Is Majority of BTC Mining Hashrate is Controlled by two Pools?

Since the last few months, Bitcoin hashrate has continuously increased, ultimately pushing the process of solving a block into a tougher scenario. As per data from Coinwarz at the time of writing this article, the BTC hash was near 312.6599 EH/s.

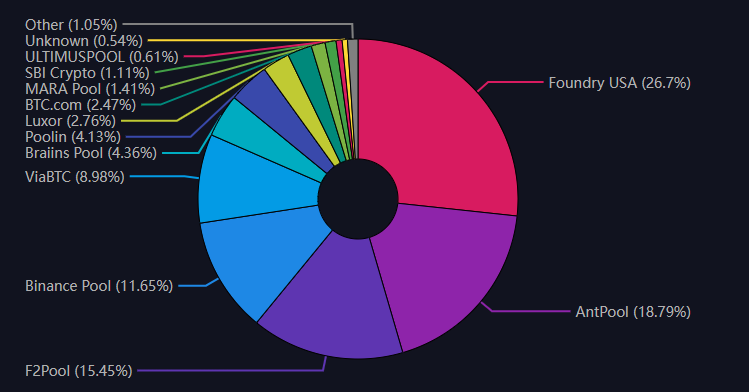

After examining the data available on Memepool, it is noted that most of the total hashrate is held by Foundry USA and Antpool. However, Foundry USA is continuously leading and holding an average of 25-30% of the total Bitcoin Network.

Foundry USA became the first non-Chinese mining pool to lead the list since November 2021. Earlier in May 2021 Chinese government banned bitcoin mining in the country.

AntPool holds the second position with 18.07%, and F2Pool is third with 13.99% of the total hash rate of the bitcoin network. Currently, over 34% of the total mining power is held by US-based pools.

Source: Memepool(Dot)com(Bitcoin Hash distribution record)

Source: Memepool(Dot)com(Bitcoin Hash distribution record)

Data shows that more than 90-95 of the total bitcoin mining power is captured by five major mining pools. Some significant factors that may be responsible for the bigger share are the distance between serves; the more the server, the more the benefit. There are also innovative alternatives emerging in the Bitcoin mining pool space. One example would be PEGA Pool. They are an eco-friendly Bitcoin mining pool that offer a reliable service with a reduced fee of 1% for miners using renewable energy. This will definitely help with overall profitability in the long term.

As reported by a media source, Bitcoin miners’ bad days may have exceeded as the hash rate braced and benefits margins slowly enhanced towards the end of the last year. Although, the industry is under great pressure, particularly for small and mid-sized miners, to be even with values exceeding $25,000 Bitcoin.

The current Bitcoin mining industry also experienced crucial challenges from the entrance of the new and well-organized machines and lowered awards after halving in the next year. Although, the ecosystem is still under great pressure under which Bitcoin collection is challenging.

Last weekend Bitcoin price gained 38.21% to reach the $23,000 mark after plunging to $16,547. Goldman Sachs has called Bitcoin the “world’s best-performing asset of 2023.”

When writing this article, Bitcoin traded at $23,141.95 with a 24-hour trading volume of $27,524,637,526. In the past 24 hours, BTC traded at $23,919.89.

From the beginning of 2023, several cryptocurrencies, including Bitcoin, have mirrored a positive sign of recovery. On January 1, 2023, BTC was trading at $16,585.And in 30 days, it gained approximately 40 percent.

Bitcoin did not easily top the list of most-traded cryptocurrencies. Behind the craze of this cryptocurrency, some push racked Bitcoin at the top.