How Bitcoin Became a Game Changer Overnight – IPWatchdog.com | Patents & Intellectual Property Law

Bitcoin was touted as the world’s first decentralized digital currency. It basically is a cryptocurrency which uses peer-to-peer technology to provide payment network gateway. Bitcoin is deliberately designed for public use by making it an open-source. Therefore, nobody owns or governs or control Bitcoin and everyone can be a part of it. Bitcoin financial infrastructure follows decentralized and automated systems which overcome the inefficiency of the traditional financial system. The unique feature of Bitcoin is that no one can block you from transferring money from anywhere in this world. Further, this makes whole transaction process irreversible. These transactions are recorded in a public distribution ledger called a blockchain.

Bitcoin was touted as the world’s first decentralized digital currency. It basically is a cryptocurrency which uses peer-to-peer technology to provide payment network gateway. Bitcoin is deliberately designed for public use by making it an open-source. Therefore, nobody owns or governs or control Bitcoin and everyone can be a part of it. Bitcoin financial infrastructure follows decentralized and automated systems which overcome the inefficiency of the traditional financial system. The unique feature of Bitcoin is that no one can block you from transferring money from anywhere in this world. Further, this makes whole transaction process irreversible. These transactions are recorded in a public distribution ledger called a blockchain.

When compared to traditional financial system which follows a centralized money transaction, where every transaction is monitored by bank or a country or a third party, Bitcoin defies all these logics. Here is a system which offers decentralized cryptocurrency using block chain technology and which can be used to exchange for other currencies, products or services.

Mục lục bài viết

The technology behind it

Using a Bitcoin?

Before using Bitcoin it is important to educate yourself as Bitcoin is a subject of market risk. Even storing Bitcoin in the wallet is not recommended as the market is pretty nascent and susceptible to risk. Also, Bitcoin transaction is irreversible this means that you should take utmost care while transferring Bitcoin to any person or company.

Before starting, all you need is your smartphone or a computer. Bitcoin offers three simple easy steps for its operation.

Step1. Bitcoin user needs to download a wallet to send, receive and store Bitcoin. The Bitcoin wallet will store your public and private key pair. Basically, the public key is your randomly generated Bitcoin address. In order to do any transaction, you need to share your Bitcoin address. Also, anyone can see your public key/Bitcoin address.

Step2. Bitcoin offers three modes from where you can buy Bitcoins – Bitcoin Exchange, Bitcoin Community and Bitcoin ATM. You can use your traditional money to buy Bitcoin from Bitcoin Exchange and stored in your Bitcoin wallet. You can also trade your Bitcoin at any nearby local community centers. Bitcoin ATMs offers an easy and simple mode to buy and sell Bitcoins closest to your location.

Step3. You can spend your Bitcoin at various business points such as online or local business. Spendabit is a search engine that offers a product for sale with Bitcoin. There are also companies, stores, and shops who accept Bitcoin for purchase. Even, small businesses like cafes and restaurants are not missing out this opportunity and are not hesitant to try this mode of transaction.

Bitcoin Features

Bitcoin uses blockchain technology to transfer this cyrptocurrency across a peer-to-peer network without any intimidatory body. Blockchain technology makes this possible by incorporating its four key features:

1: Decentralization: A decentralized technology allows us to store assets in a network that can be accessed over the Internet. The assets can be anything ranging from a token, a contract, chain-of-evidence documents, or property registry documents. This decentralization allows the owner direct control by using a private key linked directly to the asset. The asset can be transferred as wished by the owner and to anyone.

The Block-chain technology is viewed as a powerful technology and has the potential to bring massive changes in the existing industries like in the field of banking and finance. The intended objective of giving owners the direct control of assets eventually avoids the huge transactional charges paid to a third party acting as a middle men. The individual can directly indulge in transaction giving minimal fee.

