Square Stock: A Great Bitcoin Play (NYSE:SQ)

Joe Raedle/Getty Images News

Joe Raedle/Getty Images News

Square (NYSE:SQ) stock has been positively soaring since its 2015 IPO. From its close at $13.07 on its first day of trading to today, the stock has risen about 2,000% – absolutely destroying all relevant benchmarks.

In many ways, the stock’s run is reminiscent of that of Shopify (SHOP), another company involved in payments that went public in the same period. Like Shopify, Square went public at a key time for online commerce, with more and more companies going online. Also like Shopify, Square received a lot of media attention, which helped bring attention to the stock. Finally, like Shopify, Square positively rallied on its first day of trading and mostly kept up the momentum in the years that followed.

Which brings us to today. Square currently trades for $263.45, a mighty high price compared to just a few short years ago. In its most recent quarter, SQ beat on earnings but missed on revenue – the stock rallied 10% the next day. Since then, SQ has given up some of its gains, but is still up from its closing price prior to earnings.

Clearly, investors took Square’s Q2 earnings well. And they were probably right to. Square’s second quarter showed substantial growth, and despite the revenue miss, was profitable by every usual metric. A big part of that was because the company brought in so much Bitcoin revenue. Even with Bitcoin sliding in the second quarter and resulting in a $45 million impairment charge, it still made up more than half of total revenue for the quarter, and contributed $55 million to the company’s profit.

Square’s relationship with Bitcoin makes it a fairly unique company. On the one hand, it is much more invested in Bitcoin and crypto than other fintech giants like Stripe. On the other, it’s not a crypto “pure play” like, say, Coinbase (COIN), which would almost certainly see revenue decline in the event of a prolonged crypto bear market.

In this article I’ll develop a bullish thesis on Square, arguing that the stock is a perfect way to play Bitcoin without having to expose yourself to the highly volatile asset through a pure play.

Mục lục bài viết

Competitive Landscape

Square operates in the financial technology (“fintech”) industry which is both very competitive and highly differentiated. The industry features a number of small-to-large sized companies that are implicit competition but vary their products/services to cater to different niches. Some of Square’s most notable competitors include:

- Shopify, whose bread and butter e-commerce platform competes with Square’s online stores offering.

- PayPal (PYPL), whose Zettle card reader is in competition with several of Square’s card reader products.

- Clover, a privately held POS company that offers a credit card reader among other features.

The above are some examples of companies that compete with Square’s “traditional” business of card readers and online shops. In addition, there’s another group of companies that could be considered in indirect competition with Square. That is, crypto exchanges like Coinbase (COIN) and Binance. Square is not a crypto exchange, but it’s involved in at least one business activity that exchanges are involved in:

Remittances.

Square, through Cash App, does a lot of crypto remittances. The app is used to make donations, tip professionals and exchange money with family members. The major crypto exchanges also tout their services’ ability to facilitate remittances. In their case, remittance is not a specific feature within a dedicated app, but it’s easily accomplished through their core portfolio features. So, people doing crypto remittances could use either an app like Cash App or go direct through an Exchange like Coinbase or Binance. This puts Square in tacit competition with the exchanges. Also Cash App allows customers to buy and sell (i.e. trade) Bitcoin just like exchanges do.

Square’s Bitcoin Exposure

Square gets its Bitcoin exposure through two main sources:

- Cash App’s revenue-generating business.

- Bitcoin holdings on its balance sheet.

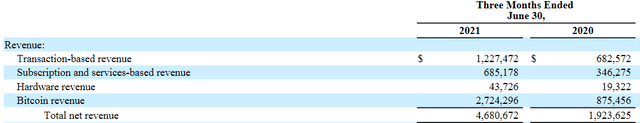

The revenue impact of Bitcoin to Square is substantial. In the second quarter, Bitcoin made up 58% of SQ’s total revenue, a feat made all the more impressive by the fact that BTC was in a freefall in Q2. As mentioned earlier, Square took a $45 million impairment charge on Bitcoin in the quarter, so Bitcoin’s outsized revenue contribution really shows just how popular it is. It was volume, not price, that made revenue soar.

Source: Square

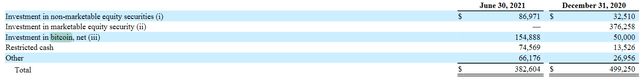

There’s also the fact that Square holds a significant amount of Bitcoin on its balance sheet. In the second quarter, these Bitcoin holdings were worth about $154 million. Not massive as a percentage of Square’s total assets ($13.8 billion) but big enough to contribute to Square’s Bitcoin exposure.

How Bitcoin Contributed to Square’s Second Quarter Results

Now we get to the really interesting part of this investigation:

How Bitcoin contributed to Square’s second quarter earnings.

The crux of my thesis is that Square is a great crypto play because it has just enough Bitcoin exposure to make a difference, but not so much that it will make or break the company. To prove that, we’ll need to look at Square’s most recent earnings.

In the second quarter, Square delivered the following results:

- Revenue: $4.68 billion, up 143%.

