Square Stock Forecast: How Would Bitcoin Mining Impact Their Outlook? (NYSE:SQ)

Olemedia/E+ via Getty Images

Mục lục bài viết

Elevator Pitch

I maintain a Neutral rating for Square, Inc. (NYSE:SQ).

I first wrote about Square in my initiation article published on July 30, 2021. Subsequently, I did a comparison of Square and PayPal Holdings, Inc. (PYPL) in another article published on August 24, 2021. Square’s shares have increased by a marginal +2% since my first article on the company was written, which justifies my Neutral rating on the stock during this period.

Square has witnessed a significant increase in Bitcoin revenue in the past one year, while it has substantial Bitcoin investments on its books that are worth a few hundred million dollars. As such, it is not too much of a surprise that SQ is interested in venturing into Bitcoin mining.

But my analysis suggest that Square’s future growth outlook should not be heavily influenced by the decision on Bitcoin mining. As such, I continue to rate Square’s shares as a Hold, with the stock’s expensive valuations being a key factor for my investment rating.

What Is Bitcoin Mining?

On October 16, 2021, Jack Dorsey, co-founder, chairman and CEO of SQ, published a tweet announcing that “Square is considering building a Bitcoin mining system based on custom silicon and open source for individuals and businesses worldwide.”

I will discuss about the possible reasons for Square considering Bitcoin mining in the next section of the current article. In this section, I will seek out definitions and descriptions of Bitcoin mining as a start.

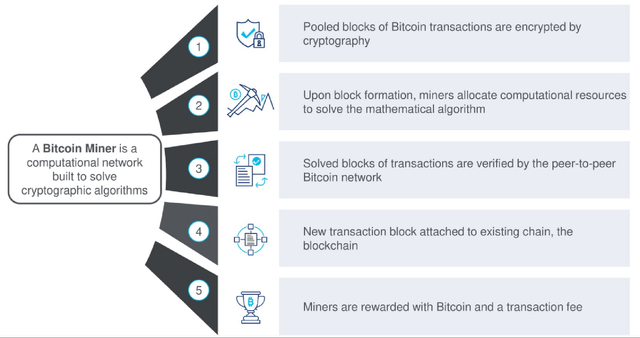

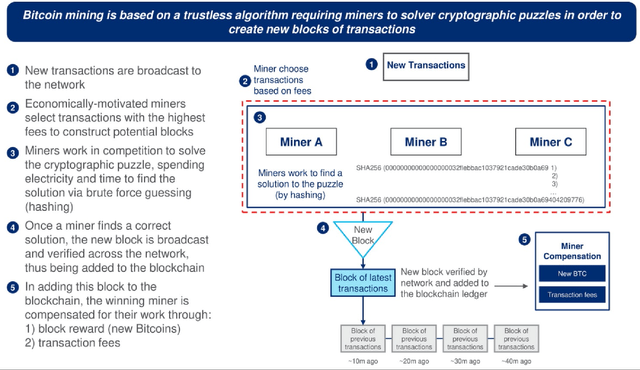

A CNBC article last updated in June 2021 defines Bitcoin mining simply as “the discovery of new bitcoins” or “the verification of bitcoin transactions.” Cipher Mining Inc. (CIFR), whose “mission is to become the leading Bitcoin mining company in the United States” as per its corporate profile, offers an even more detailed description of Bitcoin mining as presented below.

The Process Of Bitcoin Mining

Source: Cipher Mining’s March 2021 Investor Presentation

Source: Cipher Mining’s March 2021 Investor Presentation

With an understanding of what Bitcoin mining is all about, it is time to revisit the recent news of Square considering Bitcoin mining in the subsequent section.

Why Is Square Considering Bitcoin Mining?

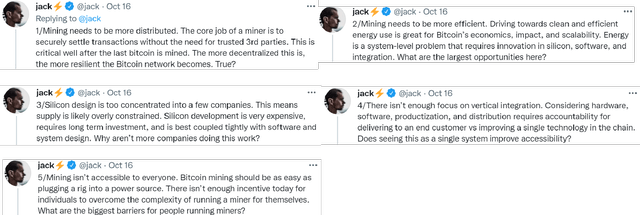

In his tweet (reproduced below), Jack Dorsey provided a couple of reasons why SQ is thinking about Bitcoin mining, and all the reasons he provided are largely linked to what he views as flaws or inadequacies in the current Bitcoin mining processes and systems. But as investors, we are more interested in the business rationale for Square possibly engaging in Bitcoin mining sometime in the future.

Jack Dorsey’s Five Reasons For Square Considering Bitcoin Mining

Source: Jack Dorsey’s October 16, 2021 Tweet

Source: Jack Dorsey’s October 16, 2021 Tweet

Bitcoin has always been an important part of Square’s business, prior to Jack Dorsey’s tweet. I highlighted in my July 30, 2021 initiation article for SQ that “Bitcoin serves as a marketing tool for SQ to attract users for its Cash App business”, despite having “a limited contribution to Square’s overall profitability.”

