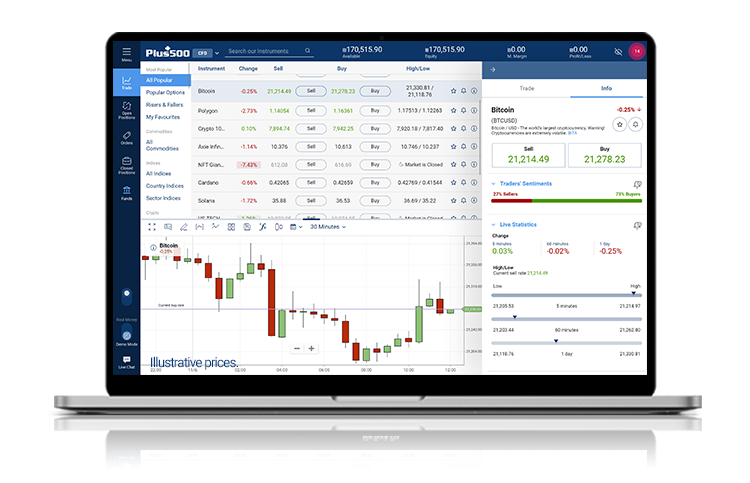

You can also use risk management tools like the Stop Loss and Take Profit orders that you will find on the Plus500 platform. Stop Loss stops out your trades when the value of the asset falls to, or past, a certain level. Take Profit allows you to close a position when it has accrued a certain level of profit in order to lock in the profits. There is also the Guaranteed Stop order, for which a fee is charged but it guarantees that your position will close at the exact rate you specify.

Illustrative prices.

How will the Bitcoin Halving impact the crypto markets?

In terms of the crypto market as a whole, Bitcoin tends to be the flag bearer for the wider market. Most of the leading cryptocurrencies seem to rise when Bitcoin rises for a reasonable time, drawing the conclusion that altcoins, like Ethereum and Litecoin, and Bitcoin bull periods may be positively correlated. The aphorism “A rising tide lifts all boats” certainly seems to be the case with the altcoins, which have been trading in a bullish trend after each past Halving. While the global economy is in chaos, and almost all assets are suffering as a result, Bitcoin owners may potentially once again reap the rewards of the next Halving. Watch this space and remember you can trade Bitcoin CFDs with Plus500.

*Subject to operator availability.