Bitcoin Mining Around the World: Paraguay

Paraguay, one of the smallest countries in Latin America, is quickly becoming one its largest Bitcoin mining hubs.

When China’s mining ban shifted the axis of the Bitcoin mining industry from East to West, Latin America experienced a meteoric rise as a key mining hub. For Paraguay, the country’s surplus of cheap hydropower has quickly made it a popular spot for miners.

The only thing that could stunt the country’s hashrate growth, though, are the power tariffs and red tape that Paraguayan bureaucracy are placing on the industry.

Today, we’ll be taking a closer look at what makes Paraguay such an attractive hub for Bitcoin mining, as well as some of the regulatory mandates that may be a cause for concern for future hashrate growth in the country.

This article is the latest in our Bitcoin Mining Around the World series. Our previous articles cover Sweden and Norway.

Mục lục bài viết

Latin America’s burgeoning Bitcoin mining hub

The Cambridge Bitcoin Electricity Consumption Index estimates that Paraguay housed 0.15% of Bitcoin’s hashrate in December 2021. Not only is this figure outdated, but it also relies on a top-down approach that tracks the IP address of Bitcoin mining pool user dashboards. The use of VPNs, not to mention the fact that many miners host their machines in different countries than they reside, impairs the accuracy of this data.

To supplement Cambridge’s figure, we used a bottom-up approach that samples every known Bitcoin mine in Paraguay based on Luxor business data and miners who are active in the country.

