What is a Crypto Fork? Are Hard & Soft Forks Taxed? | Koinly

All

Last updated: Thursday, 15 September 2022

Both soft and hard forks happen occasionally in the crypto community for a variety of reasons. Not only do they create volatility for your investments, but they may also increase your tax bill. Learn more about forks and how they’re taxed.

All cryptocurrencies are built on decentralized, open software known as blockchains. Because they’re decentralized, the communities that use a given blockchain often maintain and develop said blockchain.

When these developments happen, not all users within a community will agree with it. When this happens, the blockchain may split – creating a fork.

There are different types of forks – soft forks and hard forks – which will change the sequence of events after a chain split and your subsequent taxation. We’ll be covering everything you need to know about forks and how forks are taxed.

Mục lục bài viết

What is a fork in crypto?

Put simply, a fork occurs whenever there is a change to the current status quo of a specific blockchain. There are two kinds of forks you need to know about – soft and hard forks.

Soft forks vs. hard forks

The easiest way to understand a soft fork vs. a hard fork is to think of them as backward compatible or non-backward compatible – much like games consoles and older games.

A soft fork is akin to a software upgrade for that specific blockchain. It becomes the new way of doing things and brings new functionality to the blockchain. The blockchain itself doesn’t split because users agree on the new changes. When the change happens, the blockchain carries on chronologically from the same chain.

A hard fork is similar in that it is an upgrade. But the changes are so fundamental (or all users cannot agree on the changes) that the blockchain cannot continue on from the previous chain. In these instances, the blockchain splits in two – the original and an updated version that implements the given change. The latter creates an entirely new cryptocurrency.

There are many popular cryptocurrencies that have been created as a result of a hard fork including Bitcoin Cash and Bitcoin Gold.

Why do forks happen?

We’ve touched on this a little already, but there are lots of reasons forks occur in cryptocurrencies. The most common is to add some new functionality, like when Ethereum switched from proof of work to proof of stake in the so called Merge.

Another important reason to update blockchains is to address any security risks. As digital currencies, cryptocurrencies are hugely appealing to hackers. With the dawn of DeFi, it is highly likely there will need to be an increasing amount of security updates to blockchains to protect users.

Finally, forks – in particular hard forks – can happen as a result of a disagreement over a given cryptocurrencies future. If the community can’t agree on what should happen or what changes should be made to address existing issues and so on, often the easiest way to resolve this disagreement is for the blockchain to split.

What is the impact of a fork?

Forks can be good or bad news for crypto investors.

Soft forks – when managed well and implemented at a steady pace – can add new functionality and new investment opportunities for investors. A good example of this is the steady rollout of Ethereum 2.0. The changes are discussed among the community, a majority consensus is found and a roadmap of changes is developed and implemented. On September 15 2022, the Merge was completed with no major disruptions and no hard fork.

Hard forks tend to create more volatility – which can be difficult to imagine in an already volatile market. A historical example of this is Bitcoin Cash, which came as a result of a disagreement over updates for the Bitcoin blockchain. Some users wanted to increase the block size to allow blocks to be processed faster by miners, but others did not. So the blockchain split into Bitcoin and Bitcoin Cash.

Any investors who held Bitcoin at the time of the split automatically received the same amount of Bitcoin cash on the new blockchain. Both Bitcoin and Bitcoin Cash’s prices soared up and down as investors tried to guess which would come out on top. It created a lot of uncertainty in the market and a lot of investors bet everything they had on one currency coming out as victorious.

These are just two examples of many, but they show how the different types of forks will affect the assets investors will come out with. This all matters when it comes to tax.

How are crypto forks taxed?

The way forks are taxed depends on the type of fork and comes down to the way tax offices view cryptocurrency.

Almost all countries see cryptocurrency as a kind of asset, not an actual currency – so more like a share or rental property. Because of this view, tax offices are only interested when you “dispose” of an asset or when you acquire an asset under particular circumstances.

Disposing of an asset refers to any time you sell, swap, spend or (sometimes) gift your crypto. When you do this, any profit you make from the disposal will be subject to Capital Gains Tax. The amount you’ll pay will depend on where you live and how much you earn.

