Quicken Review: Features, Pricing & Alternatives for 2023

This article is part of a larger series on Accounting Software .

Eric is a staff writer at Fit Small Business and CPA focusing on accounting content. He spends most of his time researching and studying to give the best answer to everyone.

Tim is a Certified QuickBooks Time (formerly TSheets) Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content.

Quicken is a personal finance management application for creating a budget, tracking expenses, and managing investments. Its Mac and Windows versions share key features, such as budgeting, bill payment, and a debt reduction planner, and the Windows version offers basic rental management and business accounting. Based on our Quicken review, its personal finance tracking app, Simplifi, is great for managing your finances, investments, and debt; however, it lacks rental property management features.

Pros

- Manage personal finances in addition to rental property

- Email custom invoices and collect payments online

- Powerful budgeting capability

- Every Quicken desktop application includes a web and mobile companion app

Cons

- Not a double-entry accounting system

- Not appropriate for a large number of rental properties

- Must download and install on your computer to use the web companion

- Need to sync Quicken web and desktop manually before and after using

- Individuals seeking personal finance software: Quicken is primarily a personal finance software that can track your spending, savings, and retirement accounts as well as help you prepare a budget.

- Simple businesses seeking an alternative to QuickBooks: Quicken is one of our leading QuickBooks alternatives because it allows property managers to keep track of their tenants, rental rates, and lease terms, which isn’t possible with QuickBooks.

- Landlords with one to three properties: Quicken, one of our top-recommended real estate accounting software, is well-suited to landlords with few properties who don’t need automation and advanced rental management functionality.

- Corporations, partnerships, and limited liability companies (LLCs): Business entities should use a double-entry bookkeeping system like the solutions in our guide to the best small business accounting software.

- Sole proprietors with employees: Quicken has no way to manage and track company payroll. We recommend QuickBooks Online because it offers an integrated payroll service. Learn more about this leading accounting platform in our QuickBooks Online review.

- Real estate companies with over three units: Quicken lacks automation features and the adaptability of other software to support multiple units. We recommend Buildium given its property management-specific features like tenant evaluation and specialized accounting functions. Our review of Buildium has more information about its features.

- Businesses with multiple users: Quicken supports only a single user. If you have many team members who need to use your accounting software, Xero supports an unlimited number of users for no extra charge. Read more about the advantages of this accounting software in our Xero review.

Visit Quicken

Mục lục bài viết

Quicken Deciding Factors

Supported Business Types

Small real estate businesses managing a few rental properties and freelancers

Monthly Pricing

- Starter: $3.49; Mac and Windows

- Deluxe: $4.99; Mac and Windows

- Premier: $6.99; Mac and Windows

- Home & Business: $9.99; Windows only

- Simplifi: $3.99; Quicken’s personal finance tracking app (web and mobile)

Free Trial

30 days

Discount

Currently offering 40% off on all plans

Standout Features

- Offers a web and mobile companion app with every Quicken desktop program

- Allows you to email custom invoices and collect payments online

- Can be used to manage personal finances

- Lets you create one budget per month

Customer Support

Live chat, phone support, self-help guides, community forum, and help center

Is Quicken Right For You?

Is Quicken Right For You?

Question 1

This quiz will help to determine the best software for small business owners.

How many employees do you currently have?

Question 1 of 4

1 minute approx

None

1–5

6 or more

Question 2

This quiz will help to determine the best software for small business owners.

Will you need access for more than one user?

Question 2 of 4

1 minute approx

Yes

No

Question 3

This quiz will help to determine the best software for small business owners.

What is the most important feature that you’d like your accounting software to have?

Question 3 of 4

1 minute approx

Invoice clients and pay bills

Functional mobile app

Categorize transactions and reconcile accounts

Question 4

This quiz will help to determine the best software for small business owners.

Do you have any rental properties?

Question 4 of 4

1 minute approx

None

1–3

4 or more

Quicken New Features for 2023

- Real-time quotes: Investment customers who are subscribed to Quicken Premier or Home & Business will get real-time stock quotes of publicly traded stocks.

- Crypto support: You can now add and manage cryptocurrency the same way as any type of security in your portfolio. Quicken tracks up to eight decimal places for more accurate tracking of cryptocurrency positions.

- Restricted stock unit (RSU) support: If you’re an RSU holder, you can now choose how RSUs are represented in your net worth or portfolio. For instance, you can opt to include the potential value of unvested RSUs or remove them completely to reflect your actual net worth.