2: A publicly available distributed ledger: A block-chain is a public ledger that provides information of all the participants and all digital transactions that have ever been executed. A block is termed as “prevailing” part of a block-chain and keeps the record of the recent transactions. Once completed, it goes into the block-chain. Blocks are added in sequential manner with the next block containing hash of the previous block. A new block is generated as soon as the previous block gets entered in the block-chain database. This technology helps in recording each transaction and sharing it across the network. Every user in the network can validate transactions and has an identical copy of the ledger, to which the encrypted transactions can be added.

The end result is a highly efficient and secure method of performing transactions and it serves as an online ledger keeping record of transactions that can’t be changed.

3: Secure Ecosystem: Block-chain provides a tamper free environment for the participants in the network. Blockchain network automatically checks and updates itself every few minutes, this helps in providing a self-reviewing system. It helps in providing a very robust system. All data is embedded within the network which makes it public. Hence, it helps in providing transparency. It needs a huge amount of computing power to attempt altering of the data and eventually makes it less prone to corruption. Also, as the data is divided into blocks, verification happens at every block resulting in no failure.

4: Easily mintable: By data mining, one can easily mint a Bitcoin. A computational puzzle has to be solved to be able to mint a Bitcoin. The role of the miner is to create the block containing a number of latest transaction, it has to encrypt data by all the computational process and thus provide the proof of work. The proof of work is a protocol essential for Bitcoin mining. The miner gets rewarded financially by doing it. The miners compete with each other in order to be the first one to add the recent block on the top of the block-chain. The added block is then verified by other nodes when other blocks are added on top of it.

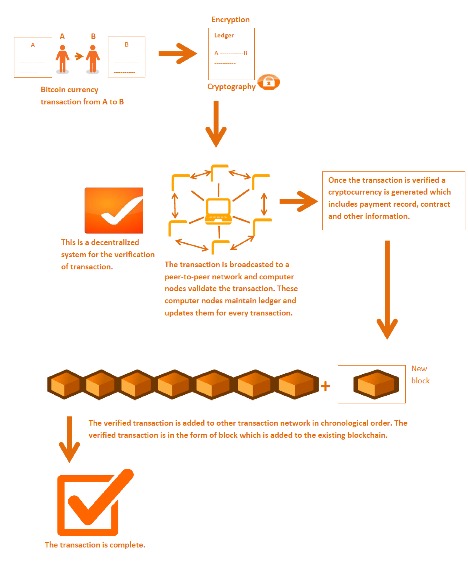

The Technology Transaction Flow

What does Patenting trends reflect?

Have we bored you with so much technology jargon? We believe so and hence we are shifting our focus towards what we do best – Patent research. For starters, Bitcoin and the technology behind it is still in the early stages of the research. What follows is an attempt to discuss the top technology trends that have been observed.

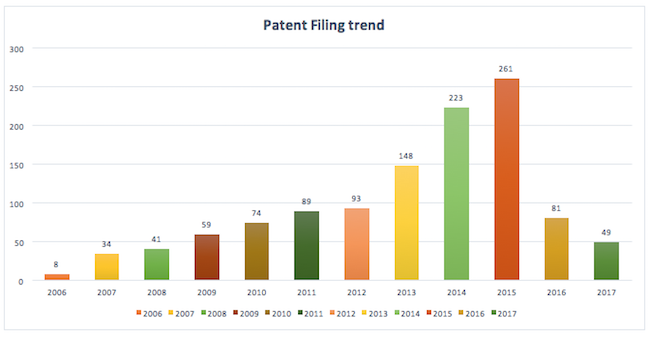

Patent filing activity

Bitcoin is making a huge buzz in the digital economy world. Technology futurists see it as a new financial system that could change the way we use banks. We have seen how Bitcoin popularity has grown tremendously and its value has climbed in price to over $10,000 USD per coin, and possesses a huge technological potential and is adapting new technology to reduce its flaws.

