Bitcoin Taproot Utilization Hits New ATH, Thanks To Ordinals

Data shows that Bitcoin taproot utilization has now hit a new all-time high, thanks to the emergence of Ordinals on the network.

Mục lục bài viết

Bitcoin Taproot Utilization Hits New All-Time High Of 4.2%

According to the latest weekly report from Glassnode, both Taproot adoption and utilization have hit all-time highs recently. “Taproot” is a BTC upgrade that introduced some changes to how transactions are processed, to make them faster and more efficient. The upgrade went live back in the November of 2021.

The “Taproot adoption” here is a metric that tells us how much adoption the upgrade has seen among users on the network. The indicator is inspired by the one the community came up with for monitoring SegWit adoption (SegWit being another BTC protocol that went live back in 2017).

Like the SegWit adoption, the Taproot adoption quantifies adoption based on the percentage of the total Bitcoin transactions that have at least one Taproot input involved in them.

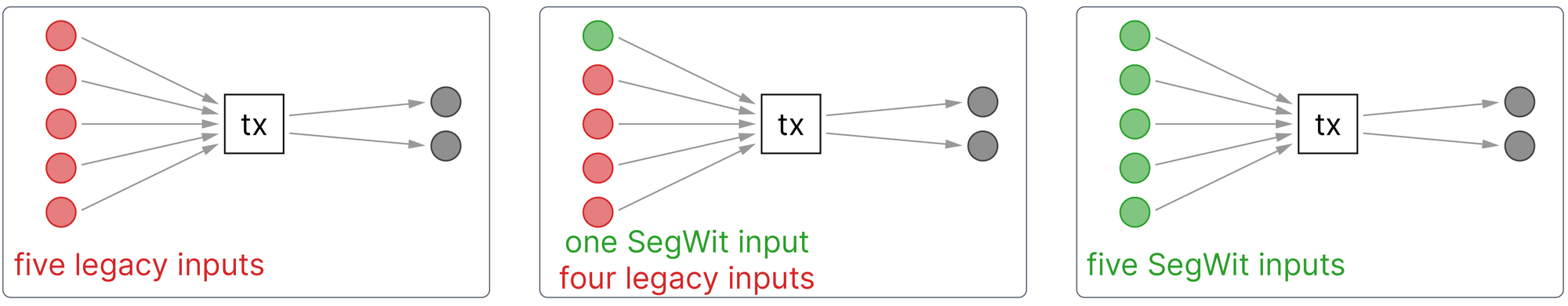

This methodology, however, has a major flaw. Glassnode’s report on SegWit adoption from last year summed up the problem using the example in the below figure:

Three examples of BTC transactions | Source: Glassnode

In this example, the center transaction involved one SegWit input (and four legacy ones), while the right one had five SegWit inputs. Since the SegWit adoption indicator only cares about how many transfers include at least one such input, both center and right transactions will be considered SegWit ones.

Because two-thirds of the transfers here are SegWit according to the indicator, the adoption would be valued at 66%. However, clearly, this isn’t an accurate representation of the actual utilization of the protocol, as the indicator ignores the finer details of the transactions.

To solve the issue, Glassnode came up with the “utilization” metric, which actually counts all the spent outputs involved in a transfer and calculates the value based on their total. If this new indicator is applied to the above example, the utilization would come out to be 40% as only 6 out of the 15 inputs here are made using SegWit-ready software.