- Investment partnership support: If you’re involved in a limited partnership, you can track your activities, such as venture capital funds and private equity, fund contributions, and cash or stock returns.

Quicken Alternatives

![]()

![]()

![]()

![]()

![]()

![]()

Best for: Businesses that need a double-entry accounting system

Best for: Companies with multiple users

Best for: Companies that manage many real estate properties

Starts at: $30 per month

Starts at: $13 per month

Starts at: $52 per month

Visit QuickBooks OnlineVisit XeroVisit Buildium

Quicken Pricing

- Starter: Available for $3.49 monthly, Starter helps you track basic finances, such as categorizing income and expenses and creating budgets.

- Deluxe: Deluxe costs $4.99 per month and is good for running fiscal year budget reports, tracking investment portfolios, and managing loans, assets, and brokerage accounts.

- Premier: Premier is valued at $6.99 a month and offers additional features like advanced tax reports, free same-day online processing, and investing reports.

- Home & Business: Quicken Home & Business at $9.99 monthly is needed to manage tenants, lease terms, and rental rates as well as generate business reports for freelancers.

- Simplifi: Simplifi, which costs $3.99 per month, is purely cloud-based since it has no desktop app—you can use it via a web browser or mobile app.

Fit Small Business Case Study

We use our internal case study to analyze accounting software based on a set of criteria, such as pricing, features, and ease of use. A program then earns a score based on how it performs against the features we look for in a double-entry accounting system. However, since Quicken isn’t a double-entry accounting system, we were unable to analyze it using our rubric and, therefore, isn’t rated.

Quicken Features

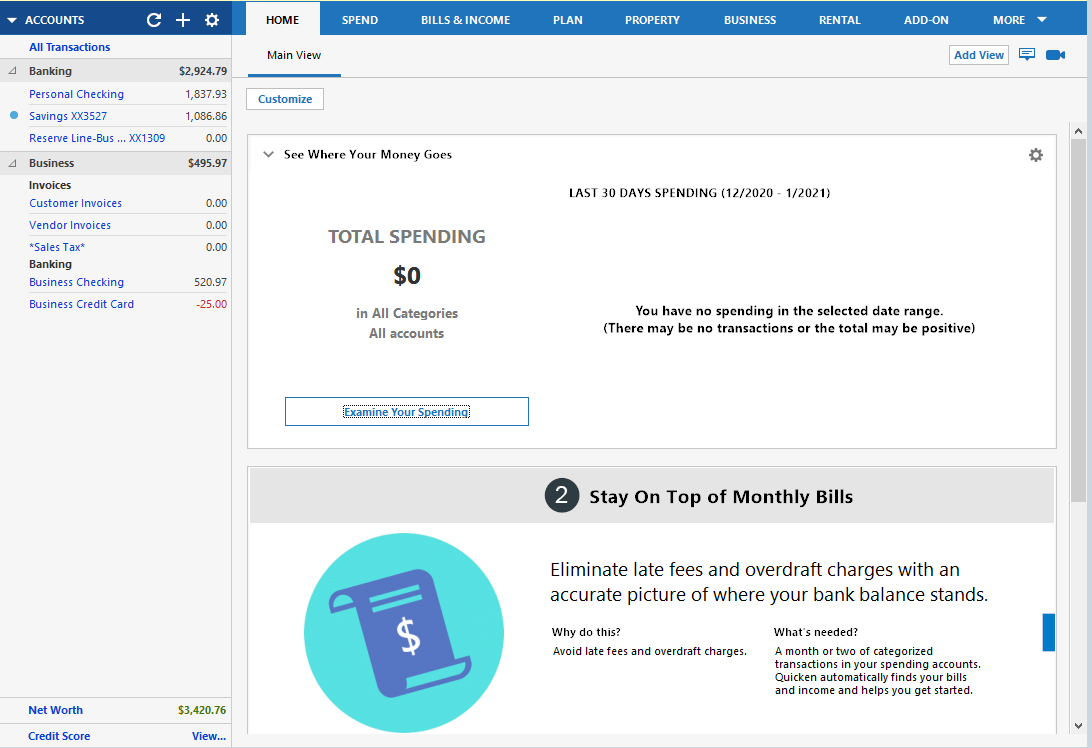

Your financial management journey begins on the dashboard or Home tab, which gives you a holistic view of your finances. The dashboard enables you to manage and track your budget, spending, and bills. You can customize the Home tab by creating multiple views and choosing which financial areas show up.

