Top 11 dividend discount model bitcoin in 2023

Below are the best information and knowledge on the subject dividend discount model bitcoin compiled and compiled by our own team mix166:

Mục lục bài viết

1. Bitcoin & Cryptocurrencies Bad Ending | HBS Online

Author: online.hbs.edu

Date Submitted: 06/28/2019 02:34 PM

Average star voting: 3 ⭐ ( 49652 reviews)

Summary: We recently analyzed the cryptocurrency phenomenon through an accounting lens, but now we will analyze Bitcoin’s value through a financial lens.

Match with the search results: So what is the value of Bitcoin? Well, it will never pay a dividend, so the dividend discount model would suggest that its value is $0….. read more

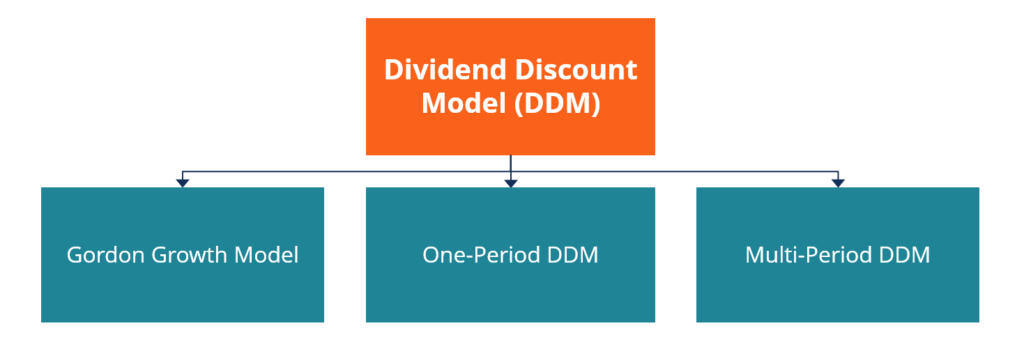

2. Dividend Discount Model (DDM) Formula, Variations, Examples, and Shortcomings

Author: www.investopedia.com

Date Submitted: 07/10/2021 09:09 PM

Average star voting: 5 ⭐ ( 87227 reviews)

Summary: The dividend discount model (DDM) is a system for evaluating a stock by using predicted dividends and discounting them back to present value.

Match with the search results: The dividend discount model (DDM) is a system for evaluating a stock by using predicted dividends and discounting them back to present value….. read more

:max_bytes(150000):strip_icc()/ddm-6340db943f88443eafd0dde9a1a80688.jpg)

3. How Does the Dividend Discount Model (DDM) Work?

Author: www.investopedia.com

Date Submitted: 03/12/2022 04:16 PM

Average star voting: 3 ⭐ ( 92261 reviews)

Summary: Learn about the dividend discount model (DDM) and when it can most appropriately be used to measure the value of a stock by fundamental investors.

Match with the search results: The dividend discount model (DDM) is used by investors to measure the value of a stock. It is similar to the discounted cash flow (DFC) valuation method; ……. read more

:max_bytes(150000):strip_icc()/GettyImages-1091374554-0b3b7b13d235497e933e22b127de4a8f.jpg)

4. Dividend Discount Model (DDM) Formula and How to Use It | The Motley Fool

Author: www.fool.com

Date Submitted: 12/16/2019 03:39 PM

Average star voting: 5 ⭐ ( 93694 reviews)

Summary: Learn what the dividend discount model is and then how to use this model to value a stock. See the model’s variations and learn when to deploy each of them.

Match with the search results: The dividend discount model, or DDM, is a method used to value a stock based on the idea that it is worth the sum of all of its future dividends. Using the ……. read more

5. Dividend discount model — Commentary — Money, Banking and Financial Markets

Author: www.moneyandbanking.com

Date Submitted: 10/06/2022 03:07 AM

Average star voting: 5 ⭐ ( 83944 reviews)

Summary:

Match with the search results: Bitcoin is all the rage, again. Last week, the price rose above $10,000 for the first time. Following a Friday announcement by the Commodity Futures Trading ……. read more

6. Dividend Discount Model

Author: corporatefinanceinstitute.com

Date Submitted: 04/15/2021 12:35 AM

Average star voting: 4 ⭐ ( 57731 reviews)

Summary: The Dividend Discount Model (DDM) is a quantitative method of valuing a company’s stock price based on the assumption that the current fair price of a stock

Match with the search results: The Dividend Discount Model (DDM) is a quantitative method of valuing a company’s stock price based on the assumption that the current fair ……. read more

7. Valuation Models for Cryptocurrencies – FinTech Ranking

Author: fintechranking.com

Date Submitted: 07/05/2020 12:57 PM

Average star voting: 3 ⭐ ( 98758 reviews)

Summary:

Match with the search results: Dividend Discount Model (DDM): The dividend discount model (DDM) is a method of valuing a public company based on the theory that its stock is ……. read more

8. Calculating Stock Price Valuation using Dividend Discount Model (DDM)

Author: blog.colonialstock.com

Date Submitted: 02/27/2020 03:31 PM

Average star voting: 4 ⭐ ( 70624 reviews)

Summary: The dividend discount model provides a stock price valuation based on expected future cash flows from dividends, similarly to the DCF model. The main difference is that the cash flow/dividend growth rate is constant in the DDM model where it is not in the DCF model. How Does the Dividend Discount Method Work? In

Match with the search results: The dividend discount model provides a stock price valuation based on expected future cash flows from dividends, similarly to the DCF model….. read more

9. Dividends, Earnings, and Cash Flow Discount Models – Fidelity

Author: www.fidelity.com

Date Submitted: 01/16/2022 01:13 AM

Average star voting: 4 ⭐ ( 96177 reviews)

Summary: Learn about various dividend, cash flow, and earnings discount models.

Match with the search results: The dividend discount model. The dividend discount model (DDM) is a method for assessing the present value of a stock based on its dividend rate. If the company ……. read more

10. Introduction to Financial Valuation

Author: crypto.com

Date Submitted: 08/16/2020 11:47 AM

Average star voting: 3 ⭐ ( 16342 reviews)

Summary: Here we delve into the financial analysis tools and models used to determine the value of an asset.

Match with the search results: It indicates the dollar amount an investor can expect to invest in a company in order to receive a dollar of that company’s earnings. Dividend Discount Model ( ……. read more

11. Dividend Discount Model (DDM): Formula Breakdown & Example

Author: investorjunkie.com

Date Submitted: 11/06/2020 07:50 PM

Average star voting: 5 ⭐ ( 81967 reviews)

Summary: Are you an investors that values fundamental analysis? Use the dividend discount model to gain insight and make informed investing decisions.

Match with the search results: So what is the value of Bitcoin? Well, it will never pay a dividend, so the dividend discount model would suggest that its value is $0….. read more