Private equity and institutional investors back away from crypto and DeFi

Institutional investor, private equity and venture capital investments in cryptocurrency and decentralized finance have faded significantly over the course of 2022, a tumultuous year for both digital currencies and the digital financial system emerging alongside them.

The rapid collapse in November of cryptocurrency exchange FTX Trading Ltd. and subsequent arrest of co-founder Sam Bankman-Fried on fraud charges closed out a year that began with the onset of a so-called “crypto winter.” The total market cap for all cryptocurrencies peaked at $2.97 trillion in November 2021 but had declined nearly 73% to about $811 billion as of Dec. 23, 2022, according to CoinMarketCap.

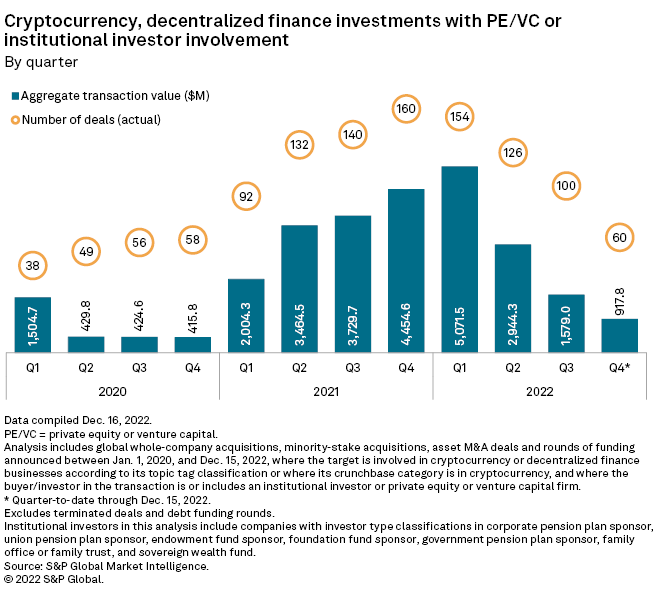

Trending in the same direction was the flow of capital into cryptocurrency and decentralized finance, or DeFi, both of which are built on blockchain’s distributed ledger technology. Institutional investor, private equity and venture capital investments in cryptocurrency and DeFi since the start of the fourth quarter totaled $917.8 million as of Dec. 16, on track for the lowest quarterly total in two years.

Investment in cryptocurrency and DeFi by private equity, venture capital and institutional investors exploded in 2021, increasing nearly five times over the previous year’s total to $13.65 billion. Dealmaking value and volume trended in only one direction last year, expanding in all four quarters of 2021.

That trend continued into the first quarter of 2022, when private equity-, venture capital- and institutional investor-backed transactions in cryptocurrency and DeFi peaked at $5.07 billion before falling sharply. The second-quarter total of $2.94 billion in investments represented a decline of nearly 42% from the previous three-month period.

Investments continued to sink lower in the third quarter, a trend that appeared likely to hold in the fourth quarter.

Deals sour for investors

The largest deal of the last five years in either cryptocurrency or DeFi dates to March 2020: a $900 million round of series B funding for FTX that included participation from five dozen investors. At least one of those investors, Sequoia Capital Operations LLC, announced that it was writing the value of its stake in FTX down to $0 following the revelations about Bankman-Fried’s alleged fraud.

Institutional investor Ontario Teachers’ Pension Plan Board separately announced that it was writing off its investments in FTX, which totaled $95 million, according to a statement. The public pension fund participated in an October 2021 funding round that raised $420.7 million for FTX.

The fallout from the FTX bankruptcy also hit BlockFi Inc., the target of the third-largest deal in cryptocurrency or DeFi since 2018 that included the participation of institutional investors, private equity and venture capital. The cryptocurrency lender secured $572.1 million in a March 2021 round of venture capital funding, but its financial entanglement with FTX prompted BlockFi to file for voluntary Chapter 11 bankruptcy protection in late November.

Outlook

Earlier in 2022, as the crypto winter set in but months before the FTX bankruptcy, a survey conducted by Fidelity Digital Assets found positive perceptions of digital assets such as cryptocurrency were on the upswing among institutional investors. Fidelity hired a firm to survey 1,052 global institutional investors during the first six months of 2022, and 81% of the respondents indicated they saw some role for digital assets in investment portfolios.

Enthusiasm for digital assets was higher among European and Asian institutional investors in the survey compared with those based in the U.S., where just 71% saw a place for digital assets in their investment portfolio. Of the 397 U.S. firms surveyed, 26% said digital assets should not be a part of a portfolio.

* Learn how private equity is using blockchain to connect with retail investors.

* Get an update on private equity investment in application software.

* Read more private equity coverage.

While the collapse of FTX could have positive implications for cryptocurrency and DeFi, spurring needed regulation and weeding out unsustainable enterprises, according to 451 Research analyst Alex Johnston, it may also drive investors away from blockchain-based systems.

451 Research is part of S&P Global Market Intelligence.