Ethereum: Zhejiang Testnet Means Staking Withdrawals Are Coming

anyaberkut/iStock via Getty Images

Mục lục bài viết

Thesis

Despite its recent price decline, Ethereum (ETH-USD) remains at the center of decentralized finance, smart contracts, NFTs, and other fast-growing trends that should support long-term price appreciation. The ability for investors to sell staked Ethereum could be an upcoming catalyst, and the success of the Zhejiang Testnet in facilitating test withdrawals indicates that this upgrade is right on the horizon.

The Zhejiang Testnet

Ethereum Github

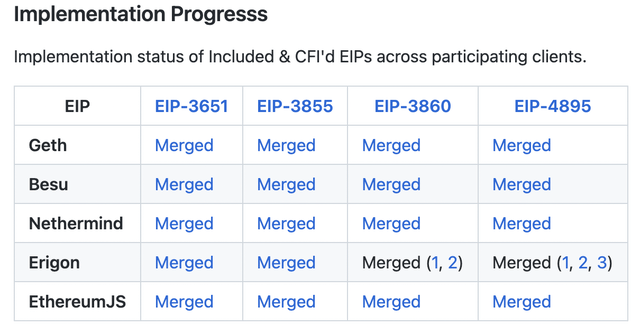

As shown in the GitHub page for the Shanghai Network Upgrade, all code changes necessary for this upgrade (which will enable staking withdrawals) have been merged into Ethereum’s code base as of last month. Now, the only thing stopping this upgrade from going live is testing.

I last covered Ethereum almost a year ago, and incidentally, my last article was also about testing consensus layer upgrades. For a more detailed explanation of testnets, shadow forks, and other Ethereum development/testing details, I recommend reading that article as well.

In summary, a testnet is what Ethereum developers use to test changes to Ethereum’s code before enabling those changes for the actual blockchain (the mainnet). Because even the best developers sometimes make mistakes and write buggy code, a testnet is a fairly standard tool that helps balance Ethereum’s need for stability with its continued evolution.

Developers have been creating testnets for parts of the Shanghai upgrades, including staking withdrawals since November of last year. Zhejiang is a testnet that ran more recently – on February 7th. It’s notable because it included all of the code for the Shanghai upgrade and because it was the first testnet that successfully simulated staking withdrawals without reports of glitches or major issues.

The lack of reported issues is a direct measure of the success of a testnet; if a testnet uncovers no issues, then in theory the tested code can also go live on the mainnet without any issues. In practice, a testnet isn’t guaranteed to uncover all potential issues on the mainnet, which is why it’s still premature to consider staking withdrawals fully de-risked. That said, Ethereum’s developers already have a track record of successfully deploying consensus layer upgrades, and I’m confident that they’ll pull this one off as well.

The expectation is that Ethereum developers will run two more testnets after Zhejiang to reduce the risk of launching on the mainnet as much as possible. If these testnets are as successful as Zhejiang was, it seems likely that staking withdrawals are on track to go live for everyone on the mainnet sometime in March.

Why Are Staking Withdrawals Good?

ethereum.org

It’s objectively great news for Ethereum as a technology that the Shanghai upgrades are closer to going live. It should be obvious that the ability to withdraw staked Ethereum unlocks a beneficial new functionality for those who use the blockchain. Among other benefits, the increased liquidity of staked Ethereum should encourage more people holding Ethereum to stake it, thus improving the security of the proof-of-stake network.

To give a personal example, I keep less than half of my Ethereum staked due to liquidity concerns. Although the Zhejiang testnet increases my confidence that withdrawals are coming soon, I don’t want to stake the rest until I’m completely confident that I’ll eventually be able to withdraw it. As soon as staking withdrawals are live, I’ll stake 100% of my Ethereum.

Also, once these upgrades are complete Ethereum developers will be able to shift their focus to implementing sharding, the final of three major upgrades planned for Ethereum in recent years. Among other benefits, sharding will improve the scalability of the network, especially as it relates to layer 2 protocols like Arbitrum (ARB-USD). I’ll likely cover this in another article as that upgrade gets closer to launching.

Will Staking Withdrawals Increase Ethereum’s Price?

It’s clear from the previous section that the Beijing upgrade is good for Ethereum as a technology, but that doesn’t mean that its release will push Ethereum’s price higher.

