Cryptocurrency candlestick charts: the top 9 patterns | EXMO Info Hub

Candlestick analysis is one of the most effective and popular types of technical analysis that is used to determine possible price movements based on historical data. In this article, we cover the top 9 most popular candlestick patterns to help you predict crypto prices more accurately.

Mục lục bài viết

What is cryptocurrency candlestick analysis

Since the cryptocurrency market is still relatively young, it has not yet achieved a high level of efficiency. Therefore, price movements on charts primarily depend on the sentiment of market participants.

Candlestick analysis is an indispensable tool in helping you predict asset price changes based on historical data.

The basics of candlestick patterns were introduced by Munehisa Homma, an 18th-century Japanese rice trader. He believed that the ideal price change chart should be also handy for analysis. Today, Japanese candlesticks are the most popular way to quickly analyse price movements among traders.

The top 9 single candlestick patterns

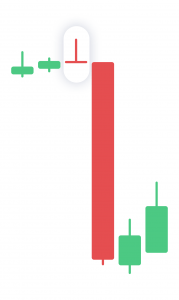

Neutral Doji

This pattern indicates equal confrontation between buyers and sellers and the state of indecision on the market. Often, the neutral Doji is followed by a short-term price reversal.

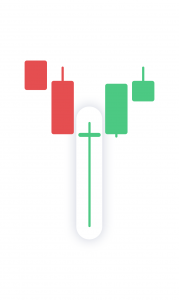

Dragonfly Doji

It is observed when the high, opening and closing prices are equal or close in value, while the low of the period is considerably lower. This pattern may indicate a reversal of a downtrend.

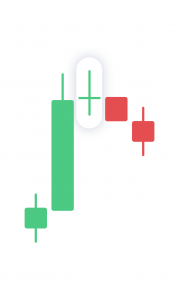

Gravestone Doji

It represents the upcoming trend reversal from bullish to bearish when sellers are stronger than buyers. Such a candle is often followed by a sharp decrease in price action.

Hammer

Like the Doji candle, it can indicate that an asset is oversold, and a trend reversal is about to take place.

Inverted Hammer

The candlestick pattern resembles the shape of an inverted Hammer and indicates a possible trend reversal from a bearish to bullish.

Shooting Star

Unlike the Hammer pattern, it occurs during a bullish market and indicates possible reversal from an uptrend to a downtrend.

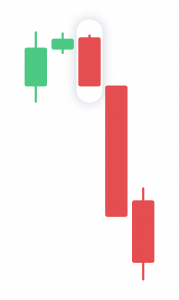

Hanging Man

This pattern basically resembles a Shooting Star which is flipped upside down. It occurs at the end of a bullish trend and indicates the beginning of the bearish one.

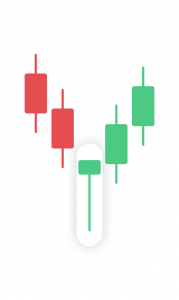

White Marubozu

It shows buyers’ confidence in the market, as well as suggests that the asset price will follow this pattern for a short period until it reaches the resistance level.

Black Marubozu

It shows consumer confidence in the market, as well as suggests that the asset price will follow this pattern for a short period until it reaches the support level.