How To Run An On-Chain Analysis On Glassnode

Have you ever felt overwhelmed with the crypto market? No matter how much you read or research, the prices always seem opposite to your prediction? If you think this way, don’t worry- you’re not alone.

Almost every other crypto trader has felt this way at least once. As a result, we often need a bit of context to determine where the market is going and conduct thorough analyses.

To figure out the missing puzzle pieces, it’s always a good idea to research blockchain activity. Nearly every kind of cryptocurrency transaction can be viewed publicly, which means you can see how money moves in real-time. With the help of a well-known tool called Glassnode, we will go through how to run a blockchain analysis in simple steps.

Mục lục bài viết

What is on-chain analysis?

Even if you’re an experienced crypto investor, the on-chain analysis might be a relatively new concept. The on-chain analysis is a research strategy based on macro information found in the public Blockchain.

When planning your investments, you may rely on the news and some financial indicators, but sometimes that’s not enough. Monitoring blockchain activity can give you the macro information for the context in which transactions are made, which can help you make better, more informed decisions.

But how is blockchain activity monitoring possible? Because the Blockchain is transparent, we can track any transaction. Through a block explorer like Etherscan, you can find details of transactions, including sender and receiver addresses and transaction fees.

The metrics for crypto on-chain analysis can be divided into three broad categories that are explained below:

1. Market capitalization

The market capitalization of a cryptocurrency defines the total or net value of the blockchain network. The total value of a network is said to be the product of the crypto’s price with its total circulating supply. We can use a coin’s market capitalization to evaluate the market size, adoption, and potential risks.

2. Hold status

A metric known as HODL is often used to understand trends in the market. It also helps us know the age of the cryptocurrency held by the user. This chain metric tells analysts whether traders are HODLing their assets or selling them off. You can understand the market’s mood through this metric and anticipate traders’ next moves.

3. Prospects

You need to monitor chain activity to know if a cryptocurrency is gaining or losing traction among investors. You must see the future open interest and consider factors like the correlation between the token and Bitcoin prices.

Correlating the token prices can significantly reduce risk factors because it will help you cut down on losses of cryptos that are related to Bitcoin price drops. Additionally, inflows or outflows from some tokens from exchanges can help analysts see the adoption status of the assets.

Holders may often depend on the news or financial indicators to plan their assets. Still, monitoring blockchain activity for crypto assets is a more intelligent move. How is blockchain monitoring possible? As we mentioned, it is transparent, and you can see any transaction.

That entire data can be tracked with macro analysis, which includes leveraging various paid and unpaid on-chain indicators that don’t necessarily involve wallet activities.

Key on-chain metrics

So now that you are familiar with key chain concepts, and know how important it is to be aware of the on-chain activity, let’s take a look at some of the most important chain metrics you can track to get the general idea of what’s going on on the Blockchain.

1. Exchange Net Position Change

That is an indicator that tells us the net amount of Bitcoin that has entered or exited wallets of all kinds of exchanges. When this net position change is positive, exchanges have more inflows than outflows. When the change is negative, it’s the opposite. This metric helps determine if investors are spending or withdrawing their Bitcoins.

Glassnode can help you see whether the exchange net position change is positive or negative and how long that metric has stayed the same.

Exchange net position change

Exchange net position change

2. Network Value to Transaction ratio

That is also known as the NVT ratio. It tells us the market capitalization ratio divided by the transacted volume in a specific window. You must divide the market cap (USD) by the daily transfer volume (USD). Even though the NVT ratio cannot predict a market crash, it can let interested people know the difference between a dip and a reversal after the peak.

In Glassnode, you can check the NVT ratio and its trends through a graph. Glassnode also gives an NVT Ratio guide so that anyone can easily understand how to calculate it.

Network value to transaction ratio

Network value to transaction ratio

3. HODL wave

The HODL wave is a graphic visualization that shows the amount of Bitcoin in circulation grouped according to different age bands. The different colors in the graph show how recently transacted Bitcoin was: the warmer the color, the more recent the transaction. In addition, the thickness of each band is proportional to the total coin supply.

