The Biggest Bitcoin Development You Should Know Is Strike

peterschreiber.media/iStock via Getty Images

Forget Bitcoin’s (BTC-USD) economics and storage of value narrative for just a second. While all that is necessary, it is important to remember that Bitcoin is a truly decentralized protocol with real utility. Currently, Bitcoin’s Lightning Network maintains the underlying power to disrupt the global payments industry, by offering efficient, affordable, secure, and global settlement rails through Bitcoin. Further, with Bitcoin’s Taproot upgrade set to occur within one month, the Lightning Network is poised to finally mature into its maximum effectiveness.

Major technological developments are currently occurring within the Bitcoin network. However, there is next to no discussion in the traditional media about this. For Bitcoin’s entire lifespan, it has predominantly been known for its speculative and volatile price movements. While this is understandable (volatility yields the most hype), it misses the main focus behind Bitcoin. Fundamentally, Satoshi made Bitcoin with the intent for it to be digital cash. More than anything else, the Lightning Network achieves this.

I’ve said it before and I’ll say it again. The Lightning Network is the next ‘big thing’ in crypto. Everything that is presently built on Ethereum can and will be built on Bitcoin’s Lightning Network. Further, the Lightning Network will provide a global standard for monetary settlement. Like a freight train gaining momentum, Bitcoin has grown for the past decade. Currently, the stage is set for layer-2 Lightning companies like Zap to provide Bitcoin’s immense utility to consumers.

Mục lục bài viết

The Significance of the Lightning Network

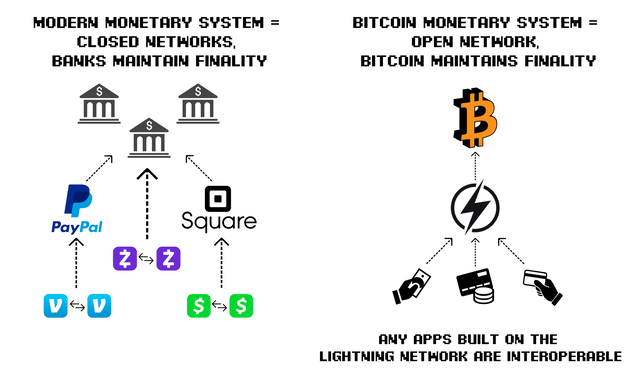

Over time, open networks tend to beat closed networks. The Lightning Network is an open network that can gradually beat our current monetary system of closed networks. The reasoning for this is simply because open networks offer more inclusivity, and thereby reduce interoperable complexity. Since the Lightning Network provides payment rails that are equally as effective as those currently maintained by PayPal (PYPL), Visa (V), and Mastercard (MA); eventually the Lightning Network can garner more users because it more effectively provides a global standard for monetary settlement.

Source: Author

Since the Lightning Network limits interoperable complexity, my thesis is that it will overtake closed payment networks over time. Any companies built on the Lightning Network will automatically be interoperable with each other. Gradually, this should increasingly incentivize startups to build on Lightning.

Strike: A Merge Between Two Trends

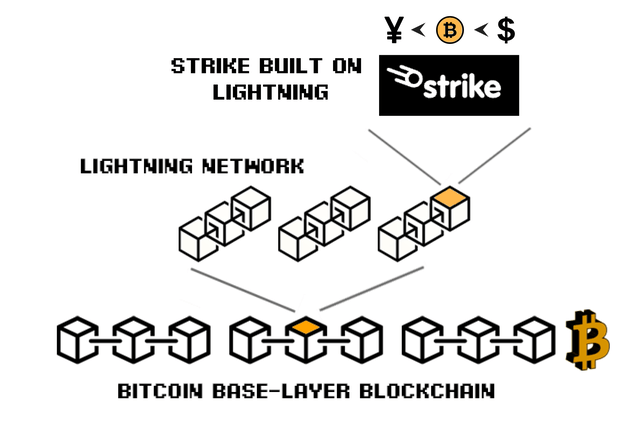

Source: CEO of Zap Jack Mallers’ Medium page

Within the past decade, the fintech industry has seen two major technological trends. This includes a consumer shift towards ‘neo-banking’ mobile apps, such as Cash App, Zelle, and Venmo, along with the growth of cryptocurrencies, specifically Bitcoin. Each of these trends derives from two overarching consumer wants:

- Consumers want the opportunity to make cheap digital payments.

- Consumers want their money to be easily accessible.

Zap’s flagship project, Strike, combines both of these decade-long trends (mobile payments and crypto) into a functional, free, and scalable product.