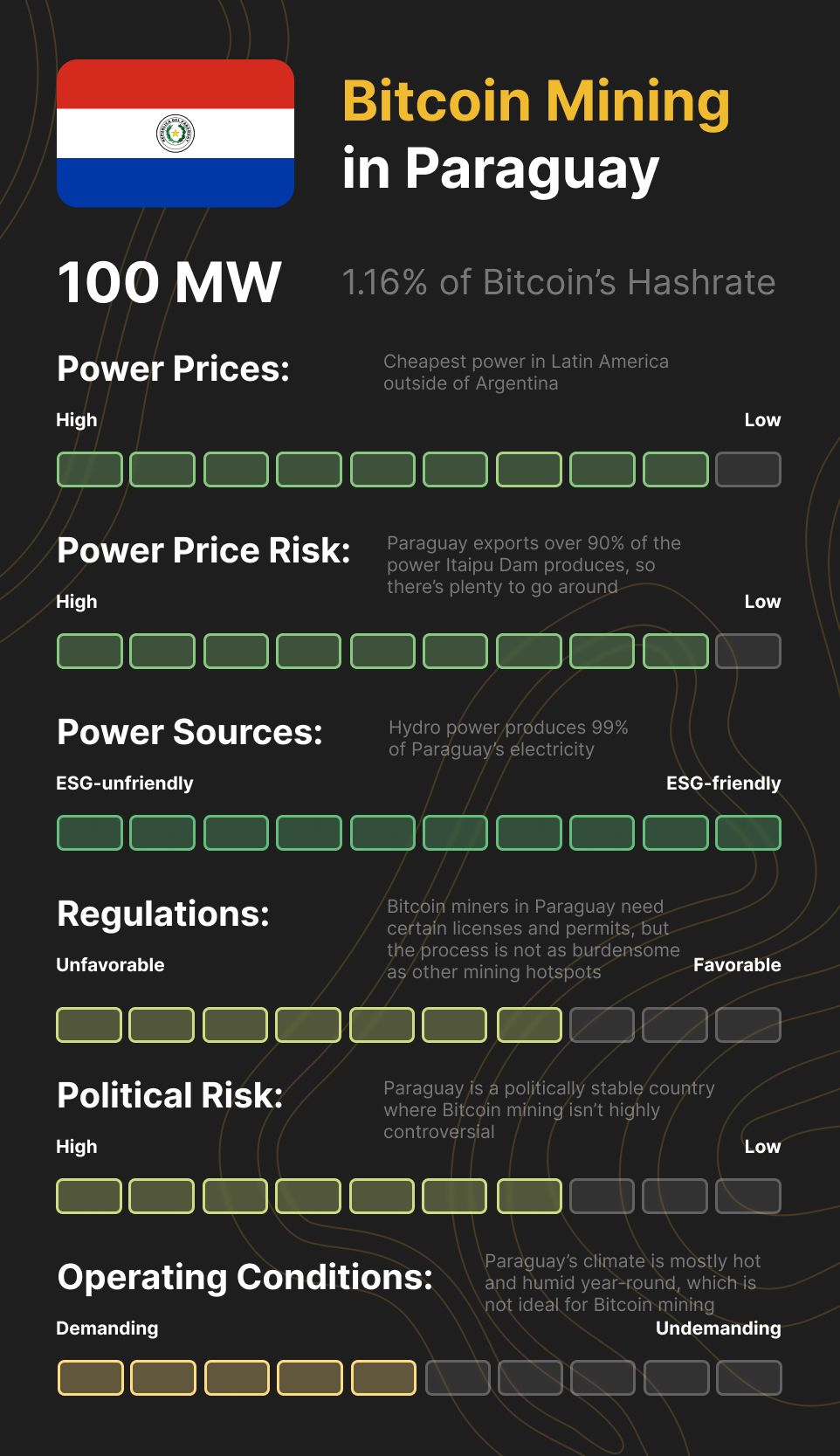

Using this methodology, we estimate that there is anywhere from 100-125 MW of Bitcoin mining in Paraguay, which would translate to 1.45% of total network hashrate on the high end and 1.16% on the low-end, according to Hashrate Index’s Bitcoin Mining Energy Consumption Index.

The Itaipu Dam provides gushes of renewable energy

The biggest incentive for Bitcoin miners to move to Paraguay comes in the form of 23,700 feet of concrete and steel: the Itaipu Dam.

