How to Use the Strike Mobile Payment App

Strike is a mobile payment application like Cash App or PayPal with one caveat: Instead of using the traditional payment rails, it uses the Bitcoin blockchain to send and receive money.

It is developed by Zap Solutions, a Chicago-based fintech startup led by entrepreneur Jack Mallers, known for his idiosyncratic TV appearances. The company launched its mobile application in 2020 for U.S. users and plans to expand globally, focusing on emerging regions such as Latin America.

The firm’s goal is to disrupt pricey global transactions and remittances and provide a cheap way to send money across borders by cutting out all the middlemen by using the Bitcoin protocol as a payment rail. As Strike CEO Mallers said at the launch in Argentina, “Bitcoin is the first and only monetary network in human history that works everywhere and is open to everyone. It functions in New York, San Salvador and Buenos Aires equally.”

Strike further boosted El Salvador, the first country to make bitcoin legal tender, as a bitcoin hotbed when it launched in the country in early 2021. Twitter also partnered with Strike to implement Twitter Tips, which lets users send bitcoin micropayments on the social media platform.

Mục lục bài viết

How does Strike work?

Strike leverages the Bitcoin blockchain’s secondary layer called Lightning Network to send and receive money instantly. The Lightning Network allows users to sidestep Bitcoin’s blockchain to execute transactions by grouping them together and reconciling them later in a batch, rather than as single transactions. This way, the main blockchain does not get clogged, and there is no need to wait for the time-consuming settlement process on the main blockchain that can take up to an hour.

As Strike does not charge extra fees on payments executed on the Lightning Network, it is ideal for sending small amounts of money or for frequent transactions. It also makes it possible to “stream” money in real time by sending a series of micropayments.

Strike’s vision is to be a borderless system for sending money from one country to another that is cheaper and faster than bank transactions or solutions such as Western Union that charge hefty fees.

Currently, Strike’s access is limited to residents of a few countries. As of March 2022, the app is available in:

-

United States

-

El Salvador

-

Argentina

Even within the U.S., the app is not available in every state. Users based in New York and Hawaii cannot access the mobile app.

The company has plans to expand globally. When it launched in Argentina in early 2022, the company said in a statement that it will launch in more countries throughout the year, with a focus on Brazil, Colombia and other Latin American markets, with plans for other regions throughout the world following that.

It’s important to note that users in Argentina cannot buy, hold and send bitcoin as of March 2022. The app only supports the USDT stablecoin, Tether, a digital currency pegged to the U.S. dollar, but local users cannot convert their local currency, the Argentine peso, to USDT in the app.

How to open and fund an account

First, you have to download the Strike mobile app from the App Store for iOS or Google Play for Android. There’s a desktop version that you can download from the Chrome Web Store, too.

You can open a Strike account by submitting your email address, phone number and full name.

-

First, submit your email address. You will receive an email with a verification code.

-

Then submit your phone number on the next screen. Again, you will receive a code via text message to verify the phone number is yours.

-

Then submit the country of residency (U.S., El Salvador and Argentina are the only available options) and your full name as it appears on your ID.

Strike account opening: email address

If you want to send or store more than $1,000 on your account, you will need to add more personal information, such as your address and social security number. This is required by regulators to comply with know-your-customer and anti-money laundering rules.

How to send fiat currency with Strike

Strike lets you send fiat currency, such as U.S. dollars.

-

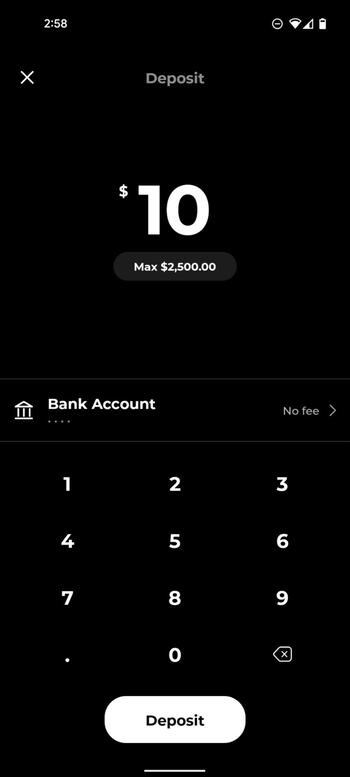

First, link your bank account or debit card to your account to fund your account.