Strike is a simple payments application that operates on the Lightning Network. Most importantly, Strike does not require users to spend their Bitcoin. Instead, Strike uses the Bitcoin network as a form of global payment rails. To achieve this, Strike payments are firstly converted to Bitcoin, transacted through the Lightning Network, and then re-converted into the end currency of desire. By using Bitcoin’s Lightning Network as a transactional conversion layer, Strike users can pay anyone, anywhere, with any currency, and achieve physical finality.

Source: Author (Created from this article)

Source: Jack Mallers’ YouTube

Strike’s Advantageous Circumstances

Strike maintains a rare opportunity as a startup fintech application, because it has no need for private infrastructure. Fundamentally, Strike is just free downloadable software. Since it’s built on Bitcoin, it has no requirement to build payment rails or work through legacy banking infrastructure. Simply put, Strike’s goal is to exist as a gateway to allow individuals to use the utility of the Lightning Network, without requiring any technical knowledge.

Below are the various advantages that Strike maintains over legacy payment applications:

- Physical Finality: Payments through Strike achieve finality through the Lightning Network. Conversely, payments through legacy settlement rails achieve inefficient finality through banks. Currently, to increase settlement efficiency, payment companies take on credit risk, counterparty risk, balance sheet float, and overall have to deal with a ton of fixed-cost and necessary intermediaries. These intermediaries cost legacy payment companies money to achieve finality. Since Strike operates through the Lightning Network, its cost to achieve finality is essentially zero. Further, Strike achieves physical and provable finality through a decentralized network (Bitcoin), whereas all other payment companies maintain finality through centralization (banks).

- Profitability Through Near-Zero Fees: The base fee per transaction on the Lightning Network is 1 satoshi, or 0.04 cents. Separately, for a merchant to receive a payment through Visa, it is charged with a transactional fee in the ballpark of >2.5%. Visa has to charge this high fee because, once again, it has to deal with numerous fixed-cost intermediaries. Strike, on the other hand, only needs to charge a transactional fee of about 0.04 cents and all of that fee is kept for Strike as profit (since Strike does not have to pay any intermediaries).

- Interoperability: As I explained previously, since the Lightning Network is an open network, Strike will maintain the ability to seamlessly interact with any other applications that are built on Lightning. This gives Strike an advantage over apps like Venmo or Cash App, which can only interact with themselves.

Twitter + Visa Partnerships

Source: Strike’s Twitter

Twitter (TWTR) is the first Fortune 500 company to take advantage of Strike’s Lightning Network payments model. Going forward, I expect to see more major companies either use the Strike API, or use some version of the Lightning Network to transact payments. This is simply because the Lightning Network is cheaper than legacy payment rails.

On September 23rd, Twitter confirmed its plan to integrate Strike’s API into its platform, thereby allowing for Bitcoin payments through Twitter. Currently, Twitter users can use Strike to pay other Twitter users with Bitcoin. Overall, this is big news for Twitter, Zap (the startup that created Strike), and for cryptocurrency in general.

Furthermore, Strike is currently working with Visa to launch a Strike-Visa card. Although Strike is firstly focused on the Lightning Network, it additionally plans to release a Visa card to more effectively compete with other neo-banking apps (notably Square (SQ) and Coinbase (COIN)). Once the Visa card is released, users will be able to use the Strike application both as a bank account with debit card opportunities and as a mobile payments platform.

Risk

The biggest risk to Zap’s startup application is that there is nothing stopping other, bigger payment companies from using their Lightning Network business model. If PayPal, for example, starts to use the Lightning Network to transact payments, then this would act as some pretty stiff competition for Zap. Currently, Zap maintains a first-mover advantage and it is tightly partnered with Twitter, so this should help to bring in users. Going forward, it will be interesting to see how the fintech sector reacts to the expansion of Strike and other Lightning Network companies.

Conclusion

Below is a summary of all my main points, in order of descending importance.

- Bitcoin’s Lightning Network offers a single, efficient, and global standard for monetary settlement.

- Due to its lack of intermediary costs, companies around the world are monetarily incentivized to use the Lightning Network.

- The first-mover in the Lightning Network payments ecosystem is Zap, which has recently released its flagship product, Strike.

- Strike maintains inherent advantages over legacy payment companies and is subsequently poised for continued growth.

- Over time, legacy payment companies will be increasingly incentivized to use the Lightning Network. This has the potential to make comparably inefficient banking settlement rails obsolete.

Note: If you found this article interesting and want to learn more, then I highly suggest you listen to Zap CEO Jack Mallers speak on Anthony Pompliano’s business show. Many of the points I stressed in this article I found from this interview.