How To Mine Bitcoin In 2023: A Complete Guide For Beginners

Bitcoin remains operational due to a decentralized network of miners. In return for validating and securing transactions, Bitcoin miners earn BTC rewards for their efforts. With the promise of earning rewards, crypto mining has become a popular alternative method for acquiring the world’s leading digital asset.

To assist those that are interested in mining Bitcoin, we have compiled an ultimate guide for how to mine Bitcoin. In this guide, we will review what mining is, what equipment is required, assess the costs involved, a step-by-step tutorial, and most importantly help determine if mining Bitcoin is right for you.

Mục lục bài viết

How To Mine Bitcoin In 2023: Quick Guide

What Is Bitcoin Mining?

All cryptocurrencies, including Bitcoin, are supported by a blockchain. The Bitcoin blockchain, which is best thought of as a public ledger, is stored on tens of thousands of computer servers around the world. Every transaction sent across the Bitcoin blockchain needs to be verified and recorded before BTC can be transferred. However, the blockchain needs to make sure that each transaction is both accurate and immutable.

To ensure that the same cryptocurrencies are not spent twice – known as the double spend problem – each transaction is ordered and then grouped into blocks. To ensure that transactions are then immutable, Bitcoin employs a Proof-of-Work (PoW) consensus mechanism. This is where Bitcoin mining is required.

The PoW protocol requires Bitcoin miners to sacrifice computing power. By proving that a certain level of computing power (work) has been achieved, Bitcoin miners can add the next block to the blockchain. This ensures that each block is immutable. To change a block, an individual would need to sacrifice the same level of computing power for that block plus any other blocks that followed. This makes each block nearly impossible to change. Therefore, Bitcoin mining keeps Bitcoin operational and also ensures that the blockchain remains decentralized.

How Does Bitcoin Mining Work?

Bitcoin employs a proof-of-work consensus mechanism to ensure the blockchain remains immutable (unchanged). The protocol states that parties wishing to verify transactions and add new blocks to the blockchain must prove that a certain level of ‘work’ has been sacrificed. In the instance of Bitcoin, computing power must be sacrificed to solve a mining algorithm. The more power a user can sacrifice, the more chance they have of solving the mining algorithm first.

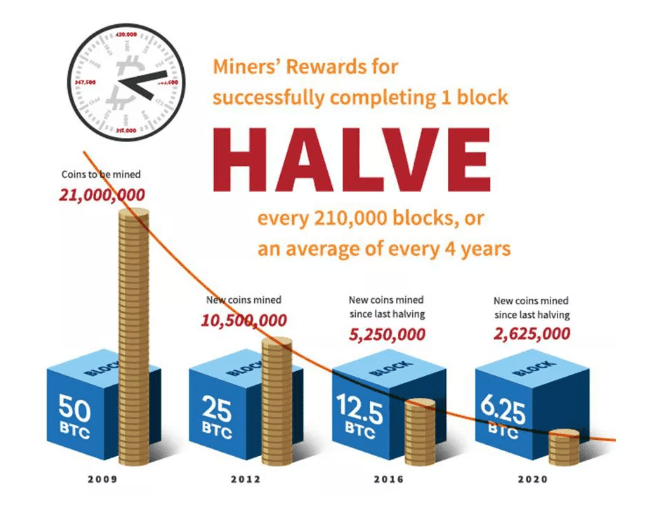

When a miner solves the algorithm, they are presented with the opportunity to add the next group of transactions (block) to the Bitcoin network. For accurately verifying and recording all transactions, the miner is rewarded with a BTC block reward. The current block reward for validating a block is 6.25 BTC. However, due to Bitcoin’s preprogrammed halving event, the mining rewards are expected to halve to 3.125 BTC in 2024.

Types of Bitcoin Mining

For several years after Bitcoin’s release, mining Bitcoin could be completed with home computers. However, due to the interest from businesses, most individual miners can no longer compete with regular computing equipment. As a result, Bitcoin miners often turn to Bitcoin mining pools or cloud mining solutions.

