Bitcoin Mining: What Is It And How Does It Work? | Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money .

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bitcoin mining is the process of creating new bitcoins by solving extremely complicated math problems that verify transactions in the currency. When a bitcoin is successfully mined, the miner receives a predetermined amount of bitcoin.

Bitcoin is a cryptocurrency that’s gained wide popularity due to its wild price swings and surging value since it was first created in 2009.

As prices of cryptocurrencies and Bitcoin in particular have skyrocketed in recent years, it’s understandable that interest in mining has picked up as well. But for most people, the prospects for Bitcoin mining are not good due to its complex nature and high costs. Here are the basics on how Bitcoin mining works and some key risks to be aware of.

Dollar Coin

Bitcoin mining statistics

- A miner currently earns 6.25 Bitcoin (about $152,000 as of March 2023) for successfully validating a new block on the Bitcoin blockchain.

- Creating Bitcoin consumes 121 terawatt-hours of electricity each year, more than is used by the Netherlands or the Philippines, according to the Cambridge Bitcoin Electricity Consumption Index.

- It would take nine years of household-equivalent electricity to mine a single bitcoin as of August 2021.

- The price of Bitcoin has been extremely volatile over time. In 2020, it traded as low as $4,107 and reached an all-time high of $68,790 in November 2021. As of March 2023, it traded for about $24,300.

- While it depends on your computing power and that of other miners, the odds of a modestly powered solo miner solving a Bitcoin hash were about 1 in 26.9 million in January 2023.

- The United States (37.4 percent), Mainland China (18.1 percent) and Kazakhstan (14.0 percent) were the largest bitcoin miners as of January 2022, according to the Cambridge Electricity Consumption Index.

Understanding Bitcoin

Bitcoin is one of the most popular types of cryptocurrencies, which are digital mediums of exchange that exist solely online. Bitcoin runs on a decentralized computer network or distributed ledger that tracks transactions in the cryptocurrency. When computers on the network verify and process transactions, new bitcoins are created, or mined. These networked computers, or miners, process the transaction in exchange for a payment in Bitcoin.

Bitcoin is powered by blockchain, which is the technology that powers many cryptocurrencies. A blockchain is a decentralized ledger of all the transactions across a network. Groups of approved transactions together form a block and are joined to create a chain. Think of it as a long public record that functions almost like a long running receipt. Bitcoin mining is the process of adding a block to the chain.

How Bitcoin mining works

In order to successfully add a block, Bitcoin miners compete to solve extremely complex math problems that require the use of expensive computers and enormous amounts of electricity. To complete the mining process, miners must be first to arrive at the correct or closest answer to the question. The process of guessing the correct number (hash) is known as proof of work. Miners guess the target hash by randomly making as many guesses as quickly as they can, which requires major computing power. The difficulty only increases as more miners join the network.

The computer hardware required is known as application-specific integrated circuits, or ASICs, and can cost up to $10,000. ASICs consume huge amounts of electricity, which has drawn criticism from environmental groups and limits the profitability of miners.

If a miner is able to successfully add a block to the blockchain, they will receive 6.25 bitcoins as a reward. The reward amount is cut in half roughly every four years, or every 210,000 blocks. As of March 2023, Bitcoin traded at around $24,300, making 6.25 bitcoins worth $152,000.

Is Bitcoin mining profitable?

It depends. Even if Bitcoin miners are successful, it’s not clear that their efforts will end up being profitable due to the high upfront costs of equipment and the ongoing electricity costs. The electricity for one ASIC can use the same amount of electricity as half a million PlayStation 3 devices, according to a 2019 report from the Congressional Research Service.

As the difficulty and complexity of Bitcoin mining has increased, the computing power required has also gone up. Bitcoin mining consumes about 121 terawatt-hours of electricity each year, more than most countries, according to the Cambridge Bitcoin Electricity Consumption Index. You’d need 9 years’ worth of the typical U.S. household’s electricity to mine just one bitcoin as of August 2021.

