Research: Public Bitcoin Miners in better financial health despite 12.1% YoY drop in BTC holdings

Mục lục bài viết

Ad

Glassnode data analyzed by CryptoSlate shows that Bitcoin miners are beginning to enjoy some respite in the current year after struggling in 2022.

Bitcoin miner’s holdings decline 12.1% YoY

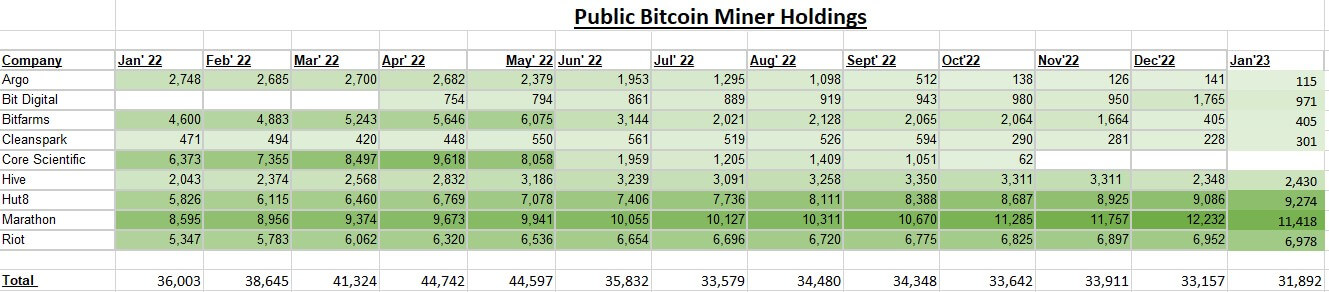

As of Jan. 2022, Bitcoin miners held 36,003 BTC, with mining firms like Core Scientific, Riot, Hut8, Marathon, and Bitfarms holding over 30,000 coins.

However, the landscape appears to have changed in the current year as Hut 8, Marathon, and Riot are now the dominant miners, holding 87% — 27,760 BTC — of the miners’ BTC holdings, according to CryptoSlate’s research.

Bitfarms and Core Scientific fell off as they struggled in 2022 — the latter filed for bankruptcy while the former dealt with debt obligations.

Meanwhile, the market has seen a little BTC distribution from miners in January 2023 compared to the previous year.

Besides that, the shares of several miners have risen by three figures on the year-to-date (YTD) metric. Miners like Hut8, Riot, Iris, Marathon, etc., have all seen their shares increase by over 100% YTD.

Miners are selling their BTC to exchanges at “extremely low levels”

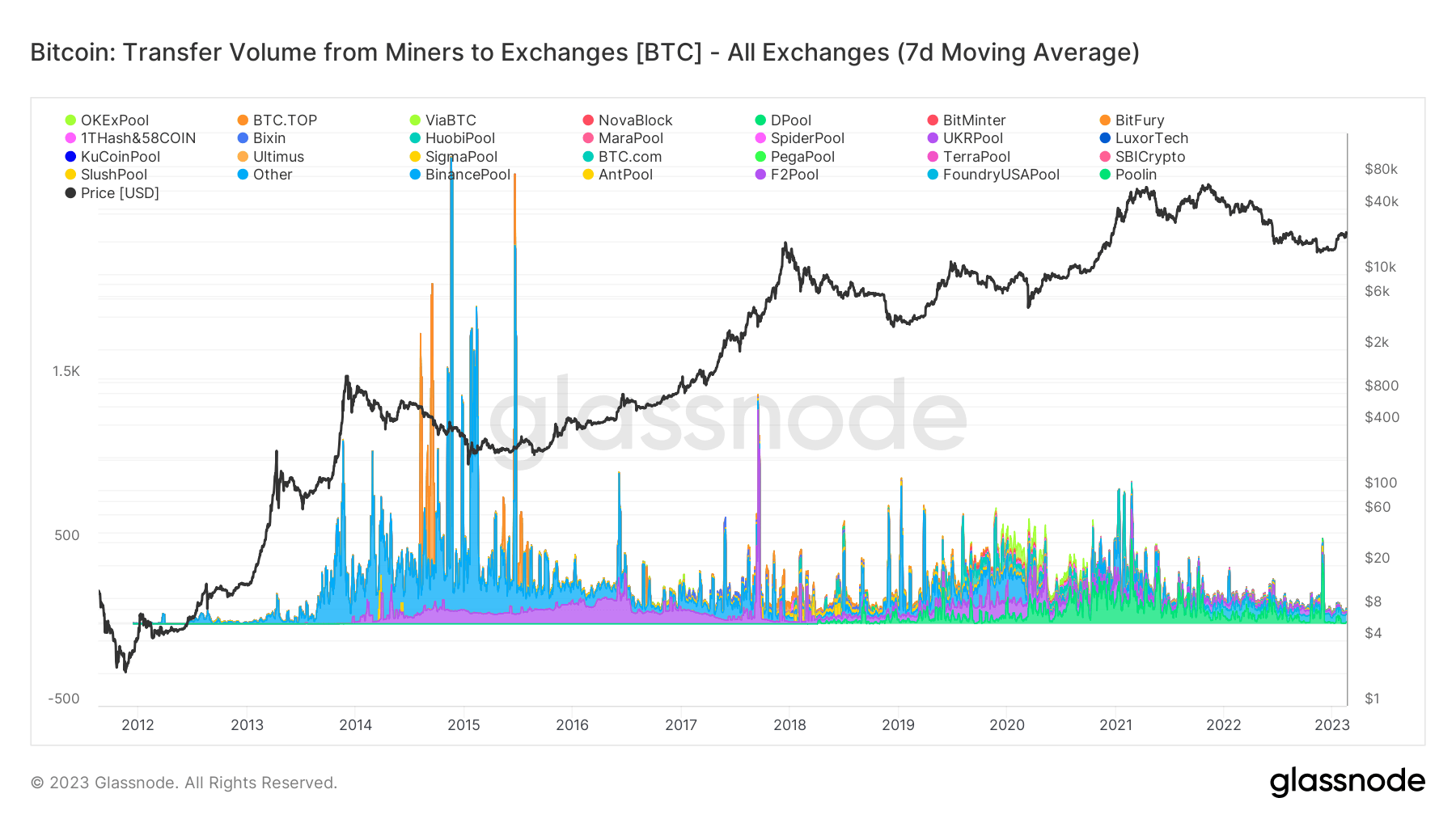

CryptoSlate’s analysis showed that miners appear to be in a healthier position compared to the previous year.