GPU Mining

Although it is rare, Bitcoin can still be mined using a Graphical Processing Unit (GPU). Thanks to the Arithmetic Logic Unit (ALU) built within most GPUs, advanced laptops and computers can be used to solve the complex algorithms required by the Bitcoin blockchain.

However, due to the increase in Bitcoin mining difficulty, the majority of GPUs are no longer efficient and more susceptible to GPU damage with constant mining. To overcome the advances in difficulty, most individuals now turn to Application-Specific Integrated Circuits (ASICs). ASICs were specifically designed to tackle the Bitcoin mining algorithm which means that they can complete the process far more quickly. Computing output is far higher for the energy required, but ASIC mining rigs can require a higher upfront capital investment. To learn how to build an ASIC mining rig and what components are required, read this article next.

Bitcoin mining pools

Unless a solo Bitcoin miner can afford thousands of mining rigs, most individuals now turn to Bitcoin mining pools in order to compete. Bitcoin pools consolidate the hash rate (computing power) produced by individuals so that the pool has a better chance of competing with larger mining farms and businesses. Any Bitcoin block rewards are then shared among participants. Although payout methods can vary, most pools abide by the rule that the more hash rate contributed to a pool, the larger the percentage payout. For a complete guide and list of our top Bitcoin mining pools, read this article.

Cloud mining

Bitcoin mining farms can generate BTC block rewards on their own, and many now also offer the opportunity to lease ASIC mining rigs. This option is particularly useful for those without the capacity to own and store their own mining rig.

Another benefit of cloud mining is that it removes much of the technical knowledge required to get a mining rig up and running. The operations of the mining rig are all handled by the cloud mining operator. The higher the hash power required, the higher the costs will be. While an easy option, it is worth bearing in mind that many of the top cloud mining companies can take several years until they start making a profit for the individual.

What To Consider Before Setting Up A Mining Rig

Although the economic aspects of establishing a Bitcoin mining rig are important, both economic and environmental factors need to be considered for a Bitcoin mining venture. Mining rigs require consistent cheap power, a stable Internet connection, a way to remove heat, and also a way to reduce noise.

- Power requirements. Many ASIC miners require a 220V access point. Unfortunately, the standard outlet in most residential homes only allows for 110V. If a 220V access point is unavailable, a qualified electrician may be required to fit one, which can increase upfront capital costs.

- Stable Internet. A stable Internet connection is required to connect with the Bitcoin blockchain. While Bitcoin transactional data can be sent via other means, the Internet is by far the most efficient. Although wireless connections are more convenient, connecting mining equipment via an Ethernet cable often provides the most stable results.

- Cooling. All electrical devices produce heat. However, due to the amount of computing power required to mine Bitcoin, ASIC miners generate excess amounts. To work efficiently, devices need to be kept as cool as possible which may involve introducing a secondary system that can circulate air. In certain locations, the heat produced by a Bitcoin miner can be used to warm other parts of a home.

- Noise reduction. Unfortunately, alongside producing immense amounts of heat, most ASIC miners are also incredibly loud. Some hardware can produce noise equivalent to a lawn mower which could easily disturb family life or neighbors; especially if it is running 24/7. To overcome this, many solo miners purchase noise-insulating containers to place hardware inside. However, again this can increase upfront capital costs.

As can be seen from the factors above, the environment for Bitcoin mining can also have a significant impact on profitability. If accommodating the factors above is difficult, individuals might find cloud mining a more suitable solution.

Is Bitcoin Mining Worth It?

Bitcoin mining is not a feasible venture for everyone. Although it offers a way to make money and support the Bitcoin blockchain, capital costs are high and there is no guarantee of instant profits. Let’s take a look through the key pros and cons to determine if Bitcoin mining is right for you.