-

Add your debit card or bank account details. Strike uses Plaid to connect with your bank.

-

Once it’s connected, you type the amount of money you want to send and there you go.

How to send money with Strike

How to buy and send bitcoin with Strike

Strike lets you buy and send bitcoin directly from the app. There are two options to do that:

-

If you already have a bitcoin wallet, you can connect it to Strike just like your debit card or bank account by scanning the bitcoin wallet QR code.

-

crypto wallet

https://apps.apple.com/us/app/zap-bitcoin-lightning-wallet/id1406311960

with Strike, which has a custody partner (

Buy and send bitcoin directly within the app. In this case, you’ll have awith Strike, which has a custody partner ( Prime Trust ) to store and keep your bitcoins safe. Bitcoin holdings are not protected by Federal Deposit Insurance Corp. (FDIC) deposit insurance protection.

What else you can do with Strike?

Recurring purchases for dollar-cost averaging

You can use the app for dollar-cost averaging, an investment strategy to regularly buy small amounts of an asset over a period of time. To set it up in the app, you have to go to the “BTC” tab, click on “Buy,” type in the U.S. dollar amount of bitcoin that you want to buy on a recurring basis and select “Frequency” to set the time period. It can be any increment of time, from hourly purchases to daily or weekly, that suits your investment goals.

This feature is available only to U.S. users who have further verified their account by providing identity documents.

Pay me in bitcoin

You can convert a portion of your paycheck into bitcoin automatically. Go to “Profile” at the bottom right of the app and click on “Direct Deposit.” From there, you can view your direct deposit details and configure your USD/BTC percentage.

Cash back

Users can earn rewards and rebates when they pay for selected goods and services with Strike. But the selection of merchants is rather limited compared to most credit cards. To earn cashback, scan a QR code and confirm the payment.

Here’s a list of some of the merchants that have partnered with Strike:

- BitcoinShirt.co , a bitcoin-only online apparel store (5% cash back).

- Bitrefill , offering 4,000 gift cards for businesses from Airbnb to Uber. (5% cash back).

- CryptoCloaks , a bitcoin-only online shop (5% cash back).

- Lightnite , a video game powered by the Lightning Network that allows you to spend and earn bitcoin inside of the game (15% cash back).

Strike API

Strike API lets merchants, businesses and marketplaces integrate Strike as a payment processor to their website. This is what Twitter uses for its bitcoin tipping.

The company is working on expanding into various emerging markets and rolling out a range of new services. Its plans include providing contactless payment solutions to merchants, issuing debit cards in partnership with Visa and expanding its cashback offering.

Fees and taxes

Sending and receiving money with Strike is free, but it incurs an on-chain transaction fee, which is the cost to use the Bitcoin blockchain. The base fee per transaction on the Lightning Network is the smallest unit of bitcoin, 1 satoshi, which is four-one hundreds of a cent as of writing, which is infinitesimally smaller than bank transactions.

Sending and receiving fiat currency does not incur taxes. On the other hand, if you use Strike to buy bitcoin and later sell it at a profit, you’ll owe capital gains taxes.

Pros of Strike:

-

Practically instant transactions.

-

Deposits are insured by the FDIC (For U.S. users). This means your cash deposit is protected up to $250,000 from theft or the company’s bankruptcy.

-

Lower cross-border transaction fees than traditional wire transfer or remittance services.

Cons of Strike:

-

Limited availability (currently in Argentina, El Salvador and the U.S. except New York and Hawaii).

-

Limited functions (cannot buy bitcoin in Argentina).

-

Bitcoin holdings are not insured by FDIC.

-

Hard to find information on their web site about topics such as cashback partners, for example.

Further reading on bitcoin

While bitcoin’s wild price movements might seem random, they are often driven by the same fundamental catalysts as in the traditional markets.

At some point, you’re going to want to spend your bitcoin. But where can you go to exchange it for goods and services?

Twitter now lets you receive tips via third-party payment channels. Learn how to set up this feature to start sending bitcoin-denominated tips.