What Is a Crypto Faucet?

Crypto faucets are a way of rewarding users with instant payments of Bitcoin in exchange for performing tasks on a website or app. Like Bitcoin, this works based on a decentralised system using blockchain technology as a ledger to underlie the crypto.

Crypto faucets, like cryptocurrency, are part of a decentralised financial system using peer-to-peer transactions. A cryptocurrency faucet doesn’t incur any transaction fees by bypassing traditional financial services and payment systems, such as banks and credit cards, as well as advertising business models such as Google Ads which would typically sit between a user and a website or app.

The tasks the user completes could be clicking on a paid ad, completing a CAPTCHA test or logging in every day. The user – that is, the wallet holder – earns Bitcoin cash by completing tasks on a crypto faucet via a website or an app.

What’s the benefit for each party? A crypto faucet cuts out the intermediary, typically Google Ads or any other online monetization company, and rewards the user directly. Factors including ad clicks and CAPTCHA tests generate website traffic and this, in turn, is a source of revenue for the website or app, while the user earns crypto coins directly into their crypto wallet.

Mục lục bài viết

What is a Bitcoin faucet?

A Bitcoin faucet is a rewards system that specifically dishes out Bitcoin, the largest cryptocurrency. There are faucets for other cryptocurrencies in addition to Bitcoin, including altcoins, such as Ethereum, Dogecoin or Litecoin. Simply put, these crypto coins are different assets for people to invest in. The crypto-assets can all be used as rewards via a Bitcoin faucet, Dogecoin faucet Litecoin faucet, and others.

Crypto stats

Capped supply of Bitcoin: 21 million

How often new Bitcoins are minted by miners: 10 minutes

How much 10000 satoshis will give you in GBP: 2.3631 GBP

The supply is capped at 21 million Bitcoins. Buying or earning through crypto faucets just 1 Bitcoin means you’ll be joining the very exclusive 21 million club. You’ll be 1 in 21 million.

So which type of faucet do you go with? You might want to pay attention to market capitalization – or market cap – that’s the price of each coin multiplied by the number of coins in circulation. Bear in mind Bitcoin will only ever have 21 million coins in circulation since this affects how this cryptocurrency scores in the ranking of cryptocurrencies and is indicative of its potential for growth. The same applies for other cryptocurrencies.

How do crypto faucets work?

Now we know what a faucet is, how exactly do they work? When thinking about how faucets work, including Bitcoin faucets, think of it as a mutual exchange between the user, the wallet holder, and the faucet, the website or app. The user earns cryptocurrency into a secure crypto wallet by completing tasks and the faucet that dishes out the crypto as a reward generates revenue from the traffic generated through the actions or tasks carried out by the user, including:

- Clicking on paid ads

- Logging on to a website every day

- Completing CAPTCHA tests

- Playing games

- Watching ads

Long term strategy

The reward system used with crypto faucets is done over time and in small quantities. It’s a low effort and low-risk way for the user to earn crypto coins,

The reward system used with crypto faucets is done over time and in small quantities. It’s a low effort and low-risk way for the user to earn crypto coins, but you have to be willing to put the time in over a period of days, weeks, or months. You’re playing a long game.

Like other investment assets, there are various risks and rewards involved, different types of asset class, as well as short term and long term strategies to adopt with cryptocurrencies.

A lot has already been said about the volatility of Bitcoin price and its value. But volatility means that while there are risks, there are also big gains to potentially be made and the potential to generate wealth. The volatility of Bitcoin and other cryptocurrencies means that while the digital asset may be earned in small amounts over time through crypto faucets, it has the potential to gain significant value over time. To put this in context, 1 Bitcoin is worth approximately $34,000 USD today. Just over a decade ago in 2010, 1 Bitcoin was worth less than $0.01 USD.

Crypto faucets, secure transactions and Blockchain

Bitcoin transactions are public and can be viewed on Bitcoin software, known as the blockchain. This is because cryptocurrency transactions are part of an open, decentralised financial system. Every time someone sends Bitcoin or other cryptocurrencies to another wallet, a transaction is created with an ID that is used to verify transactions.

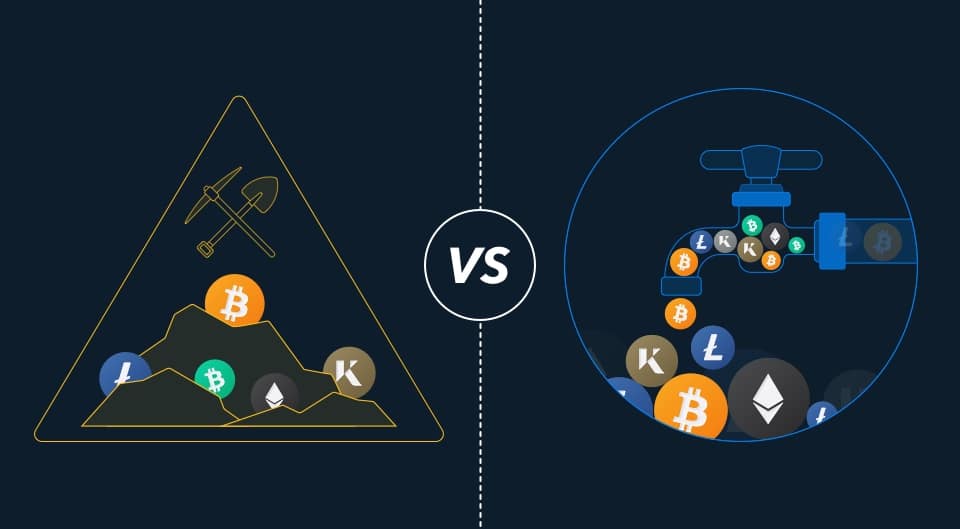

Mining v faucets

Mining Bitcoin through Blockchain is significantly more complicated than using a cash faucet. Bitcoin miners will need the right technology, which has become more scarce, in addition to hardware and a powerful electricity supply. One will also incur power costs in order to connect to and mine the Bitcoin network. Plus, many people are asked to solve a complex mathematical query to be authorised as a miner.

Buying or earning Bitcoin through a Bitcoin cash faucet is much more simple. If you want to explore Bitcoin or other cryptocurrencies, a faucet Bitcoin is a good place to start. Low risk, low effort and doesn’t involve mining – and when it comes to minting, this process is also easy and just got a lot quicker.

Future of money and cryptocurrency

Digital currency isn’t going anywhere. Governments and banks are becoming more open to the idea of investing in digital currencies, as well as the broader public. El Salvador just announced plans to make Bitcoin legal tender in the country from September. Wealth managers increasingly advise clients on investing in crypto assets instead of traditional assets, or as part of a diversified portfolio. If you decide you want to invest in crypto, firstly, take the time to understand the digital currency landscape. If you’re still a bit unsure, consider starting with a low-risk option, such as crypto faucets.

What do you think is the future for cryptocurrency?