Mooners and Shakers: Bitcoin has outperformed everything so far this year, notes Goldman Sachs – Stockhead

Mục lục bài viết

share

![]()

Link copied to

clipboard

The total crypto market is fluctuating and edgily shifting from foot to foot waiting for the next Fed decision, but Bitcoin is currently pretty steady near US$28k. Of course, that could change at the drop of a hat or a hardware wallet.

But Goldman Sachs is certainly prepared to acknowledge Bitcoin’s staying power right now.

The investment banking giant notes that BTC has outperformed IT stocks, Nasdaq 100, S&P 500, gold, and many other major investments since the start of 2023.

This is in terms of year-to-date (YTD) and risk-adjusted returns, as you can see from the chart below.

Goldman Sachs out highlighting #bitcoin as the best performing asset year-to-date. pic.twitter.com/I0qoELfIMs

— ◢ J◎e McCann (@joemccann) March 19, 2023

In fact, Bitcoin has barely put a foot wrong so far this year, with its price surging from US$16,500 on January 1 to about US$28,200 at the time of writing – close to a 70% increase.

It’s a rally that has many an analyst (for example Ryan Selkis, founder of the Messari crypto-intelligence firm) starting to believe that the crypto bear market could well be in retreat.

My rough prediction for the next twelve months:

1. More bank failures in the next couple of weeks.

2. Fed cuts / QE is back!

3. BTC climbs, sustained moderate inflation.

4. “Outside Money” / “Sound Money” -> $100k / BTC.

5. Institutions buy faster than Feds can shut down.Game.

— Ryan Selkis 🥷 (@twobitidiot) March 17, 2023

Bitcoin shifts up a gear: Glassnode

Indeed, on-chain (blockchain) analytics gurus Glassnode said overnight (AEDT) that Bitcoin “appears to be shifting gears” amid the US banking turmoil. And it points to several on-chain signals that indicate the asset might be at the early stage of a bull market.

The firm has released its latest weekly report, in which it shows Bitcoin’s monthly average transaction count reached 309.5k/day over the past week – its highest level since Bitcoin hit US$64,000 in April 2021.

Additionally, more than 122,000 unique new users have been appearing on chain every day – higher than nearly 90% of all other days.

“As more people interact and transact within the Bitcoin economy, it is typically associated with periods of increasing adoption, network effects, and investor activity,” wrote Glassnode.

The rise in network activity is also creating some congestion and transaction-fee pressure on the Bitcoin blockchain, which Glassnode notes is “a common precursor to more constructive markets”.