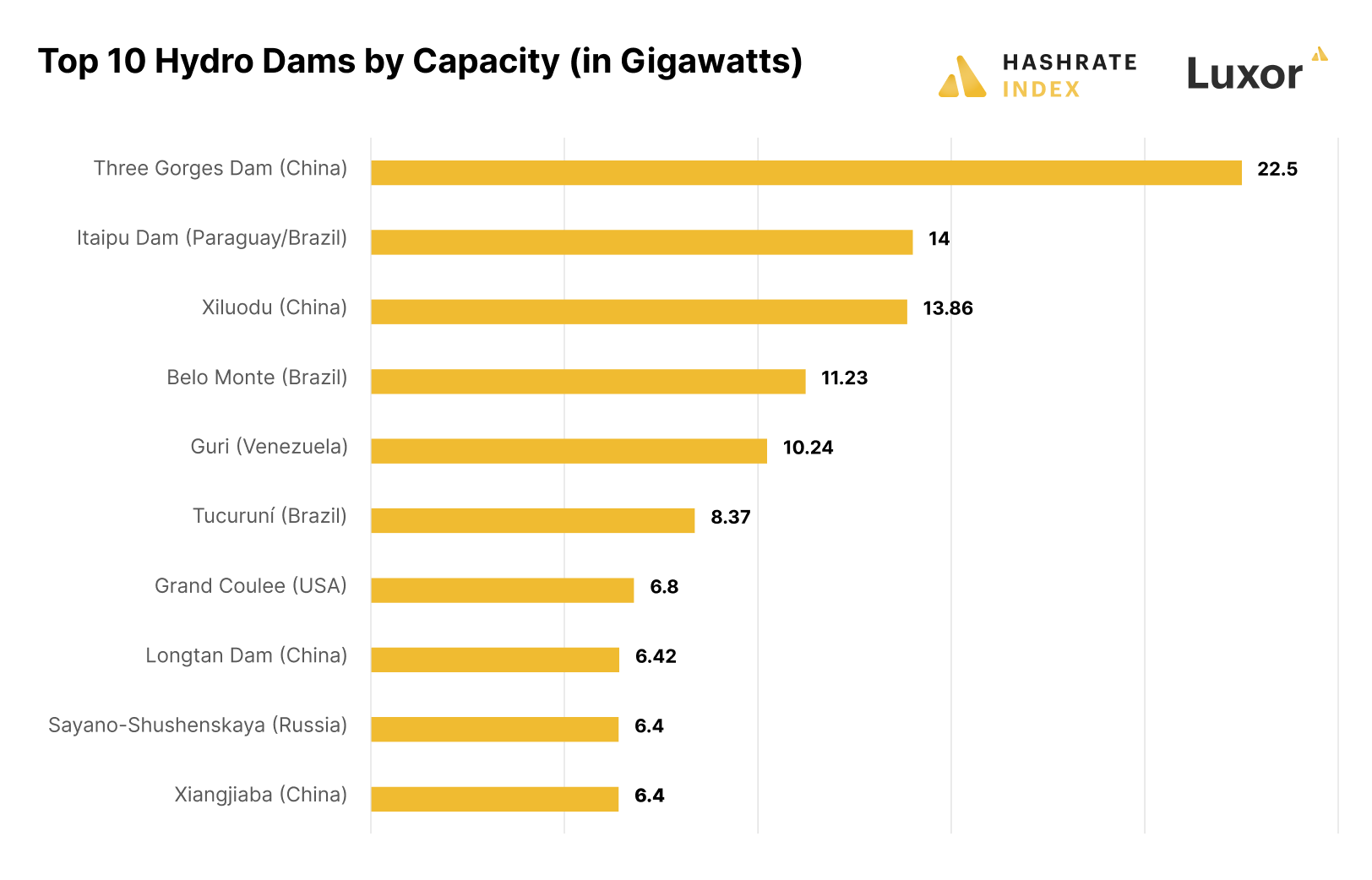

Second only to China’s Three Gorges Dam, the beating heart of China’s Bitcoin mining industry then (and now), the Itaipu Dam is capable of generating 14 GW of power. Operational since May 5, 1984, the dam provides power to Paraguay, Brazil, and Argentina, while Brazil and Paraguay co-own the colossus.

Paraguay draws over 99% of its power from this dam and its much smaller cousins, the Yacyretá and Acaray dams. However, Paraguay’s population of 6.7 million comes nowhere close to consuming all of the energy its dams produce, leaving it to export 90% of this production to neighboring countries Brazil, Bolivia, and Argentina.

Top 10 hydro dams in the world by power generation capacity | Source: Source: Statista

Top 10 hydro dams in the world by power generation capacity | Source: Source: Statista

Negotiating power rates with ANDE

The Administración Nacional de Electricidad (ANDE) is Paraguay’s national grid operator and holds a monopoly on power production and distribution. The only exceptions to this monopoly are CLYFSA (Compañía de Luz y Fuerza, S.A.), a power company that can sell electricity in Villarrica, and the Empresas Distribuidoras Menonitas del Chaco Central. Rates from CLYFSA can be as low as $1.6/kWh, so contracts with the power provider are very coveted. They’re so popular that demand has pushed CLYFSA to its production limits.

Since ANDE is the only entity allowed to commercialize energy in the country, most Paraguayan hosting contracts call for profit sharing. ANDE’s monopoly disallows hosting facilities from making a spread on the power they sell to their mining customers; instead, they take a slice of the miner’s profit. A typical profit share in the country is anywhere from 15-20% depending on the miner’s deployment size.