When it comes to acquiring crypto, in most instances, tax offices aren’t interested in this transaction. For example, when you buy or you’re gifted crypto, this isn’t a taxable transaction. The exception to this rule is when tax offices view you acquiring the asset as income – for example, if you’re getting paid in crypto in exchange for a service. This would be subject to Income Tax.

When it comes to soft forks – you don’t need to worry about tax. There is no new coin or token added to your wallet, so it can’t result in any tax.

Hard forks are a little more complicated as they’re viewed slightly differently by different tax offices. In almost all countries, you’ll pay Capital Gains Tax on any asset you dispose of, including those you received from a hard fork. However, in some countries, you’ll also pay Income Tax at the point you receive a new asset as a result of a hard fork.

We’ll cover how various tax offices like the IRS and HMRC view and tax hard forks.

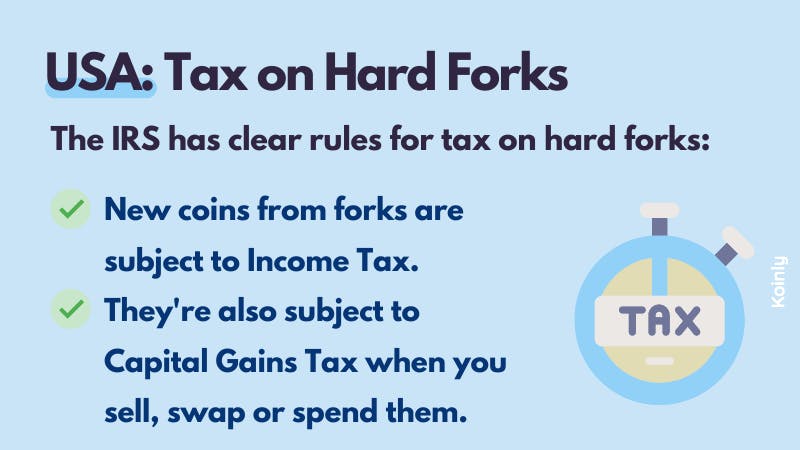

How does the IRS tax forks?

The IRS has taken a pretty hard stance on crypto forks. They’ve clarified that any new coins received as a result of a hard fork should be treated as income and subject to Income Tax. You can calculate the amount of income by identifying the fair market value (FMV) of the coin on the day you receive it. You’ll need to report this as “other income” on IRS Form 1040.

As well as Income Tax, if you later sell, swap or spend your asset, any profit you make will be subject to Capital Gains Tax. Your cost basis for coins from a fork will be the fair market value on the day you received them, like above. You’ll need to report this on IRS Form 8949.

So for American crypto investors, you’ll pay two different kinds of tax on any coins or tokens received as a result of a hard fork.

You can find more information on how cryptocurrency is taxed in the US in our US Crypto Tax Guide.

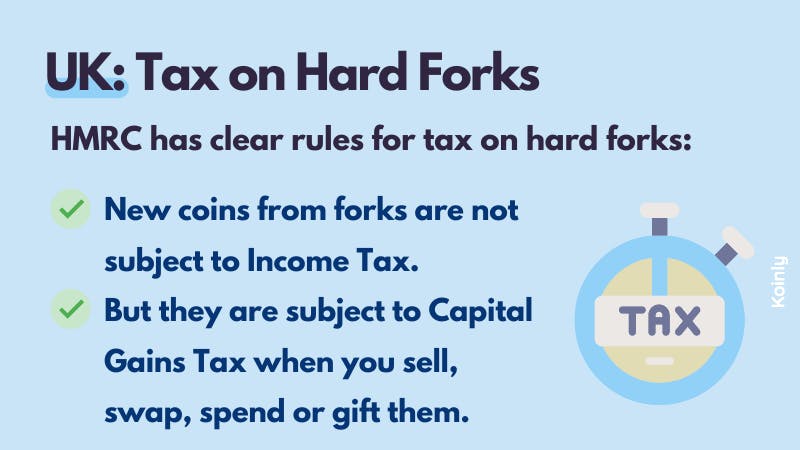

How does HMRC tax forks?