HODL waves can give you a macro view of the coin supply distribution and changes among different age bands. In addition, you can see what other market participants are doing with their Bitcoins and if there is a FOMO or Fear Of Missing Out.

This evolution creates a wave-like pattern all over the graph, hence its name. HODL waves can give you a macro view of the coin supply distribution and changes among different age bands.

HODL wave

HODL wave

4. Exchange balances

Exchange balance refers to the amount of a specific coin (Bitcoin, Ethereum, etc.) currently held by a particular platform. If the crypto on an exchange balance is high, there is high liquidity for buying or selling tokens.

Glassnode can give you a list of exchange balances and their distributions. Exchange balances are essential because they help you monitor crypto trends and see where the market is going.

Exchange balances

Exchange balances

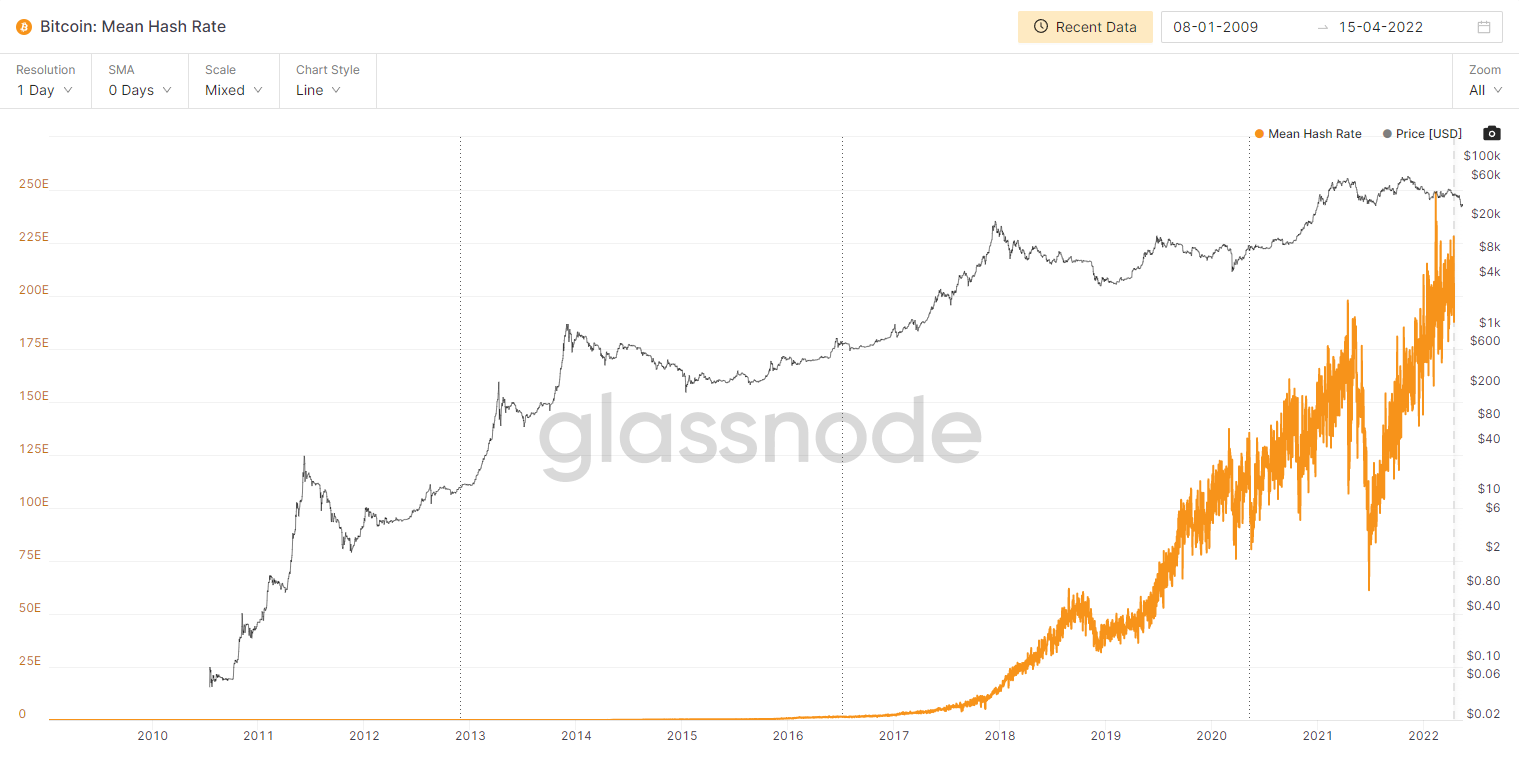

5. Mean Hash Rate

To validate transactions, the Blockchain needs computers. The Mean Hash Rate measures the total computational power a crypto network uses to process transactions in a blockchain. That can also be explained as the rate at which a crypto miner’s machines complete these calculations.

Networks with a higher hash rate show they can process more data in a shorter time and are much more efficient and secure, indicating more profitability. The price of a cryptocurrency usually moves close to the hash rate, but its correlation hasn’t been proven yet. Nevertheless, this indicator remains important to investors.

Glassnode on-chain analysis gives you a chart of the mean hash rate and provides you with the most recent data.

Mean hash rate

Mean hash rate

6. Active addresses

That refers to the number of unique addresses successfully participating in a transaction, either as a sender or a receiver. Active addresses are an indication of blockchain activity.

A price drop can lead to a decline in active addresses as investors try to exit the market. On some occasions, you can see them go up, but that’s because people are looking to sell their assets before they drop at even a lower price.

Active addresses can also indicate if a particular crypto project is attracting new investors into the network.

Glassnode gives you a graph of active addresses filtered according to different resolutions. In addition, the graph mentions the number of active addresses as well as the price in USD.