Bitcoin trading was made available on Square’s Cash App since 2018, and the company’s quarterly Bitcoin revenue jumped from $1.2 billion in Q2 2020 to $3.3 billion in Q2 2021. This is a testament of the popularity of Bitcoin trading and its importance in helping Cash App acquire new users.

One of the possible reasons for Square considering Bitcoin mining is to have an alternative source for the supply of Bitcoins, apart from purchasing Bitcoins. In the company’s Q2 2021 Shareholder Letter, SQ noted that “the market cost of bitcoin” is typically “volatile and outside our control” and mentioned that “we purchase bitcoin to facilitate customers’ access to bitcoin.”

Another possible reason with regards to SQ’s decision to engage in Bitcoin mining is the company’s confidence in the future potential of this cryptocurrency. This is validated by the fact that Square has significant Bitcoin investments with an aggregate market value of $281 million as of end-June 2021 as disclosed in the company’s Q2 2021 shareholder letter. In the company’s Q2 2021 10-Q filing, SQ also emphasized that “we believe cryptocurrency is an instrument of economic empowerment that aligns with our corporate purpose” and that “we expect to hold these investments for the long term.”

In the next section, I discuss about how Square’s financial forecasts and business outlook could possibly be affected by the decision to possibly engage in Bitcoin mining.

Square Stock Forecast

Market consensus points to strong top line and bottom line growth for Square in the next two years. Wall Street analysts expect Square’s revenue to expand by +12% and +21% in fiscal 2022 and 2023, respectively. The sell-side analysts also see SQ’s normalized earnings per share growing by +26% and +37% for FY 2022 and FY 2023, respectively.

It is natural to assume that the sell-side would not have made changes to their financial forecasts for Square in light of the new development regarding Bitcoin mining, as the final decision (to engage in Bitcoin mining or not) has yet to be made.

More significantly, I don’t think that Bitcoin mining will have a substantial impact on the company’s financial numbers. According to the company’s Q2 2021 shareholder letter, Bitcoin trading accounted for only 5% of Square’s gross profit in that quarter. SQ noted in the letter that “we only apply a small margin to the market cost of Bitcoin” for Bitcoin trading. This suggests that even if Bitcoin trading volume were to increase as a result of Square having a new supply source by engaging in Bitcoin mining, the direct impact on SQ’s profitability will be limited.

On the other hand, more active Bitcoin trading could potentially help to increase overall transaction activity on Square’s Cash App and lead to higher revenue and earnings. In the past two years, SQ’s Cash App segment has been growing at a much faster pace compared to its Seller segment. The two-year gross profit CAGRs for Square’s Seller and Cash App Segments were +30% and +128%, respectively up to the second quarter of 2021 as disclosed in the company’s recent Shareholder Letter.

But it is impossible to link Bitcoin trading or Bitcoin mining to Cash App’s growth directly, as there are other marketing tools and growth drivers for Cash App apart from cryptocurrencies. I mentioned about the “upmarket growth strategy” and “international expansion” as key drivers of Cash App’s future growth in my initiation article for the company published on July 30, 2021.

In conclusion, I don’t see Bitcoin mining have a meaningful, direct impact on Square’s future revenue and earnings, even if it materializes. This view is also justified by SQ’s muted share price performance following Jack Dorsey’s tweet. Square’s share price rose by a mere +2.4% from $249.00 to $255.04 from October 15, 2021 to November 1, 2021. If Bitcoin mining is expected to be a major driver of SQ’s future bottom line growth, one would expect Square to witness a big jump in its stock price which did not happen.

Is SQ Stock A Buy, Sell, Or Hold?

SQ stock remains a Hold, an investment rating which I have maintained since end-July 2021.

Note that Jack Dorsey concluded his tweet by mentioning that Square “will start the deep technical investigation required to take on this project” and it will “update this thread as we make our decisions.” Also, there is no mention of Bitcoin mining in the “News” section of Square’s investor relations website. In other words, there is no certainty that Square will eventually decide to engage in Bitcoin mining. Also as per my analysis, even if Square decides to proceed with Bitcoin mining, this decision should not affect SQ’s future financial performance directly to a large extent.

In my two previous articles, I have expressed caution about Square’s rich valuations, and I still hold the same view. Based on the company’s last traded price of $255.04 as of November 1, 2021, Square is valued by the market at consensus forward fiscal 2022 and 2023 EV/EBITDA multiples of 84.0 times and 58.7 times, respectively.

Square’s growth outlook is positive, as evidenced by the consensus financial estimates I quoted earlier. But this has been largely factored into SQ’s valuations, implying that a Hold or Neutral is the most appropriate investment rating for Square.