HMRC has clear guidance on how they tax hard forks and it’s good news! HMRC doesn’t view coins received as a result of hard forks as income, so they’re not subject to Income Tax.

They will however, be subject to Capital Gains Tax when you sell, swap, spend or gift them (excluding to spouse). Only any profit made from this transaction will be subject to Capital Gains Tax.

To figure out your profit, you simply subtract your cost basis (how much it cost you to acquire the coins plus any fees) from the value of the coin at the point you disposed of it. This matters when it comes to forks because HMRC has very specific rules for your cost basis.

Your cost basis for any coins from a fork is derived from your existing tokens from the previous blockchain – not the FMV of the new coin on the day you received it.

You can find more information on how cryptocurrency is taxed in the UK in our UK Crypto Tax Guide.

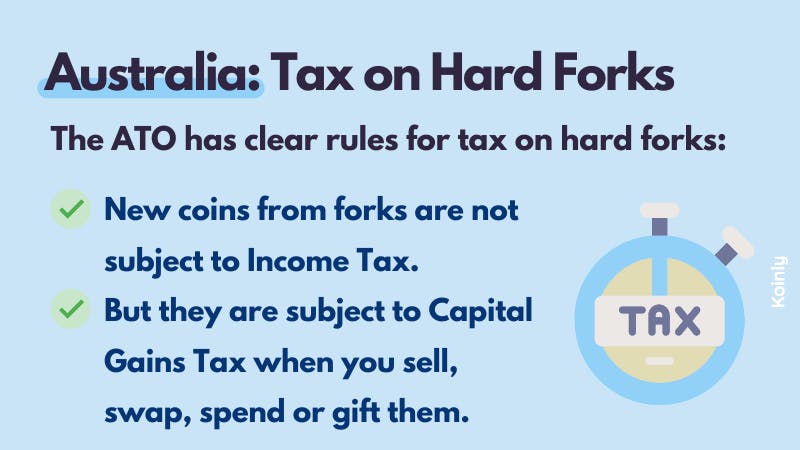

How does the ATO tax forks?

The ATO has two rules for hard forks and it depends on whether you’re an investor or running a cryptocurrency business.

If it’s the latter, you’ll need to follow trading stock tax rules, not crypto tax rules.

If you’re an investor, you won’t pay Income Tax on any new coins received as a result of a hard fork. You’ll only pay Capital Gains Tax when you dispose of them.

The ATO is also very clear that the cost basis for new coins from a hard fork is zero, so you’ll pay Capital Gains Tax on the total value of your coin as it’s all seen as profit. For example, you received 1 BCH in 2017 when it split from BTC. Your cost basis for this new coin is $0. You sell it a couple of months later at its peak for $2,000. Because your cost basis is zero – the whole $2,000 is viewed as profit by the ATO and subject to Capital Gains Tax.

One of the ways you can reduce this taxation is to HODL. Australian investors who hold assets for longer than a year enjoy a 50% long-term Capital Gains Tax discount when they sell, swap, spend or gift them. This discount would apply to coins received from a fork, just as it would to any other crypto asset held for more than a year.

You can find more information on how cryptocurrency is taxed in the Australia in our Australian Crypto Tax Guide.

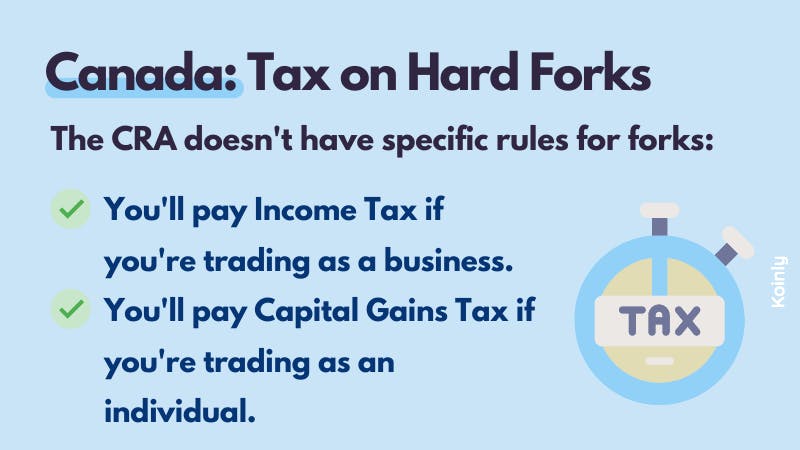

How does the CRA tax forks?