Get a better handle on your household spending with Quicken’s personal finance management tools. Whether you’re creating a budget, managing your bills, or planning for your retirement, it has the features you need to reach your goal.

- Expense management: Understand where your expenses go by sorting your accounts and transactions in one place. Create customized categories, track spending by categories and amounts or types of expenses, see spending trends, and get an idea of what your future finances will look like.

- Budgeting: Plan your personal or household expenses and compare them to your actual spending. You can track your budget on the web or a mobile device easily.

- Bank feed integration: Connect your bank accounts to track your income and spending effortlessly.

- Bill management: Send your payments through QuickPay for digital bills and Check Pay for physical checks. You can also set up automatic billing alerts so that you’ll never miss payments again.

- Retirement planning: Quicken gives you an overview of your assets, holdings, and investments, including 401(k)s, 403(b)s, and individual retirement accounts (IRAs). It includes a Lifetime Planner―available in Windows―which helps you envision all kinds of financial scenarios.

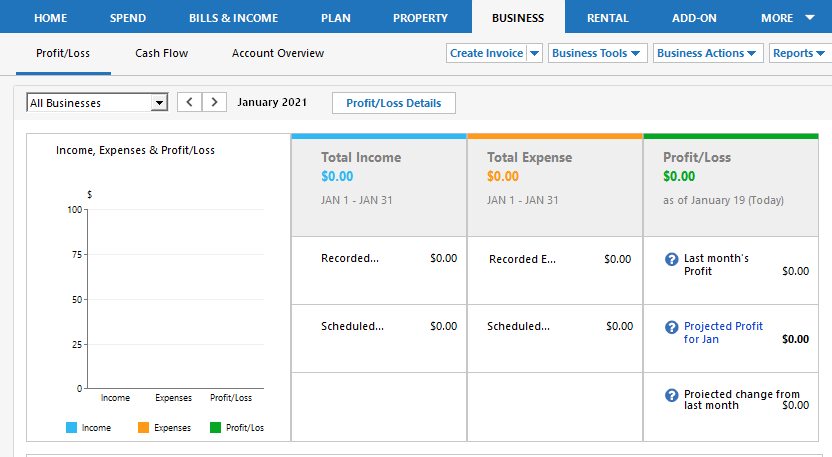

Quicken Home & Business is suitable for freelancers needing basic support for creating customer estimates and invoices, tracking accounts receivable (A/R) and accounts payable (A/P), and creating several reports:

- Invoicing: Choose from several templates to create customized invoices and add a payment link to PayPal. You can print your invoice or email it directly to your client.

- Estimates: Create an estimate, and then print or send it to your customer through email. You can track your estimates in the Estimate list.

- A/P and A/R tracking: Purchase Quicken Home & Business to start tracking your A/R (invoices), A/P (bills), loans, and fixed assets.

- Deduction finder: Know if you qualify for more than 100 common tax deductions. If you do, Quicken lets you add the tax-related categories you need to simplify tax time.

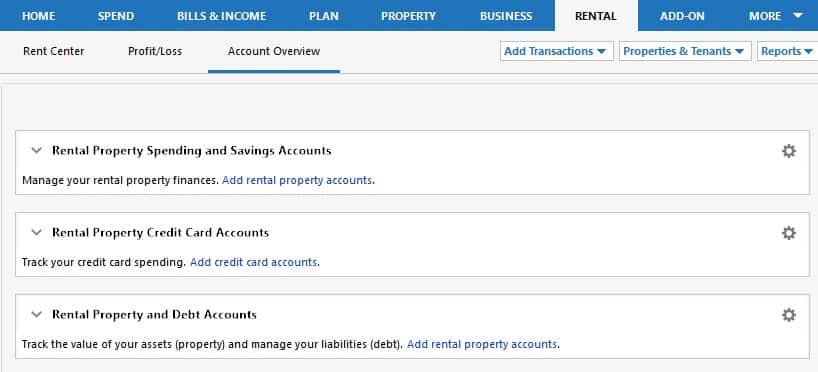

Quicken’s rental property manager provides helpful features to streamline landlord responsibilities. These features are available only on Quicken Home & Business. Its key rental features include the following:

- Contact management: Organize and manage all your contact details, including rental agreements, security deposits, and move-in and move-out dates, all in one place.

- Tenant management: Stay on top of your tenant lists, income, expenses, bank accounts, documents, loans, and property value.

