Top 6 bitcoin gold halving in 2023

Below are the best information and knowledge on the subject bitcoin gold halving compiled and compiled by our own team mix166:

Mục lục bài viết

1. Bitcoin Gold Halving Countdown (Bitcoin Gold Halving Dates and Prices History)

Author: bitcoingold.org

Date Submitted: 07/18/2021 11:46 PM

Average star voting: 3 ⭐ ( 26555 reviews)

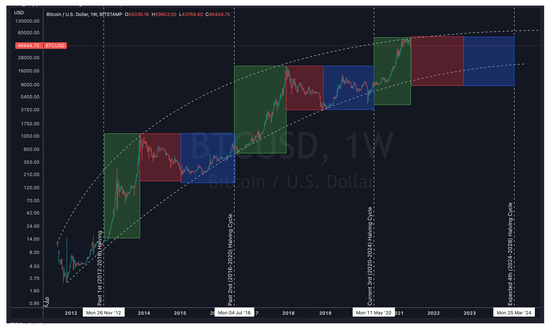

Summary: When is the next halving of Bitcoin Gold ? The current Bitcoin Gold block reward (after the 3rd halving in May 2020) is 6.25 BTG per block. The next Bitcoin Gold Halving is approximately April 24, 2024 and Bitcoin Gold block reward will decrease to 3.125 BTGper block. Bitcoin Gold halving explained Bitcoin Gold is

Match with the search results: . The initial reward was 50 per block; the first halving (at block 210 000) cut it to 25, and the second halving (at block 420 000) cut it to 12.5….. read more

2. What is Bitcoin Gold? How Does Bitcoin Gold Work? | Exchanges | ZenLedger

Author: halvingdates.com

Date Submitted: 01/06/2020 07:08 AM

Average star voting: 4 ⭐ ( 16395 reviews)

Summary: Bitcoin Gold was launched in 2018 after its split from Bitcoin. So, what is Bitcoin Gold’s origin story? Learn about it and more in this detailed guide.

Match with the search results: The 2020 Bitcoin Gold Halving occured on Apr 18, 2020 1:44:22 PM. Since the 2020 halving BTG mining reward is now 6.25 BTG per block. The next Bitcoin Gold ……. read more

.png)

3. Bitcoin Gold Price Today: BTG to USD Live Price Chart – CoinJournal

Author: en.wikipedia.org

Date Submitted: 05/09/2020 09:48 AM

Average star voting: 3 ⭐ ( 71763 reviews)

Summary: View the real-time Bitcoin Gold price, conversion rates (USD, GBP, EUR), charts, predictions, latest BTG price news and more.

Match with the search results: 6.25 BTG, halved April 18, 2020, at block no. 630000. Will halve again at block no. 840000 (~spring of 2024). Block time, 10 minutes….. read more

![]()

4. What Will Happen After All Bitcoin Are Mined? | River Financial

Author: www.investopedia.com

Date Submitted: 06/01/2020 10:15 AM

Average star voting: 3 ⭐ ( 38459 reviews)

Summary: When all bitcoin have been mined, miner revenue will depend entirely on transaction fees. The cost of transaction fees and purchasing power of bitcoin will likely adjust higher to the lack of new supply.

Match with the search results: A Bitcoin halving event occurs when the reward for mining Bitcoin transactions is cut in half. · Halvings reduce the rate at which new coins are created and thus ……. read more

5. The Bitcoin Halving Cycle Volatility Dynamics and Safe Haven-Hedge Properties: A MSGARCH Approach

Author: altcoinsbox.com

Date Submitted: 12/26/2021 01:32 PM

Average star voting: 4 ⭐ ( 98150 reviews)

Summary: This paper introduces a unique perspective towards Bitcoin safe haven and hedge properties through the Bitcoin halving cycle. The Bitcoin halving cycle suggests that Bitcoin price movement follows specific sequences, and Bitcoin price movement is independent of other assets. This has significant implications for Bitcoin properties, encompassing its risk profile, volatility dynamics, safe haven properties, and hedge properties. Bitcoin’s institutional and industrial adoption gained traction in 2021, while recent studies suggest that gold lost its safe haven properties against the S&P500 in 2021 amid signs of funds flowing out of gold into Bitcoin. Amid multiple forces at play (COVID-19, halving cycle, institutional adoption), the potential existence of regime changes should be considered when examining volatility dynamics. Therefore, the objective of this study is twofold. The first objective is to examine gold and Bitcoin safe haven and hedge properties against three US stock indices before and after the stock market selloff in March 2020. The second objective is to examine the potential regime changes and the symmetric properties of the Bitcoin volatility profile during the halving cycle. The Markov Switching GARCH model was used in this study to elucidate regime changes in the GARCH volatility dynamics of Bitcoin and its halving cycle. Results show that gold did not exhibit safe haven and hedge properties against three US stock indices after the COVID-19 outbreak, while Bitcoin did not exhibit safe haven or hedge properties against the US stock market indices before or after the COVID-19 pandemic market crash. Furthermore, this study also found that the regime changes are associated with low and high volatility periods rather than specific stages of a Bitcoin halving cycle and are asymmetric. Bitcoin may yet exhibit safe haven and hedge properties as, at the time of writing, these properties may manifest through sustained adoption growth.

Match with the search results: The current Bitcoin Gold block reward (after the 3rd halving in May 2020) is 6.25 BTG per block. The next Bitcoin Gold Halving is approximately April 24, ……. read more

6. Will Bitcoin’s Halving Be The Gold Rush Some Expect?

Author: changelly.com

Date Submitted: 11/17/2020 11:49 AM

Average star voting: 4 ⭐ ( 85783 reviews)

Summary: This will be the third halving since Bitcoin’s inception in January 2009 and from a price perspective, both of the previous events were very bullish for the cryptocurrency, triggering rises of 81 times and 30 times in the 18-month period after the 2012 and 2016 halvings respectively.

Match with the search results: Averaged price prediction for Bitcoin Gold. We analyzed BTG price history, news and fundamental reasons for the asset to grow or fall….. read more