I’ll be the first to admit that when I published a similar article last year about the “The Merge” (Ethereum’s switch to proof-of-stake), Ethereum’s price tanked leading up to its successful Merge and has been basically flat since. And that’s despite the fact The Merge included changes that should directly support Ethereum’s price such as the switch from being inflationary to being deflationary.

It’s possible that the successful implementation of staking withdrawals will boost Ethereum’s price as new investors decide to buy in right afterward, either because they were waiting to buy until the network successfully went through a risky hard fork to implement withdrawals, or because they’re lured by a more liquid staking yield.

However, it’s also important to consider that there’s currently a lot of staked Ethereum (aka ETH2) which has been illiquid for a long time. ETH2 began rolling out in December 2020, when Ethereum’s price was around $600 – less than half of today’s price. (Incidentally, this technical improvement correlated with a strong bull run in Ethereum and the price nearly reached $2000 less than two months later.)

Some of the early adopters of ETH2 who began staking Ethereum at $600 (or perhaps even less if they’d been holding for years already) may be itching to sell after over two years of being unable to and earning a nice 100%+ gain.

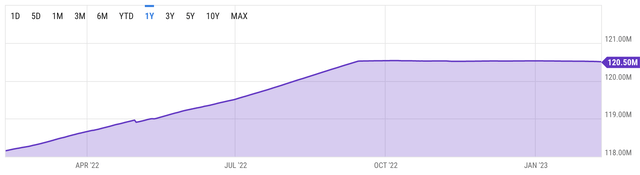

All told, the amount of staked Ethereum recently passed 16 million, double the 8 million I reported a year ago. 16 million staked coins represent 13% of Ethereum’s circulating supply and about 4 days’ worth of trading volume. If everyone rushes to sell these staked ETH as soon as it’s possible, that amount of selling pressure could certainly tank the price.

Fortunately, I think that this scenario is unlikely, considering that half the ETH2 was staked within the last year and that much of the ETH2 was actually staked at a price range similar to today’s. Most people staking Ethereum are likely long-term holders, since they were hopefully well aware of the liquidity issues with staking when they signed up for it.

Still, it’s inevitable that some ETH2 will be sold when it becomes possible to do so. Thus, in the short term, it’s difficult to determine whether the positive attributes of staking withdrawals, the increased selling pressure from more liquid staking, or other factors will prove most important to Ethereum’s price movement.

Is Ethereum A Good Long-Term Investment?

Thinking longer term, even if there is a run for the door as soon as staked Ethereum can be sold, early stakers will eventually run out of ETH2 to sell. That leaves only the positive long-term benefits mentioned above.

Once staked Ethereum is liquid, the investment thesis for Ethereum can actually be spun to sound a lot more like a stock or company than a “worthless” digital currency. If I had to pitch Ethereum with staking withdrawals as an investment, I’d say something like:

Ethereum enabled trustless digital transactions and other blockchain-based products for a growing community of artists, collectors, and merchants. Investors can earn a yield of over 4%, and “shares” are regularly retired with the supply shrinking since last September.

A “stock” in a fast-growing industry that offers a high yield and buybacks certainly sounds appealing to me. The abrupt post-Merge flattening and eventual decline of Ethereum’s supply is a huge story that’s apparently been lost given Ethereum’s lackluster post-Merge performance:

YCharts

The one caveat here is that Ethereum’s yield is not like a dividend, which can support a share price and reduce volatility. Rather, the yield received (when converted to USD) would fluctuate depending on Ethereum’s price. That caveat will rightfully prevent risk-averse investors from finding Ethereum as appealing as a high dividend stock, but it shouldn’t matter as much to long-term growth investors.

Conclusion

Staking withdrawals are coming to Ethereum soon, and that’s great news for Ethereum as a technology and long-term investment. In the short term, there’s some risk that the increased liquidity of ETH2 or other factors will cause Ethereum’s price to decline despite this good news. So, I’m not looking at staking withdrawals as a reason to buy extra Ethereum now, and I am continuing my regular DCA instead.

But if Ethereum did sell off harshly after successfully implementing staking withdrawals, I’d eagerly buy more than usual. And I’m sure that many other potential investors are thinking the same way.