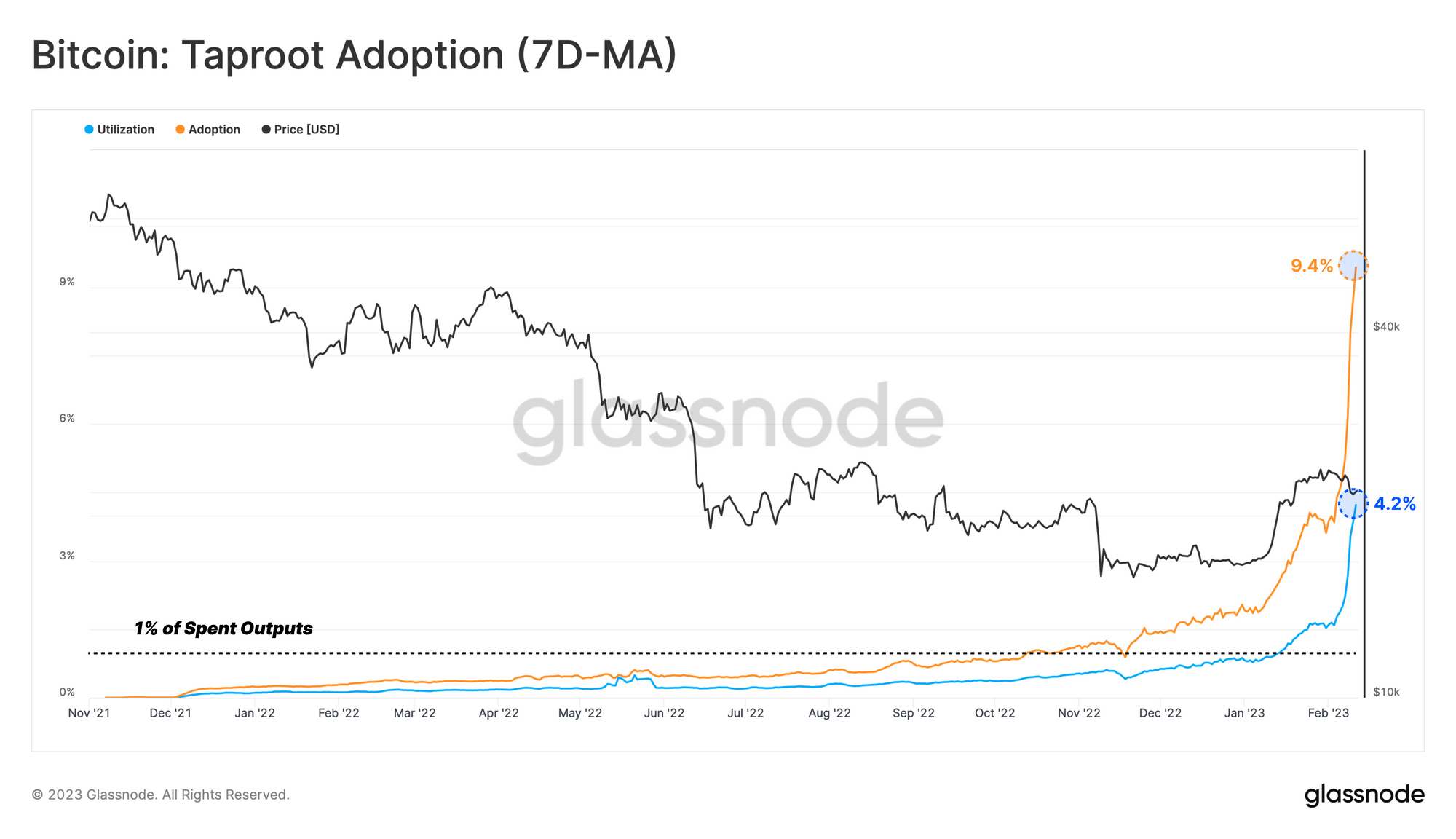

Coming back to Taproot, this same methodology can also be applied to judge the acceptance of this Bitcoin upgrade. Below is a chart that shows the trend in the 7-day moving average (MA) Taproot adoption, as well as the utilization, since the upgrade went live back in November 2021:

The 7-day MA values of both the metrics seem to have shot up recently | Source: Glassnode's The Week Onchain - Week 7, 2022

As displayed in the above graph, both the 7-day MA Bitcoin taproot adoption and utilization have rapidly gone up recently and hit new all-time highs of 9.4% and 4.2%, respectively. The adoption here is more than double the utilization, further showing how misleading the picture presented by the former indicator can be.

The reason behind this sudden surge in Taproot utilization is the rise of Ordinals in the market. Ordinals is a protocol that makes use of Taproot to inscribe data into the witness portion of a BTC transaction.

In simple terms, what Ordinals allows a user to do is to attach things like images to BTC transactions, something that has led to the onset of non-fungible tokens (NFTs) on the blockchain. As these NFTs have been rapidly gaining popularity, it’s no surprise that Taproot has also been observing significantly more use.

BTC Price

At the time of writing, Bitcoin is trading around $21,800, down 5% in the last week.

BTC continues to move sideways | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com