Pros of mining Bitcoin:

- By mining Bitcoin, individuals ensure that the Bitcoin blockchain remains operational and decentralized. The more miners in the network, the more secure the network becomes. If you believe in the future that Bitcoin and cryptocurrencies offer, becoming a Bitcoin miner could be a great way to support the industry.

- Alongside helping to support the Bitcoin blockchain, profits are one of the main incentives for Bitcoin miners. Bitcoin miners need to ensure that BTC rewards will cover the costs involved.

Cons of mining Bitcoin:

- Profitable Bitcoin mining requires purpose-built ASIC mining hardware. Although secondhand units can be purchased for cheaper, basic models start from approximately $2,000. There could also be additional costs when setting up a mining rig at home, plus the cost of providing power to the unit.

- Profits from mining Bitcoin are distributed as BTC block rewards. The profitability of mining, therefore, depends on the price of BTC. Some Bitcoin miners may choose to sell BTC profits instantly, while others may choose to hodl BTC for the long term. Regardless of the portfolio strategy, Bitcoin is one of the most volatile markets in the world, and profitability depends on Bitcoin market prices.

- As a result of the increasing competition, individual Bitcoin miners will find it near impossible to solve a Bitcoin hash function independently and, therefore, collect a full BTC block reward. More commonly, Bitcoin miners need to pool resources together, but this means BTC block rewards also need to be shared.

Is Bitcoin Mining Profitable?

The days of instant Bitcoin mining profits are long gone. However, it is still possible to generate extra revenue from a strategic Bitcoin mining operation. Crucially, the profitability of Bitcoin mining depends on several key factors. Hardware and power are the two largest costs for Bitcoin miners. As a result, these components have the largest bearing on profitability and how long it will take to mine 1 Bitcoin.

- Hardware. Starting with ASIC miners, these machines can cost anywhere from $2,000 to $15,000. The more expensive the unit, the more capital expenditure is required upfront. However, expensive units have the benefit of higher hash power, which means BTC block rewards can be accumulated quicker. The capital expenditure should be compared against the average profit per day to calculate the number of days to break even. For example, if an ASIC mining rig cost $2,000 and generated an average profit of $10 per day, the machine would break even after 200 days (without taking into account the cost of electricity).

- Electricity. In addition to hardware expenses, electric power is the major operating expenditure for Bitcoin miners. The cost of electricity varies throughout the world but averages between $0.03-$0.06 /kWh. According to experts in the Bitcoin mining field, if electricity costs more than $0.06, it can be difficult to mine profitably.

Full Guide To Bitcoin Mining

Bitcoin mining provides an excellent way to accumulate BTC while also supporting the Bitcoin blockchain. However, before investing in expensive hardware, it is important to understand the steps required to mine Bitcoin and, therefore, ensure that the endeavor is a profitable one.

Step 1. Assess The Viability & Costs Of Mining Bitcoin

To assess the viability of mining Bitcoin, an accurate estimate of costs needs to be acquired. This will involve obtaining cost estimates for mining hardware, electrical consumption, and mining software. Using the price of BTC, these costs can then be used to estimate profitability.

Mining Hardware

Sustainable Bitcoin mining now requires high-powered computers that are specifically designed for the process. Known as ASIC miners, these machines are now the most common piece of hardware that allows individuals to stand a chance of earning BTC block rewards. The more powerful the ASIC miner, the more likely it will return BTC rewards. However, the most powerful and best hardware for mining Bitcoin also requires the largest upfront investment.

Alternatively, if acquiring an entire machine is not feasible, another option for individuals is to acquire several GPUs. Although GPUs are not as powerful as ASIC miners, several GPUs can be combined over time to improve computing power. Unlike acquiring a ready-to-go machine, this would require a mining rig to be built either from scratch or from a PC that is already operational.

As a result of the high turnover of mining equipment, there are several options to buy secondhand equipment, which can help to save on hardware costs. If purchasing secondhand hardware, remember to ensure that the equipment is being sold by a reputable dealer.