Unlike the tax offices above, the CRA hasn’t issued specific guidance on how hard forks are taxed.

This said, the CRA is very clear that the way cryptocurrency is taxed depends very much on how they view you as a taxpayer. If they view you as an individual, you’ll only pay Capital Gains Tax on your crypto assets at the point you dispose of them by selling, swapping, spending or gifting them.

However, if the CRA views your investment activities as more similar to a business, you’ll pay Income Tax on crypto assets at the point you receive them, as well as Capital Gains Tax when you dispose of them.

What is important to note is that because Canada uses the adjusted cost basis method, the cost basis for any new coins received as a result of a fork would be zero as you didn’t pay anything for them. This means when you later dispose of this asset, you’d pay Capital Gains Tax on the total value of your coins as it’s all considered profit.

This said, when you pay Capital Gains Tax in Canada, you’ll only pay Capital Gains Tax on half of your net capital gains. So, you’ll essentially only pay tax on 50% of any disposed assets received from a hard fork.

You can find more information on how cryptocurrency is taxed in Canada in our Canada Crypto Tax Guide.

Calculate crypto forks tax with Koinly

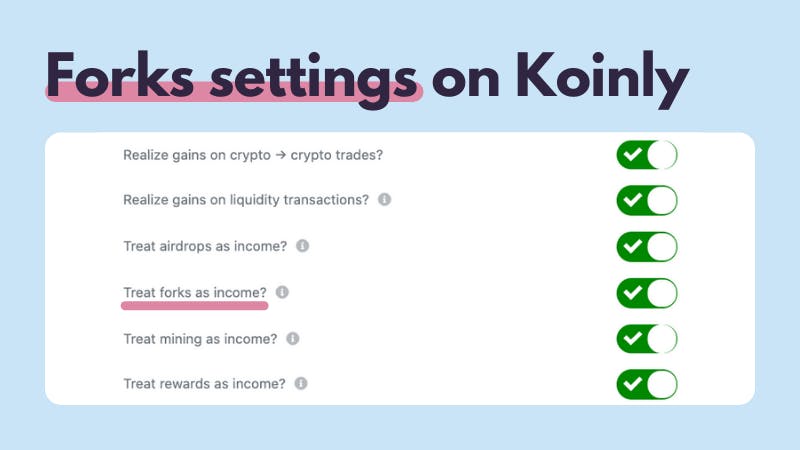

With all these various rules, it can be difficult to calculate taxes on crypto forks, but crypto tax software like Koinly can help.

All you need to do is import your transactions from the various crypto wallets and exchanges you use into Koinly. You can do this via CSV file or through API integration for most wallets. Once your data is imported, it should automatically tag different transactions – including forks. However, if your data is missing this information, you can easily tag individual transactions in Koinly. Just find the transaction in our platform and use the three dots on the right hand side to tag as a fork.

For users in countries where coins as a result of a hard fork are considered income, you can also head into settings to turn the “treat forks as income” option on.

Once your transactions are tagged and your settings are correct for your location, Koinly will calculate your crypto taxes, including any capital gains from forks and any income from forks. You can find an easy to read summary in the tax reports page, as well as specific tax reports to download and use when it’s time to file your taxes.

Summary

- A fork (or chain split) occurs whenever there is a change to a specific blockchain.

- There are two kinds of forks – soft forks and hard forks.

- Soft forks are compatible with the existing blockchain.

- Hard forks are incompatible with the existing blockchain and a new blockchain and coins are created.

- Soft forks are not subject to any tax as you don’t receive any new coins.

- The taxation of hard forks depends on where you live.

- In some countries, coins from a hard fork are subject to Income Tax when you receive them.

- In most countries, coins from a hard fork will be subject to Capital Gains Tax when you sell, swap, spend or gift them.

- In some instances, you may pay both Income Tax and Capital Gains Tax on coins received from a hard fork.