GBTC: The Million Dollar Bitcoin Bet

alexsl

It’s been about eight months since I last covered Grayscale Bitcoin Trust (GBTC) and I have a bit of a ‘love-hate relationship’ with this ticker. I first wrote about GBTC for Seeking Alpha in December 2019. My thinking at that time was the premium made GBTC much less interesting than holding BTC directly:

The question an investor should ask oneself is “if the trust lags the asset, requires a premium to purchase, and decays 2% annually, why buy the trust over the asset?”

This logic still certainly applies if we’re comparing GBTC only to self-custodied Bitcoin (BTC-USD) but it isn’t necessarily applicable if we’re comparing GBTC to other Bitcoin-proxy wagers in a traditional investment account. GBTC does have the benefit of providing tax-advantaged exposure to BTC if the investor is okay with not actually having the keys to the coins. Last July, I ended my most recent GBTC article with this:

After the liquidation of a top shareholder, I think GBTC shares at a 30% discount are a solid way to long Bitcoin for a potential rally in the spot price.

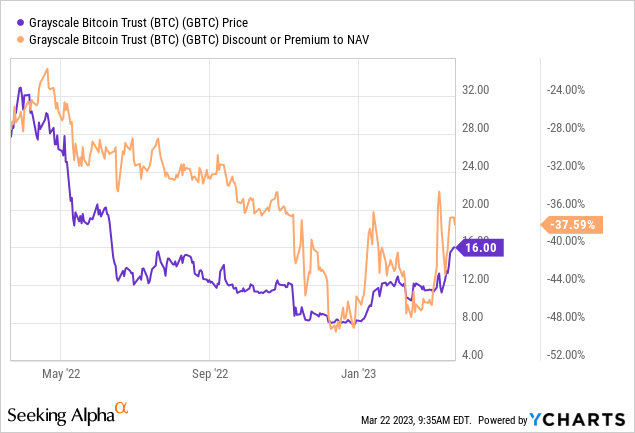

Eight months later, GBTC is roughly where it was at the time of my July 2022 article publication but the discount to NAV is actually larger at just under 38%:

Data by YCharts

Data by YCharts

Since that article, concerns about Grayscale’s parent company and general market panic actually pushed the GBTC NAV discount down to 49% as recently as December. Despite the abysmal market sentiment surrounding Grayscale, Digital Currency Group, and the underlying asset, I think GBTC is a long at this point and I suspect the worst has already been priced in through the NAV discount.

Mục lục bài viết

SEC Lawsuit

Earlier this month, Grayscale’s case against the SEC was laid out in front of District of Columbia Circuit Court of Appeals judges. The most interesting take away from that hearing may not have been how Grayscale’s argument was received by judges, but rather how the SEC’s argument was received. From CoinDesk’s writeup at that time:

The judges questioned the SEC’s logic in distinguishing between Bitcoin spot market prices and futures market prices. Grayscale’s argument is the SEC acted arbitrarily in rejecting the ETF application and previously approving Bitcoin futures ETFs.

The attorney for the SEC was hit with a barrage of difficult questions from the judges and the market viewed this very positively for Grayscale. If we assume Grayscale wins this lawsuit, it stands to reason the SEC will take one of two approaches following the decision:

- The agency will approve Grayscale’s next conversion application

- The agency will go the other way and un-approve the BTC futures ETFs

I personally believe option 1 is more likely. As an ETF with the possibility of redemption, GBTC’s NAV discount should close considerably. If the SEC doesn’t allow US-based investors a “safe, regulated” way to get Bitcoin exposure through an ETF, it could risk damaging the agency’s integrity to a significant degree in my opinion.

After all, it should not be lost on investors that Gary Gensler’s SEC has allowed ETFs that track the calls of a cable television personality but not a spot Bitcoin ETF. Taking the position that a Bitcoin spot ETF can’t exist because of theoretical manipulation risk while also allowing two ETFs that one man can push around with a television show seems counter-intuitive; and that’s me choosing to be generous.

The Balaji Bet

Balaji Srinivasan is a venture capitalist and entrepreneur. He was previously the CTO at Coinbase (COIN) and can certainly be seen as a pro-crypto advocate. He’s been making headlines over the last few days because of a wager he publicized on Twitter calling for a $1 million Bitcoin price within 90 days. His argument for this call stems from the proliferation of bank failures and what he calls a “stealth financial crisis” leading to hyperinflation in the US dollar.