According to Glassnode’s data, as analyzed by CryptoSlate, miners are selling their BTC to exchanges at extremely low levels compared to previous years.

This is because profitability is beginning to return to the mining industry as BTC’s price has risen by around 50% in 2023 — the flagship digital asset briefly traded above $25,000 for the first time since August 2022 on Feb. 16.

Meanwhile, Bitcoin hash rate rose 34% on the year-on-year metric and hit a new all-time high of 300 TH/s. This shows the network’s current consistency and strength.

Mining BTC is currently cheaper

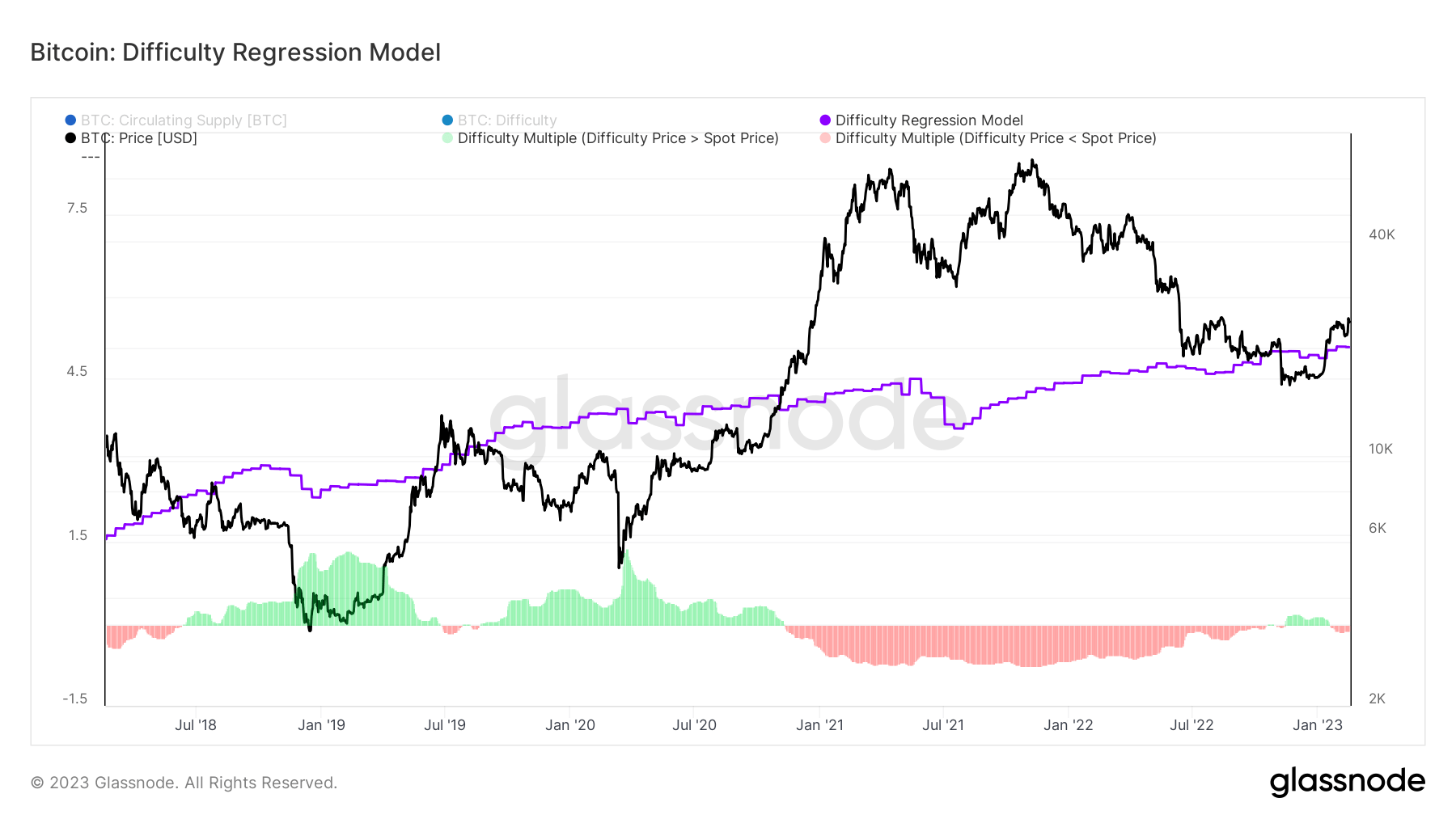

The Difficulty Regression Model, a metric used to measure the cost of mining Bitcoin, is currently under the asset’s spot price.

According to the chart above, the DRM is at $20,000, more than $4000 below BTC’s current spot price at the time of writing.

The current DRM level is essential for the miners to hold as it ensures that they are in an excellent financial position even if the hash rates continue to soar and the mining difficulty rises.

Meanwhile, the DRM could also be used to gauge bear markets sentiments when BTC’s price falls under the DRM.