With both ASIC and GPU mining hardware options available, a new miner will need to decide which option best serves them. At the time of writing, top-of-the-range ASIC units, such as the Antminer S19 Pro, can cost over $6,000. These units produce 110 Th (Terra hashes)/s. In comparison, one of the cheapest GPU units, the EVGA GeoForce GTX 1660, costs $700. The cheaper GeoForce GPU produces 26 Mh (Mega hashes)/s.

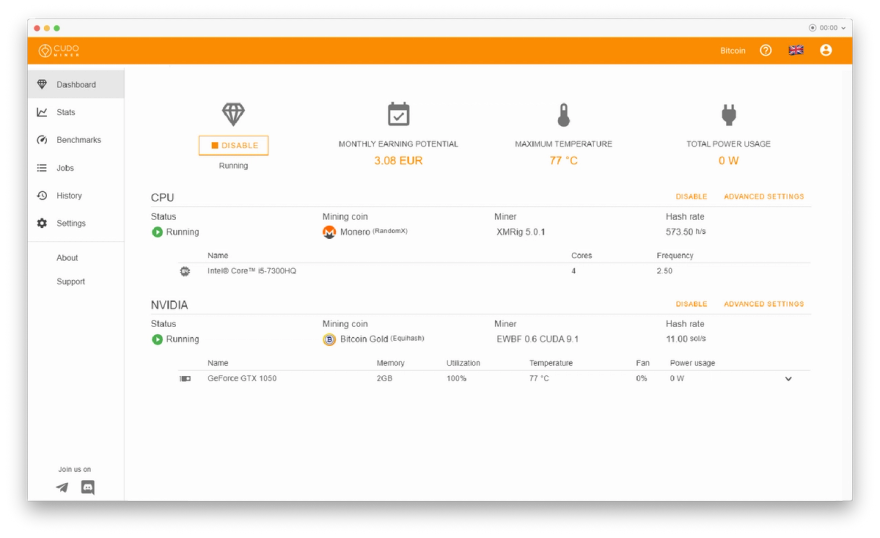

ASIC miner vs GPU mining. Source: Cudominer.com

It is worth noting that the price of ASIC miners and Bitcoin-related GPUs can vary with time depending on supply and demand. During market downturns, the need for mining equipment can decrease which can result in cheaper prices.

Electricity Consumption

When choosing a mining rig, the daily cost of running the equipment should also be taken into consideration; this involves calculating the potential electricity consumption. Due to the level of computing power required, the amount of electricity consumed from mining rigs is far higher when compared with regular computers. In addition, mining rigs need to be operational all of the time to stand a chance of earning BTC block rewards. This means all equipment requires consistent power.

A top-of-the-range Antminer S19 Pro ASIC miner consumes 3250 W per hour or 78 kWh per day. On the lower end of the spectrum, the EVGA GeoForce GPU, utilizes 300 W per hour or 7.2 kWh per day. According to the EIA, an average US residential home burns through 890 kWh per month, which means that even a modest GPU unit will significantly add to the cost of electricity bills. As the prominent operating expenditure, determining electricity costs is extremely important when estimating profits.

Mining Software

Before a mining rig can begin sacrificing computing power to the Bitcoin blockchain, it must first connect to the blockchain using specialist mining software. Fortunately, most mining software can be downloaded for free and, therefore, should not impact the bottom line of mining operations.

Example Bitcoin mining software. Source: Cudominer.com

The key consideration for mining software is user experience. Some mining software programs are extremely user-friendly and are geared to users that are inexperienced. These systems help to get mining rigs up and running as quickly as possible. However, customization is often sacrificed for ease of use. For those looking for complete control advanced technical software is also readily available. Some of the best mining software platforms include CGMiner, MultiMiner, NiceHash, and EasyMiner. For a full review of the 10 best mining software platforms, read this article.

Calculate Profitability

Bitcoin mining calculators are one of the best tools to help determine the profitability of a Bitcoin mining operation. Users can input details of a chosen mining rig, the hash rate output, the power consumed, and the local cost of electricity. Many also include inputs for additional costs such as the percentage fee charged by the BTC pools.