While even some of the most bullish Bitcoin advocates view this $1 million BTC bet more as a publicity stunt than as an honest wager, Srinivasan himself insinuated on a recent podcast appearance that the wager is more about the banks than about Bitcoin:

I hope I don’t win. Okay. Because what this is is a way to call attention to this stealth financial crisis.

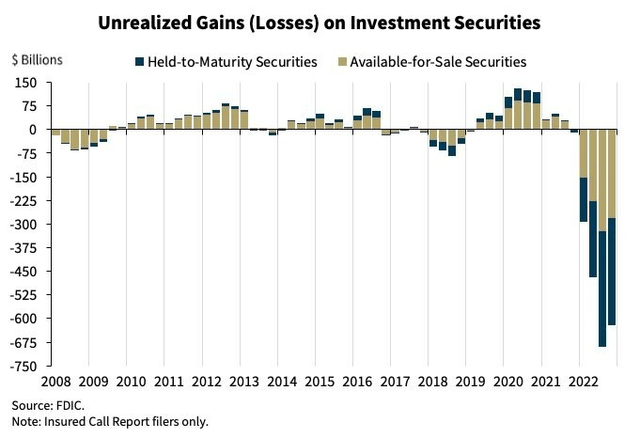

Srinivasan’s thesis for hyperinflation is that banks are underwater on collateral and can’t cover withdrawals if enough people want their deposits back. There is certainly some truth to this fear as the unrealized losses on investment securities last year were nothing short of catastrophic:

Unrealized Losses (FDIC)

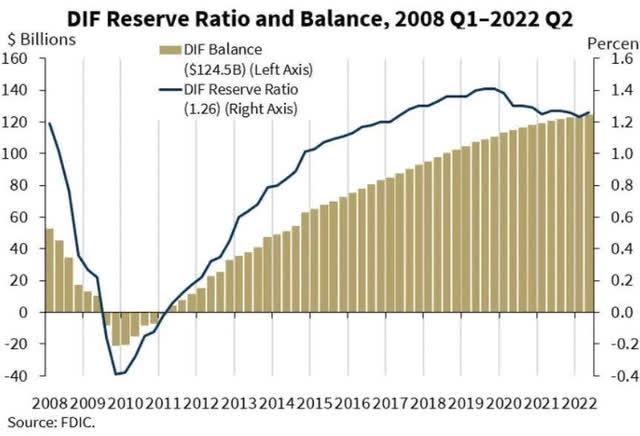

The reality is information travels much faster in 2023 than it did during the last financial crisis and the “bank run” no longer requires a physical bank branch. In Srinivasan’s view, the only option the central bank and federal government will have to backstop all deposits is through monetized debt. The FDIC simply doesn’t have the reserves necessary to payout all deposit holders in the event of a larger systemic financial collapse:

FDIC

This is likely why the FDIC, US Treasury, and Federal Reserve just announced the Bank Term Funding Program:

The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

Bold my emphasis. This program is staggering because it allows banks to borrow against treasuries at par, even if the positions are underwater. This is a roundabout way to turn the liquidity hose back on. As I see it, borrowing against underwater collateral makes more sense if the parties involved have an understanding that the underwater collateral won’t be underwater for much longer. Bitcoin was quite literally made for this moment.

Summary

In my view, there is now too much at stake for the SEC not to allow a spot Bitcoin ETF. If it doesn’t, the risk shifts to keeping BTC-proxy capital with the established institutions. We’re already living in what is probably another financial crisis judging by the bank closures and rescues that we’ve witnessed over the last few weeks. I have a very hard time believing there aren’t other banks suffering from the same borrow/lend duration problem that took out SVB a couple weeks ago and the we can already see a sneaky admission of it through the Bank Term Funding Program.

Bitcoin has started accounting for a money printer that has only recently been turned back on. Even if the SEC loses the Grayscale lawsuit and does ultimately decide to un-approve the ProShares Bitcoin Strategy ETF (BITO) and other Bitcoin futures ETFs in an attempt to keep BTC out of the legacy financial system, it could just push the $930 million in AUM from those funds to GBTC anyway. Which is another possible catalyst that could result in the GBTC NAV gap constriction. If that were to happen, even if Bitcoin’s performance is flat, GBTC will outperform. To be clear, I think BTC is best held in self-custody, off exchanges. But for dollars stuck in TradFi retirement accounts, GBTC isn’t a bad idea given the setup.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.