- Bitcoin revenue: $2.72 billion, up 211%.

- Non-Bitcoin revenue: $1.96 billion, up 87%.

- Gross profit: $1.14 billion, up 91%.

- Operating income: $124 million, up from a loss.

- Net income: $204 million, up from a loss.

- Diluted EPS: $0.4, up from a loss.

- Cash flow from operations: $297 million (note: this metric is for the most recent six month period, not for the quarter).

These were pretty strong results. They do point to a stock with a very steep valuation, as the $0.4 in EPS is only a tiny fraction of SQ’s $263 stock price. But the growth was incredible, pointing to the possibility of multiple contraction as earnings catch up with the stock price.

More to the point:

We can see clearly here the effect that Bitcoin is having on Square’s financials. The effect is a large one, as Bitcoin is over half of revenue. But non-Bitcoin revenue is still growing at high double digits. Even with Bitcoin totally out of the picture, this would be a rapidly expanding business. That’s something you don’t get with a crypto pure play like Coinbase, whose fate is entirely tied to that of the crypto universe.

This has implications for Square’s financial fortunes. If Bitcoin staged another 100% rally and Square bought no further Bitcoin nor experienced any change in its Bitcoin transaction volume:

- The Bitcoin on the balance sheet would immediately surge in value to $308 billion.

- Bitcoin revenue would probably rise approximately 100% as well.

That would be an instant growth shot to Square’s earnings and book value based on just Bitcoin gains alone. But if Bitcoin went to $0? Well, it would sting, but Square is still growing non-Bitcoin revenue at 87%. The business is by no means over and done with if BTC goes kaput. This is in contrast to a company like Coinbase which – following a brief revenue spike due to volatility – would sink in a prolonged crypto bear market.

Valuation

Now we get into what is perhaps the sorest spot of the analysis for Square: its valuation. Some of Square’s valuation metrics are extremely high even for a tech stock of its size. We normally expect high growth tech stocks to trade at high multiples, but Square’s metrics are really something else. In particular, we have:

- Adjusted P/E: 152.

- GAAP P/E: 237.

- Price/sales: 7.5.

- Price/book: 44.7.

- Price/operating cash flow: 145.4.

These are all extremely high multiples. The one that isn’t so high is the price/sales ratio, which isn’t surprising, as Square is investing heavily in growth. A company that is sinking money back into itself will naturally have a much lower multiple to sales than to earnings, because the investment spending will make earnings smaller. For example: Square spent $326 million on product development in the second quarter alone. If that spending weren’t there, earnings would have been higher and the P/E ratio (assuming the same stock price) would have been lower. You should always take multiples with a grain of salt when it comes to companies like Square, because their heavy investments are intended to pay off in the future. If they do, then the multiples should come down – but by that point, the stock will be more expensive in absolute terms. So it may be worth buying now if you think the growth will continue.

Speaking of growth:

Square’s PEG ratio – the P/E ratio divided by earnings growth – is 3.3. This is not a shockingly high ratio. It is a little high compared to other tech stocks, but it’s not that high compared to all stocks. And remember that Square took a $45 million Bitcoin impairment charge in the second quarter. That’s a non-recurring, non-cash charge that may not be indicative of the company’s future. If you take that out, then the P/E ratio goes lower and earnings growth go higher, resulting in a lower PEG ratio. In fact, if we simply calculate diluted EPS with the $45 million impairment charge added back in, we get to $0.47. If we annualize that, we get to $1.90 in EPS. That produces a P/E ratio of about 137, which is much lower. So, there are reasons to think that SQ stock is not as expensive as it appears.

Risks and Challenges

As we’ve seen already, Square is a solid stock market Bitcoin play that will rise if Bitcoin rises and at least basically survive if Bitcoin’s price collapses. That seems appealing. However, there are a number of risks and challenges to this thesis, including:

- A prolonged Bitcoin bear market. Bitcoin made up the majority of Square’s revenue in the second quarter. The stock market would not react well to SQ if Bitcoin entered a bear market. Yes, Square is less exposed to crypto than say Coinbase, but its exposure is still immense.

- Regulation. Regulatory scrutiny on Bitcoin is increasing, much of it applying to companies that manage crypto transactions. Just recently, the U.S. Senate had a massive debate over crypto regulation that held up it passing the infrastructure bill. These regulations are coming sooner or later. In a worst case scenario, they could dramatically increase Square’s compliance costs or even reduce its ability to do business.

- Competition. Credit card processing is a competitive business. Most major fintech companies are involved, and the competitors vie for a slice of the same customers’ money. A truly killer app from one of Square’s competitors could cause problems for the company, as it could lead to slower growth, or even existing customers switching.

The Bottom Line

The bottom line on Square is this:

It’s a great Bitcoin play that has a lot more going for it than just Bitcoin. Sure, it does a lot of crypto revenue, but its traditional credit card reader business is growing rapidly as well. The stock is a bit expensive, but not so expensive that growth can’t catch up with it. Overall, it’s a great way to get some Bitcoin exposure on the stock market.