Related: How much is a Bitcoin transaction fee?

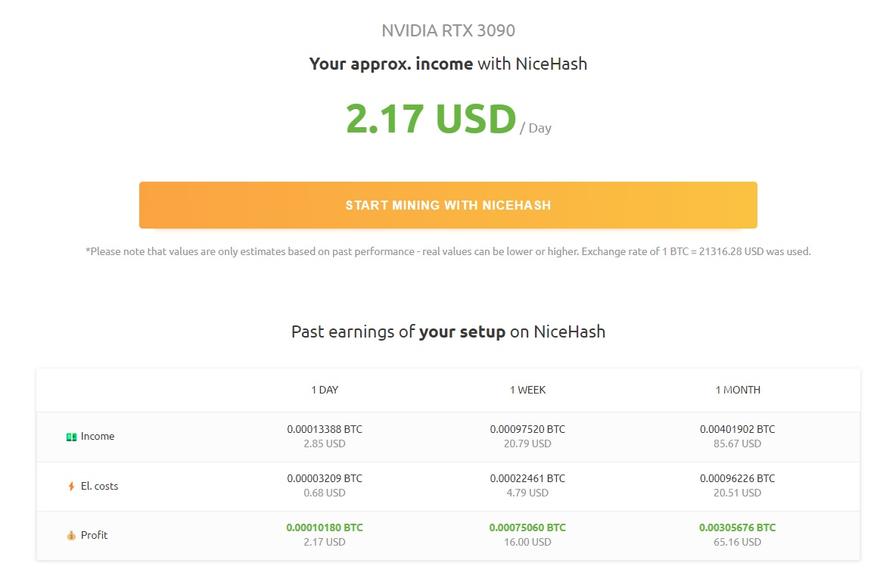

For example, let’s imagine that a new miner chooses to invest in a high-end GPU to mine Bitcoin. They choose the NVIDIA GeForce RTX 3090 which outputs 121 MH/s. The GPU consumes 7.2 kWh per day. The miner lives in the US where electricity costs an average of $0.16 per kWh. As a result, the cost to run the GPU for a year is calculated as $394.20 (($0.15 X 7.2) X 365).

By inputting the details of the mining rig into a Bitcoin mining calculator, such as NiceHash, the calculator suggests that the GPU can earn $1.84 per day. This equates to an income of $671.60 per year and an overall profit of $277.40. While this is a great side income, the cost of an NVIDIA RTX 3090 GPU is $1500, which means that the rig would only break even after 6 years.

Although Bitcoin mining calculators are useful for initial due diligence, it is worth bearing in mind that there is a range of other factors that can influence the profitability of mining. These include:

- Variations in electrical costs

- Variations in the price of Bitcoin

- Changes to Bitcoin mining difficulty

- Fluctuations in mining hardware prices

- Mining pool fees

- Future Bitcoin halving events

Step 2 – Choose A Mining Rig

The due diligence performed in step 1 should have provided a good estimate for the type of mining rig that can provide optimum results. However, before committing to a miner, make sure that each of these factors has been evaluated:

- Price and shipping costs. Regardless of whether choosing an ASIC or GPU mining rig, the price for the unit will have a significant impact on how long it takes for a miner to break even. The newer the unit, the more efficient it will likely be. However, modern units will be more expensive and, therefore, require more BTC to break even. It is also important to factor in additional costs such as shipping, import fees, and any costs associated with improving the environment of a mining rig, like a cooling system or noise filtering equipment.

- Hash rate. The hash rate output is the second most prominent factor to consider. The higher the hash rate, the quicker a miner can attempt to solve the Bitcoin mining algorithm, and the more BTC rewards can be accumulated. The hash rate is often provided in Terra hashes per second (Th/s) for ASIC units or in Meta hashes per second (Mh/s) for GPUs.

