Crypto Fear & Greed Index Hits 14-Month High as Bitcoin Climbs

Cryptocurrencies like Bitcoin tumbled in the last year as the Federal Reserve hiked interest rates, but now spirits could be improving.

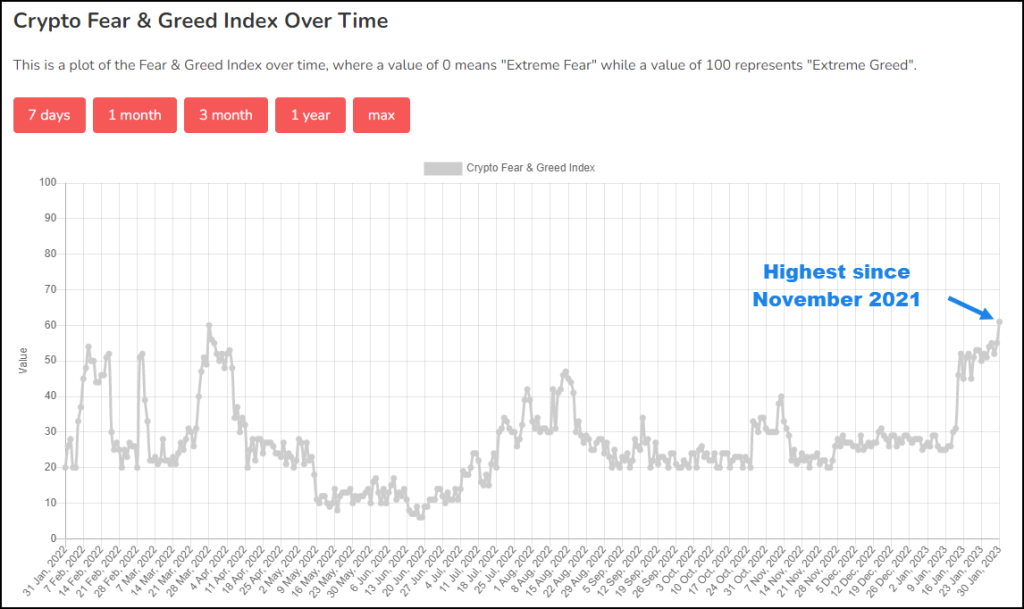

The Crypto Fear & Greed Index, which includes factors like Volatility and Momentum, hit 61 on Monday. It was the highest reading since November 2021, when Bitcoin was 150 percent higher.

The increase followed a three-week rally in the cryptocurrency. BTCUSD now finds itself back above $22,000 and is testing peaks from last August. Investors could find it interesting for a few reasons.

First is the Federal Reserve meeting tomorrow. Cryptocurrencies shot to new highs in late 2020 after policymakers cut interest rates near zero. They also fell in late 2021 as investors braced for higher rates. In that respect, they’ve been leading equities — especially growth stocks on the Nasdaq-100.

Crypto Fear & Greed Index, courtesy of Alternative.me.

Crypto Fear & Greed Index, courtesy of Alternative.me.

The market broadly expects the Fed to raise interest rates by 25 basis points on Wednesday, with the possibility of one more hike on March 22. (According to CME’s FedWatch tool.) Any indications of central bankers pausing earlier could potentially impact Bitcoin because it would probably lower borrowing costs. Softer monetary policy could also depress the U.S. dollar, increasing the appeal of assets like precious metals and cryptos.

Second, fundamentals of the crypto market have tightened. Data from CryptoQuant.com shows fewer than 2.2 million Bitcoin available on public exchanges, down from 3.1 million three years ago. That suggests less supply is available, which may help support prices.

Mục lục bài viết

Charting Bitcoin

Bitcoin has been pushing against its September high around $22,750. Traders could next eye the August peak of $25,200.

To the downside, chart watchers could focus on the $21,500 level. That was a level from November that Bitcoin broke on January 20.

Still, participation has been narrow as other digital assets like Ethereum, BNB and Polygon struggle. That’s different than Bitcoin’s last bull run. At that time (December 2020) Bitcoin rallied but shrank as a percentage of the total crypto market. So-called Bitcoin dominance slid from over 70 percent to under 40 percent by May 2021, according to TradingView data. The move resulted from money streaming into the broader market. This time, it’s mostly going to Bitcoin.

There could be three ways to view the relative strength of Bitcoin.

Bitcoin (BTCUSD), daily chart, with key levels cited above, courtesy of TradingView.

A pessimistic view would be that investors have lost interest in cryptos overall and Bitcoin is the “last man standing.”

An optimistic view would note that Bitcoin dominance tends to peak as bear markets end. Therefore if other tokens like Ethereum gain versus Bitcoin in coming weeks, it could suggest investors are returning to the broader space.

A mixed view could be favorable toward Bitcoin alone. After all, BTCUSD was the first major crypto and has always boasted the largest market capitalization. It’s received the the most attention by large investors. It could also have the least risk of being regulated as a security, according to regulators.

In conclusion, Bitcoin could be nearing a turning point as sentiment brightens and markets look for the interest rates to stop rising. Investors who’ve abandoned cryptocurrencies could start looking again.

Advertisement