The chart below represents the research trend in the domain. It is evident from the chart that since 2006, there has been an increasing patent filing activity. With several players such Mastercard, Bank of America, Capital One, Microsoft and Paypal aggressively doing the R&D and filing patents. With such promising observations in terms of efficiency and security over the last five years, they intend on keeping up with the Bitcoin block-chain technology for commercial purposes. As said earlier, the trends of 2016 and 2017 do not reflect an accurate observance as most the patents are not yet available in the public domain. If the trend is extrapolated, it is highly likely that the filing should be anywhere between 300-400 patents for 2016-17.

Top countries researching

This graph gives an insight on which countries are leading in terms of filing the patents related to Bitcoin and block-chain technology in general. USA with 159 patents is the top country with a maximum number of the patents. Japan with 112 patents is ranked #2.

It is evident that USA, Japan and China has a huge market potential and is going to generate a great amount of user base for the consumption of this crypto currency.

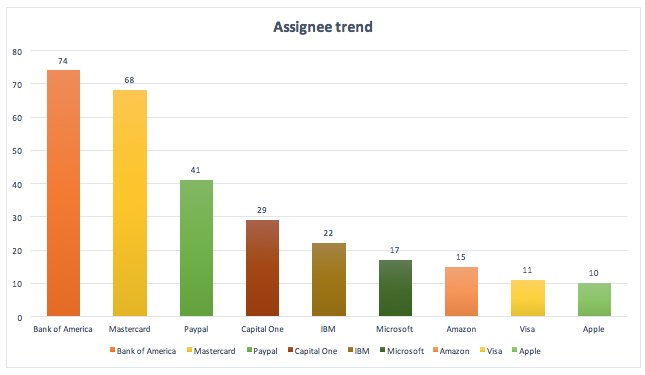

Assignees investing heavily in R&D

Bank of America, Mastercard, Paypal, Capital One are some of the top companies that are heavily vested in the research related to the Bitcoin and block-chain technology. In order to figure out how exactly their focus has shifted from traditional transaction based research to the bitcoin research, we looked at their patents filed over the last decade. The insights revealed are as follows:

Bank of America leads the charge with most patents filed closely followed by Mastercard. Paypal, Capital One, IBM take the honors at #3, #4, and #5 slot respectively.

Top technologies filed

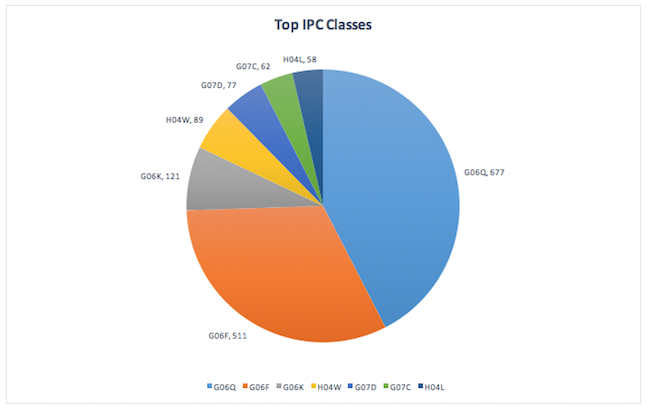

We analyzed the patent classes which had the most filings to understand what technologies have been at the centre of focus for the companies. Technologies such as financial forecasting, mathematical computations, digital data processing, and transmission of secure digital date has been the forefront.

What kind of Patents are filed?

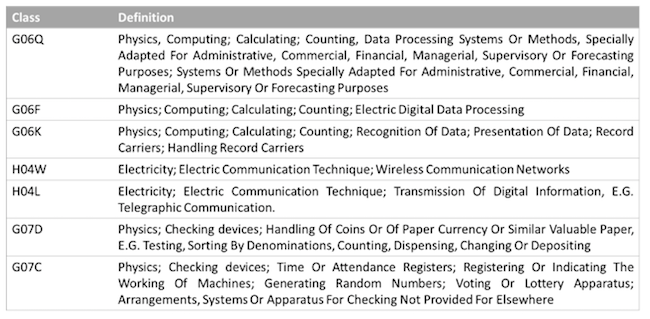

Bitgo’s patent publication number US20150120569A1 is one of the most cited patents. This patent discloses a novel method and system to secure virtual currency address. This involves network device over an electronic network to receive public keys of two or more second public-private key pairs.