- Market value tracker: Gain insight into your holdings and view snapshots of your portfolio by type, sector, or allocation using its integrated Morningstar’s X-ray tool (Windows users).

- Receipt scanning: Make expense tracking a breeze by saving your receipt data as a QIF file or importing it to Quicken.

- Document storage: Store and manage documents related to your properties, tenants, and projects.

In every Quicken plan, you can use the web companion for more accessibility. However, you still need to buy the desktop version to use the web version. There’s no difference between the desktop and web versions. The major downside is that the desktop and web versions don’t sync automatically, so you’ll have to sync before and after using them to ensure that the two versions are up to date.

Download the Quicken mobile app on Google Play or the App Store to manage your finances anytime and anywhere. After you set up your mobile app, your information will be synced between the mobile app and your desktop program via the Quicken Cloud. This mobile app isn’t a stand-alone service of Quicken as you still need to get the desktop version to use the mobile app.

Simplifi by Quicken focuses on personal finance. Unlike Quicken, it’s purely cloud-based since it has no desktop app. While it doesn’t have features for freelancers like Quicken Home & Business, it offers more streamlined personal-finance tracking because it has both mobile and web browser access.

Here are some of Simplifi’s notable features:

- Spending and savings management: Track your spending across all of your bank accounts, create income and expense categories, and set custom saving goals on Simplifi. The custom saving goals feature isn’t present in Quicken Starter.

- Budgeting: Create a one-month budget, budget for savings, and track spending history. As a personal finance tracker, Simplifi only offers one budget per month. If you need multiple budgets and rollover budgeting features, we recommend any Quicken plan.

- Bill management: Simplifi can auto-detect bills, alert you about unusual bills, and project cash flow. These features are useful in planning your spending and ensuring healthy liquidity.

- Debt, investments, and mortgage tracking: If you have debt and equity securities, Simplifi can serve as a tracker. You can include education (529) and custodial accounts, retirement 401(k), individual retirement accounts (IRAs), and 403(b). You can also track your home value and net worth.

Quicken generates ample financial reports, including cash flow, profit and loss (P&L), account balances, transactions, payee comparisons, budget spending, cash flow comparisons, and banking summaries. However, it cannot generate a balance sheet for your small business or rental properties. If you need a balance sheet, you’ll need a double-entry bookkeeping software like QuickBooks Online.

Quicken Customer Service & Ease of Use

While Quicken generally is easy to use, some of its features aren’t intuitive, and you’ll need to devote time to learning to use them. Quicken offers multiple options for customizations, so you can make it completely personalized to your needs.

It also offers plenty of support options to help you get the most out of the software, such as a Getting Started guide, a community forum, and a help center. Quicken is ready to respond to your questions over the phone and through live chat. If you subscribe to Quicken Premier or a higher plan, you get unlimited priority access to its customer care phone support for one year.

Quicken User Reviews & Ratings

Quicken received a lot of positive feedback from user review websites. Many appreciated that Quicken allows you to add recurring future-dated transactions and is versatile depending on your situation. Others also mentioned that the program is both easy to use and it offers an affordable monthly fee. Some negative feedback seems to focus on issues with connecting bank accounts and lost data when updating the software.

Here are the Quicken review scores on third-party sites:

- Software Advice: 4 out of 5 based on around 380 reviews

- G2: 4.2 out of 5 based on around 65 reviews

- Trustpilot: 3.6 out of 5 based on more than 14,300 reviews

Frequently Asked Questions (FAQs)

Yes—if you manage only a few rental properties and need a basic solution for creating invoices and tracking bills and tenant payments, then Quicken Home & Business might be right for you.

Yes. Quicken is one of our best QuickBooks alternatives, particularly for individuals with real estate properties.

The best Quicken alternative depends on your needs and situation. If you have a corporation, partnership, or LLC, then one of our best small business accounting software might be right for you.

No, Quicken doesn’t provide tax preparation services. However, you can use it to organize your tax-related data and export it to tax software like TurboTax.

Yes, Quicken has a mobile app that is available for iOS and Android users. The app allows users to track their expenses, view account balances, and receive alerts.

Bottom Line

If you’re looking for a fairly straightforward solution for managing your business and personal finances side-by-side, then Quicken offers pretty good value for your money. It has a good set of features, plus its mobile app gives you the ability to manage and view your finances on the go. Quicken Home & Business delivers the most value to small businesses and rental property owners looking for a simple way to manage their finances.