Bitcoin’s Short-term Elliott Wave Review: the Key Levels to Watch

Mục lục bài viết

Bitcoin Elliot Wave Analysis

In my previous update, see here, I reviewed the big picture Elliott Wave Principle (EWP)-count for Bitcoin (BTC). I found the cryptocurrency was still missing a more significant 5th wave higher to around $125+/25K. Unfortunately, many retail traders and investors entered BTC late last year and ran for the exits over the last few months, swearing never to touch BTC again (because it is a scam, worthless, of no use, etc.).

Others promise to “get back into it when prices have stabilized,” which means they will -unfortunately- once again “buy high and sell low.” By sharing my price-based, objective, and mathematically precise insights, I try to break this psychologically vicious cycle that primarily retail unnecessarily subjects themselves to.

The EWP -and my real-time trading alerts– help keep emotions under control as the mind is our worst enemy when it comes to trading and investing. Especially in the fast-moving world of cryptos.

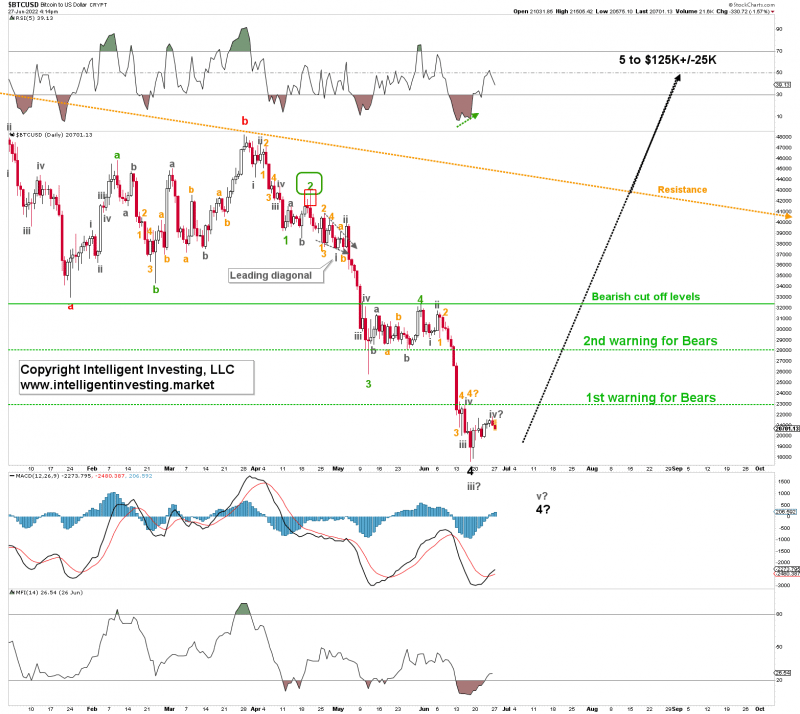

Figure 1. Bitcoin daily chart with detailed EWP count and technical indicators.

One last stab lower cannot be excluded just yet.

That said, let’s look at the daily price chart of BTC. See Figure 1 above. It contains a detailed EWP count of the Year-To-Date (YTD) price action. BTC bottomed for a more prominent (red) wave-a in January, rallied in three waves higher for a (red) wave-b into the late March high, and is now wrapping up the final (red) wave-c.

C-waves comprise five waves, in this case (green) 1, 2, 3, 4, 5, which consist of five smaller waves (grey) i, ii, iii, iv, v, etc. This repeating pattern is the fractal nature of the financial markets and the premise on which the EWP is based.

Bitcoin Price Forecast

Hence, from the above, BTC has completed all of v of 3 of c of 4, or it needs one last wave-v. In the latter case, BTC can still drop to as low as $12000 (see here), and in the former case, it is already gearing up for the run to $100K+. How will we know the difference at this stage? As usual, the EWP provides a clear set of parameters/if-then scenarios. No emotions or opinions are involved.

The Bullish count is preferred if BTC can stay above ~$19500 and rally back above $23000. However, if BTC closes below $19500, it opens up the door to $19000, and from there, ~$17000 is the most likely ideal downside target (wave-v = wave-i). Forewarned is forearmed.

This article was originally posted on FX Empire