Another patent application, US20150287026A1 assigned to Modernity Financial Holdings, utilizes big data for providing a secure medium for the transaction through private hot wallet services. This hot wallet acts as an identifier for cryptocurrency account holder.

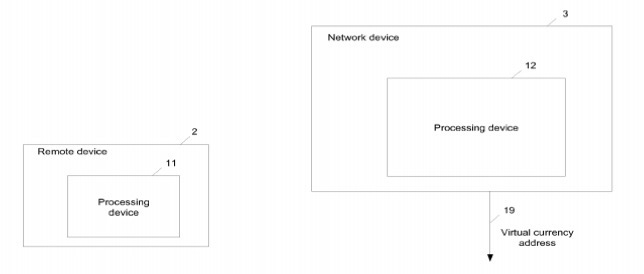

In another patent application US20140201057A1 by the assignee, Brian Mark Shuster discloses a method and system to manage certificates which are used for economy exchange. These certificates are electronically generated by computers and used as a digital currency similar to Bitcoins.

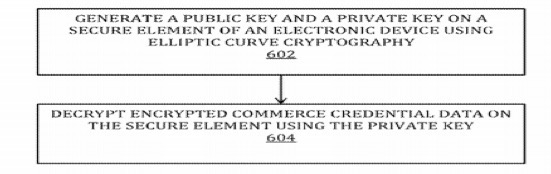

Apple has secured their Apple devices for cryptocurrency transaction by using an innovative method of cryptography. Apple’s US20150213433A1 discloses a method to use electronic devices for secure provisioning of credentials using elliptic curve cryptography. Further, this novel method provides a secure medium for cryptocurrency transaction such as Bitcoin.

Bitcoin and the competition

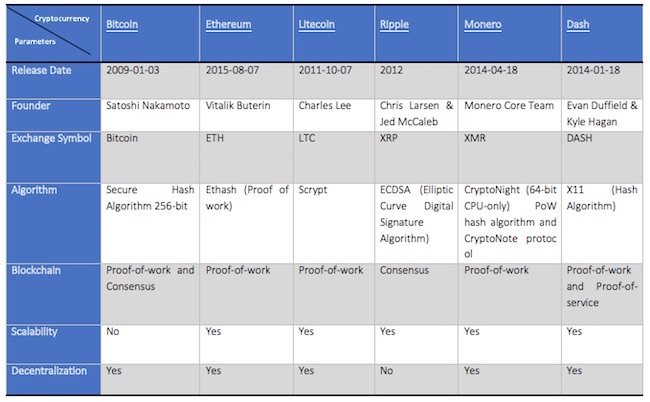

The other currencies other than the giant Bitcoin are collectively referred to as Altcoin in the industry. A comparison chart of various altcoin with Bitcoin has been created which are as follows:

- Ethereum(ETH)

- Litecoin(LTC)

- Ripple(XRP)

- Monero(XMR)

- Dash

Conclusion:

To briefly summarize, Bitcoins are the new crypto currency that utilizes block-chain technology. Blockchains are nothing but distributed peer-to-peer networks that can have many different applications. It is the first and a goliath of block-chain technology and it acts as a financial network, ledger, software, currency and asset. It’s a kind of technology that can simultaneously integrate multiple functions, and thus the third party regulators have a hard time defining cryptocurrencies. Blockchains can be quite customizable to serve a wide array of needs.

Bitcoin is the most commonly acceptable currency these days on the web and has a great dollar value currently trading around 3000 US dollars. It is highly volatile and it remains to be seen how its value shapes up in the near future. In terms of research and patenting though, there is no stopping and several banking institutions have realized the potential of such technology and are vested heavily in to further developing this and staying ahead of the game.