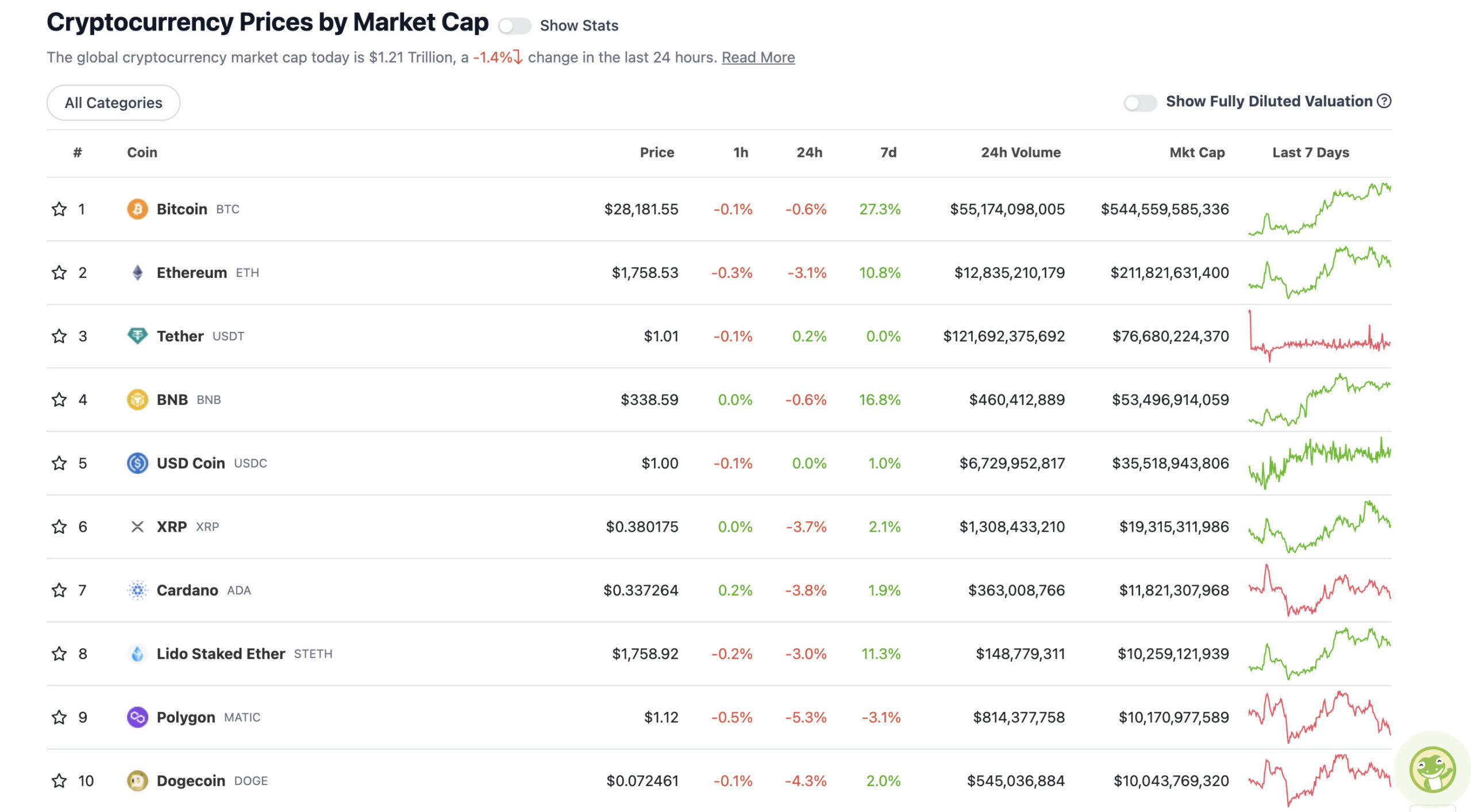

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 1.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The overall market has cooled a little since yesterday, but with Bitcoin hanging onto most of its recent gains for now, the US banking crisis looks like one giant ad for the OG crypto (and, of course, the traditional ‘safe-haven asset’ that is gold, too).

If US real yields have peaked, there’s going to be an explosive precious metal bull market this year.

Gold > $2,000

Silver > $30 pic.twitter.com/lxGTnsqdnv— tedtalksmacro (@tedtalksmacro) March 20, 2023

Roman Trading, one of the Crypto Twitter analysts that shows up regularly in our feed, is never backwards in coming forward with bearish takes. Here, however, he’s striking a pretty positive tone for at least ranging consolidation this year and a broader “macro bullish” outlook for Bitcoin.

$BTC 1W

We’ve officially closed back over the 200WMA. This is extremely macro bullish for #Bitcoin . Does it mean we will see 100k next month? No.

What it does tell us is the lows/bottom are likely in. We will most likely range for the next year before beginning yet another… https://t.co/6kxIGA1gRH pic.twitter.com/4cgdJCdJdS

— Roman (@Roman_Trading) March 20, 2023

Investors are hoping, wishing for a #BTC dip

Which is a stark contrast to the fearful sentiment from just about a week ago$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 20, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.6 billion to about US$425 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• XDC Network (XDC), (market cap: US$546 million) +12%

• MultiversX (EGLD), (mc: US$1.18 billion) +6%

• Synthetix Network (SNX), (mc: US$958 million) +2%

• Solana (SOL), (mc: US$8.6 billion) +1%

SLUMPERS

• ImmutableX (IMX), (market cap: US$1.08 billion) -16%

• Conflux (CFX), (mc: US$865 million) -13%

• SingularityNET (AGIX), (mc: US$557 million) -12%

• Render (RNDR), (mc: US$490 million) -10%

• Optimism (OP), (mc: US$792 million) -9%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Getting the popcorn ready for Powell’s press conference this week.. pic.twitter.com/OnyUARmCOP

— Sven Henrich (@NorthmanTrader) March 20, 2023

This year may be one for the books.

The advent of AGI.

The devaluation of the dollar.

The rise of Bitcoin.

The global flippening to the East.Even for someone who was thinking about these trends, the pace of change will feel shockingly, disorientingly fast.

It reminds me a bit… https://t.co/45c02hf1ot pic.twitter.com/WEJeifkmfb

— Balaji (@balajis) March 20, 2023

#Bitcoin won’t hit $1m in 90 days.

But the hyperbitcoinization theory just got a whole lot more attention.@balajis is using his outlandish bet as a vehicle to perpetuate this narrative. And it’s working.

Powerful strategy.

— Miles Deutscher (@milesdeutscher) March 19, 2023

Jack Mallers on fire! 🔥🔥🔥

“You’ve gotta be absolutely crazy to believe the Federal Reserve right now. They’re full of it. And I don’t have to, because I own bitcoin.”#bitcoinpic.twitter.com/ttc1VKwcPu

— Neil Jacobs (@NeilJacobs) March 20, 2023

Holy shit.

On March 14, Jim Cramer said to sell the Bitcoin rally.

Since then, Bitcoin is up 14%. pic.twitter.com/3Xs8jdiI0p

— unusual_whales (@unusual_whales) March 20, 2023

Read More

BitcoinCryptocurrency

share

![]()

Link copied to

clipboard

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox.

“*” indicates required fields

Name

*

*

Hidden

Email Lists

Morning Update

Lunch Update

Market Close Update

Weekend Update

It’s free. Unsubscribe whenever you want.