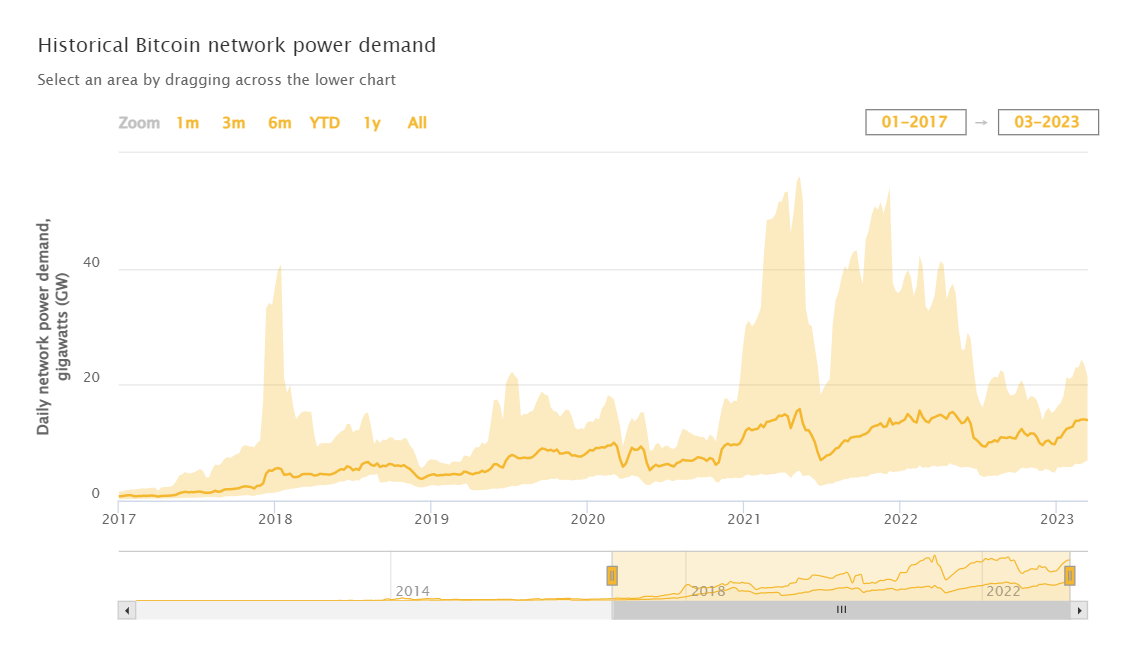

Source: Cambridge Bitcoin Electricity Consumption Index

One way to share some of the high costs of mining is by joining a mining pool. Pools allow miners to share resources and add more capability, but shared resources mean shared rewards, so the potential payout is less when working through a pool. The volatility of Bitcoin’s price also makes it difficult to know exactly how much you’re working for.

How do you start Bitcoin mining?

Here are the basics you’ll need to start mining Bitcoin:

- Wallet. This is where any Bitcoin you earn as a result of your mining efforts will be stored. A wallet is an encrypted online account that allows you to store, transfer and accept Bitcoin or other cryptocurrencies. Companies such as Coinbase, Trezor and Exodus all offer wallet options for cryptocurrency.

- Mining software. There are a number of different providers of mining software, many of which are free to download and can run on Windows and Mac computers. Once the software is connected to the necessary hardware, you’ll be able to mine Bitcoin.

- Computer equipment. The most cost-prohibitive aspect of Bitcoin mining involves the hardware. You’ll need a powerful computer that uses an enormous amount of electricity in order to successfully mine Bitcoin. It’s not uncommon for the hardware costs to run around $10,000 or more.

Risks of Bitcoin mining

- Price volatility. Bitcoin’s price has varied widely since it was introduced in 2009. Since just November 2021, Bitcoin has traded for less than $20,000 and nearly as high as $69,000. This kind of volatility makes it difficult for miners to know if their reward will outweigh the high costs of mining.

- Regulation. Very few governments have embraced cryptocurrencies such as Bitcoin, and many are more likely to view them skeptically because the currencies operate outside government control. There is always the risk that governments could outlaw the mining of Bitcoin or cryptocurrencies altogether as China did in 2021, citing financial risks and increased speculative trading.

Taxes on Bitcoin mining

It’s important to remember the impact that taxes can have on Bitcoin mining. The IRS has been looking to crack down on owners and traders of cryptocurrencies as the asset prices have ballooned in recent years. Here are the key tax considerations to keep in mind for Bitcoin mining.

- Are you a business? If Bitcoin mining is your business, you may be able to deduct expenses you incur for tax purposes. Revenue would be the value of the bitcoins you earn. But if mining is a hobby for you, it’s not likely you’ll be able to deduct expenses.

- Mined bitcoin is income. If you’re successfully able to mine Bitcoin or other cryptocurrencies, the fair market value of the currencies at the time of receipt will be taxed at ordinary income rates.

- Capital gains. If you sell bitcoins at a price above where you received them, that qualifies as a capital gain, which would be taxed the same way it would for traditional assets such as stocks or bonds.

Check out Bankrate’s cryptocurrency tax guide to learn about basic tax rules for Bitcoin, Ethereum and more.

Mục lục bài viết

Bottom line

While Bitcoin mining sounds appealing, the reality is that it’s difficult and expensive to actually do profitably. The extreme volatility of Bitcoin’s price adds more uncertainty to the equation.

Keep in mind that Bitcoin itself is a speculative asset with no intrinsic value, which means it won’t produce anything for its owner and isn’t pegged to something like gold. Your return is based on selling it to someone else for a higher price, and that price may not be high enough for you to turn a profit.