- Electrical consumption. Typically provided in Watts/hour (W), electrical consumption determines the operating costs of a rig. The higher the Watt consumption, the more expensive the electrical costs will be. Electricity prices are most commonly provided in Kilowatt hours (kWh). To convert from W to kWh, multiply the W by the number of hours of operational time per day (usually 24 hours for Bitcoin mining). That number can then be divided by 1000 to produce kWh. For example, if an ASIC miner consumes 3250 W, the kWh per day would be 78 ((3250 x 24)/1000)

Bitcoin mining rig types

- ASICs. When it comes to ASIC units, Bitmain and MicroBT dominate the market. These companies have provided some of the most reliable and efficient miners to date. However, due to their leading market position, the devices built by these manufacturers command slightly higher prices than other brands. Some of the most popular Bitcoin miners from these two brands include the Bitmain Antminer S19 and the MicroBT Whatsminer M30S. Although these two machines are some of the most popular, both manufacturers have other models available. Cheaper Bitcoin mining manufacturers also include Bitfury, Canann, and Ebang.

- GPUs. NVIDIA and AMD offer the best GPUs when it comes to Bitcoin mining. As a result of their experience and dominance within the traditional graphics processing sector, NVIDIA and AMD now produce some of the most reliable GPUs that are equipped for Bitcoin mining. The graphics cards produced by these companies are fitted within many of the top gaming computers. However, that power can also be harnessed to earn BTC. The GeoForce series is the most popular range of GPUs produced by NVIDIA, whereas the Radeon series is the most popular range of GPUs produced by AMD.

Step 3 – Choose And Install Mining Software

There is a broad range of Bitcoin mining software. However, not all mining software may be applicable to all regions. When comparing different options here are a few key factors to consider:

- User-friendliness. For those new to Bitcoin mining, this could be a deciding factor. Some mining software is designed with user-friendliness in mind, while others require a complex understanding of Bitcoin mining technology. It is best to look at customer reviews to determine whether the software is better suited to a certain level of experience.

- Operating system. Most Bitcoin mining software is only compatible with one operating system. Check whether the software works with Windows, Linux, or Mac before downloading.

- Cost. While the majority of Bitcoin mining software is free to download and install, there may be additional features that incur a charge. All internal pricing should be listed clearly on the associated software website

- Mining pool requirements. Some Bitcoin pools require specific mining software. The process of Bitcoin mining via a pool is far easier when using a recommended software provider.

Once mining software has been selected, it should then be downloaded and installed onto a computer. Search for the downloads section of the chosen mining software provider and download the necessary files. After the download is complete, follow the prompts and choose where to install the software.

After mining software has been chosen and installed, the software will need to be configured with the chosen ASIC or GPU hardware. While some may only require a few short clicks, others may require more a complex process to optimize. The majority of mining software will anticipate the optimum settings for specific mining rigs, however, some platforms do allow miners to enter this information manually.

Step 4 – Create a Bitcoin wallet

To receive those rewards an individual will require a Bitcoin wallet. To keep mining activity separate from other cryptocurrency investments, it can be useful to create a dedicated Bitcoin mining wallet. For the best security, purchase a hardware wallet that can be kept offline.

Step 5 – Choose And Connect To A Mining Pool

To have a chance of competing individually, Bitcoin miners will need to find and join a Bitcoin mining pool. The pool shares all Bitcoin mining hash power and allows individuals to receive consistent, reliable profits. However, it is important to understand that not all pools are built the same. Pools can vary based on size, payout methods, and fees.

- Size. The size of a pool is determined by the cumulative amount of hash power that the pool dedicates to the Bitcoin blockchain. The higher the hash rate, the more likely it is the pool will find rewards. However, if there are more individuals, the rewards may also be lower.

- Fees. Bitcoin pools are run by operators and provide an efficient and cost-effective way to earn mining rewards. As a result, most mining pools charge fees that are subtracted from BTC block rewards. Fees can range from 0% up to 4% depending on the size and payment method of the pool.

