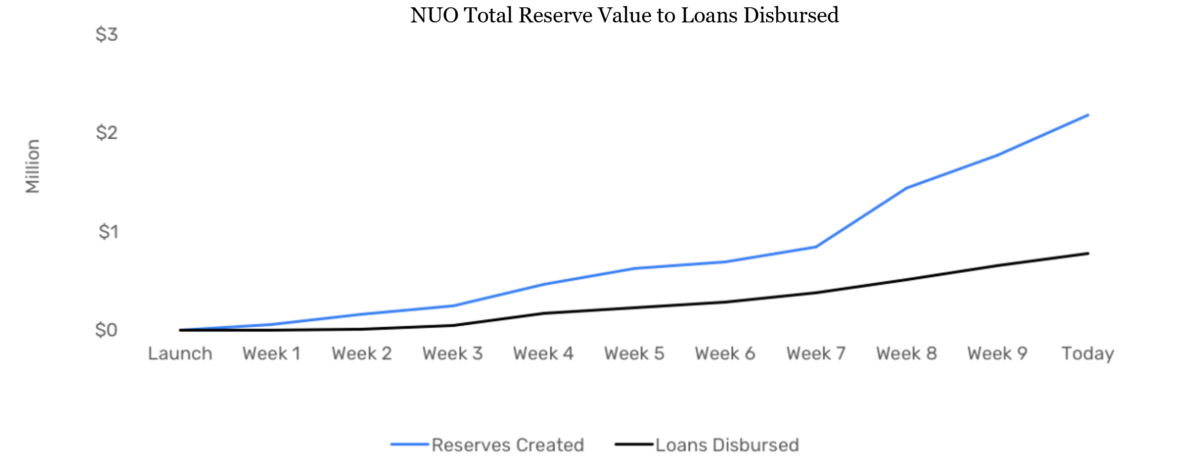

Nuo Network crosses $2 million in crypto reserves, making it the largest lending protocol based in Asia

Nuo.Network, a non-custodial lending protocol backed by ConsenSys Ventures has recently cracked the top 5 of USD value locked-in DeFi projects, and is currently the largest lending protocol based in Asia, according to DeFi Pulse. The value of loans disbursed through the platform has now doubled over the past month, fueled in part by growth in DAI reserves which are now close to $500K and Maker stability fee hikes.

The collateralized lending application currently offers borrowing in a handful of assets, including DAI, ETH, USDC, MKR, and wrapped BTC. Nuo also recently enabled the ability to margin trade with up to 3x leverage through Uniswap and Kyber pools.

Nuo Co-Founder Varun Deshpande told The Block that Maker’s recent stability fee hikes have pushed DAI liquidity to the platform, as traders seek additional avenues for leverage.

“As the stability fee increases, more users want to Long ETH with 3x leverage by taking higher loans from our reserves. This increases the returns and attracts more lenders on the platform bringing additional DAI liquidity for traders to sell,” Deshpande noted.

“What makes Nuo unique is that lenders pool funds in a contract, which directly lends to borrowers or provides margin to trade against Kyber or Uniswap pools. This is the first contract to contract implementation of margin trading and loans across DeFi. This C2C modal unlocks massive liquidity and makes all transactions near instant.”

While Nuo currently offers collateralized crypto loans and margin trading, the team is aiming to provide other debt products like refinancing Maker CDPs and tokenized bonds, among others in the future.