Number of active addresses

Number of active addresses

7. Whale behavior

Whale behavior is not strictly a metric but is important nevertheless. That refers to monitoring the movements of big investors, or as they’re known in the crypto environment, whales.

The actions of these more prominent players are early indicators of good or bad news. For example, if whales sell a considerable amount of a specific coin, that can’t be a good thing.

On Glassnode, you can check this out by looking up “Supply held by entities with a balance 1K-3K”.

8. Futures open interest

Futures’ open interest is important because it helps understand the market sentiment and price strength.

That is calculated as the estimated values of all possible open future positions or the aggregate dollar value of outstanding contract specified BTC deliverables. A higher open interest indicates optimism amongst investors.

Bitcoin futures open interest

Bitcoin futures open interest

Monitoring on-chain data with automated screenshots

Tracking blockchain activity is an essential complement to every crypto investor’s strategy. To stay in the know of these movements, you can use a tool that lets you keep a constant record of this data. And for this end, automated screenshots can be your ally.

Stillio automatically captures website screenshots at regular intervals and is compatible with Glassnode! With the best plan, you can set the screenshot intervals daily, weekly, monthly, or even up to 5 minutes. Stillio will save these captures directly to your cloud or folder. Just open it whenever you want, and all your information will be safely stored for a complete and timely on-chain analysis.

Get notified whenever new screenshots are available so that you don’t manually have to keep track of your screenshots all the time. You can also check out our crypto snapshot guide if you want to know more about capturing crypto information with Stillio.

Conclusion

The on-chain analysis is crucial to making informed decisions in the crypto market. Suppose this article left you wanting to know even more; in that case, you can head to Glassnode Academy for videos and instructions on using their platform and reading more metrics.

When hopping onto the on-chain analysis bandwagon, make sure to stay updated and informed all the time with your automated record powered by Stillio. For more information, feel free to book a free demo with us.