- Payout methods. The payout method for most Bitcoin pools is determined by shares. Shares are defined as the amount of mining power an individual miner combines with a pool. Typically, the higher the mining power, the more rewards earned. However, there are several methods for the distribution of rewards. These include:

Payout TypeDescriptionPay-Per-Share (PPS)PPS is a payment method where miners get paid regardless of whether a BTC block reward is found.Full-Pay-Per-Share (FPPS)FPPS is a payment method that allows miners to get paid regardless of whether a BTC block reward is found plus additional transaction fees. Pay-Per-Last-N-Shares (PPLNS)PPLNS is a payment method where miners are only rewarded once a BTC block reward is found.

Before BTC block rewards can be received, mining software must be connected to the chosen mining pool. Each pool will provide detailed guides that outline how to connect chosen mining software. As the complexity of connections can vary considerably, most mining pool providers also offer a forum that allows users to ask questions when needed.

Pool operators typically provide a mining pool address, worker name, and password. This will allow the hash rate generated by the miner to be directed to the chosen pool. Mining platforms will also likely require information including the closest geographic region and withdrawal wallet address. Remember to double check the withdrawal wallet address as incorrect addresses will result in lost Bitcoin rewards that are difficult to recover.

Step 6 – Start Mining

After a connection has been made, the rig is ready to earn BTC block rewards. As the process is so complex, it is worth double-checking all connections. Ensure that the mining rig is configured with the mining software and that the mining software is connected to the mining pool. Once up and running, BTC block rewards will automatically distribute between mining pool participants.

Frequently Asked Questions

When Bitcoin was first released in 2009, 50 BTC were awarded for each new block added to the blockchain. However, the BTC block reward is programmed to halve every 4 years. After 3 halving events, the current block reward for miners stands at 6.25 BTC.

However, due to the competitiveness of mining, most individual miners cannot mine a full Bitcoin block on their own. As a result, miners often rely on Bitcoin mining pools that consolidate the mining power of individuals. Bitcoin block rewards are then shared between all mining pool participants, which means that the amount of BTC earned per block reward is often far less than the current 6.25 BTC.

The amount of BTC mined per day depends on the amount of mining power produced by a mining rig. The higher the mining hash rate, the more likely it is BTC block rewards will be found. The lower the mining hash rate, the less likely block rewards will be found. According to the CoinWarz profitability calculator, at the time of writing, a mining rig producing 120 TH/s would produce 0.00053550 BTC per day.

The algorithm that Bitcoin miners need to solve is better known as the hash function. The hash function receives data regarding Bitcoin transactions and cryptographically generates a string of random characters. To uncover the transactional data and add it to the blockchain, the hash function algorithm must be solved.

Due to the difficulty of the hash function, significant computing power is required to discover a solution. Computers must generate tens of thousands of guesses to eventually stumble onto the correct solution to the code. Once a code has been found, the associated block of data (transactions) can be added to the blockchain. To ensure that block generation remains at approximately 10 minutes, the difficulty of Bitcoin’s hash function is adjusted automatically every 2 weeks.

Conclusion

Bitcoin mining has become an increasingly popular method to obtain extra BTC and support the world’s leading blockchain. Unfortunately, the process is often thought of as too complex and high upfront costs can result in most individuals never starting the process. However, with a little homework and the correct guidance, Bitcoin mining can help to ensure that the world’s leading blockchain remains decentralized and secure from hackers.

When it comes to profitability, due diligence is key. It is crucial to compare the upfront costs of mining equipment, electrical consumption, and mining pool fees, against the potential BTC block rewards. Although the time to break even may take several years, once the break-even point has been reached, Bitcoin mining can become an incredibly profitable and fulfilling venture.

James Hendy

James has been involved in the cryptocurrency markets since 2018. He is a sought-after crypto writer that has published works for many cryptocurrency exchanges, fintech platforms, financial publications and investment disruptors worldwide. James work has been featured on the comparison website Finder and Real Vision covering topics in finance, business and the global economy.

Share this post

Or copy link