ANDE typically allots power in 6MW tranches per land leases, and it’s important to note that the buyers of these PPAs typically must supply their own transformers. Purchasers can secure this type of power purchase agreement (PPA) in a matter of weeks, and prices vary widely from Clyfsa’s own PPAs. A typical rate for a single 6 MW block of energy could be $4.6/mWh, though we have learned of at least one 100 MW deal which offered $2.8/mWh (with up to 10% downtime) OR $3.8/mWh with no downtime.

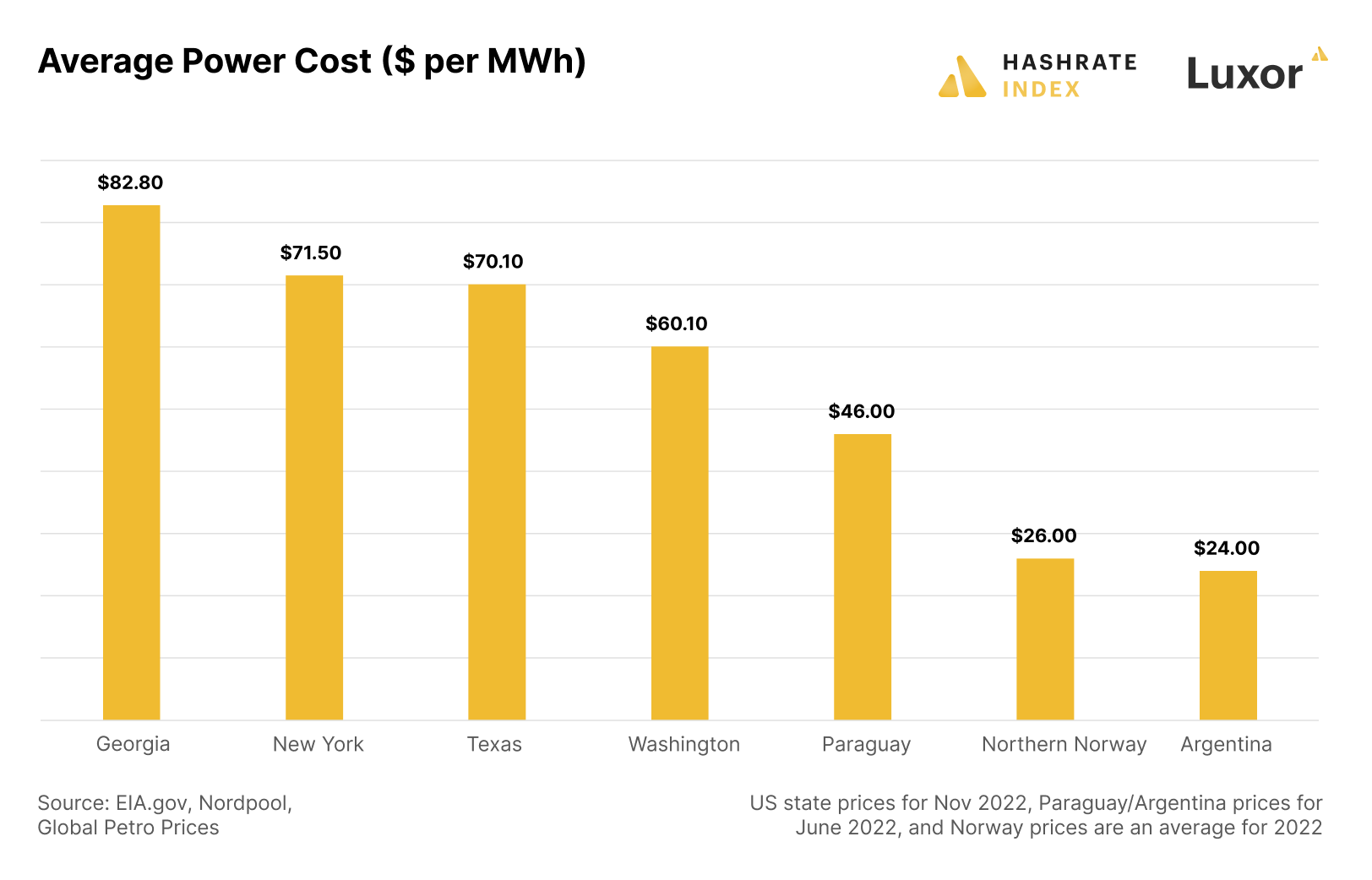

We could not source a datapoint that shows the average industrial power price in Paraguay. So the chart below shows the average price for businesses as of June 2022, and we compare this to industrial power rates in other popular mining hubs. It’s not an apple-to-apples comparison, especially considering that the power rates come from different timeframes, but it’s still useful for gauging Paraguay’s competitiveness on a global scale.

Operating conditions for Bitcoin mining in Paraguay

One of the few knocks against Paraguay’s fitness for Bitcoin mining is its climate.

Summer in Paraguay (between November and March) can easily see 100 degree Fahrenheit temperatures. Paraguay also features a very humid climate, with an annual average humidity of 70%.

Both heat and humidity are unideal for running (specifically) air-cooled Bitcoin mining rigs. Given that mining rigs operate at high temperatures, high-heat environments require extra care for cooling, and humidity can shorten a rig’s operational lifespan by rusting out important components.

All of that said, with proper cool and air circulation, the heat and humidity shouldn’t pose too much of a challenge to miners. After all, Texas and Georgia are blistering hot and horribly humid in the summer months, and the bulk of the USA’s hashrate resides in these states.

Regulatory environment for Bitcoin mining in Paraguay

Bitcoin miners have to establish an LLC to bulk import Bitcoin mining hardware, and they also need a permit to import cables and other electrical equipment needed to sustain a mining operation. Importation fees for mining rigs can cost anywhere from 17-20% of a machine’s market value (which is actually a steal when you compare it to the 50-80% tariff miners pay to import machines into Brazil and Argentina). Additionally, miners need a permit from the Ministry of Commerce to build a Bitcoin mine, but this permit can be acquired in a few days. Finally, Bitcoin miners have to pay an environmental tax to stay compliant.

