Halving countdown

The best crypto casino with 3000+ slots, live casino games, and 300% deposit bonus. Get a daily free spin and win up to 100 ЕТН!

Mục lục bài viết

BITCOIN HALVING

Have you always wondered what the Bitcoin Halving buzz is all about? We are here to give you a detailed explanation of everything you need to know.

Miners, transaction fees and the block reward

In public blockchain networks miners verify transactions in blocks and are rewarded with transaction fees and newly minted coins. Transactions waiting to be processed are temporarily stored in the mempool

The number of transactions that fit in a block is fixed by something called a blocksize. Miners will thus process transactions with the highest transaction fees first to optimize their income. On our Bitcoin Mempool dashboard, you can filter the transactions in the mempool by fee per kilobyte and on transaction pages of transactions that are waiting to be processed, we state the priority of processing. The lower is the number on the left, the faster the transaction gets into a block.

On the Bitcoin network, a block is limited to 1.3 MB, good for close to 3500 transactions. On the Bitcoin Cash network, the block limit is 32 MB but often not fully utilized. Information about the number of transactions in a Bitcoin Cash block can be found here.

Besides transaction fees, miners also receive block rewards for every block that they process correctly. The first transaction that a miner processes in a block, has new Bitcoin sent to the miner. This is called a ‘Coinbase transaction’. Besides the block reward, a Coinbase transaction also includes the transaction fees attached to transactions that are included in the block. An example of a Coinbase transaction can be found here.

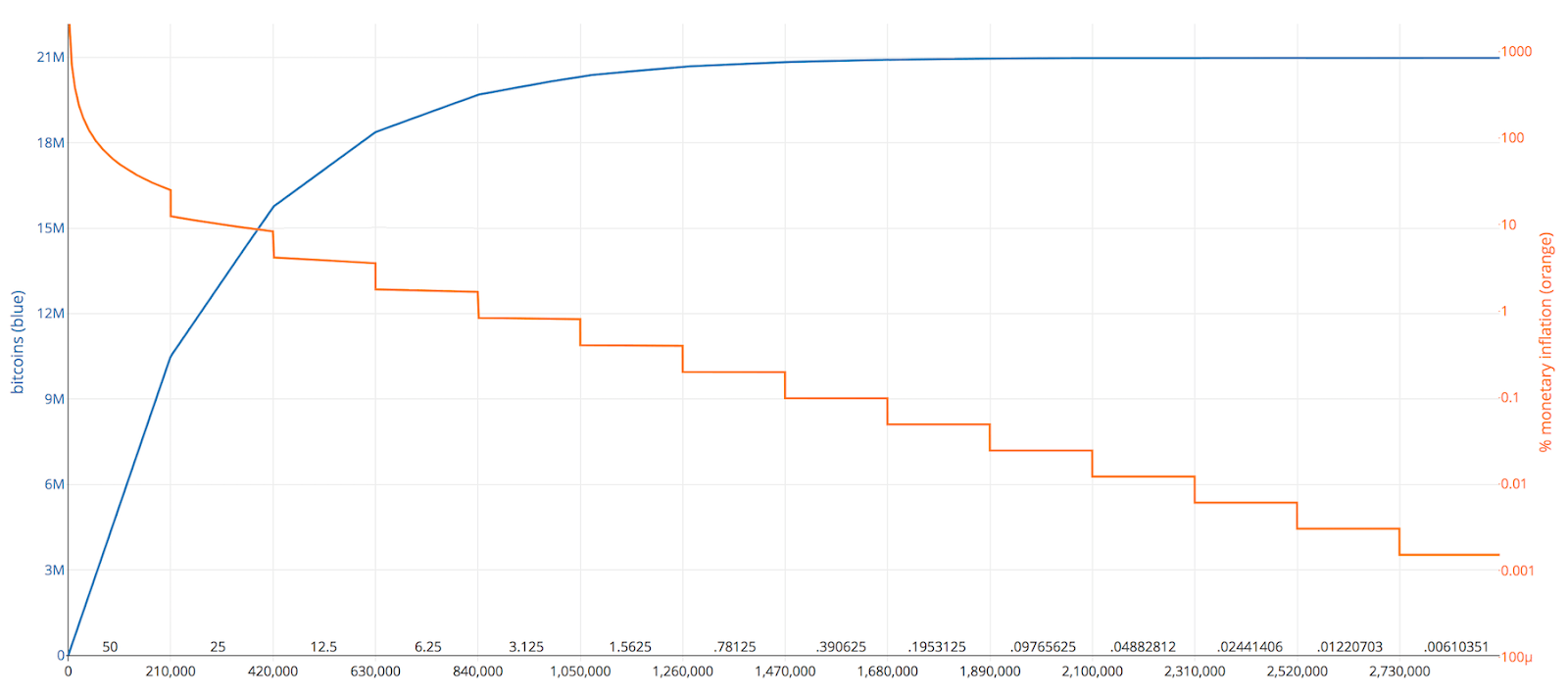

In Bitcoin and several other blockchains, the number of newly minted coins per block is cut in half after every 210,000 blocks. This means that inflation is limited, as the number of new bitcoins coming into circulation will eventually go to zero. As every block is processed at a target rate of 10 minutes, block reward halvings happen approximately every 4 years. In Bitcoin networks, the block reward started at 50 BTC per block, which already has been halved 2 times to 12.5 BTC per block now. Soon, this will become 6.25 BTC per block. In, approximately, the year 2140 there will be 21 million BTC in circulation. We can see this in the following graph:

To find out how many bitcoins are currently in circulation, you can check out this chart here.

What are the implications of a block reward halving?

There are 2 main implications to be thought of. The first one is that the price of bitcoin may increase. The second one is that the security of the network may go down if the price does not increase.

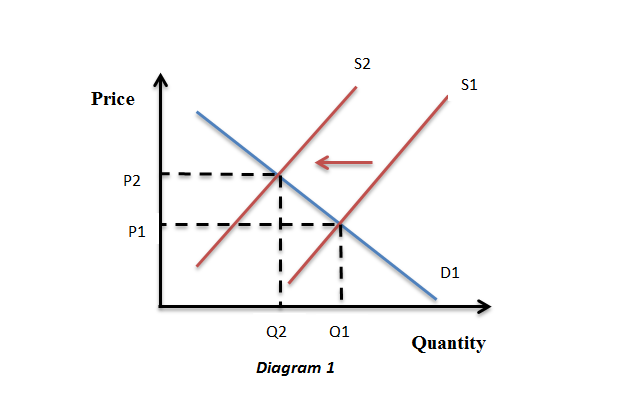

Referring to classical economic theory, many people think that the price of bitcoin should increase, due to the reduced supply of bitcoins to the market:

At the moment, miners are rewarded with approximately 1800 new bitcoins per day. With a price of $6,646.- this means a daily reward of $11,962,800.

Miners use tons of electricity to process transactions, and the general assumption is that miners directly sell their newly minted bitcoins in order to cover their costs. This would mean that after the halving not 1800 bitcoins, but only 900 bitcoins are freshly supplied to the market every day. This scarcity is believed to have a positive effect on the bitcoin price.

If the price of bitcoin does not increase after the block reward halving, the revenue of miners calculated in $USD will decrease. This means that they will have problems covering their cost, and this will drive miners with the highest electricity costs out of the market first. The reduction in electricity consumption to maintain the network means that the difficulty of processing a block of transactions will drop. Theoretically, this means that it would be easier to attack the blockchain network and create 51% attacks.

What do you think?

To stay up-to-date on the latest developments of the Bitcoin halving and for ongoing discussion, please follow us on Twitter.