Paraguay’s president vetoed a crypto and bitcoin mining regulation bill at the end of last year. Parliament did not reach sufficient quorum to vote on the bill when it returned from the President’s desk, so voting is postponed for another year.

The bill, were it to pass, would increase the bureaucratic burden for Paraguayan Bitcoin miners. It would require a new license for reporting the IP addresses of individuals operating miners in Paraguay.

The good news of the bill, though, is that it would lower the tariff miners currently pay to access power.

Paraguay will be a top Bitcoin mining hub in Latin America

Paraguay has plenty to offer Bitcoin miners. Itaipu and other dams keep the country flush with cheap, abundant electricity, and the regulatory and legal environment is relatively friendly. We expect Paraguay to step into a role as Latin America’s premier Bitcoin mining hub in the near-to-midterm future.

Of course, as with any jurisdiction, Paraguay comes with its faults. Reasonable, readily available financing, for instance, will be a challenge for miners seeking a hashing home in Paraguay. Larger players (e.g., a publicly traded firm like Bitfarms) can easily access fundraising and financing, but smaller operators may not have the same luxury.

Currently, very few crypto-native lenders will consider lending to operators in Paraguay. Regulatory uncertainty is a barrier here, not to mention that many of these lenders already get plenty of business in the US and Canada.

Finding the right incentive mechanisms to get these players comfortable and active in the region will be key to its growth moving forward. Additionally, regulatory certainty regarding the crypto bill that was shelved last year could aid the Bitcoin mining industry’s growth in the county.

Are you scaling a Bitcoin mining operation and in need of mining software, services, or hardware? We can help. You can reach us here.

Bitcoin mining in Paraguay report card

Bitcoin mining in Paraguay report card

Special thanks to Dennis Amstutz of Hydro Block for insights into Paraguay’s Bitcoin mining industry